Financial Statement Analysis and Security Valuation

5th edition

(SOLUTIONS AT THE END OF TEST BANK)

TEST NUMBER 1

Time allowed: 90 Minutes

Total Points: 40

Ques

...

Financial Statement Analysis and Security Valuation

5th edition

(SOLUTIONS AT THE END OF TEST BANK)

TEST NUMBER 1

Time allowed: 90 Minutes

Total Points: 40

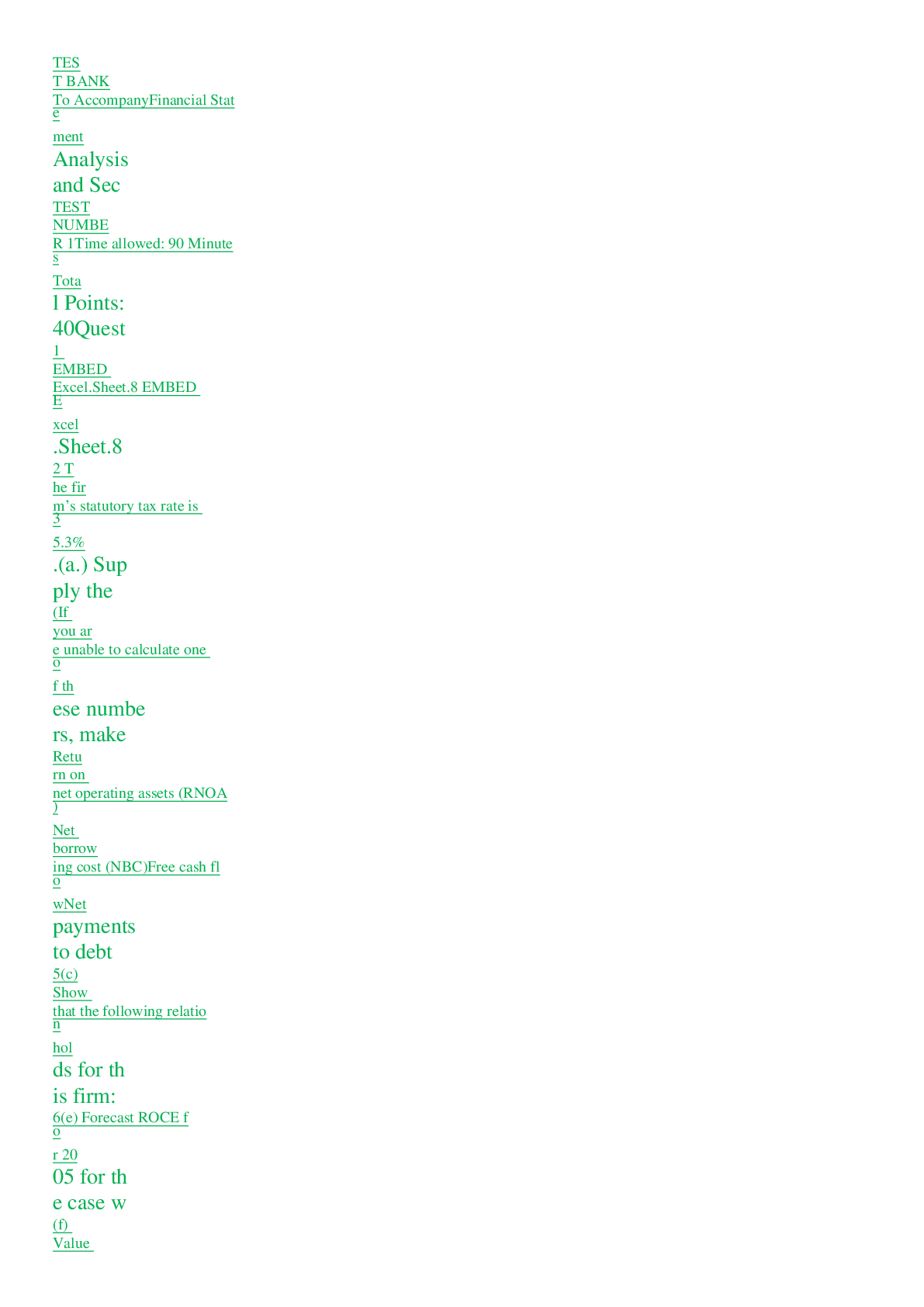

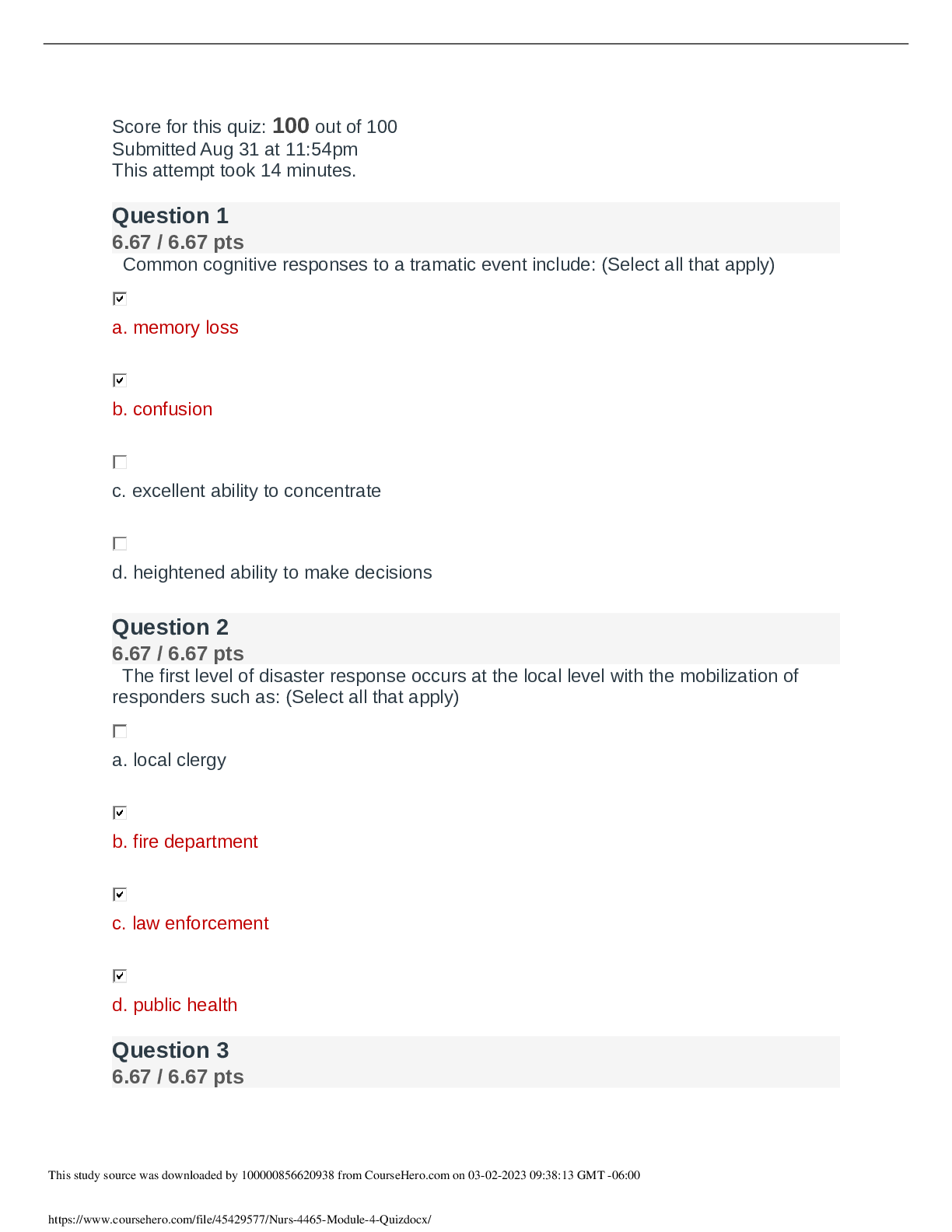

Question 1 (32 Points)

