Financial Accounting > QUESTIONS & ANSWERS > University of the People - BUS 1102Graded Quiz Unit 6. Grade 100.00 out of 100.00 (All)

University of the People - BUS 1102Graded Quiz Unit 6. Grade 100.00 out of 100.00

Document Content and Description Below

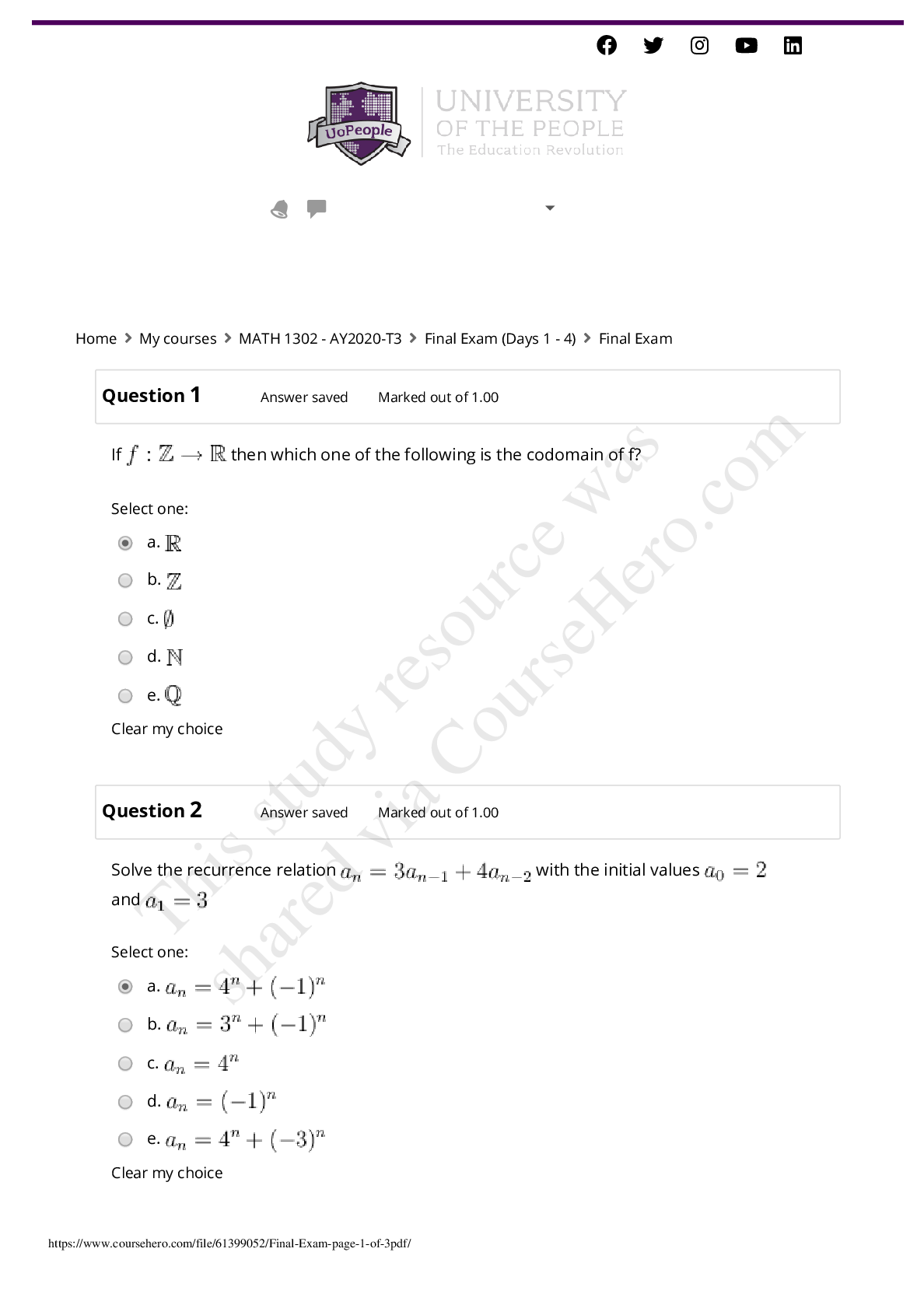

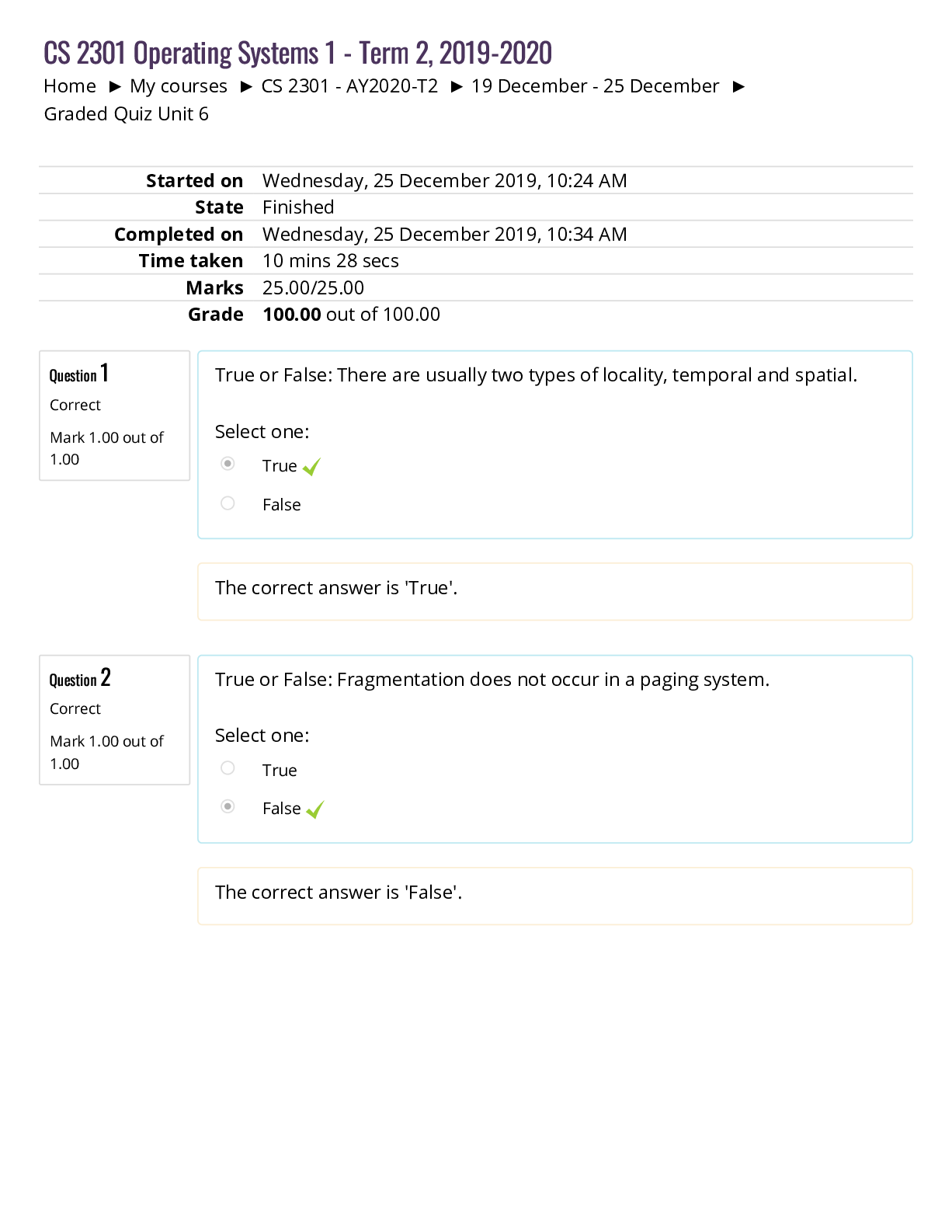

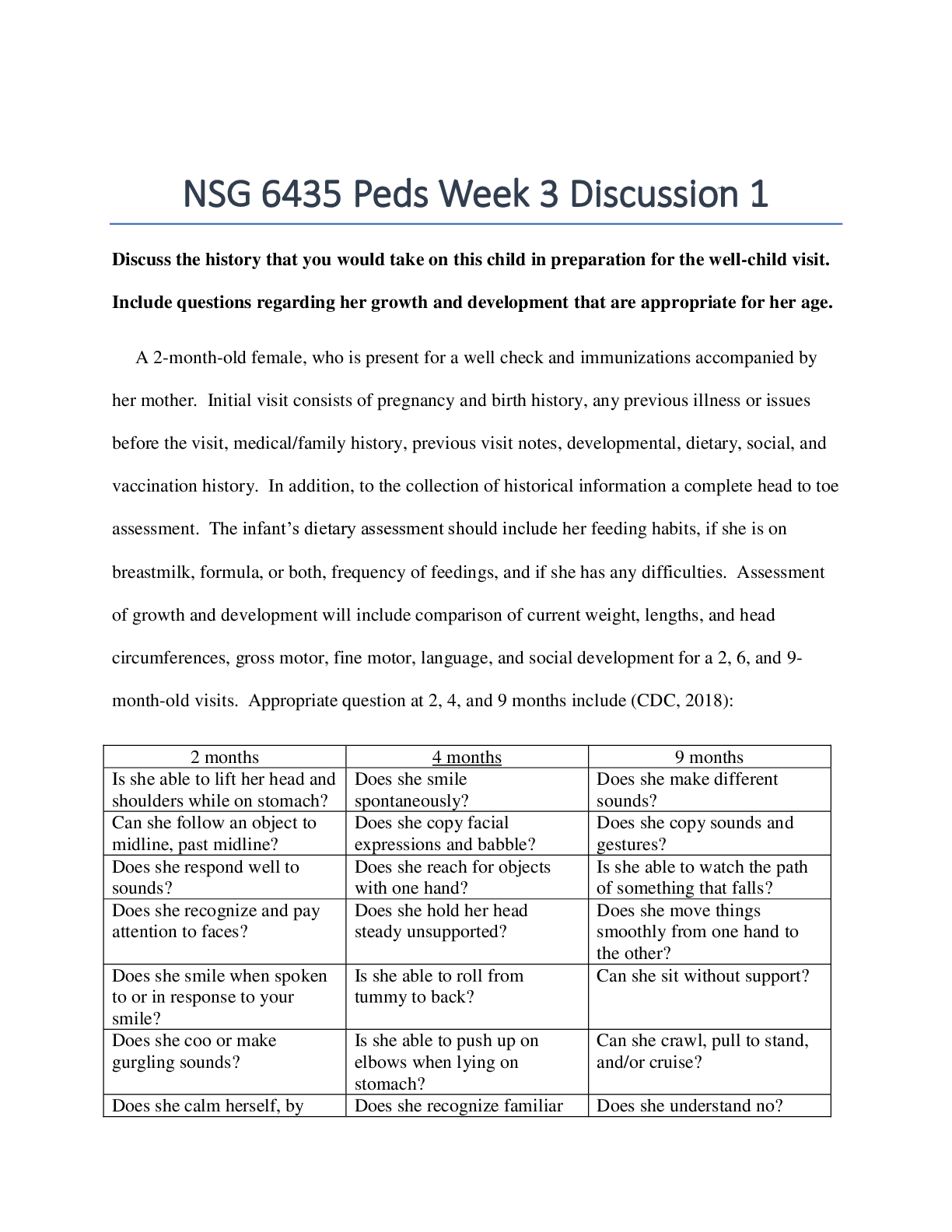

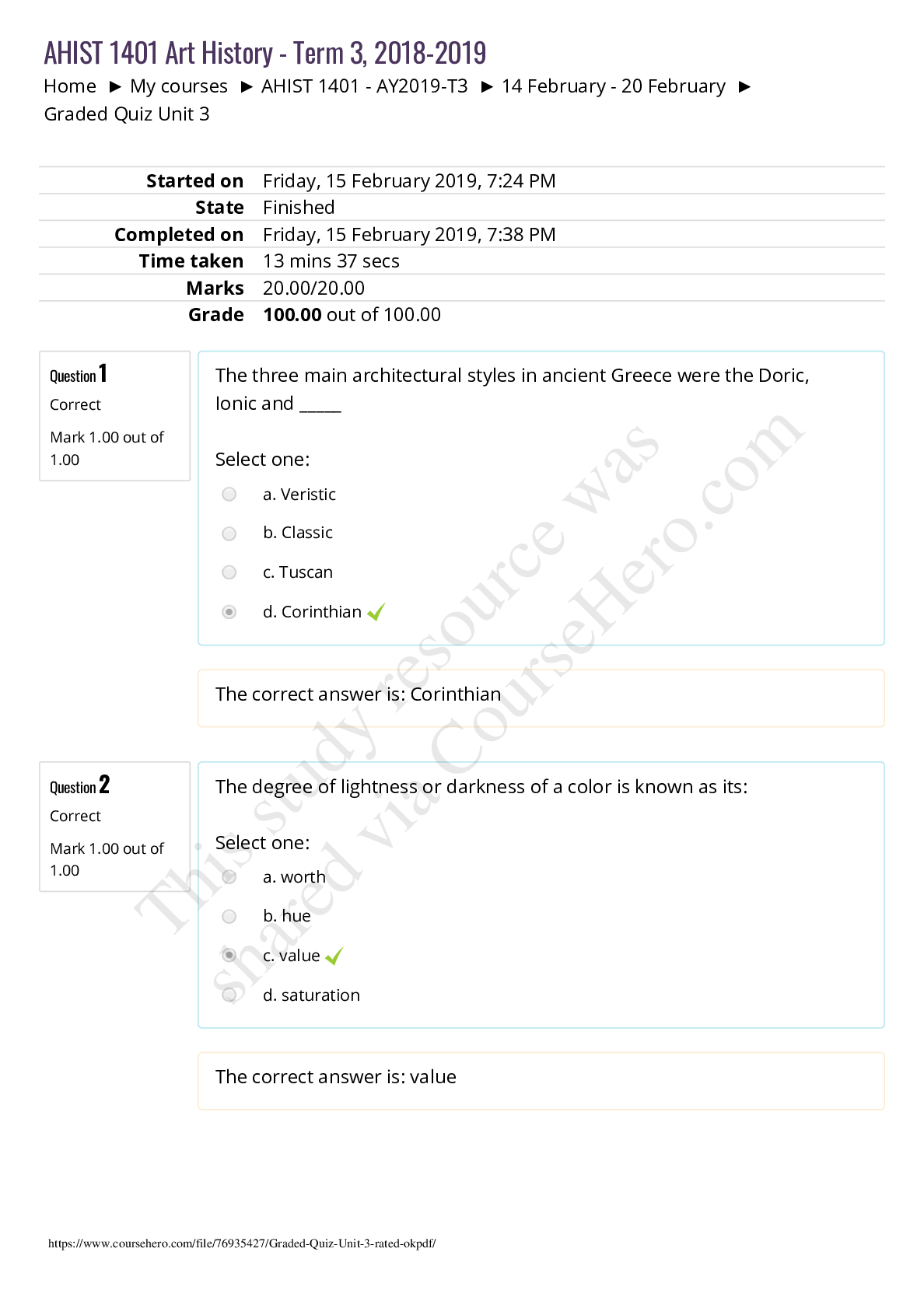

/ Home ▶ My courses ▶ BUS 1102 - AY2020-T1 ▶ 10 October - 16 October ▶ Graded Quiz Unit 6 Question 1 Mark 1.00 out of 1.00 Question 2 Mark 1.00 out of 1.00 Started on Friday, 11 O... ctober 2019, 3:19 AM State Finished Completed on Friday, 11 October 2019, 3:23 AM Time taken 4 mins 32 secs Marks 14.00/14.00 Grade 100.00 out of 100.00 The two types of general ledger accounts are: Select one: a. Nominal and Temporary b. Assets and Liabilities c. Real and Temporary d. Income and Expense Your answer is . Real and Temporary The bookkeeper prepared a check for $48 but accidently recorded it as $95. When preparing the bank reconciliation, this should be ed by: Select one: a. Depositing $47 into the bank account b. Withdrawing $47 from the bank account c. Adding $47 to the book balance d. Subtracting $47 from the book balance Adding $47 to the book balance BUS 1102 