CFA Level 1 FRA Exam 96 Questions with Answers,100% CORRECT

Document Content and Description Below

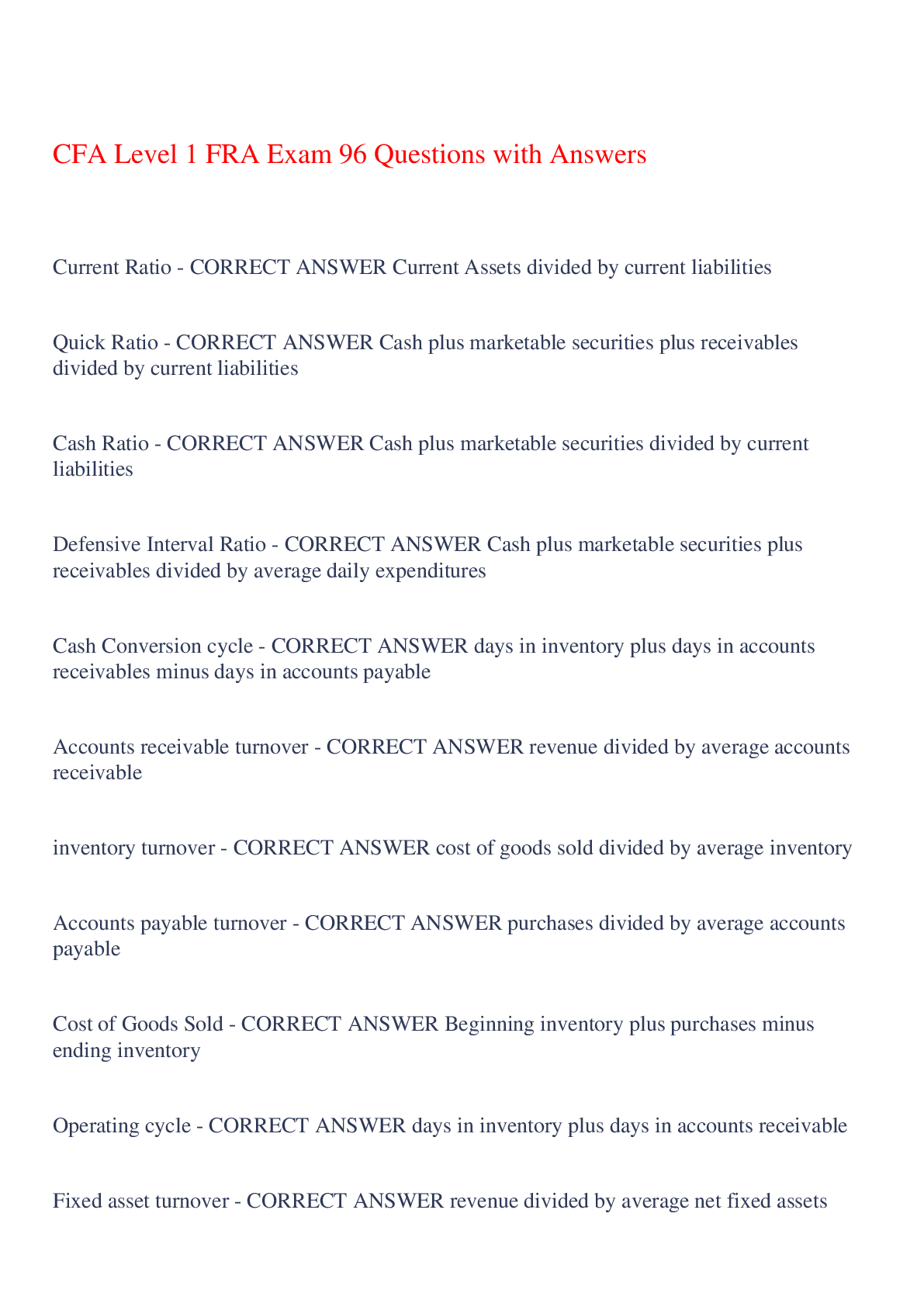

CFA Level 1 FRA Exam 96 Questions with Answers Current Ratio - CORRECT ANSWER Current Assets divided by current liabilities Quick Ratio - CORRECT ANSWER Cash plus marketable securities plus re ... ceivables divided by current liabilities Cash Ratio - CORRECT ANSWER Cash plus marketable securities divided by current liabilities Defensive Interval Ratio - CORRECT ANSWER Cash plus marketable securities plus receivables divided by average daily expenditures Cash Conversion cycle - CORRECT ANSWER days in inventory plus days in accounts receivables minus days in accounts payable Accounts receivable turnover - CORRECT ANSWER revenue divided by average accounts receivable inventory turnover - CORRECT ANSWER cost of goods sold divided by average inventory Accounts payable turnover - CORRECT ANSWER purchases divided by average accounts payable Cost of Goods Sold - CORRECT ANSWER Beginning inventory plus purchases minus ending inventory Operating cycle - CORRECT ANSWER days in inventory plus days in accounts receivable Fixed asset turnover - CORRECT ANSWER revenue divided by average net fixed assets working capital turnover - CORRECT ANSWER revenue divided by average working capital equity turnover - CORRECT ANSWER revenue divided by average equity debt to equity ratio - CORRECT ANSWER total debt divided by total equity debt ratio - CORRECT ANSWER total debt divided by total assets debt to total capital ratio - CORRECT ANSWER total debt divided by total debt plus total equity Financial leverage ratio - CORRECT ANSWER average total assets divided by average total equity interest coverage ratio - CORRECT ANSWER EBIT divided by interest payments Fixed charge coverage ratio - CORRECT ANSWER EBIT plus lease payments divided by interest payments plus lease payments Gross profit - CORRECT ANSWER Sales minus cost of goods sold Gross profit margin - CORRECT ANSWER gross profit divided by revenue operating profit margin - CORRECT ANSWER operating profit divided by revenue pretax margin - CORRECT ANSWER earnings before tax divided by revenue Net profit margin - CORRECT ANSWER net income divided by revenue Return on assets - CORRECT ANSWER net income divided by average total assets Return on Assets - CORRECT ANSWER EBIT divided by average total assets operating return on assets - CORRECT ANSWER operating profit divided by average total assets return on total capital - CORRECT ANSWER EBIT divided by average total capital Return on Equity - CORRECT ANSWER net income divided by average total equity Return on Equity - CORRECT ANSWER Return on Assets times financial leverage Return on Equity - CORRECT ANSWER Net profit margin times asset turnover times leverage ratio Return on common equity - CORRECT ANSWER net income minus preferred dividends divided by average common equity DuPont Formula - CORRECT ANSWER Net profit margin times total asset turnover times leverage Net Profit margin - CORRECT ANSWER net income divided by revenue Total asset turnover - CORRECT ANSWER Revenue divided by average assets Leverage - CORRECT ANSWER Average assets divided by average equity Extended DuPont Formula - CORRECT ANSWER Tax burden times interest burden times operating profit margin times asset turnover times leverage Tax burden - CORRECT ANSWER Earnings after tax divided by earnings before tax Interest burden - CORRECT ANSWER Earnings before tax divided by EBIT Operating profit margin - CORRECT ANSWER EBIT divided by revenue Total asset turnover - CORRECT ANSWER revenue divided by average assets leverage - CORRECT ANSWER average assets divided by average equity Leverage - CORRECT ANSWER 1 plus debt to equity ratio Growth Rate - CORRECT ANSWER retention rate times return on equity Retention rate - CORRECT ANSWER One minus dividend payout ratio Dividend payout ratio - CORRECT ANSWER