TEAS V - Science Test 2023

$ 6

025 AAPC CPC FINAL PRACTICE WITH COMPLETE SOLUTIONS.

$ 15

N494 Week 5 Assignment - Intergrating Evidence-Based Practice

$ 15

Practice JuRiSpRuDeNcE Exam With Complete Solution

$ 5.5

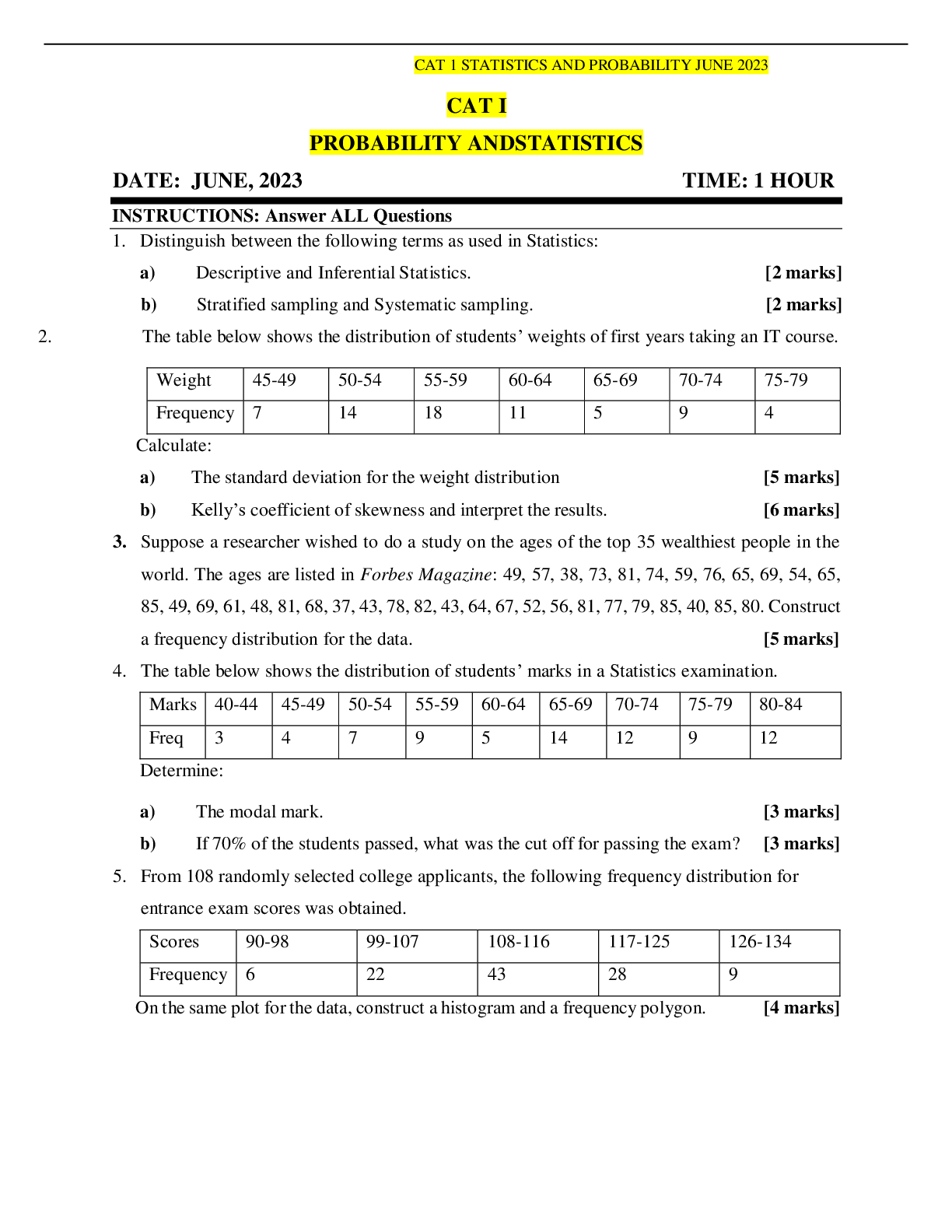

STATISTICS AND PROBABILITY ACHER CAT JUNE 2023

$ 6.5

.png)

ATI MED SURG PROCTORED STUDY( GUIDE)

$ 14

Applied Statistics and Probability for Engineers, 7e Montgomery, Runger (eBook PDF)

