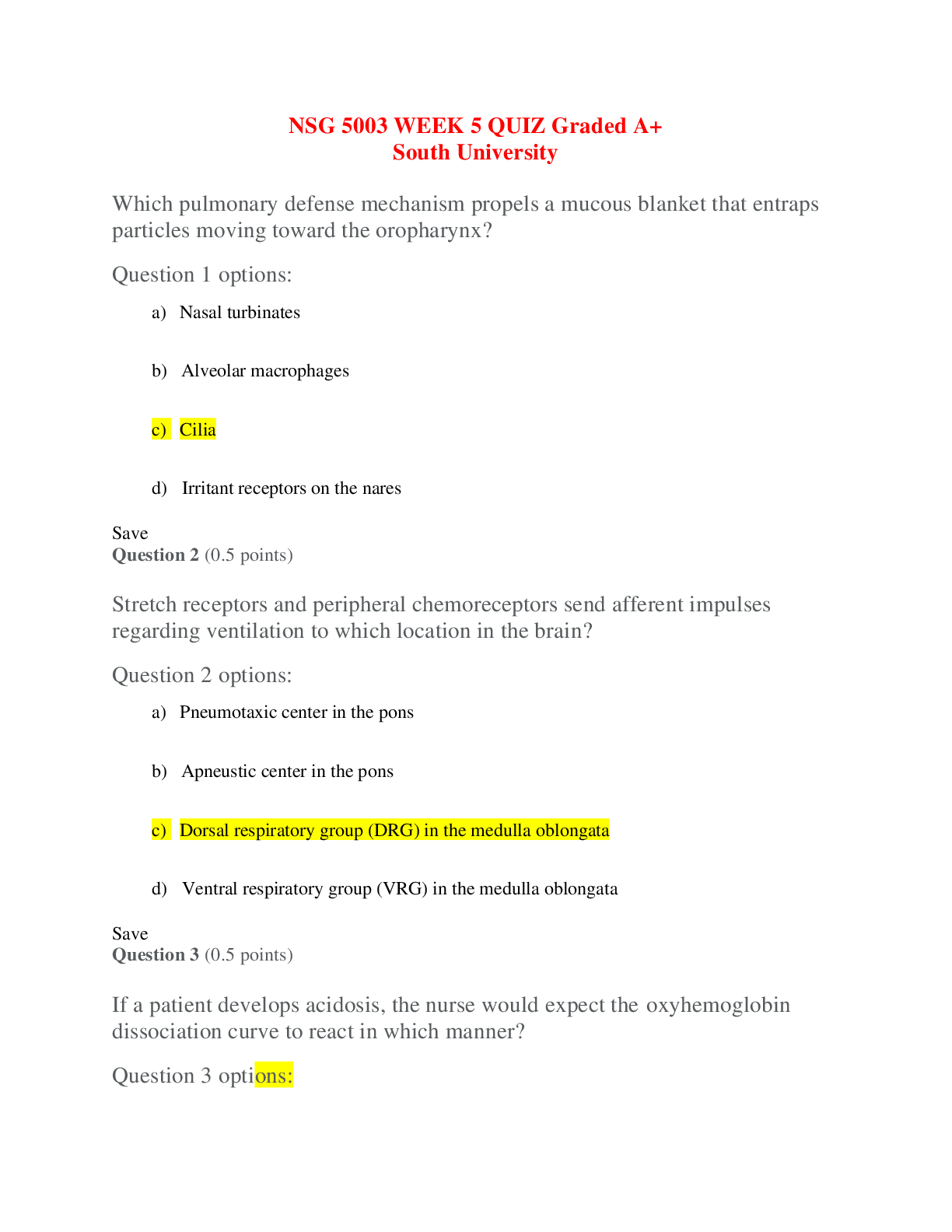

Business > QUESTIONS & ANSWERS > [Solved] Bus 495 Quiz 1 (All)

