Business > QUESTIONS & ANSWERS > QuickBooks Chapter 8 Questions and Answers 100% Pass (All)

QuickBooks Chapter 8 Questions and Answers 100% Pass

Document Content and Description Below

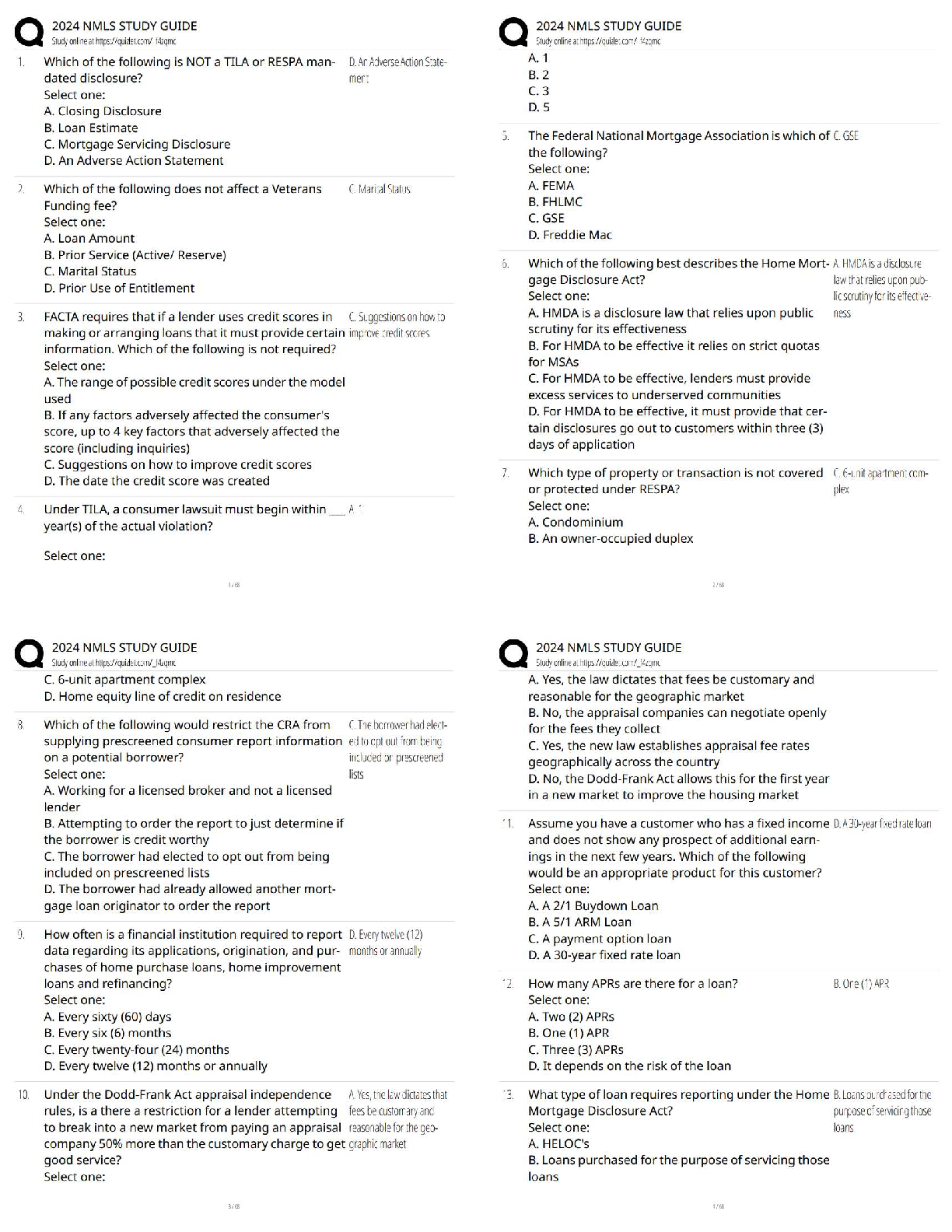

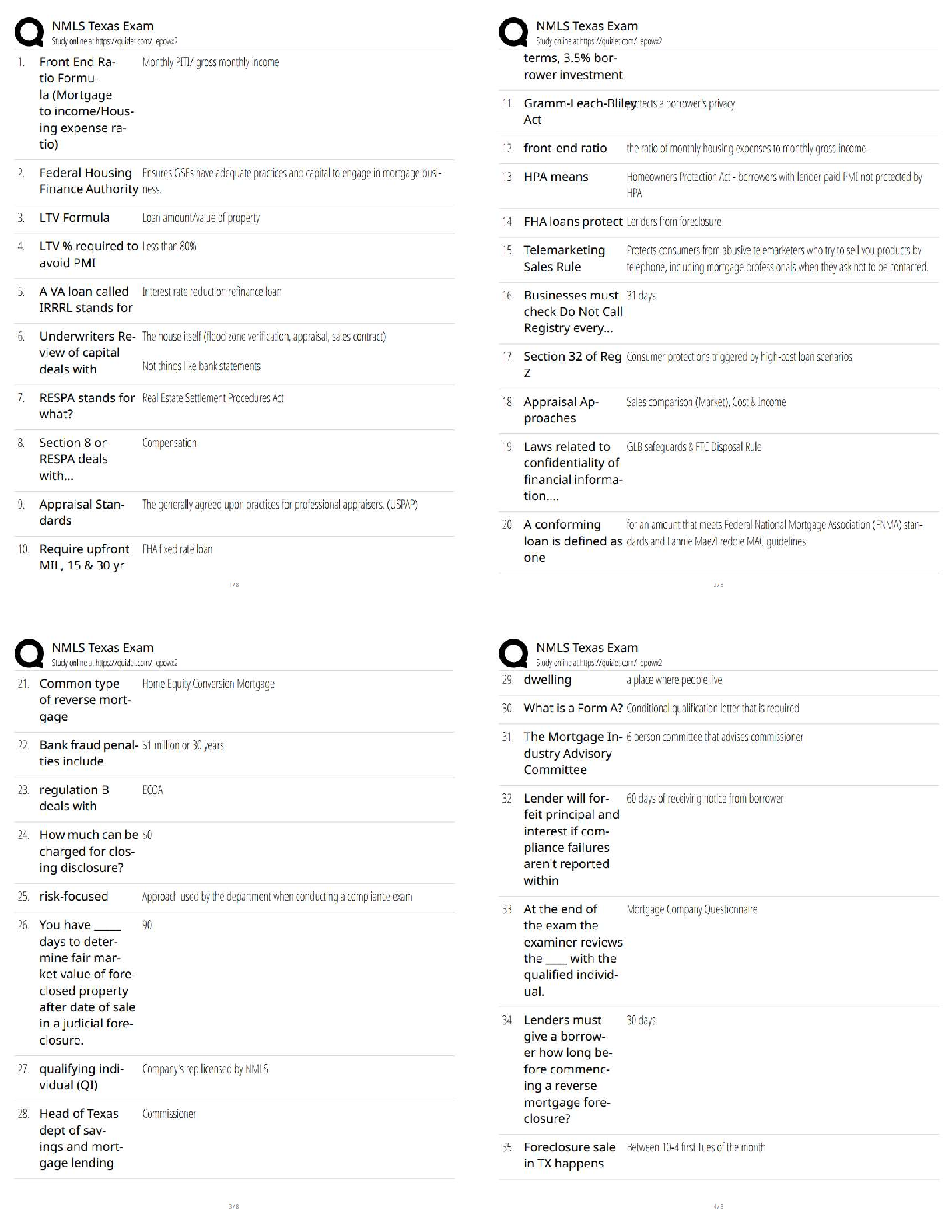

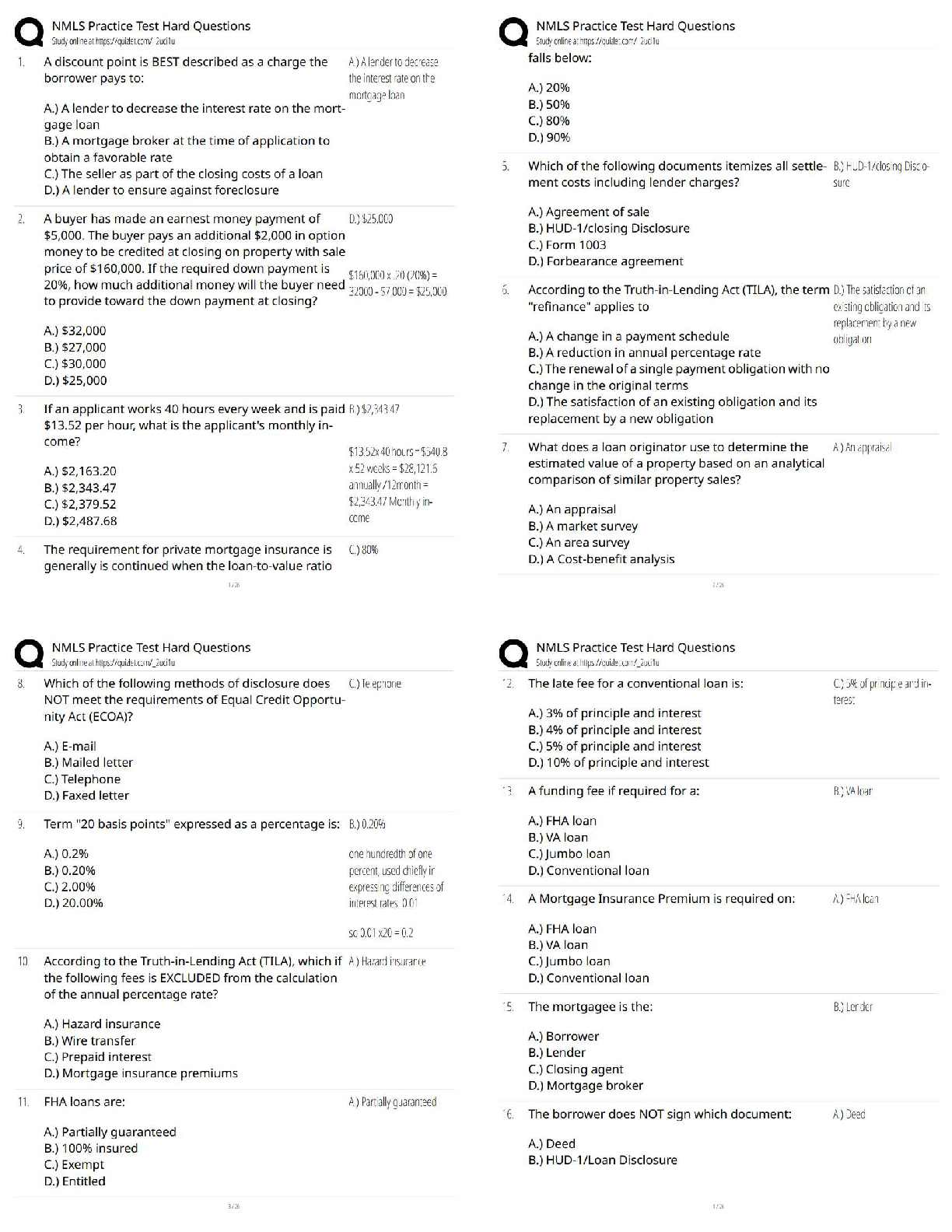

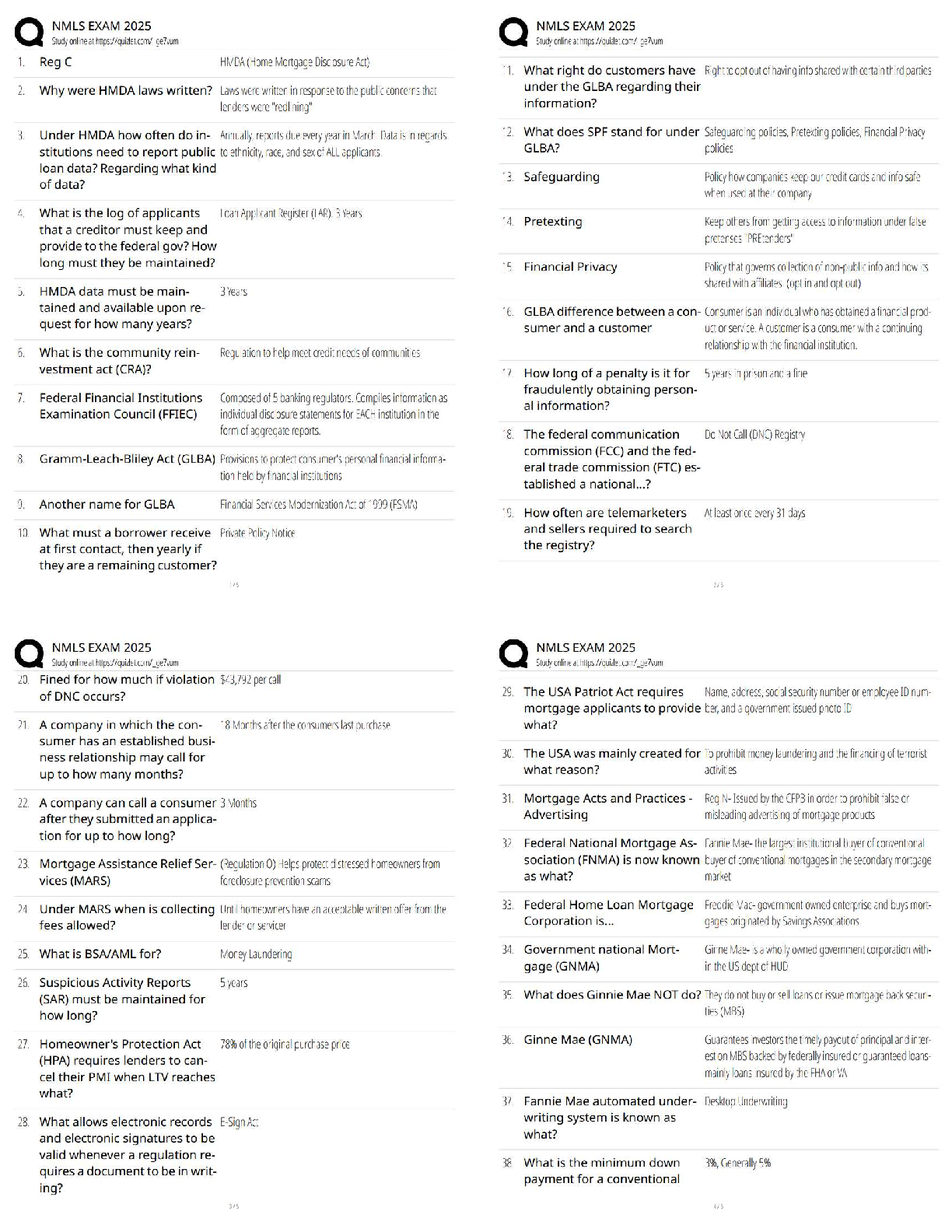

QuickBooks Chapter 8 Questions and Answers 100% Pass You cannot process payroll manually. ✔✔False Once a paycheck has been printed, you may not edit it. ✔✔False Paychecks may be printed on ... ly as a batch. ✔✔False A payroll check may never be deleted. ✔✔False Once an employee is hired, you may not change the pay period from semi-monthly to monthly. ✔✔False An employee may be added at anytime. ✔✔True If several taxes are owed to a single agency, QuickBooks generates a separate check to the agency for each tax liability item. ✔✔False If a salaried employee uses vacation pay, QuickBooks will automatically distribute the correct amount of earnings to Vacation Salary once the number of vacation hours has been entered. ✔✔True Processing the Payroll Liability Balances Report also generates the checks for payment of the liabilities. ✔✔False All payroll reports must be printed before payroll liabilities