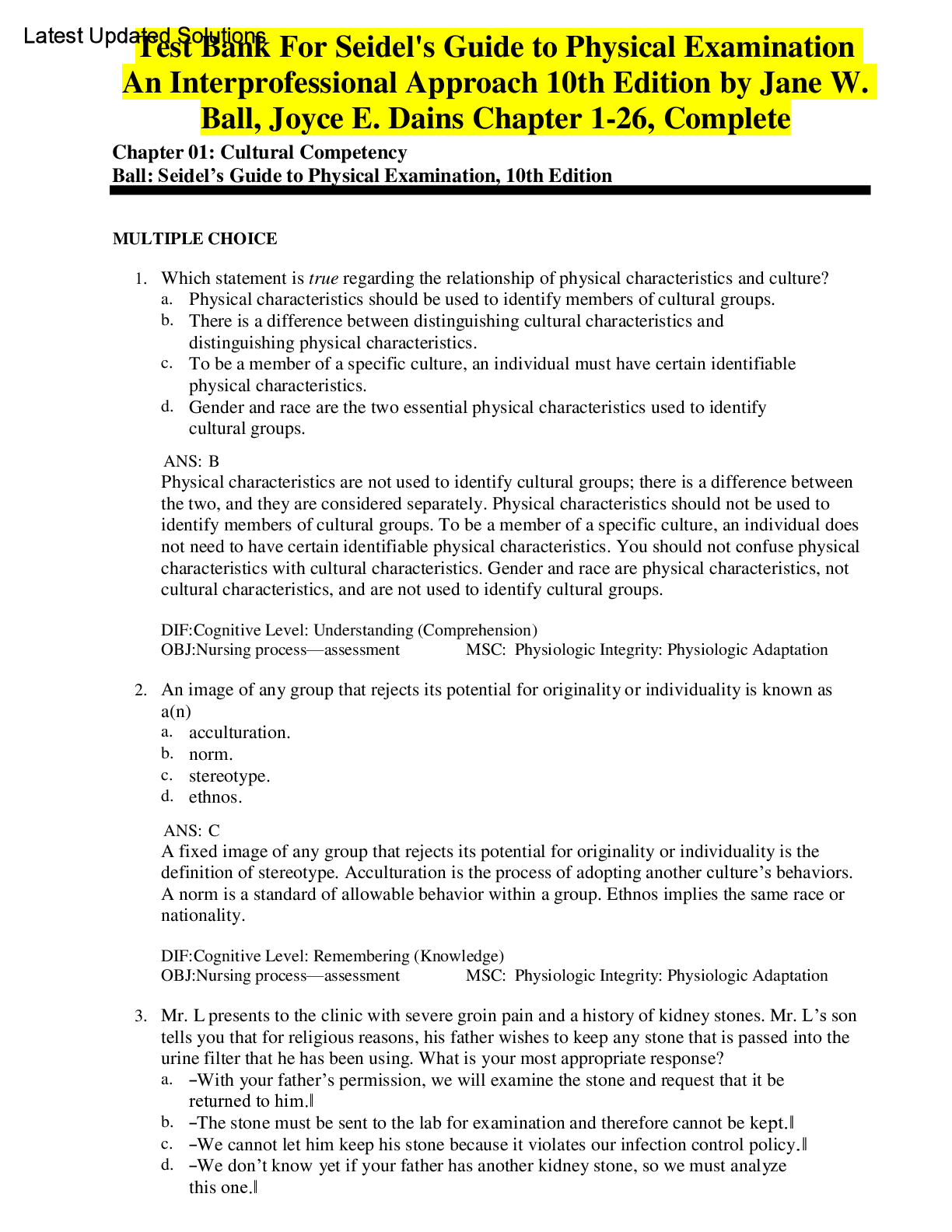

Accounting > TEST BANK > ACCT TEST BANK-INCOME TAXATION TESTBANK, ANSWERED, A+ GUIDE (All)