[Solved] Bus 495 Quiz 1

Document Content and Description Below

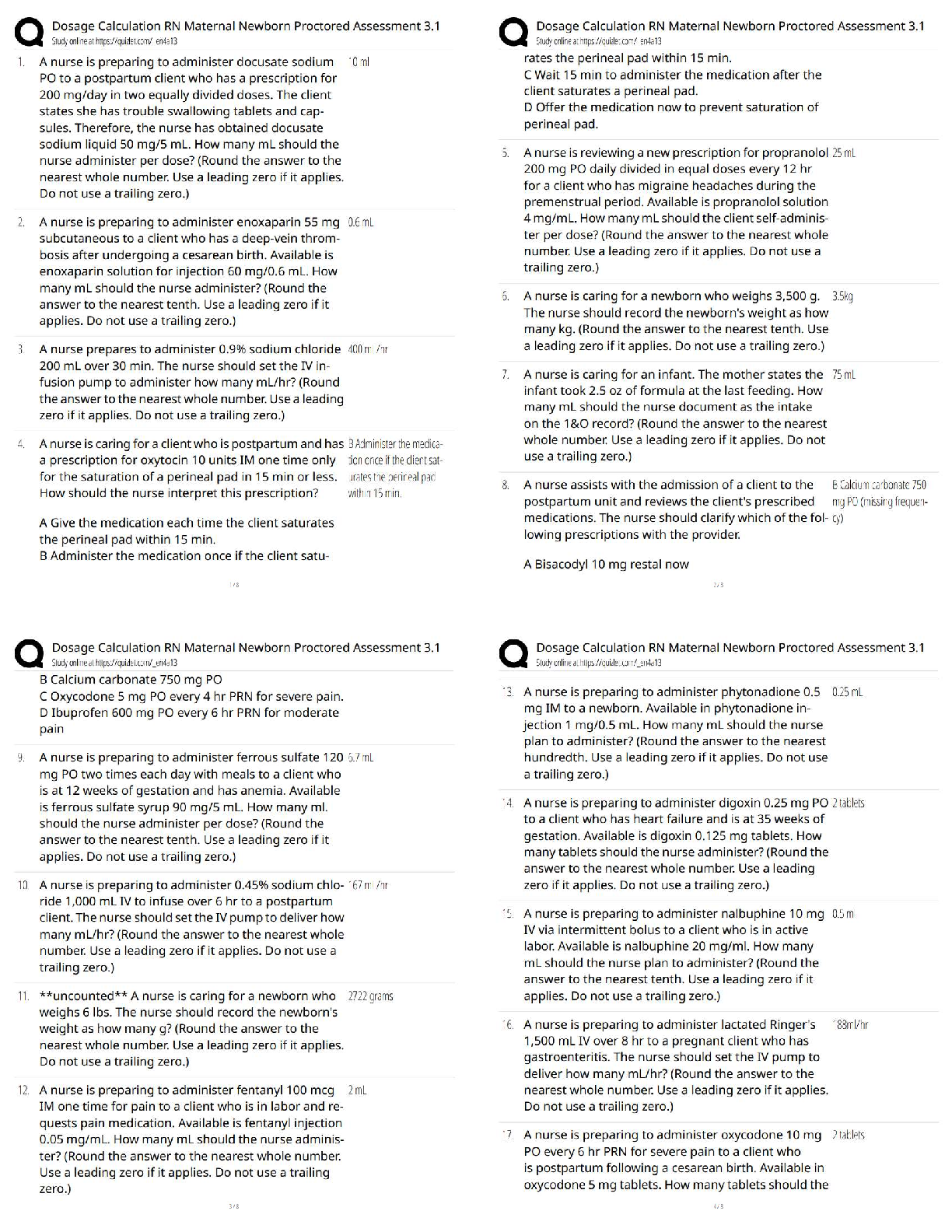

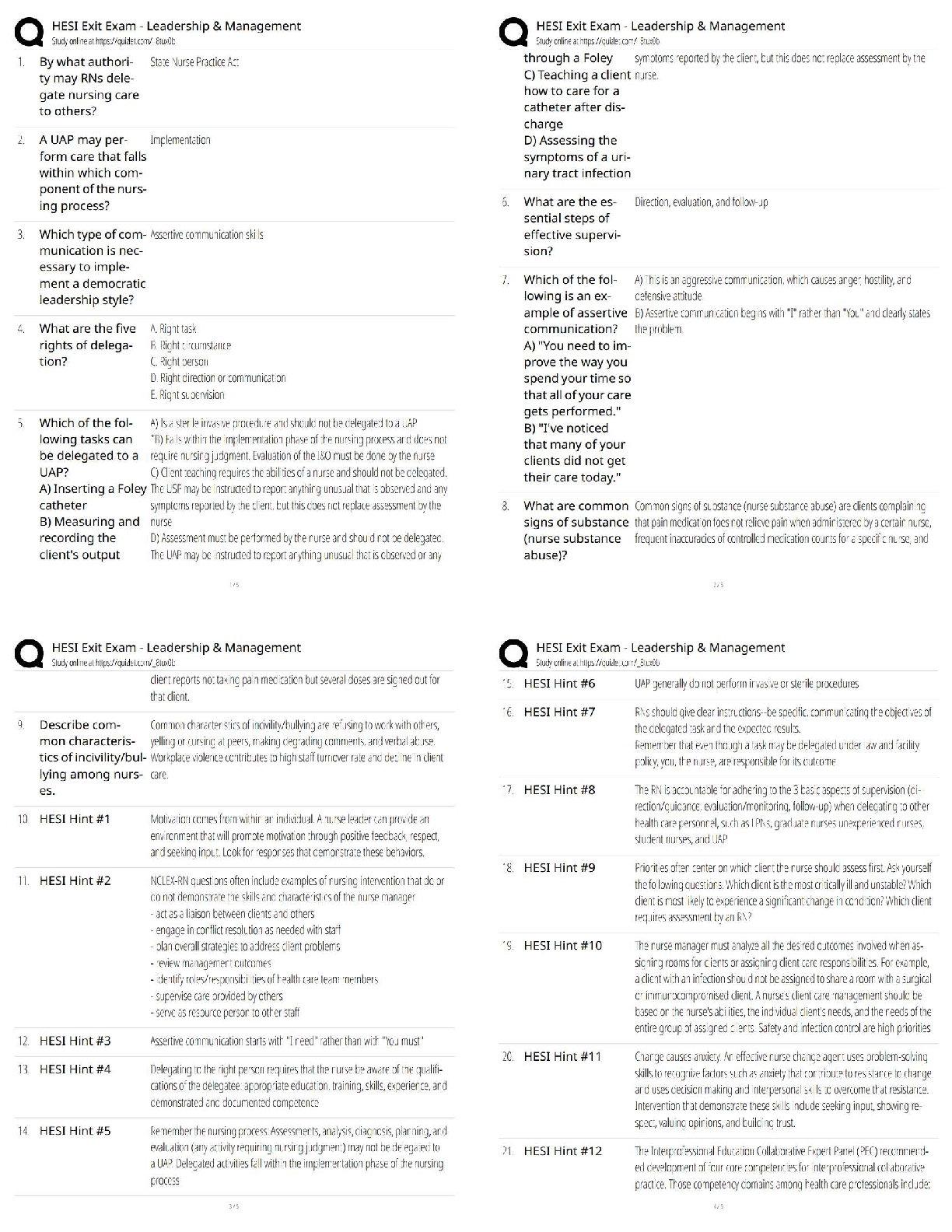

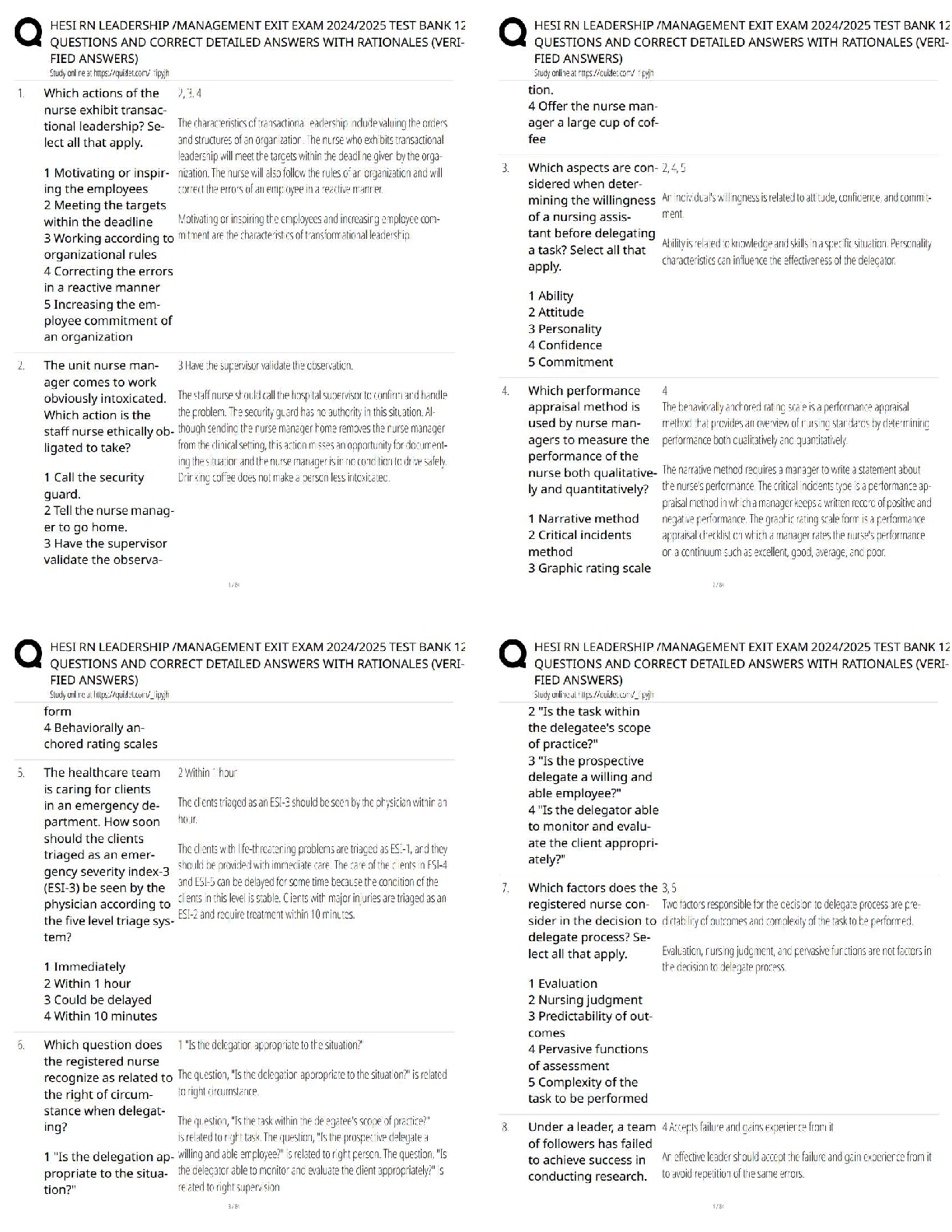

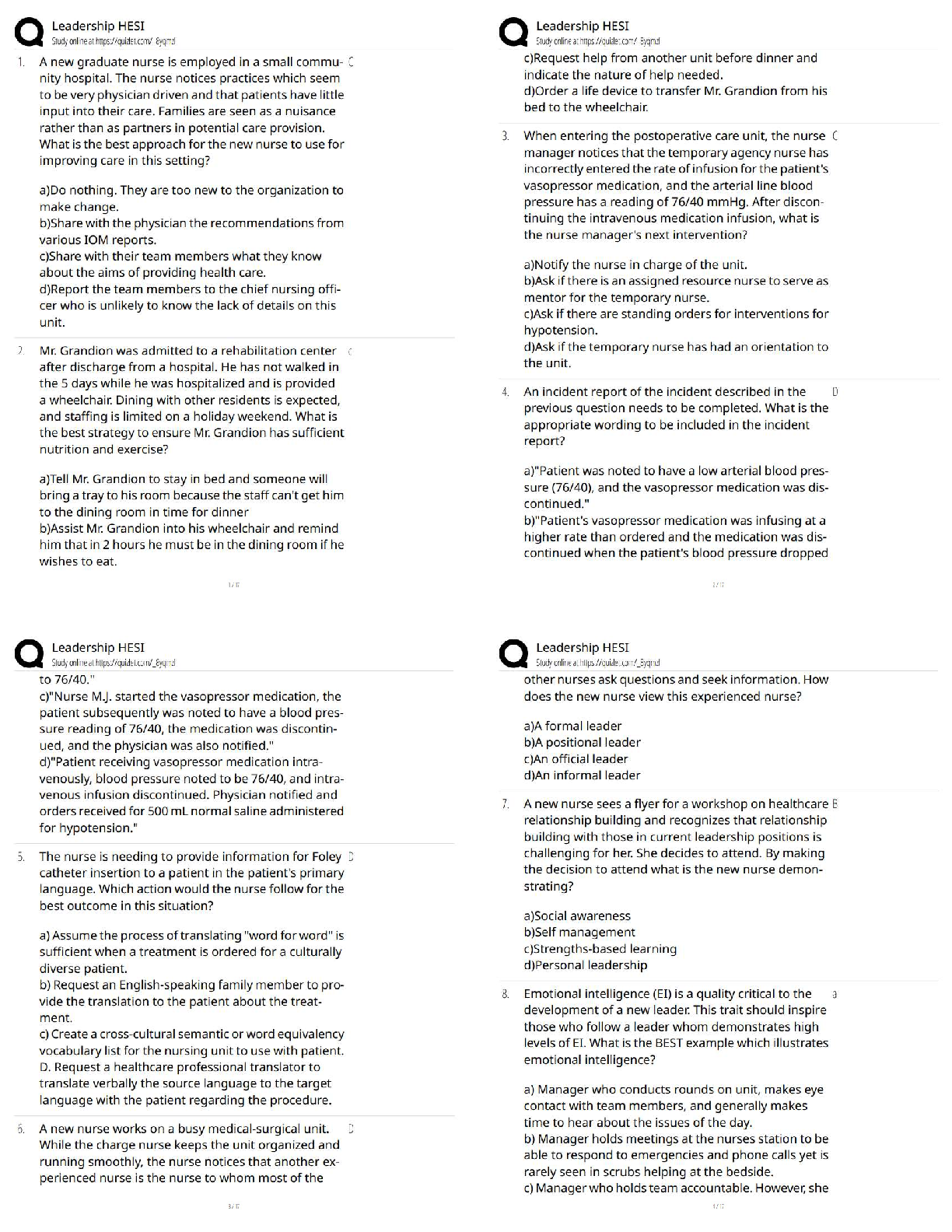

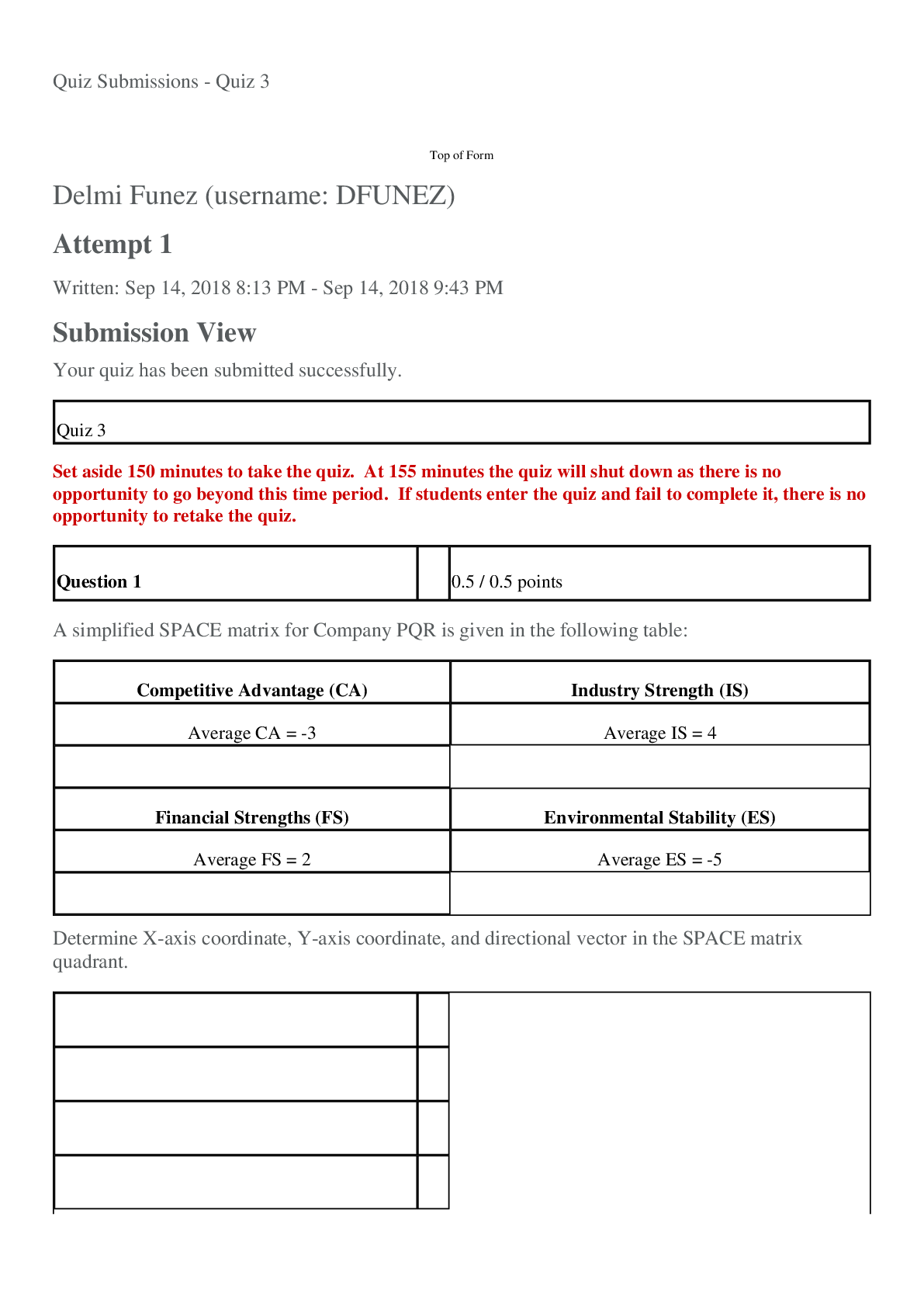

[Solved] Bus 495 Quiz 1 QIEQW QUIZ 1 BUSINESS 495 Set aside 150 minutes to take the quiz. At 155 minutes the quiz will shut down as there is no opportunity to go beyond this t ... ime period. If students enter the quiz and fail to complete it, there is no opportunity to retake the quiz. Question 1 0 / 0.4 points Companies evaluate the competitive environment by comparing their own companies with the key competitors in the industry. The appropriate matrix to be used for competitive analysis is: A) CPM matrix (Competitive profile matrix) B) Porter's Five Forces analysis C) SWOT analysis D) PESTLE analysis Question 2 0.4 / 0.4 points The current US Administration decided to levy a 20% tariff on steel and 15% on aluminum that are imported into the USA. The European Union considered such a unilateral decision as a protectionist decision, and decided to levy a counter tariff on US imports into the European Union. Harley Davison was said to pay about $2,200 additional tariff for each Harley Davison to be imported into the European Union countries. From the perspective of the management at Harvey Davison, such decisions by US Administration, and by the European Union can be evaluated because they can be classified as one of the ___________________ factors in the PESTLE analysis. A) Political B) Legal C) Economic D) Societal