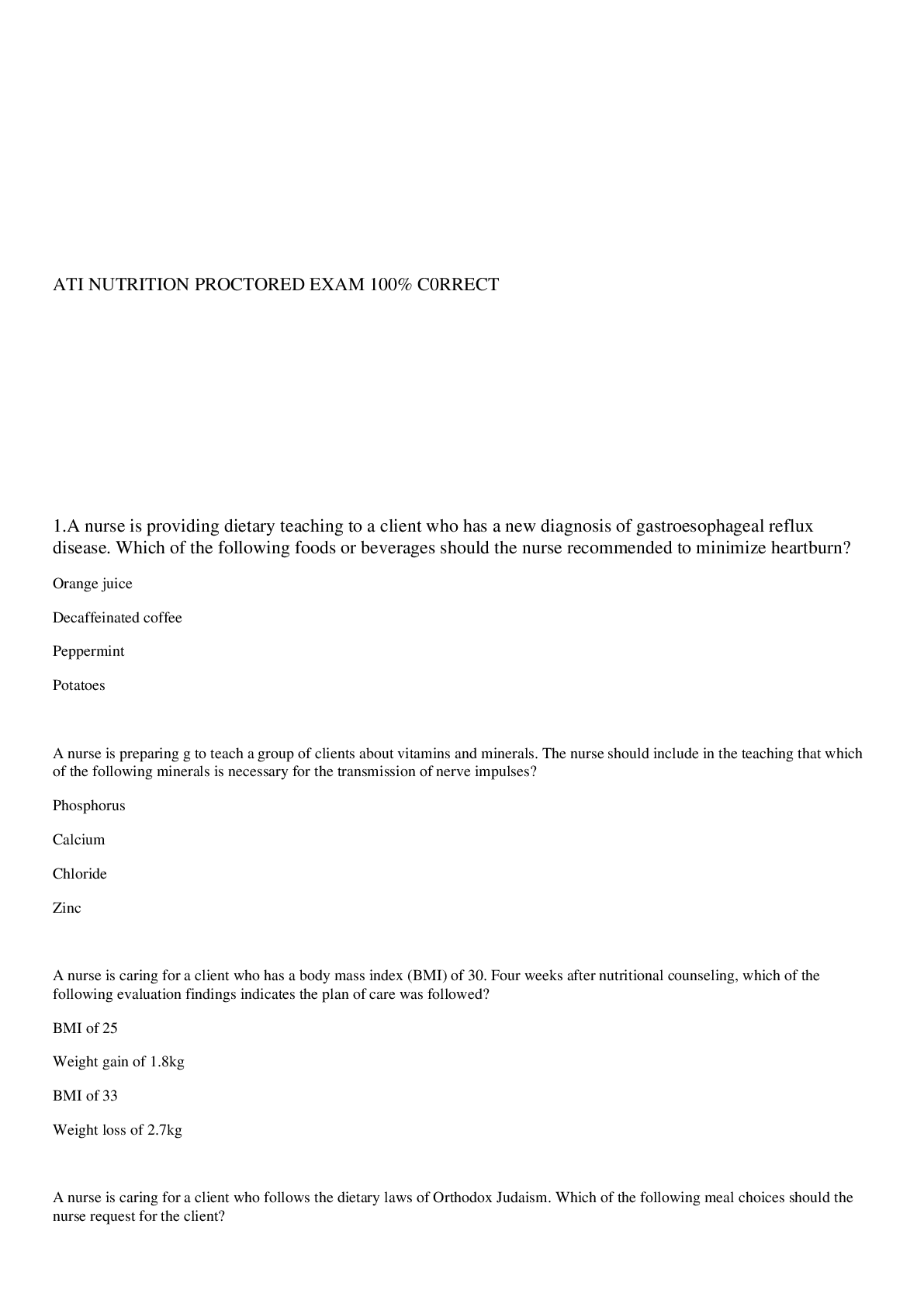

The following are partial financial statements for an industrial firm that you are required to analyze and value. All amounts are in millions of dollars.

Income Statement for Fiscal Year 2004

1

_________________________________________________________________

2

The firm’s statutory tax rate is 35.3%.

(a.) Supply the missing numbers, A to J.

A =

B =

C =

D =

E =

F =

G =

H =

I =

J =

(If you are unable to calculate one of these numbers, make a reasonable guess before

proceeding to part (b) of the question.)

3

(b) Calculate the following for 2004. Use beginning of year balance sheet numbers in denominators.

(i) Comprehensive income

(ii) Core operating income, after tax

(iii) Net financial expense, after tax

(iv) Return on net operating assets (RNOA)

4

(v) Core return on net operating assets (Core RNOA)

(vi) Net borrowing cost (NBC)

(vii) Free cash flow

(viii) Net payments to debt holders and debt issuers

5

(c) Show that the following relation holds for this firm:

ROCE = RNOA + (Financial Leverage x Operating Spread)

(d) Show that the following relation holds for this firm. Use 3% for the short-term borrowing rate. ROOA is return on operating assets.

RNOA = ROOA + [Operating Liability Leverage x (ROOA – Short-term

Borrowing Rate)]

6

(e) Forecast ROCE for 2005 for the case where RNOA is expected to be the same as core RNOA in 2004 and the net borrowing cost is expected to be the

same as in 2004.

(f) Value the equity under a forecast that

(i) Return on net operating assets in the future will be the same as core

RNOA in 2004.

(ii) Sales are expected to grow at 4% per year.

(iii) Asset turnovers will be the same as in 2004.

The required return for operations is 9%.

7

(g) Calculate the intrinsic levered price-to-book ratio and enterprise price-to-book and show that the two are related in the following way:

Levered P/B = Enterprise P/B + [Financial Leverage × (Enterprise P/B – 1)]

(h) Calculate the intrinsic trailing levered P/E and the trailing enterprise P/E. Show that the two are related in the following way:

Levered P/E = Enterprise P/E + [Earnings Leverage ×

(Enterprise P/E – 1/NBC – 1)]

8

Question 2 (8 points)

At the end of the fiscal year ending June 30, 2003, Microsoft reported common equity of $64.9 billion on its balance sheet, with $49.0 billion invested in financial assets (in the form of cash equivalents and short term investments) and no financing debt. For fiscal year 2004, the firm reported $7.4 billion in comprehensive income, of which $1.1 billion was after-tax earnings on the financial assets.

This month Microsoft is distributing $34 billion of financial assets to shareholders in the form of a special dividend.

a. Calculate Microsoft’s return on common equity (ROCE) for 2004.

b. Holding all else constant what would Microsoft’s ROCE be after the payout of $34 billion?

9

c. Would you expect the payout to increase or decrease earnings growth in the future? Why?

d. What effect would you expect the payout to have on the value of a Microsoft share?

[Show More]

.png)

.png)