APM2614 Assignment Questions / Score 100% / Updated 2025 Study Resources & Solutions

$ 7.5

SOLUTION MANUAL FOR A FIRST COURSE IN ABSTRACT ALGEBRA, WITH APPLICATIONS 8TH EDITION BY JOSEPH J. ROTMAN LATEST 2024

$ 15

DATABASE; Suppose a local college has tasked you to develop a database that will keep track of students and the courses that they have taken

$ 4

(1).png)

PRIMARY CARE 5TH EDITION SAMPLE ITEMS

$ 11.5

NR566 Midterm Study Guide 2022 Full

$ 11

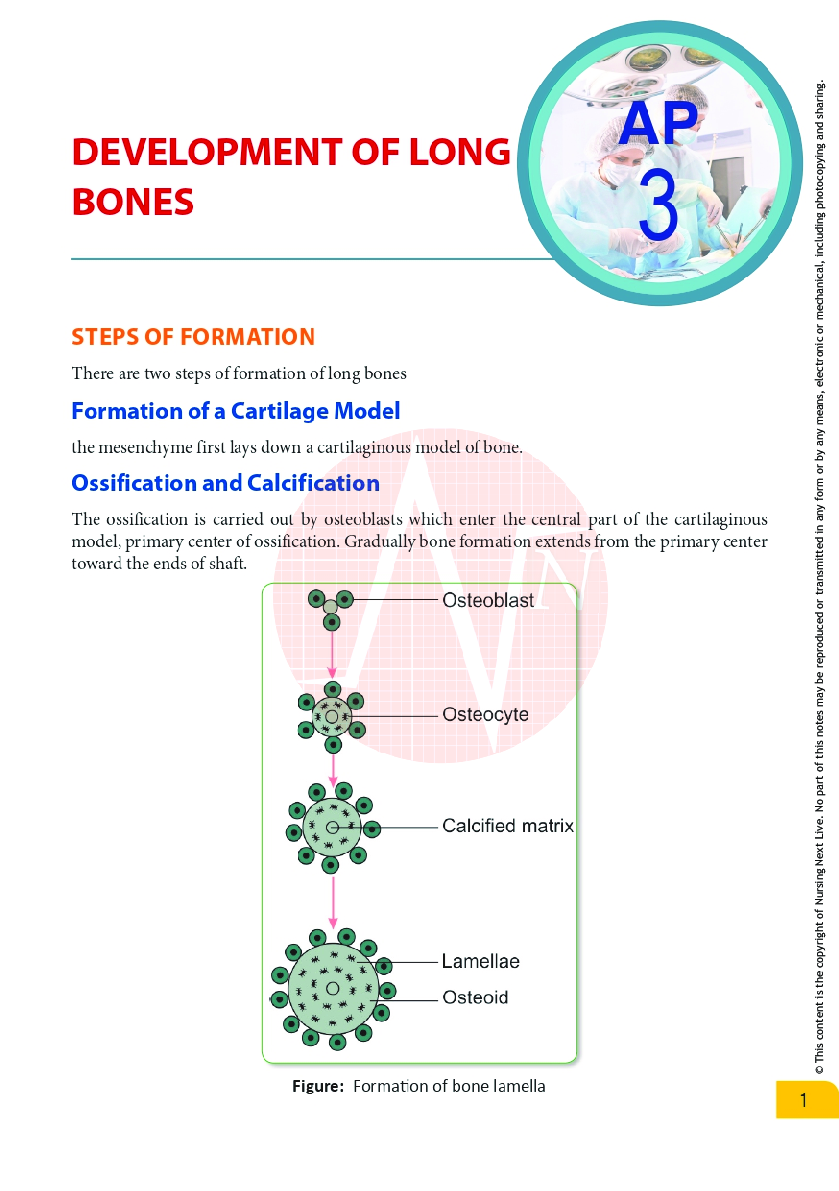

A&P--Development of Long Bones

$ 11

Power-Pant-Question-Book-Api-Asme-Test-Practice

$ 18

Study Guide > MECH2413 Engineering Mechanics Chapter 06: Deflection of Beams_ The geometric result of a beam being stressed

$ 3

BIOD 171 EXAM MODULE 5

$ 14

CET 345W Materials Testing Laboratory: Nondestructive Testing (NDT), Full lab report.