$ 25

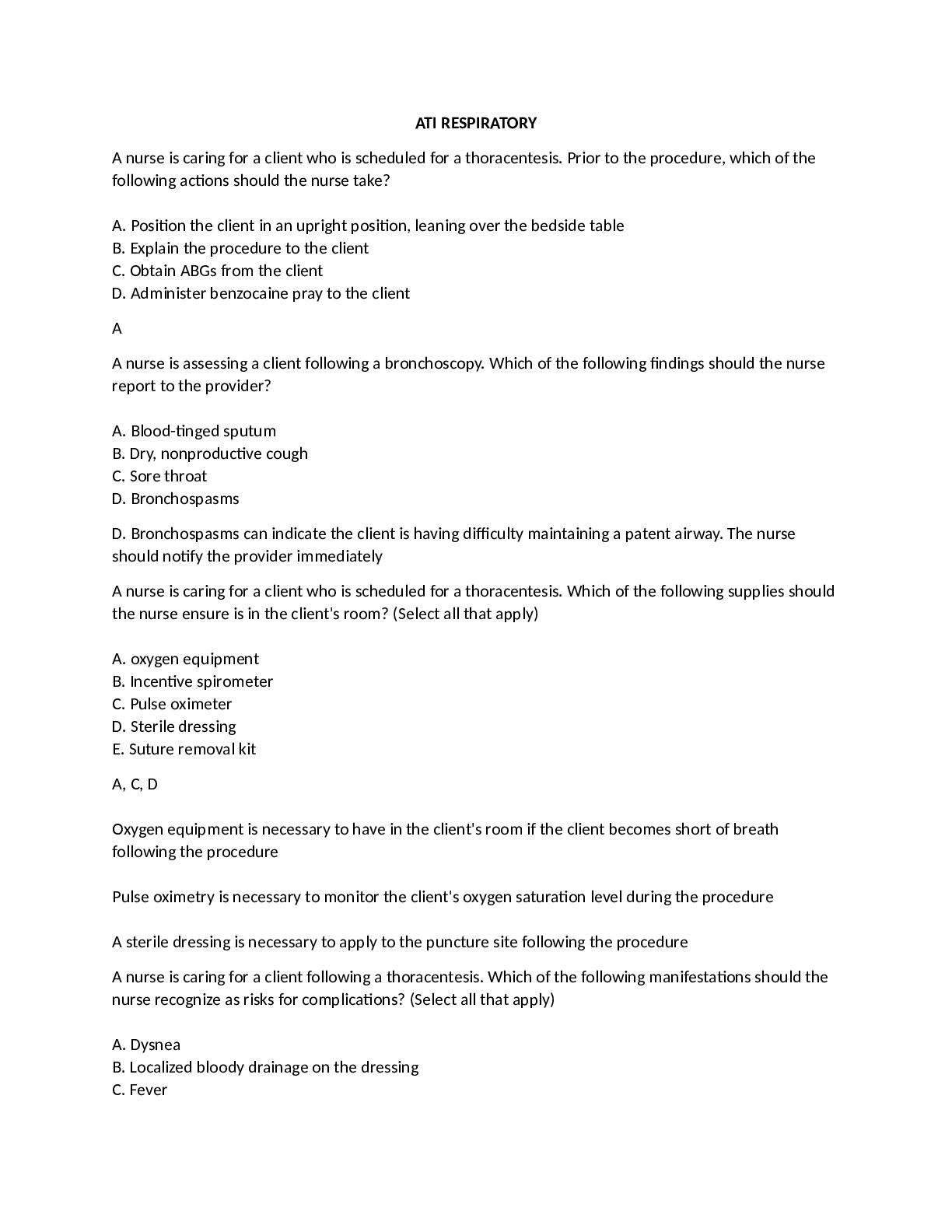

ATI RESPIRATORY Full Paper 2023

$ 11

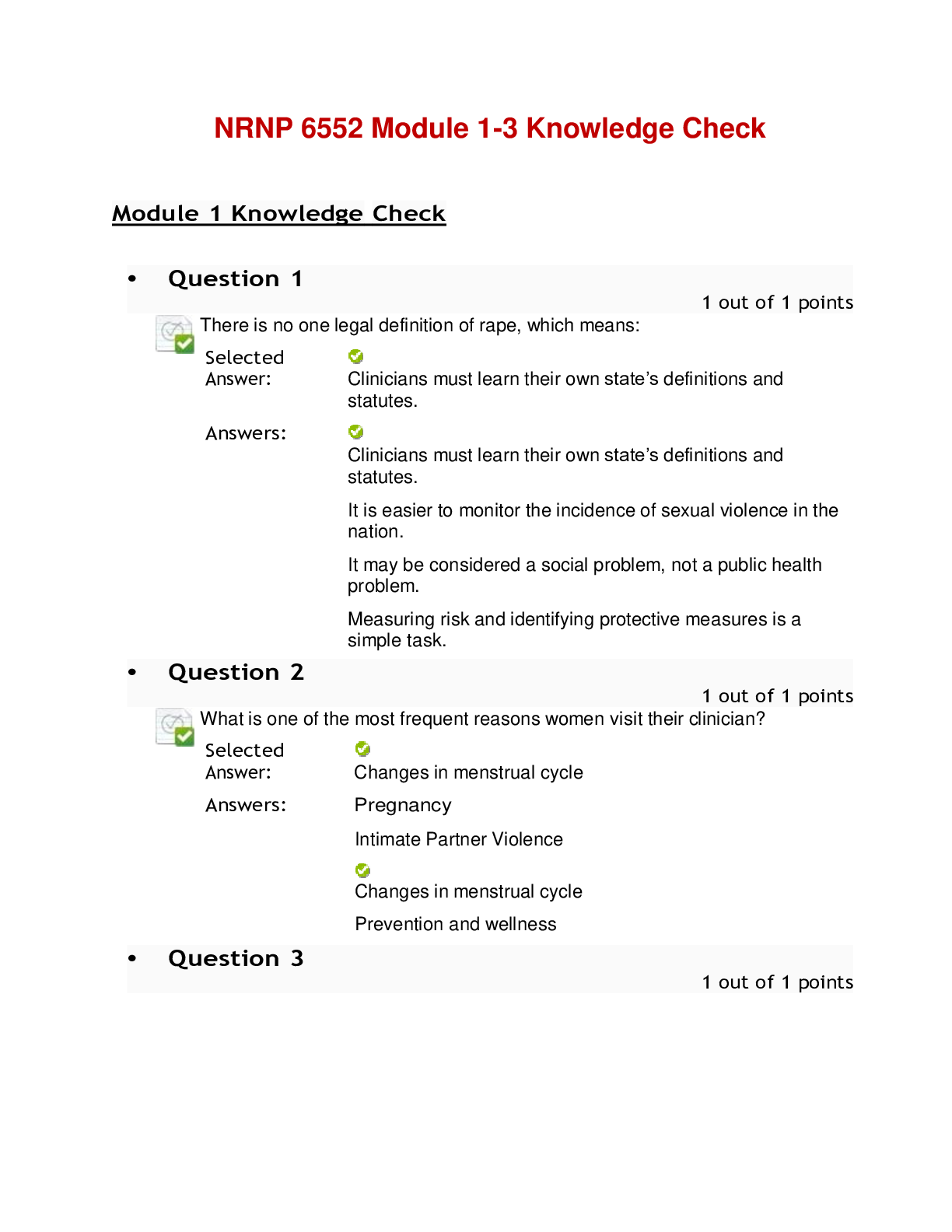

NRNP 6552 Module 1-3 Knowledge Check

$ 14

HESI Computerized Adaptive Testing (CAT) Test Bank

$ 13

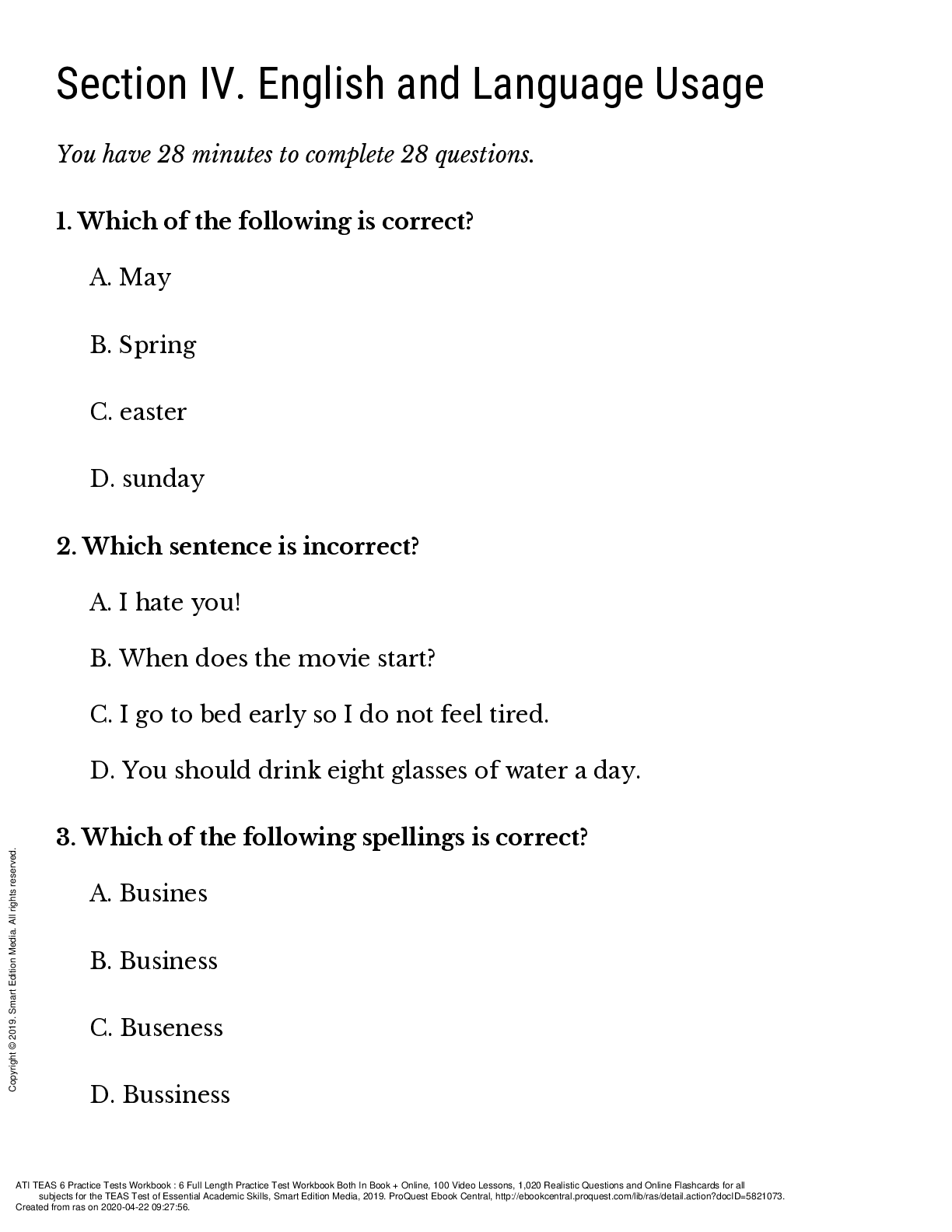

ATI TEAS 6 Practice Tests Workbook 6 Section 4

$ 9.5

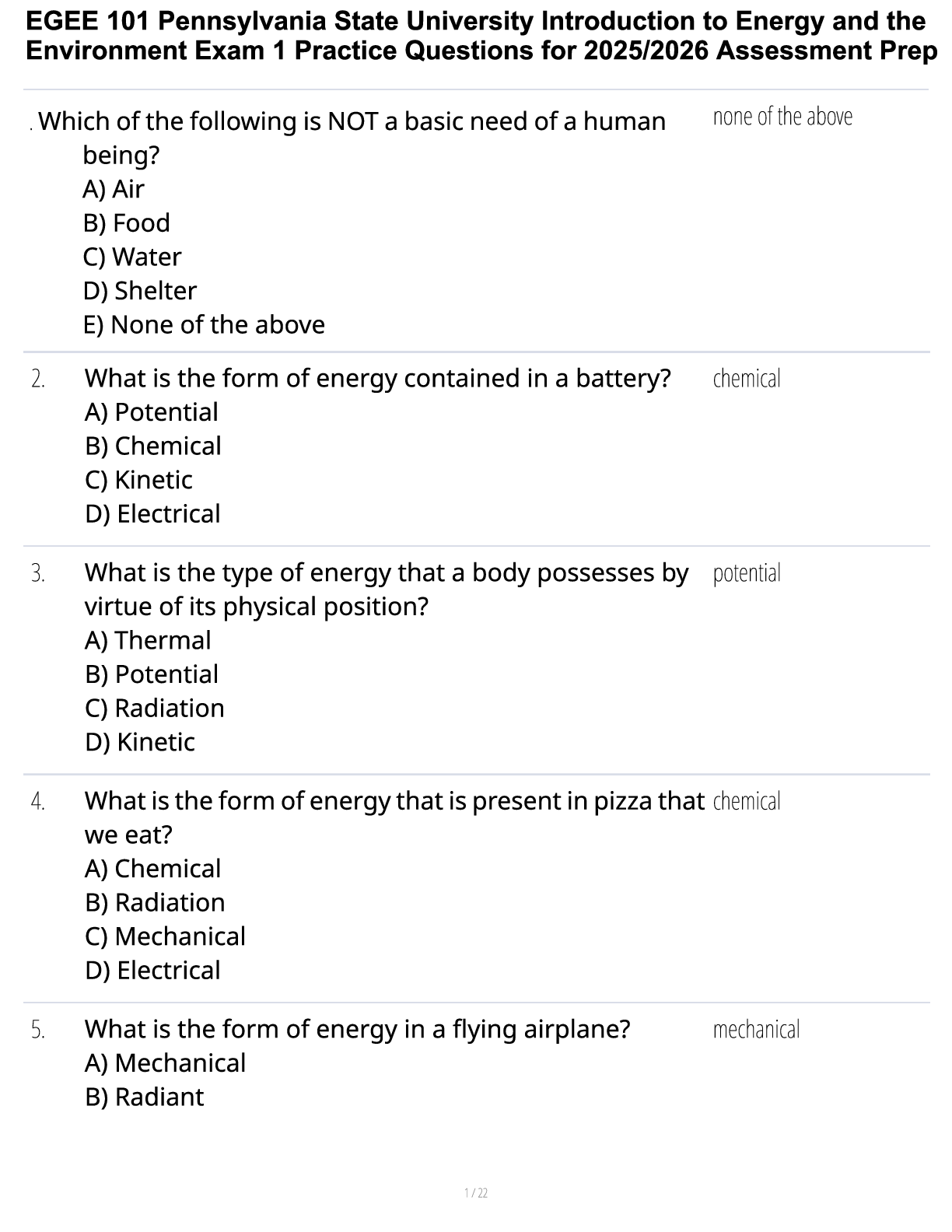

EGEE 101 Pennsylvania State University Introduction to Energy and the Environment Exam 1 Practice Questions for 2025/2026 Assessment Prep

$ 12.5

ATLS Test 1

$ 2

HESI Grammar Practice Questions

$ 6

GED Test Social Studies Comprehensive Exam Study Guide

$ 20

eBook [PDF] Life Span Human Development 4th Edition By Sigelman, George, Cunial, Kohler, Ballam, Rider

$ 30

.png)

NR 226: Patient Care study guide

$ 8

Task 2.docx (3) Running head: Data Driven Decision Making Task 2

$ 10

MVU NURS 629 EXAM 4 WITH COMPLETE SOLUTION LATEST UPDATE (A+ exam)

$ 15

NURS 208 Practice questions 2023

$ 17

APHR_Exam_2022

$ 12.5

The_Kubernetes_Book version 2

$ 12.5

Comprehensive ATI Predictor Exam 2

$ 5.5

eBook Phytochemical Drug Discovery for Central Nervous System Disorders Biochemistry and Therapeutic Effects 1st Edition By Chukwuebuka Egbuna Mithun Rudrapal