dividends per share divided by earnings per share After tax interest expense - CORRECT ANSWER Interest expense times one minus the tax rate Working Capital investment - CORRECT ANSWER Increase or decrease in non cash operating assets and liabilities Net Borrowings - CORRECT ANSWER Debt issued minus principal repaind Fixed Capital Investment - CORRECT ANSWER equals capital expenditures Free Cash Flow to the Firm - CORRECT ANSWER Net income plus non cash charges plus after tax interest expense minus fixed working capital minus working capital investment Free Cash Flow from Operations - CORRECT ANSWER Cash flow from operations plus after tax interest expense minus fixed capital investment Free Cash Flow to equity - CORRECT ANSWER Cash Flow From operations minus fixed capital investment plus net borrowings Percentiles - CORRECT ANSWER equals n plus 1 times y divided by 100 Measurement of Inventory with IFRS - CORRECT ANSWER Inventory is reported on the balance sheet at the lower of cost or new realizable value Net Realizable value - CORRECT ANSWER equal to the expected sales price less the estimated selling costs and completion costs Net realizable value less than balance sheet value - CORRECT ANSWER inventory is written down to net realizable value and the loss is recognized in the income statement Valuation allowance account - CORRECT ANSWER contra account where the inventory write down is accomplished. This separates the original cost of inventory from the carrying value of inventory Measurement of Inventory with GAAP - CORRECT ANSWER inventory is reported on the balance sheet at the lower of cost or market Market Value - CORRECT ANSWER usually equal to replacement cost but cannot be greater than net realizable value or less than net realizable value minus a normal profit margin Identifiable intangible asset under IFRS - CORRECT ANSWER Must be capable of being separated from the firm or arise from a contractual or legal right. Must be controlled by the firm. Must be expected to provide future economic benefits Unidentifiable intangible asset - CORRECT ANSWER cannot be purchased separately and may have an indefinite life -- Goodwill Research Costs - CORRECT ANSWER Under IFRS research costs are expensed as incurred Under GAAP research costs are expensed as incurred Development Costs - CORRECT ANSWER Under IFRS development costs may be capitalized Under GAAP development costs are expensed as incurred Capitalize cost - CORRECT ANSWER list the expenditure as an asset on the balance sheet. Allocate to the income statement through depreciation or amortization of expense Expense Cost - CORRECT ANSWER allocate expenditure to income statement in the period incurred Internally generated goodwill - CORRECT ANSWER expensed in the period incurred Carrying or book value - CORRECT ANSWER The net value of an asset or liability on the balance sheet. For property, plant and equipment, carrying value equals historical cost minus accumulated depreciation Straight-line Depreciation - CORRECT ANSWER original cost - salvage value divided by depreciable life Double declining balance - CORRECT ANSWER 2 divided by depreciable life in years times book value at beginning of year x output units in the period Units of production - CORRECT ANSWER original cost - salvage value divided by life in output units times output units in the period Component Depreciation under IFRS - CORRECT ANSWER requires firm to depreciate the components of an asset separately Component Depreciation under GAAP - CORRECT ANSWER allowed under GAAP but is seldom used Revaluation model - CORRECT ANSWER IFRS alternative that permits a long-lived asset to be reported at its fair value, as long as an active market exists for the asset Revaluation surplus - CORRECT ANSWER an increase in an assets value above historical cost is not reported as a gain in the income statement but as a component of shareholders' equity in the revaluation surplus