Question 3 0.4 / 0.4 points Ethanol is extracted from corn to be used as an additive in gasoline. Iowa farmers and Brazilian farmers are capable of producing ethanol in large quantities. From the strategic planning perspective, Iowa farmers can evaluate the rivalry in the international market for ethanol based on the following analysis: A) OT (Opportunities and threats) in partial SWOT analysis B) SWOT analysis C) Porter’s Five Forces analysis D) IFE matrix Question 4 0.4 / 0.4 points Below are four weight sets for calculating an EFE matrix. Which weight set correctly reflects a weight option that will return a correct EFE? EFE matrix Weight options External factors (a) (b) (c) (d) Opportunities Rising income levels in developing countries 0.15 0.20 0.07 0.10 Favorable growing seasons for good harvest 0.10 0.30 0.08 0.05 Consumer preference for the products of the company 0.25 0.10 0.15 0.20 Regional trade agreements 0.05 0.06 0.10 0.12 Threats Protectionist approach in levying tariffs 0.20 0.10 0.15 0.13 Reduction of oil extraction by OPEC countries 0.10 0.05 0.20 0.08 Increasing piracy incidents in international shipping routes 0.05 0.07 0.04 0.15 Environmental concerns due to the irrigation system 0.08 0.12 0.15 0.20 Total weights 0.98 1.00 0.94 1.03 A) (a) B) (b) C) (c) D) (d) Question 5 0.4 / 0.4 points Car manufacturers have adopted technological advancements in their manufacturing process to reduce dependence on human labor. Car manufacturers would evaluate the impact of technological advancements in their industry environment from the …………………analysis. A) SWOT B) PESTLE C) Porter’s