$ 10

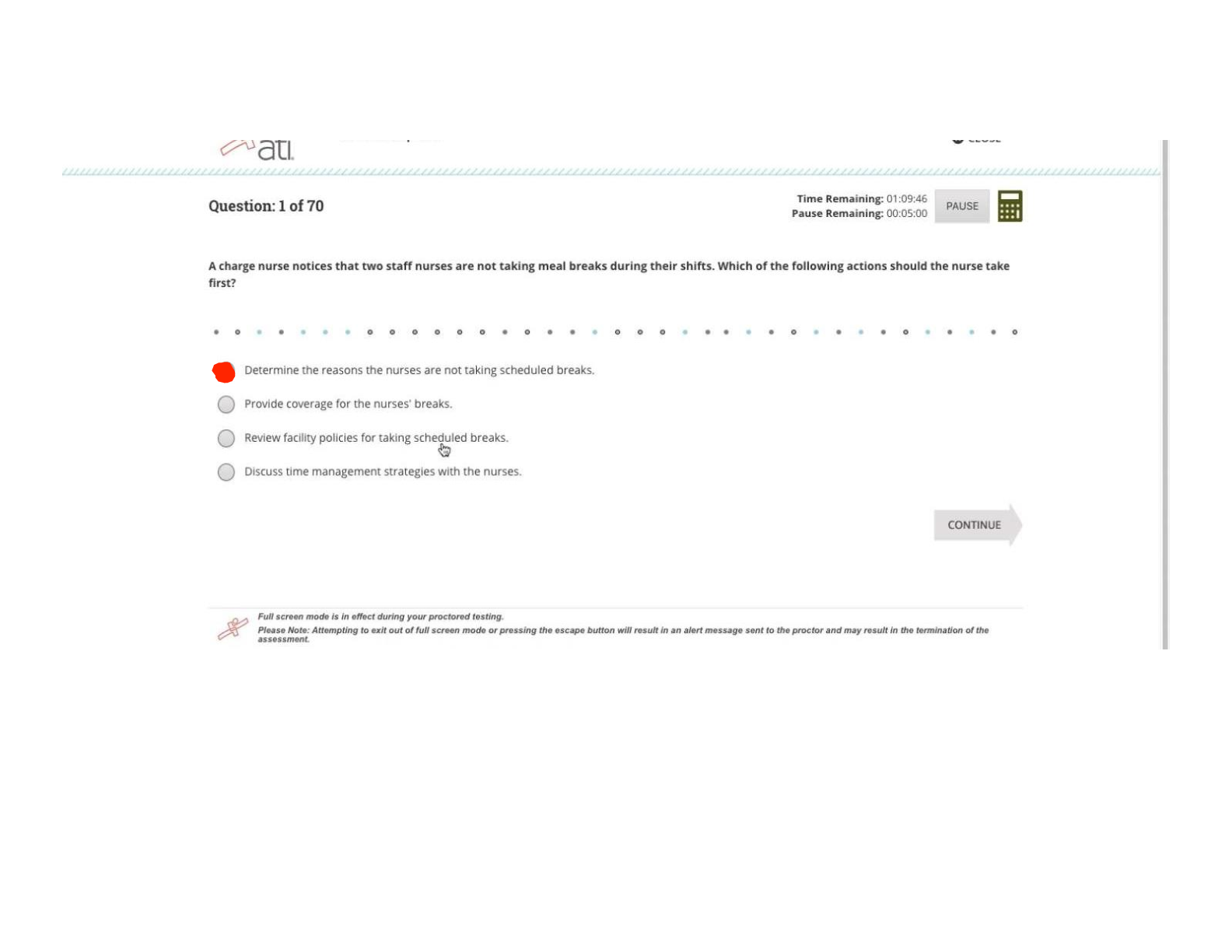

RN Comprehensive Predictor 2019 Form A

$ 27

NURS 6501 PATHOPHYSIOLOGY EASSY WEEK 2 2021

$ 8

Splunk Core Certified Power User* (2022/2023) Graded A+

$ 11

Pearson Edexcel Level 3 GCE 8FM0/27 Further Mathematics Advanced Subsidiary Further Mathematics options 27: Decision Mathematics 1 (Part of options D, F, H and K). Nov 2021, QP.