account Recoverability - CORRECT ANSWER Under GAAP an asset is considered impaired if the carrying value is greater than the asset's future UNDISCOUNTED cash flow stream Loss measurement under GAAP - CORRECT ANSWER If imparied, the asset's value is written down to fair value on the balance sheet and a loss, equal to the excess of carrying value over the fair value or the discounted value of future cash flows is recognized in the income statement Impaired - CORRECT ANSWER Asset is impaired if its carrying value exceeds its net realizable value which is fair value minus selling costs IFRS criteria for finance lease - CORRECT ANSWER title of the leased asset is transferred to the lessee at the end of the lease IFRS criteria for finance lease - CORRECT ANSWER Lessee can purchase the leased asset for a price that is significantly lower than the fair value of the asset IFRS criteria for finance lease - CORRECT ANSWER The lease term covers a major portion of the asset's economic life IFRS criteria for finance lease - CORRECT ANSWER The present value of the lease payments is substantially equal to the fair value of the leased asset IFRS criteria for finance lease - CORRECT ANSWER the leased asset is so specialized that only the lessee can use the asset without significant modifications GAAP criteria for finance lease - CORRECT ANSWER title to the leased asset is transferred to the lessee at the end of the lease period GAAP criteria for finance lease - CORRECT ANSWER A bargain purchase option permits the lessee to purchase the leased asset for a price that is significantly lower than fair market value GAAP criteria for finance lease - CORRECT ANSWER The lease period is 75% or more of the asset's economic life GAAP criteria for finance lease - CORRECT ANSWER The present value of the lease payments is 90% or more of the fair value of the leased asset Capitalized Inventory Costs - CORRECT ANSWER Include purchase cost, conversion or manufacturing costs which include labor and overhead, and other costs to bring inventory to its present state and location Inventory costs recognized as expenses - CORRECT ANSWER include abnormal waste, storage costs not required for production, selling costs and administrative overhead characteristics of decision useful financial reporting - CORRECT ANSWER relevance and faithful representation relevance - CORRECT ANSWER information presented in financial statements is useful in making decisions Information must be material Faithful representation - CORRECT ANSWER encompasses the qualities of completeness, neutrality and the absence of errors sustainability - CORRECT ANSWER one dollar of high quality earnings is expected to add more value to a company than one dollar of low quality earnings factors for low quality financial reporting - CORRECT ANSWER motivation, opportunity and rationalization of behavior Channel Stuffing - CORRECT ANSWER overloading a distribution channel to increase sales Bill and hold - CORRECT ANSWER Customer buys the goods and receives an invoice but requests that the firm keep the goods at their location for a period of time. Increases earning in current period by recognizing revenue for goods that are actually still in inventory [Show More]

Last updated: 2 years ago

Preview 1 out of 8 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Also available in bundle (1)

Click Below to Access Bundle(s)

CFA LEVEL 1 Exam (18 SETS) Questions with Verified Answer 2023,100% CORRECT

CFA LEVEL 1 Exam 275 Questions with Verified Answer 2023, CFA Level 1 - 101 Must Knows 368 Questions with Verified Answers,CFA level 1 Exam 48 Questions with Verified Answers,CFA Level 1 FRA Exam 96...

By Nolan19 2 years ago

$35.5

18

Reviews( 0 )

$9.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Jun 18, 2023

Number of pages

8

Written in

All

Additional information

This document has been written for:

Uploaded

Jun 18, 2023

Downloads

0

Views

105