may be paid. ✔✔False When completing paychecks manually, you _____. A. provide the information about hours worked B. provide the amounts for deductions C. provide the number of sick and/or vacation hours used D. all of the above ✔✔D. all of the above -provide the information about hours worked -provide the amounts for deductions -provide the number of sick and/or vacation hours used To change the amount of a deduction entered on an employee's check that has been created, you ________. A. must void the check and issue a new one B. adjust the next check to include the change C. change the Paycheck Detail for the check and reprint it D. must delete the check ✔✔ange the Paycheck Detail for the check and reprint it When paying tax liabilities, you may ________. A. pay all liabilities at one time B. select individual tax liabilities and pay them one at a time C. pay all the tax liabilities owed to a vendor D. all of the above ✔✔D. all of the above pay all liabilities at one time select individual tax liabilities and pay them one at a time pay all the tax liabilities owed to a vendor A new employee may be added . A. at any time B. only at the end of the week C. only at the end of the pay period D. only when current paychecks have been printed ✔✔at any time Pay stub information may be printed ________. A. as part of a voucher check B. separate from the paycheck C. only as an individual employee report D. both A and B ✔✔D. both A and B as part of a voucher check separate from the paycheck The Employee Earnings Summary Report lists payroll information for each employee categorized by ________. A. employee B. department C. payroll item D. date paid ✔✔payroll item A voided check ________. A. shows an amount of 0.00 B. has a Memo of VOID C. remains as part of the company records D. all of the above ✔✔D. all of the above shows an amount of 0.00 has a Memo of VOID remains as part of the company records When the payroll liabilities to be paid have been selected, QuickBooks will ________. A. create a separate check for each liability B. consolidate the liabilities paid and create one check for each vendor C. automatically process a Payroll Liability Balances Report D. prepare any tax return forms necessary ✔✔consolidate the liabilities paid and create one check for each vendor The Journal may be prepared ________. A. for any range of dates B. for a specific month C. for a specific day D. all of the above ✔✔D. all of the above for any range of dates for a specific month for a specific day Changes made to an employee's pay rate will become effective ________. A. immediately B. at the end of the next payroll period C. at the end of the quarter D. after a W-2 has been prepared for the employee ✔✔A. immediately In the ____________ , the individual employee's name, address, and telephone number is displayed in the Employee Information area. ✔✔Employee Center The _____________ is the report that lists transactions in debit/credit format. ✔✔Journal The reports that show an employee's gross pay, sick and vacation hours and pay, deductions, taxes, and other details are the _________ and the Employee ____________. ✔✔Payroll Summary and Earnings Summary . When the Employee Center is on the screen, the New Employee button is used to add a ______________. ✔✔New Employee The report listing the company's unpaid payroll liabilities as of the report date is the _____________________ Report. ✔✔Payroll Liability Balances [Show More]

Last updated: 2 years ago

Preview 1 out of 7 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$10.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Jul 08, 2023

Number of pages

7

Written in

All

Additional information

This document has been written for:

Uploaded

Jul 08, 2023

Downloads

0

Views

327

.png)