Byrd & Chen's Canadian Tax Principles 1st edition Volume 1 Solution Manual

$ 24

Lab 1: Diffusion and Osmosis: The Effect of Sucrose Molarity on the Percent Change in Mass.

$ 6

Edexcel AS Level GCE In Chemistry (8CH0) Paper 02+Mark scheme may 2025

$ 10

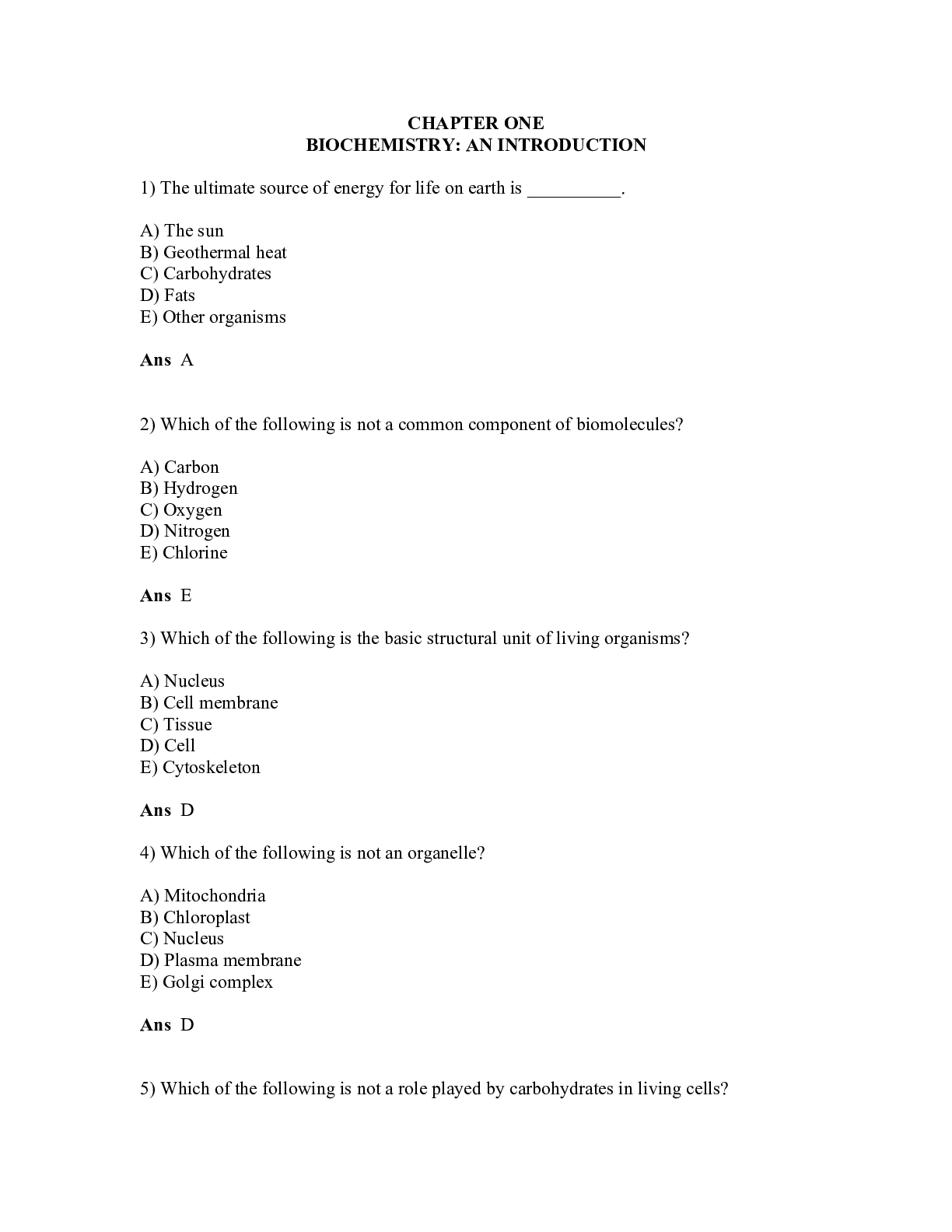

Biochemistry The Molecular Basis of Life 7th Edition by James R. McKee; Trudy McKee | TEST BANK