$ 7

.png)

Home Inspection Exam Prep Questions and Answers Graded A+

$ 8

ATI Proctored Exam: Community Health (Public Health)

$ 15

Midterm #3 Questions 3-6 - Stony Brook University ESG 332

$ 4

Cybersecurity Intro Coursera Notes / Google & IBM Certificate Review / 2025 Study Guide / Score 100% / Test Bank

$ 29.5

NCLEX-PN Test-Bank 200 Questions with Answers and Explanation; Best Prepping Material So far.

$ 15

Pearson Edexcel GCE AS In Mathematics (8MA0) Paper 21 Statistics Examiners’ Report Principal Examiner Feedback November 2021

$ 5

Case Study: POS Attacks CIS 562: Forensic Planning (ASSURED A)

$ 8

ATI RN LEADERSHIP PROCTORED ASSESSMENT EXAM 2024 WITH NGN

$ 10

eBook CompTIA Security+ Guide to Network Security Fundamentals 8th Edition By Mark Ciampa

$ 30

COMPLETE - Elaborated Test Bank for Data Analytics-A Small Data Approach-Chapman & Hall/CRC Data Science Series 1Ed.by Shuai Huang & Houtao Deng.ALL Chapters1-10(123 pages) included and updated for 2023

$ 20.5

CAIB 4 EXAM 2025

$ 17.5

.png)

AQA AS MATHEMATICS 7356/2 Paper 2 Mark scheme June 2021 Version: 1.0 Final Mark Scheme