$ 30

AQA AS PHYSICS PAPER 2 7407/2 QUESTIONS PAPER 2022

$ 10

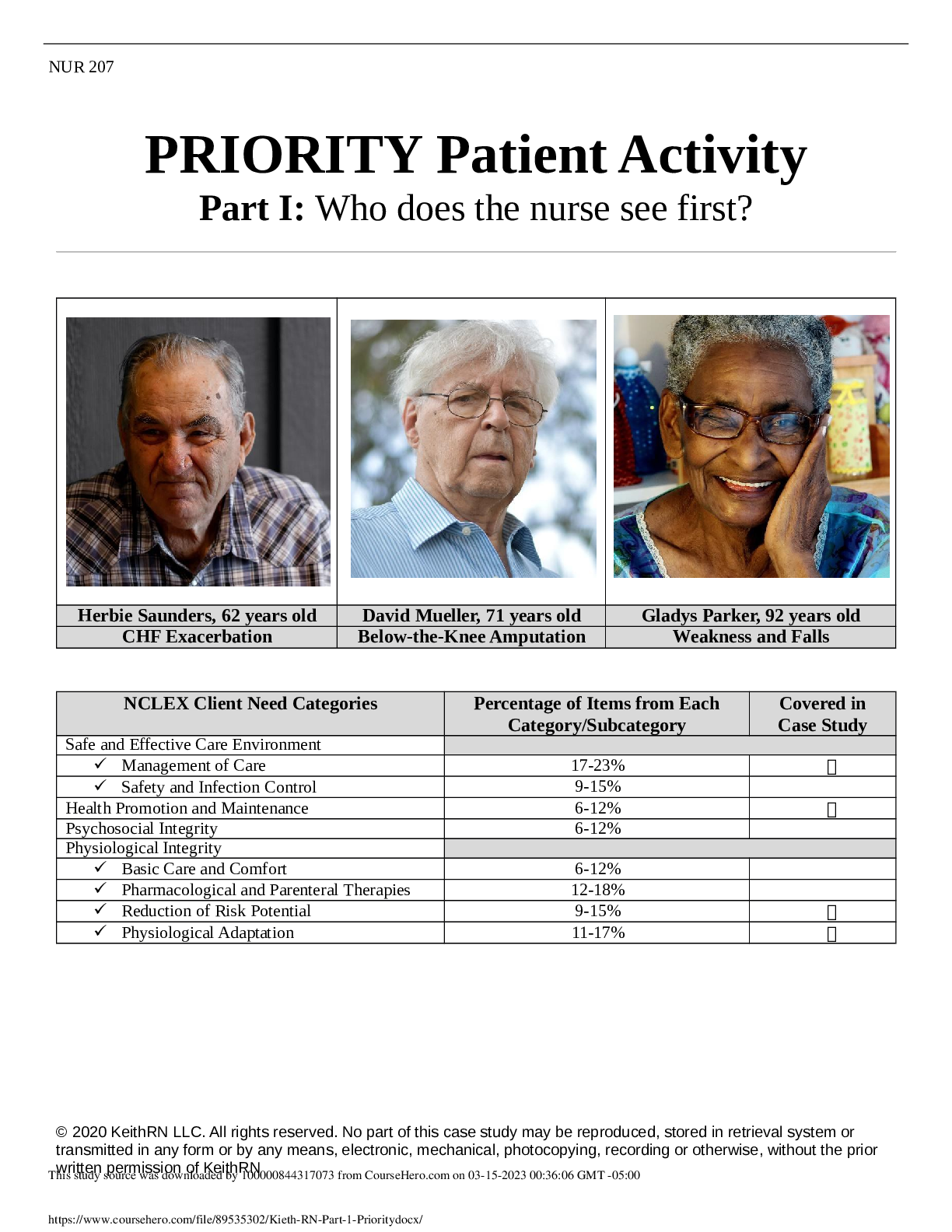

KeithRN Case Study Part 1-Priority 2023

$ 9

Test Bank for Introduction to Java Programming and Data Structures Comprehensive Version 12th Edition by Y. Daniel Liang

$ 17

Test Bank For Python Programming for Engineers and Scientists by Cengage 1st Edition Copyright 2025 9798214002446 Chapter 1-13 A+

$ 20

MDC IV - Final Exam with Complete Solution

$ 8

ATI BURN TREATMENTS STUDY GUIDE

$ 12

NURS 1533 MATH PRACTICE QUESTIONS LEVEL 2

$ 16

MPO TEST BANK (ALL CHAPTERS)

$ 18

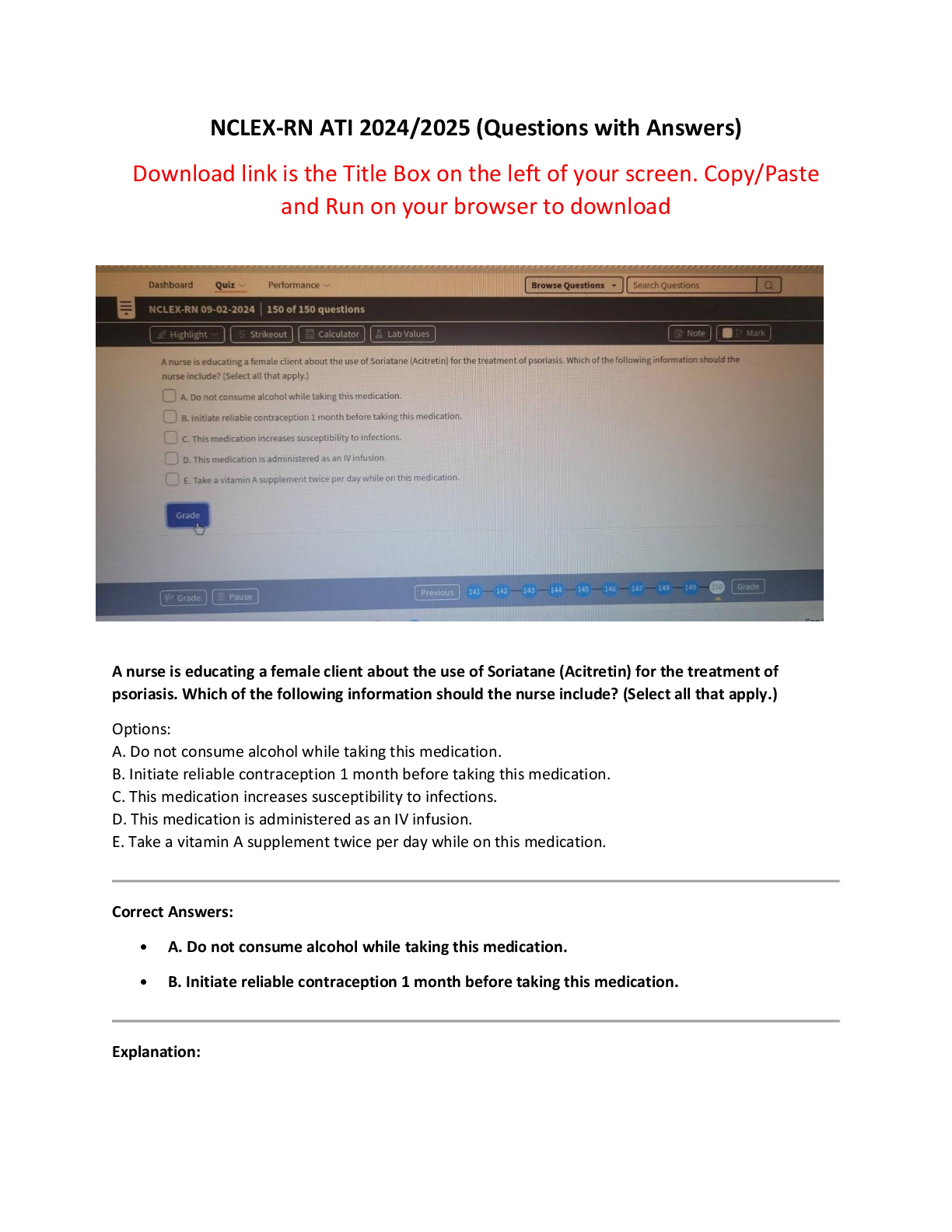

Pharmacology ATI Exam Highly Tested Questions & Amswers | Best Practice, Study Guide, Best Resource

$ 29

[eBook][PDF] Programmable Logic Controllers with ControlLogix, 1st Edition By Jon Stenerson