Five Forces D) EFE Question 6 0 / 0.4 points In using the CPM matrix, the strategic researchers use weights to evaluate the competing companies in the industry. Strategic researchers need to use the _______________ set of weights. A) Same set of weights that add up to 2. B) Different sets of weights that each set adds up to 1. C) Different sets of weights that each set adds up to 2. D) Same set of weights that add up to 1. Question 7 0.4 / 0.4 points Which weight set is appropriate for the CPM matrix? CPM matrix Critical success factors Weights (a) (b) (c) (d) Integrated supply chain management 0.25 0.15 0.1 0.05 Range of product items 0.1 0.05 0.13 0.06 Economies of scale 0.15 0.1 0.12 0.17 Research and development 0.2 0.14 0.06 0.14 Financial position 0.05 0.1 0.4 0.3 Customer service management 0.07 0.2 0.21 0.28 Product quality 0.1 0.12 0.5 0.21 Capital budget 0.5 0.08 0.3 0.25 Consumer preference 0.05 0.06 0.18 0.04 Total weights 1.47 1 2 1.5 A) (a) B) (b) C) (c) D) (d) Question 8 0.4 / 0.4 points The factors for the EFE matrix that come from the partial SWOT analysis are: A) Opportunities and weaknesses B) Opportunities and threats C) Strengths and threats D) Opportunities and strengths Question 9 0 / 0.4 points A shipping company relies on fossil fuels to run its ocean-going ships. This shipping company researches the severity of the impact suppliers in the oil-producing countries have on its industry environment. The strategic researchers would need to use a ______________ analysis to evaluate the level of impact these suppliers have on the shipping company. A) Power of the