BUS 5440 Final Exam 2, Questions And Answers

Document Content and Description Below

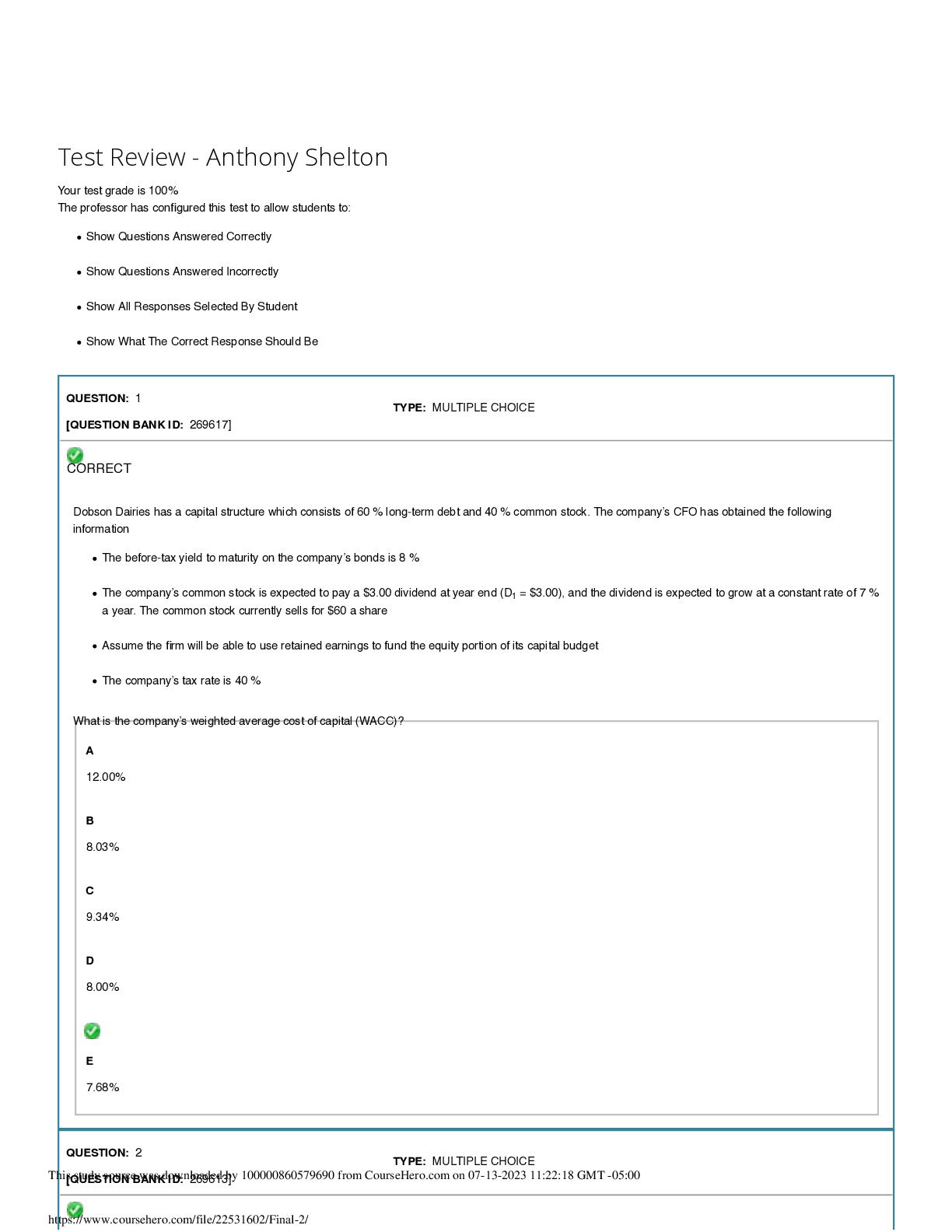

BUS 5440 Final Exam 2, Questions And Answers.Your test grade is 100% The professor has configured this test to allow students to: Show Questions Answered Correctly Show Questions Answered ... Incorrectly Show All Responses Selected By Student Show What The Correct Response Should Be QUESTION: 1 TYPE: MULTIPLE CHOICE [QUESTION BANK ID: 269617] CORRECT Dobson Dairies has a capital structure which consists of 60 % long-term debt and 40 % common stock. The company’s CFO has obtained the following information The before-tax yield to maturity on the company’s bonds is 8 % The company’s common stock is expected to pay a $3.00 dividend at year end (D1 = $3.00), and the dividend is expected to grow at a constant rate of 7 % a year. The common stock currently sells for $60 a share Assume the firm will be able to use retained earnings to fund the equity portion of its capital budget The company’s tax rate is 40 % What is the company’s weighted average cost of capital (WACC)? A 12.00% B 8.03% C 9.34% D 8.00% E 7.68% QUESTION: 2 [Show More]

Last updated: 2 years ago

Preview 1 out of 6 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$10.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Jul 14, 2023

Number of pages

6

Written in

All

Additional information

This document has been written for:

Uploaded

Jul 14, 2023

Downloads

0

Views

101

.png)

.png)