$ 14.5

HESI Pediatric Study Notes

$ 25

AB140_Assignment_Unit_7

$ 10

.png)

HESI OB HINTS

$ 20

EEE 362 POWER SYSTEM ANALYSIS - North South University _ EEE 362: Power Systems Spring 2020, Faculty – MEZ Final Assessment. Marks: 30,

$ 9.5

CISM Exam Prep Latest 2022

$ 9

TMC E 90 QUESTIONS WITH COMPLETE SOLUTIONS

$ 7

NUR 2868 EXAM 2 STUDY GUIDE

$ 13

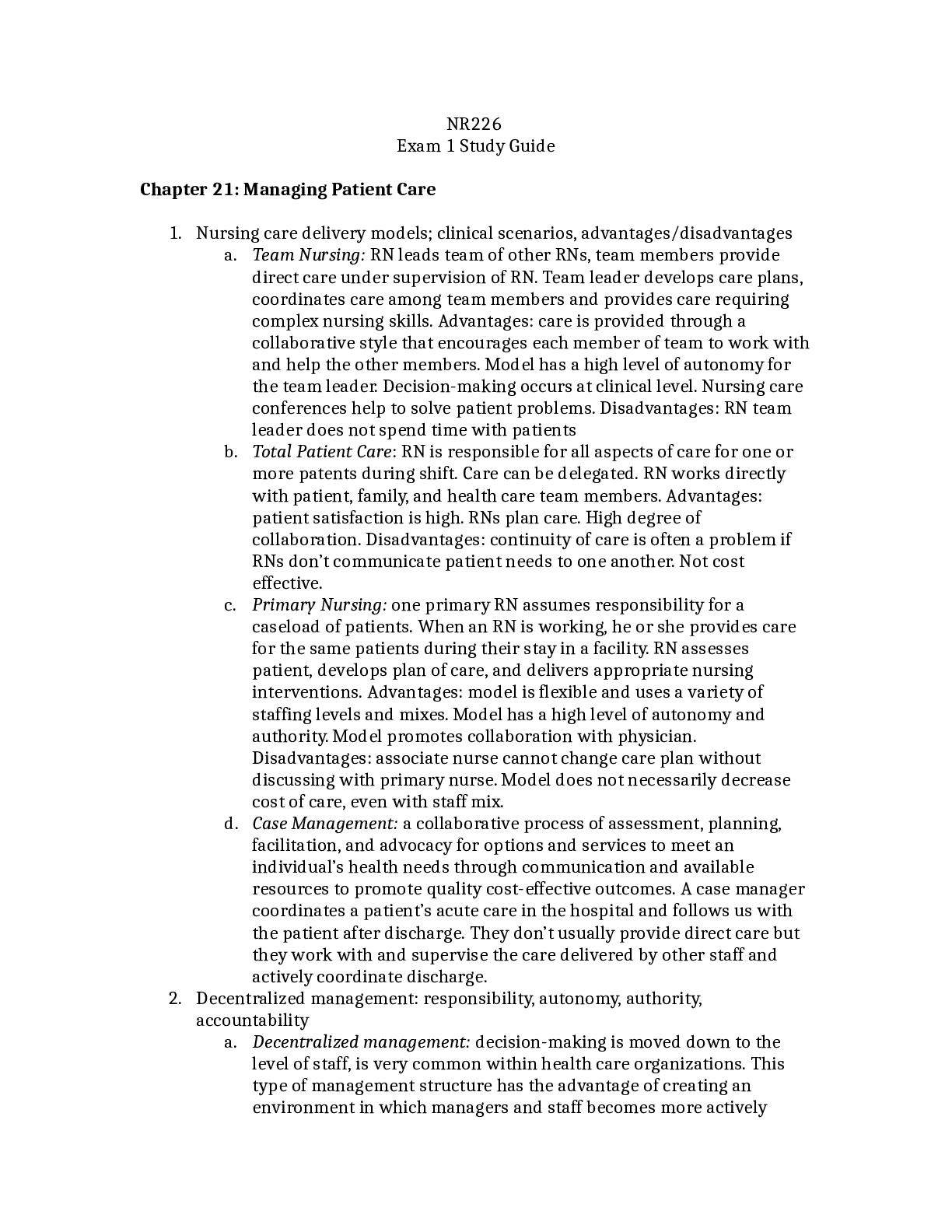

NR226Exam 1 Study Guide

$ 13

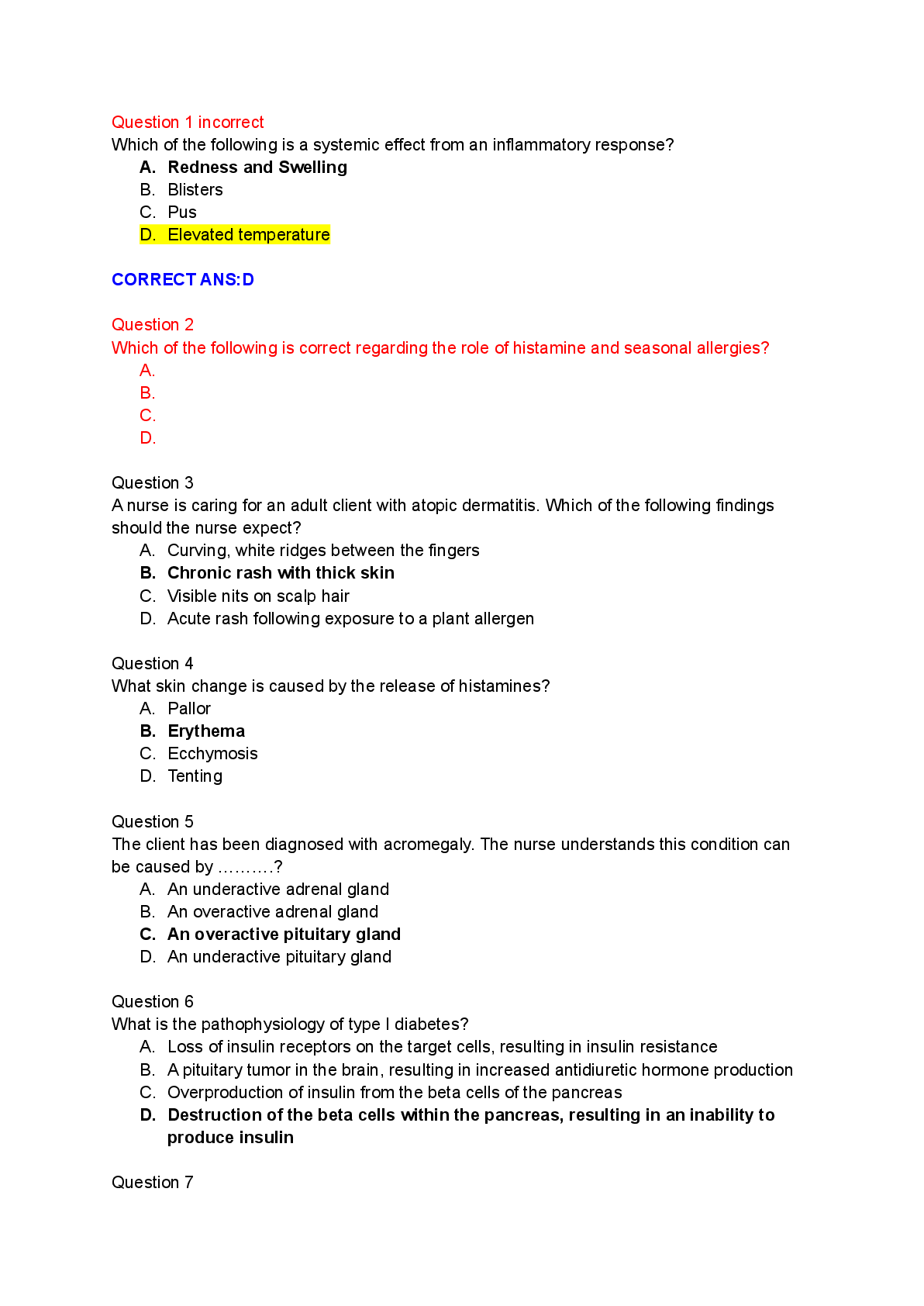

Final exam 100 Questions

$ 30

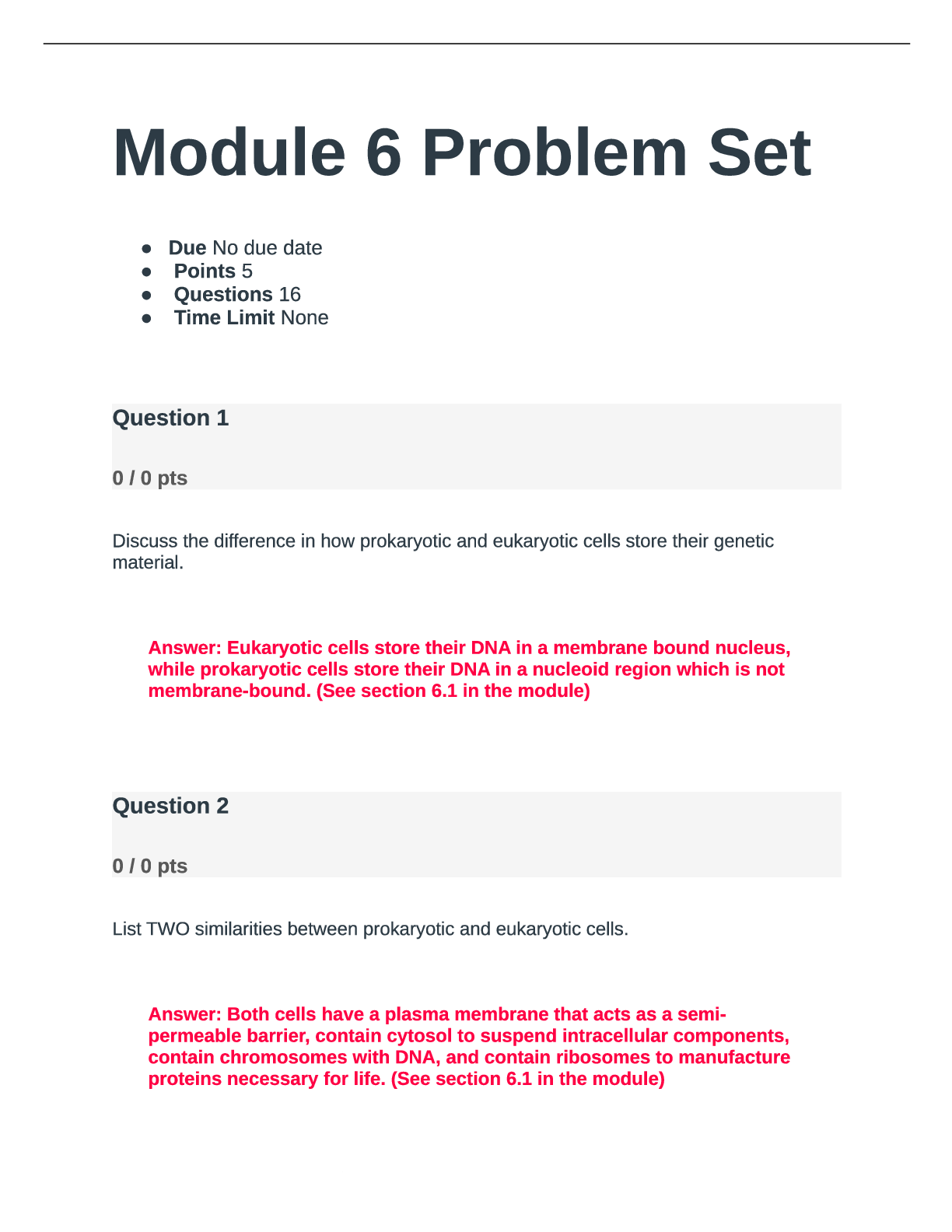

6 biod 101 module 6 problem set

$ 18

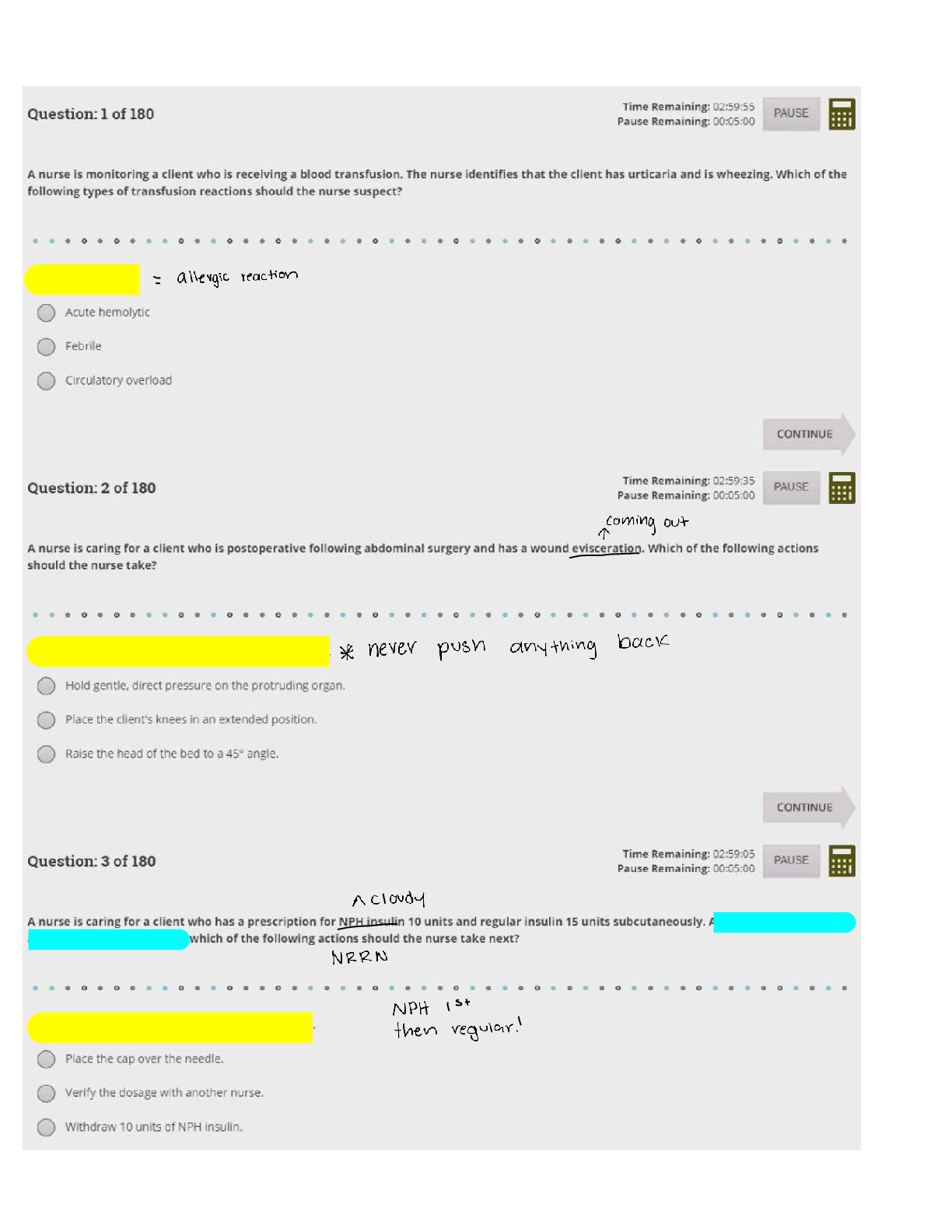