substitutes in Porter’s Five Forces analysis B) The bargaining power of suppliers in Porter’s Five Forces analysis. C) The buyers’ bargaining power CPM matrix analysis D) Political factor in PESTLE analysis Question 10 0 / 0.4 points Strategic researchers in the movie industry have found that consumers tend to spend their leisure time in watching videos at home, streaming favorite shows, going to concerts, reading books, etc. These researchers are using: A) Porter’s Five Forces analysis B) PESTLE analysis C) CPM matrix analysis D) SWOT analysis Question 11 0 / 0.4 points Key agricultural products by Iowa farmers are soy beans and corn. Many Chinese eat tofu as part of their staple diet, which is made from soy beans, but China does not produce sufficient soy beans to satisfy the domestic needs of the Chinese diet. Iowan farmers will recognize the export potential to China from their _________________in their industry analysis. A) Socioeconomic factor in PESTLE analysis B) Return on revenues in financial ratio analysis C) Rivalry in Porter’s Five Forces analysis D) Weakness in SWOT analysis Question 12 0 / 0.4 points In the CPM matrix, the factors to be used are: A) Opportunities and weaknesses from EFE matrix B) Weaknesses and threats from partial SWOT analysis C) Strengths and threats from IFE matrix D) Critical success factors for the industry Question 13 0.4 / 0.4 points A strategic researcher would evaluate the level of power suppliers have on a focal company’s industry environment using a: A) SWOT analysis B) Porter’s Five Forces analysis C) PESTLE analysis D) EFE matrix analysis Quiz 