ACCT TEST BANK-INCOME TAXATION TESTBANK, ANSWERED, A+ GUIDE

Document Content and Description Below

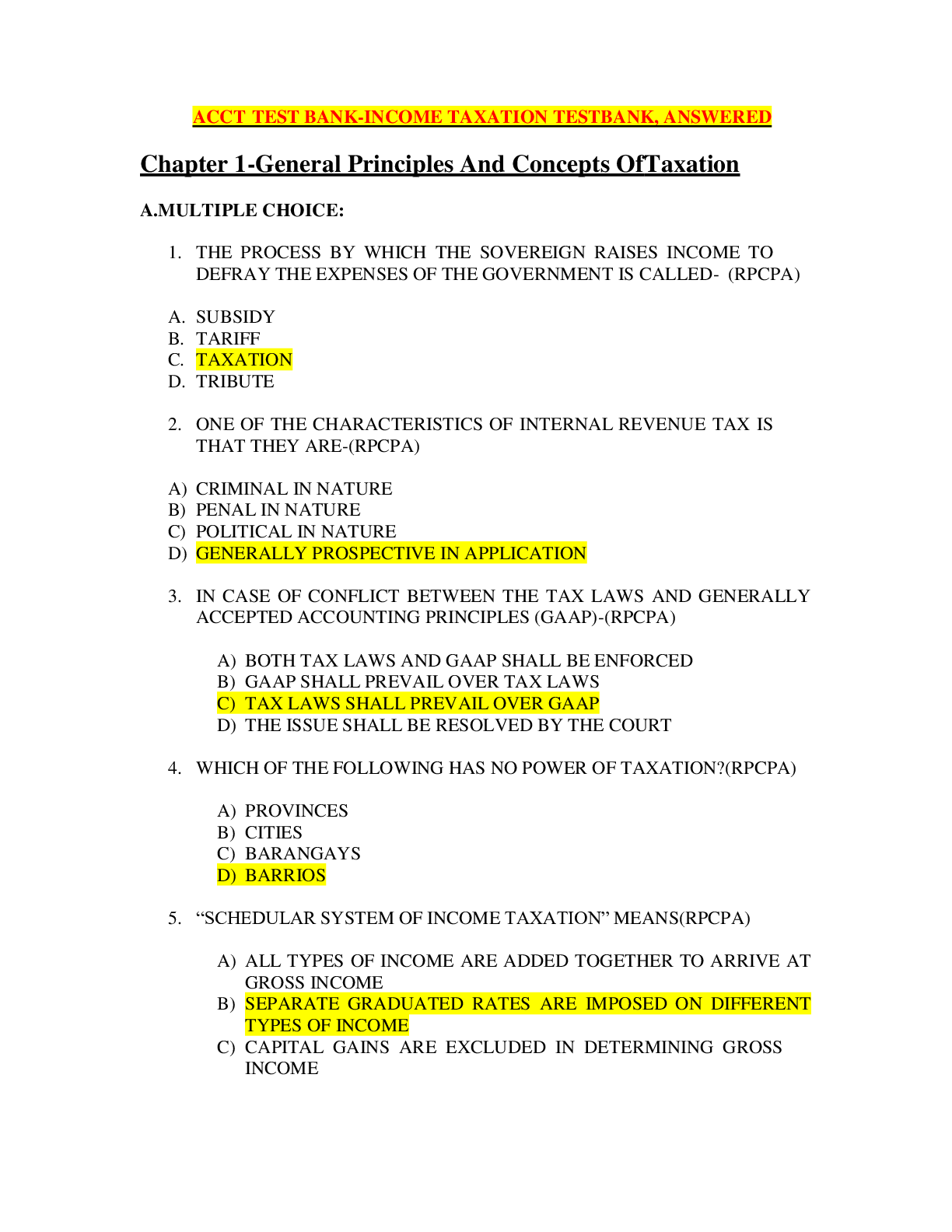

ACCT TEST BANK-INCOME TAXATION TESTBANK, ANSWERED-1. THE PROCESS BY WHICH THE SOVEREIGN RAISES INCOME TO DEFRAY THE EXPENSES OF THE GOVERNMENT IS CALLED- (RPCPA) A. SUBSIDY B. TARIFF C. TAXATION D. TR... IBUTE 2. ONE OF THE CHARACTERISTICS OF INTERNAL REVENUE TAX IS THAT THEY ARE-(RPCPA) A) CRIMINAL IN NATURE B) PENAL IN NATURE C) POLITICAL IN NATURE D) GENERALLY PROSPECTIVE IN APPLICATION 3. IN CASE OF CONFLICT BETWEEN THE TAX LAWS AND GENERALLY ACCEPTED ACCOUNTING PRINCIPLES (GAAP)-(RPCPA) A) BOTH TAX LAWS AND GAAP SHALL BE ENFORCED B) GAAP SHALL PREVAIL OVER TAX LAWS C) TAX LAWS SHALL PREVAIL OVER GAAP D) THE ISSUE SHALL BE RESOLVED BY THE COURT 4. WHICH OF THE FOLLOWING HAS NO POWER OF TAXATION?(RPCPA) A) PROVINCES B) CITIES C) BARANGAYS D) BARRIOS 5. “SCHEDULAR SYSTEM OF INCOME TAXATION” MEANS(RPCPA) A) ALL TYPES OF INCOME ARE ADDED TOGETHER TO ARRIVE AT GROSS INCOME B) SEPARATE GRADUATED RATES ARE IMPOSED ON DIFFERENT TYPES OF INCOME C) CAPITAL GAINS ARE EXCLUDED IN DETERMINING GROSS INCOME D) COMPENSATION INCOME AND BUSINESS/PROFESSIONAL INCOME ARE ADDED TOGETHER IN ARRIVING AT GROSS INCOME 6. ONE OF THE FOLLOWING IS A PRIMARY PURPOSE OF TAXATION A) PROTECTION OF LOCAL INDUSTRIES AGAINST FOREIGN