Basic Accounting - Term 1, 2019-2020 / Question 3 Mark 1.00 out of 1.00 Question 4 Mark 1.00 out of 1.00 Net income from the Income Statement appears on: Select one: a. The balance sheet b. The retained earnings statement c. Both the balance sheet and the retained earnings statement d. Neither the balance sheet nor retained earnings statement The retained earnings statement The accountant for the McCarthy Company forgot to make an adjusting entry to record depreciation for the current year. The effect of this error could be: Select one: a. An overstatement of assets, overstatement of net income, and overstatement of owners’ equity b. An overstatement of assets oàset by an understatement of owners’ equity c. An overstatement of net income and an understatement of assets d. An overstatement of assets and of net income and an understatement of owners’ equity An overstatement of assets, overstatement of net income, and overstatement of owners’ equity / Question 5 Mark 1.00 out of 1.00 Question 6 Mark 1.00 out of 1.00 Question 7 Mark 1.00 out of 1.00 The purpose of making closing entries is to: Select one: a. Reset the temporary accounts and update retained earnings b. Enable the accountant to prepare Õnancial statements at the end of the accounting period c. Establish new balances in the balance sheet accounts d. Reduce the number of expense accounts Reset the temporary accounts and update retained earnings Accounts receivable _________ Select one: a. Are usually converted to cash in 30 to 60 days b. Are relatively liquid assets c. Usually appear after short-term investments in marketable securities d. All of the above. All of the above. Closing entries would be prepared: Select one: a. After Õnancial statements are prepared b. After an adjusted trial balance c. Before the post-closing trial balance d. Before adjusting entries Before the post-closing trial balance / Question 8 Mark 1.00 out of 1.00 Question 9 Mark 1.00 out of 1.00 Question 10 Mark 1.00 out of 1.00 EÞcient management of cash includes which of the following concepts? Select one: a. Pay each bill as soon as the invoice is received b. Reconcile cash accounts to bank statements only at the end of the year c. Prepare monthly cash budgets (forecasts) up to a year in advance d. Pay suppliers in cash out of cash sales receipts before depositing them in the bank Prepare monthly cash budgets (forecasts) up to a year in advance The cost of delivering merchandise to the customer is: Select one: a. Part of cost of goods sold b. An operating expense c. Used in the calculation of sales revenue