Risk Management and Insurance > EXAM > Jasmin Insurance Exam Fx, Questions And Answers (All)

Jasmin Insurance Exam Fx, Questions And Answers

Document Content and Description Below

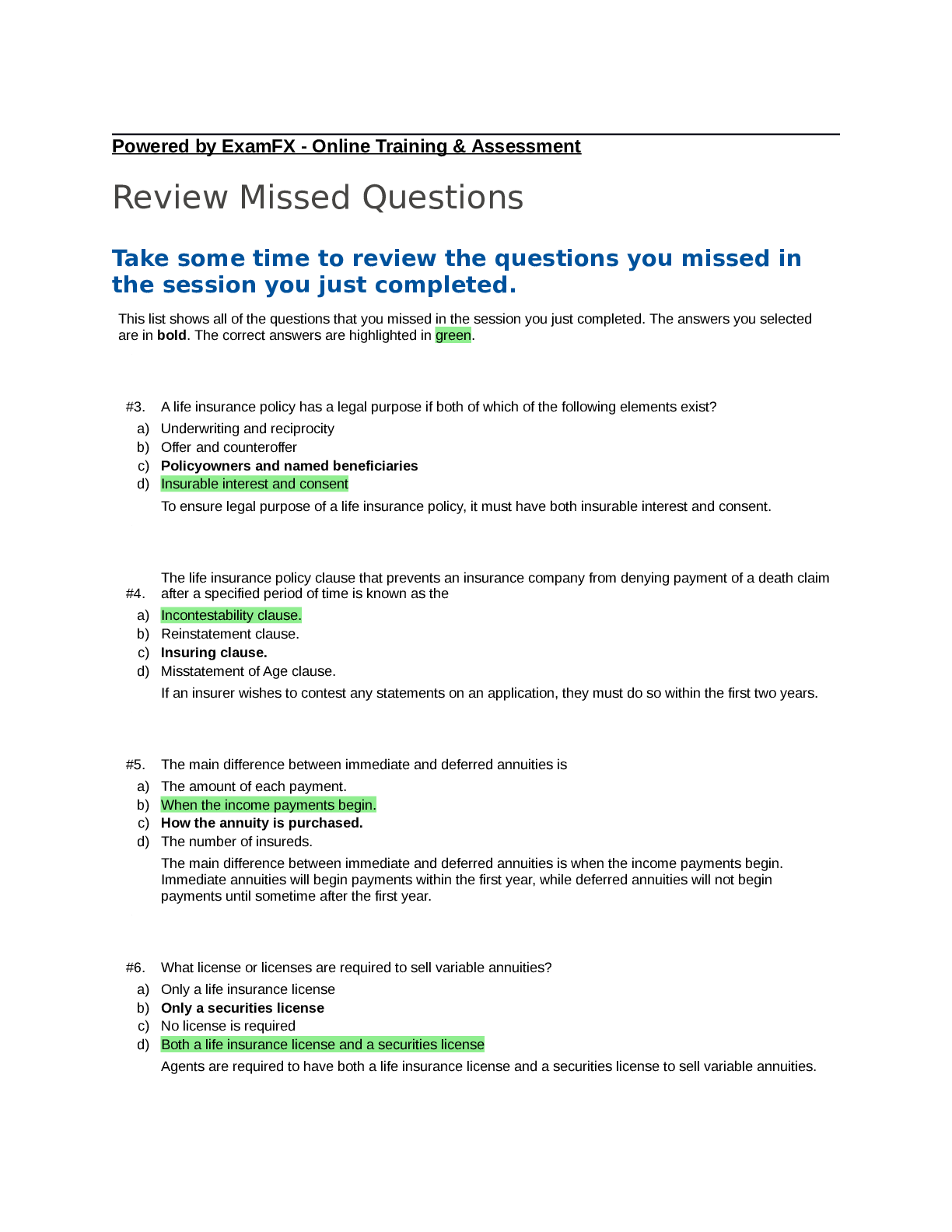

Jasmin Insurance Exam Fx, Questions And Answers.Review Missed Questions Languages: English Español Take some time to review the questions you missed in the session you just completed. This list s... hows all of the questions that you missed in the session you just completed. The answers you selected are in bold. The correct answers are highlighted in green. #3. A life insurance policy has a legal purpose if both of which of the following elements exist? a) Underwriting and reciprocity b) Offer and counteroffer c) Policyowners and named beneficiaries d) Insurable interest and consent To ensure legal purpose of a life insurance policy, it must have both insurable interest and consent. #4. The life insurance policy clause that prevents an insurance company from denying payment of a death claim after a specified period of time is known as the a) Incontestability clause. b) Reinstatement clause. c) Insuring clause. d) Misstatement of Age clause. If an insurer wishes to contest any statements on an application, they must do so within the first two years. #5. The main difference between immediate and deferred annuities is a) The amount of each payment. b) When the income payments begin. c) How the annuity is purchased. d) The number of insureds. The main difference between immediate and deferred annuities is when the income payments begin. Immediate annuities will begin payments within the first year, while deferred annuities will not begin payments until sometime after the first year. #6. What license or licenses are required to sell variable annuities? a) Only a life insurance license b) Only a securities license c) No license is required d) Both a life insurance license and a securities license Agents are required to have both a life insurance license and a securities license to sell variable annuities. #7. Which of the following is INCORRECT regarding a $100,000 20-year level term policy? a) The policy will expire at the end of the 20-year period. b) At the end of 20 years, the policy’s cash value will equal $100,000. c) The policy premiums will remain level for 20 years. d) If the insured dies before the policy expired, the beneficiary will receive $100,000. Term policies do not develop cash values. All the other statements are true. #8. An insured purchased a life policy in 2010 and died in 2017. The insurance company discovers at that time that the insured had misstated information during the application process. What can they do? a) Refuse to pay the death benefit because of the misstatement on the application b) Pay a decreased death benefit c) Sue for the right to not pay the death benefit d) Pay the death benefit The incontestability clause prevents an insurer from denying a claim due to statements in an application after the policy has been in force for 2 years, even on the basis of a material misstatement of facts or concealment of a material fact. [Show More]

Last updated: 2 years ago

Preview 1 out of 16 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$13.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Jun 20, 2023

Number of pages

16

Written in

Additional information

This document has been written for:

Uploaded

Jun 20, 2023

Downloads

0

Views

57

.png)

.png)

.png)