$ 10

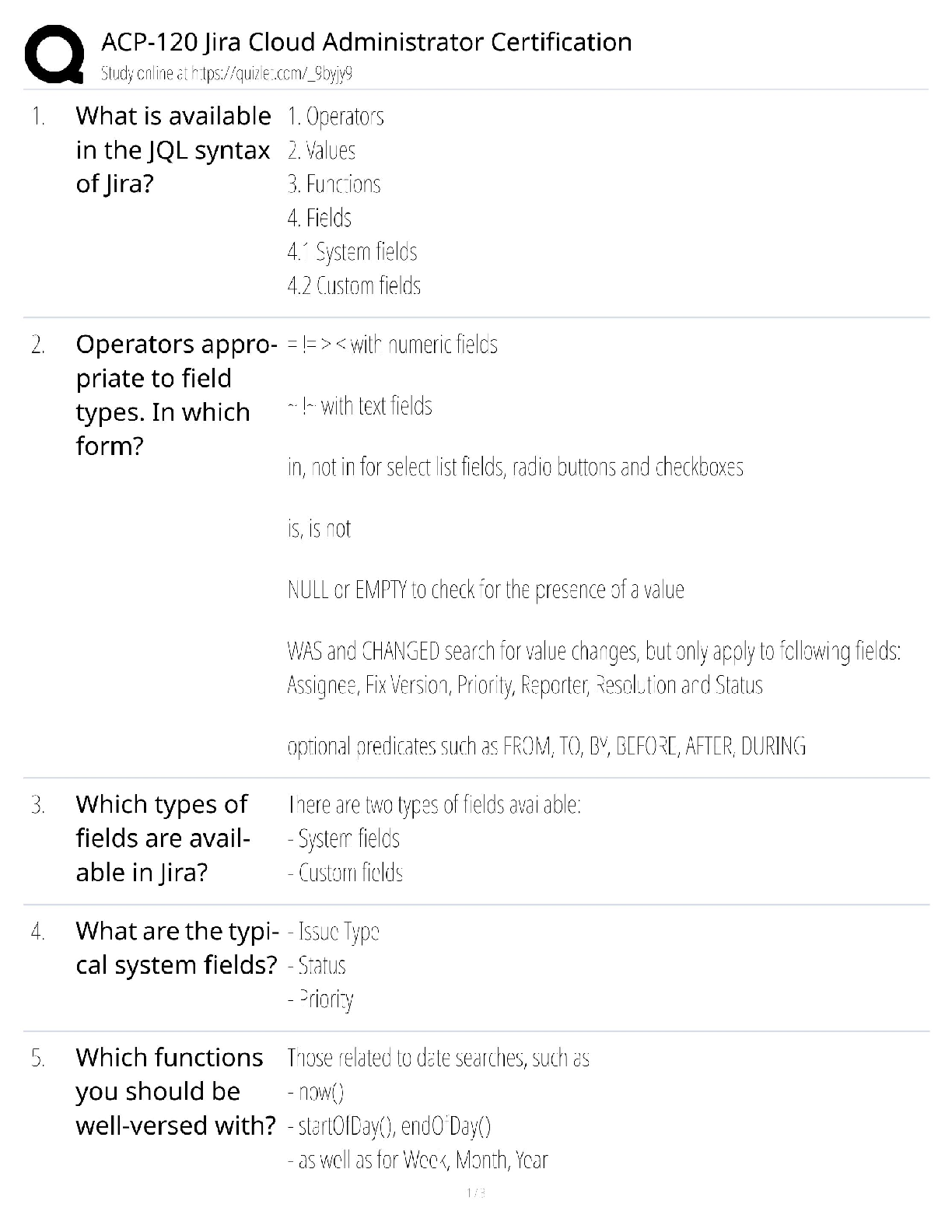

ACP-120 Jira Cloud Admin Certification / 2024 Exam Guide / 300+ Practice Questions / Pass Guarantee