PN COMPREHENSIVE

$ 85

[TEST BANK] for Course for Teaching English Learners A 3rd Edition By Lynne T. Diaz-Rico

$ 25

.png)

Edexcell Maths A level paper 32 mechanics ms November 2021

$ 11

ATI RN NCLEX Comprehensive Exam Guide

$ 20

Week_1_Journal.docx (2)

$ 10

Final exam section 1

$ 7

A COMPLETE TEST BANK ON ATI FUNDAMENTALS PROCTORED EXAMS 11 EDITION 2021-2022 ACADEMIC YEAR, QUESTION AND ANSWERS 100/100 A+

$ 17

.png)

A-Level Physics 7408/3BE - Section B - Electronics - Final

$ 2

.png)

AHIP Practice Test(questions&answers)

$ 7

CEA201 EXAM 2024

$ 7

eBook Entrepreneurial Renaissance 1st Edition By Piero Formica

$ 29

BTEC Applied Science Unit 5 Exam 105 Questions with Answers,100% CORRECT

$ 11

Practice Exam 1 (NCE) With Complete Solution

$ 11.5

CS 2205 – Web Programming I

$ 18

MATH 225N Statistics Quiz Week 2 (Correct Solutions) | 100% CORRECT.

$ 14.5

Pearson Edexcel IAL WPH14/01 A Level Physics International Advanced Level UNIT 4: Further Mechanics, Fields and Particles. QP Jan 2022

$ 4

Dispute_Resolution_Tutorials_and_Lectures_EXAM_NOTES.

$ 14.5

AQA June 2022 Question Paper A-level PHYSICS Paper 1 7408/1

$ 7

Portage LearningBIOD 121

$ 12

Questions and Answers > RES 100_ Labrador-RES100-Chapter13,14,15 ECQ

.png)