COMPETITION THROUGH IMPOSITION OF HIGH CUSTOMS DUTIES ON IMPORTED GOODS B) REDUCTION OF INEQUALITIES IN WEALTH AND INCOME BY IMPOSING PROGRESSIVELY HIGHER TAX RATES C) TO SECURE REVENUE FOR THE SUPPORT OF THE GOVERNMENT D) STRENGTHENING OF ANEMIC ENTERPRISES BY GIVING TAX EXEMPTION 7. WHICH OF THE FOLLOWING IS NOT A SECONDARY PURPOSE OF TAXATION? A) TO SERVE AS KEY INSTRUMENT OF SOCIAL CONTROL B) TO EFFECT A MORE EQUITABLE DISTRIB UTION OF WEALTH AMONG PEOPLE C) TO ACHIEVE SOCIAL AND ECONOMIC STABILITY D) TO RAISE REVENUE TO DEFRAY THE NECESSARY EXPENSE OF THE GOVERNMENT 8. WHICH IS THE BEST ANSWER? A TAX REFORM AT ANY GIVEN TIME UNDERSCORES THE FACT THAT-(RPCPA) A) TAXATION IS AN INHERENT POWER OF THE STATE B) TAXATION IS ESSENTIALLY A LEGISLATIVE POWER C) TAXATION IS A POWER THAT IS VERY BROAD D) THE STATE CAN AND SHOULD ADOPT PROGRESSIVE TAXATION 9. THE LEGISLATIVE BODY CAN IMPOSE A TAX AT ANY AMOUNT UNDERSCORES THE LEGAL DICTUM THAT TAXATION IS – (RPCPA) A) AN INHERENT POWE [Show More]

Last updated: 1 year ago

Preview 1 out of 135 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$11.50

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Jul 11, 2023

Number of pages

135

Written in

Additional information

This document has been written for:

Uploaded

Jul 11, 2023

Downloads

0

Views

109

_compressed.png)

.png)

.png)

.png)