$ 10.5

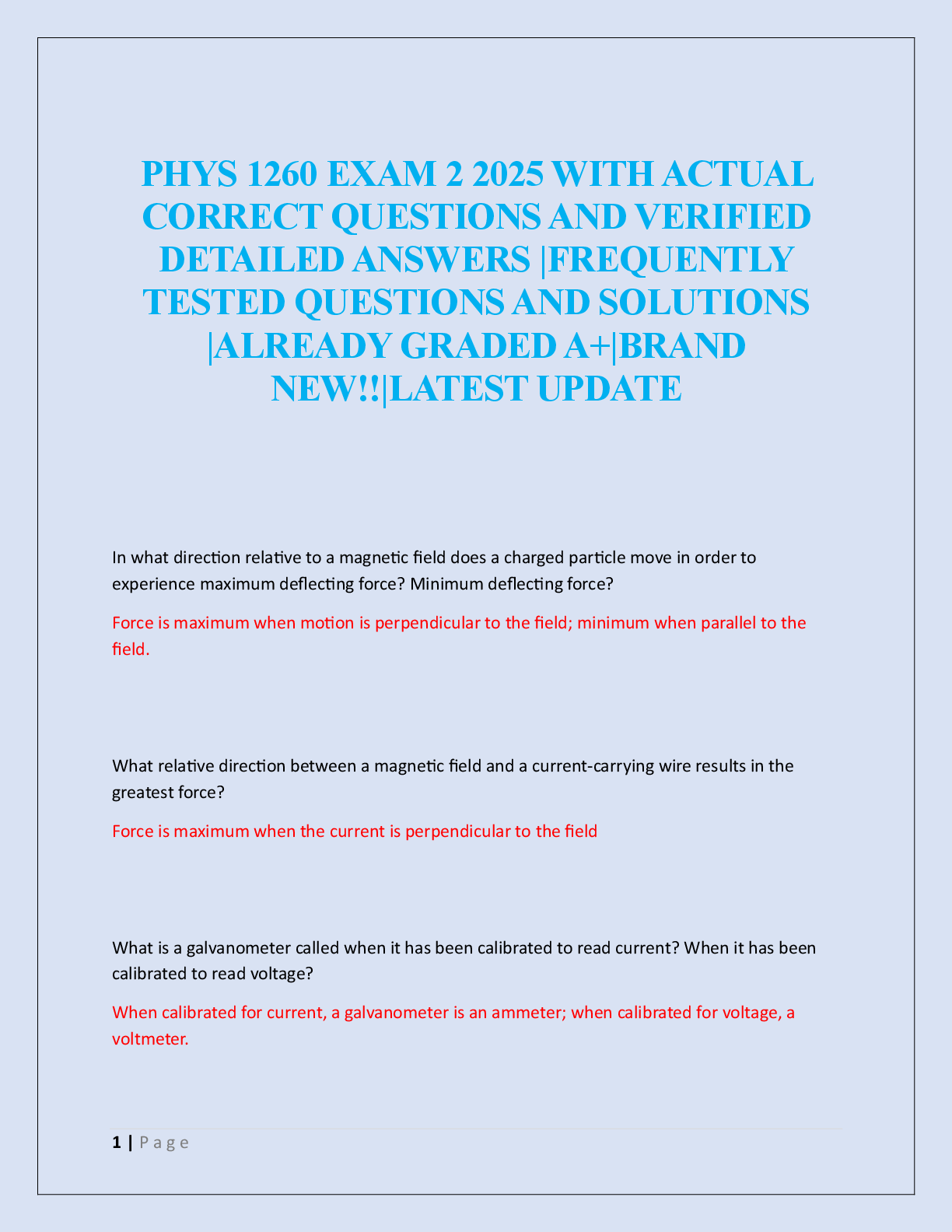

PHYS 1260 EXAM 2 2025

$ 20

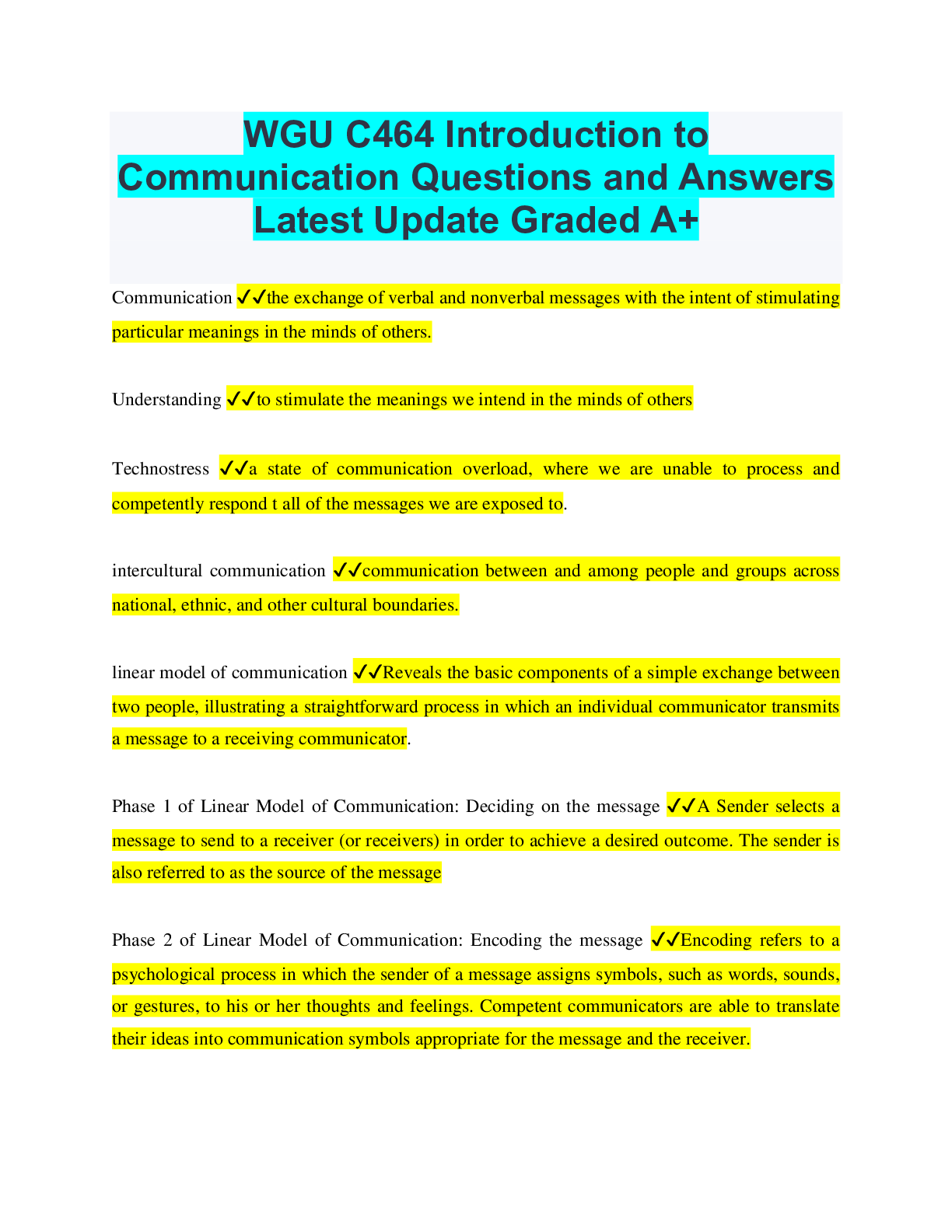

WGU C464 Introduction to Communication Questions and Answers Latest Update Graded A+