1: Question 15 Set aside 150 minutes to take the quiz. At 155 minutes the quiz will shut down as there is no opportunity to go beyond this time period. If students enter the quiz and fail to complete it, there is no opportunity to retake the quiz. Question 14 0 / 0.8 points Compute the total weighted scores, and interpret its strategic meaning with respect to other competitors. The total weighted scores are _____________. The focal company ______________. EFE matrix External factors Weights Scores Total weighted scores Opportunities Rising income levels in developing countries 0.15 3.00 Favorable growing seasons for good harvest 0.25 2.00 Consumer preference for the products of the company 0.13 3.00 Regional trade agreements 0.08 2.00 Threats Protectionist approach in levying tariffs 0.10 2.00 Reduction of oil extraction by OPEC countries 0.08 1.00 Increasing piracy incidents in international shipping routes 0.09 2.00 Environmental concerns due to the irrigation system 0.12 3.00 Total weighted scores A) 2.32; is relatively weaker than its competitors in tackling with the internal factors. B) 2.50; performs a par with its competitors in dealing with the internal factors. C) 2.32; underperforms, relative to its competitors, in tackling with the external factors. D) 2.72; tackles with the external factors better than its competitors. Quiz 1: Question 20 Set aside 150 minutes to take the quiz. At 155 minutes the quiz will shut down as there is no opportunity to go beyond this time period. If students enter the quiz and fail to complete it, there is no opportunity to retake the quiz. Question 