d. A reduction of gross proÕt An operating expense Shop-N-Go Systems purchased cash registers on April 1 for $12,000. If this asset has an estimated useful life of four years, what is the net book value of the cash registers on May 31 if the company uses the straight – line method of depreciation? Select one: a. $250 b. $3,000 c. $11,500 d. $12,000 / Question 11 Mark 1.00 out of 1.00 Question 12 Mark 1.00 out of 1.00 Ben Dryden, president of Jet Glass, Inc., noticed a $6,000 debit to Accounts Payable in the company’s general ledger. This debit could correspond to: Select one: a. A $6,000 sale to a customer b. A purchase of equipment costing $6,000 on credit c. The failure to pay this month’s $6,000 utility bill on time d. A payment of $6,000 to a supplier to settle a balance due A payment of $6,000 to a supplier to settle a balance due Investments held for resale in expectation of making a proÕt are: Select one: a. Trading securities b. Long term assets c. Not to be recorded in the book balance d. Non-current assets Trading securities / Question 13 Mark 1.00 out of 1.00 Question 14 Mark 1.00 out of 1.00 ◀ Learning Journal Unit 6 Jump to... Solutions for Assignment Unit 5 ▶ The relationship between the income statement and the balance sheet may be described as follows: Select one: a. The assets shown in a balance sheet include all the revenue shown in the income statement b. The balance sheet summarizes the change in net income occurring between successive income statements c. The income statement summarizes the changes in cash occurring between two balance sheet dates d. The income statement explains part of the change in owner’s equity between two balance sheet dates The income statement explains part of the change in owner’s equity between two balance sheet dates Before any month-end adjustments are made, the net income of Russell Company is $68,000. However, the following adjustments are necessary: oÞce supplies used, $2,060; services performed for clients but not yet recorded or collected, $2,600; interest accrued on note payable to bank, $2,000. After adjusting entries are made for the items listed above, Russell Company’s net income would be: Select one: a. $72,660 b. $69,460 c. $66,540 d. Some other amount $66,540 [Show More]

Last updated: 2 years ago

Preview 1 out of 7 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$12.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Feb 11, 2021

Number of pages

7

Written in

Additional information

This document has been written for:

Uploaded

Feb 11, 2021

Downloads

0

Views

257

.png)