$ 5

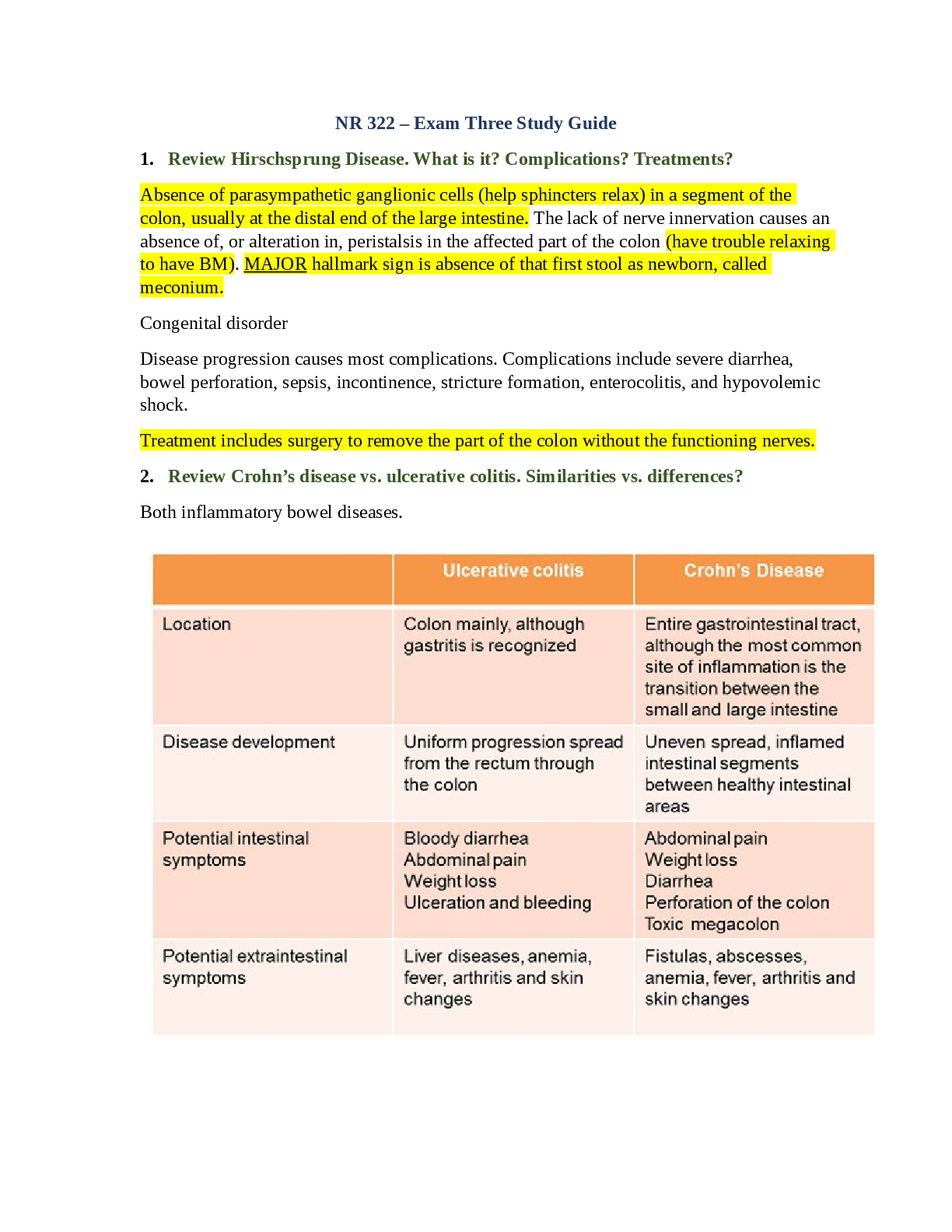

NR 322 Exam Three Study Guide

$ 30

COMMUNICATION AND COUNSELLING IN HIV/AIDS

$ 4

eBook [PDF] How to Become a Data Analyst My Low Cost No Code Roadmap for Breaking into Tech 1st Edition By Annie Nelson