15 1 / 1 point The company (companies) with the highest total weighted scores in the CPM matrix is (are) Company __________ at the total weighted scores of ____________. CPM Matrix Company A Company B Company C Critical success factors Weights Rating Weighted scores Rating Weighted scores Rating Weighted scores Integrated supply chain management 0.20 3 2 3 Range of product items 0.10 2 3 2 Economies of scale 0.05 1 2 3 Research and development 0.08 2 1 3 Financial position 0.07 1 2 2 Customer service management 0.20 3 2 2 Product quality 0.12 2 3 3 Capital budget 0.10 3 1 2 Consumer preference 0.08 1 2 1 Total weighted scores A) Company B at 2.32 B) Company A and B both at 2.30 C) Company C at 2.37 D) Company A at 2.30 Quiz 1: Questions 1-5 Set aside 150 minutes to take the quiz. At 155 minutes the quiz will shut down as there is no opportunity to go beyond this time period. If students enter the quiz and fail to complete it, there is no opportunity to retake the quiz. Question 16 0.6 / 0.6 points Company XYZ has cost of goods sold at $3,400,000, beginning inventory of $720,000 and ending inventory of $480,000. The industry inventory turnover average ratio is 8. The inventory turnover ratio of Company XYZ is ___________ and it is said to be_____________ when compared to the industry inventory average ratio. A) 4.72 and strong B) 7.99 and neutral C) 5.67 and weak D) 7.08 and neutral Question 17 0.6 / 0.6 points The income statement showed the following: Net income $91,000 Shareholder’s equity · Beginning of year: $787,500 · End of year: $829,500 What is the return of stockholder’s equity? A) 11.55% B) 11.3% C) 10.97% D) 11.26% Question 18 0.6 / 0.6 points Company CDE has current liabilities of $50,000 and long-term liabilities of $150,000. That company has current assets of $1,500,000 and owns plants and equipment that are worth $2,500,000. What is the debt ratio of Company CDE? A) 0.25 B) 20 C) 0.75 D) 0.05 Question 19 0.6 / 0.6 points The balance sheet of company XYZ indicated total assets of $440,000, and current assets of $200,000. The income statement indicated sales revenues of 1,320,000. What is the total asset turnover of company XYZ? A) 3 B) 0.152 C) 0.333 D) 6.6 Question 20 0 / 0.6 points The strategic researcher found from the balance sheet of Company PQR the following financial data: cash of $500 and other current assets of $2,500, current liabilities of $10,000 and long-term liabilities of $20,000. What is the acid-test ratio (or quick ratio) of Company PQR? A) 0.1 B) 0.25 C) 0.3 D) 0.5 [Show More]

Last updated: 3 years ago

Preview 1 out of 11 pages

![Preview image of [Solved] Bus 495 Quiz 1 document](https://scholarfriends.com/storage/[Solved]-Bus-495-Quiz-1.png)

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Also available in bundle (1)

Click Below to Access Bundle(s)

Bus 495 Quiz 1, Quiz 2, Quiz 3

[Solved] Bus 495 Quiz 1 [Solved] Bus 495 Quiz 2 [Solved] Bus 495 Quiz 3 Solved

By QUIZBANK 4 years ago

$9

3

Reviews( 0 )

$7.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Feb 10, 2021

Number of pages

11

Written in

All

Additional information

This document has been written for:

Uploaded

Feb 10, 2021

Downloads

0

Views

59

.png)