$ 22

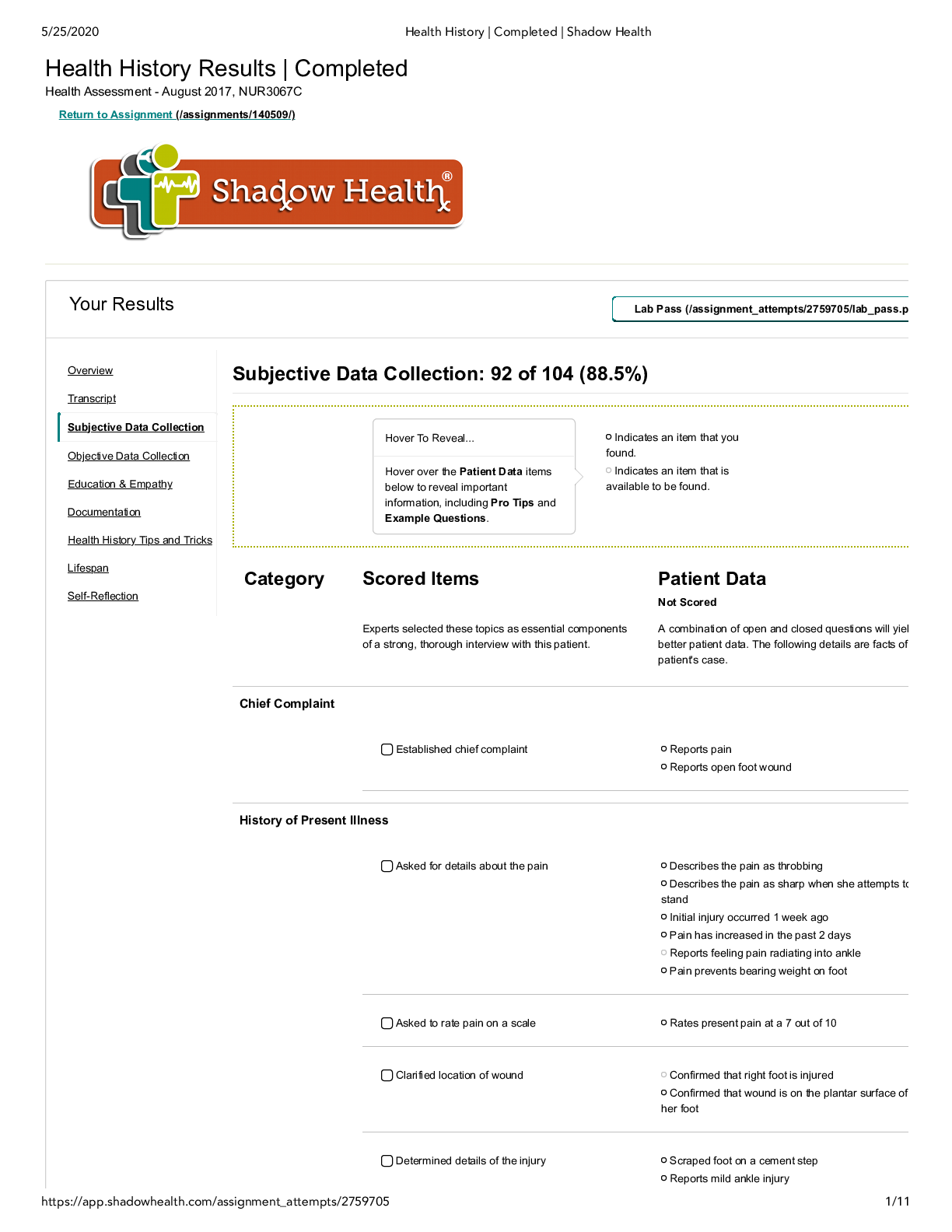

Shadow Health Tina Jones Subjective Data Collection_Completed 2021

$ 11

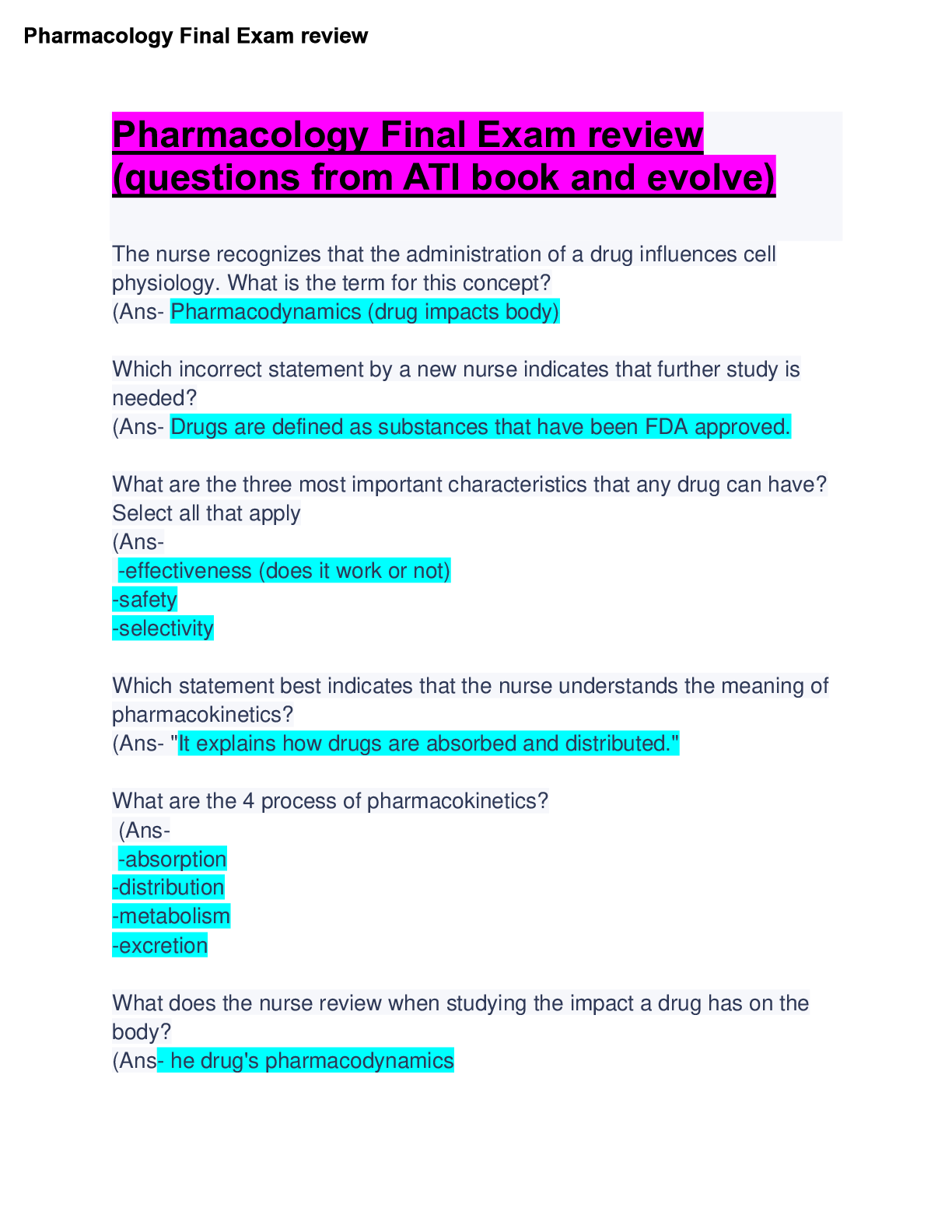

Pharmacology Final Exam Review; Questions & Answers: Updated Guide Solution

$ 8

RN Comprehensive Predictor 2019 Form A (LATEST ANSWERS)

$ 12

Final Exam Study Guide_2020_final.pdf

$ 10.5

HESI MED-SURG 2021 QUESTIONS WITH CORRECT ANSWERS

$ 12

Instructor's Manual For Brief Principles of Macroeconomics 8th Edition By Gregory Mankiw (All Chapters, 100% Original Verified, A+ Grade)

$ 25

[eBook] [ORG PDF] From Brain Dynamics to the Mind Spatiotemporal Neuroscience By Georg Northoff

$ 25

UHC Certification Complete New Exam Questions With Solution 2024 Graded A

$ 18

(WGU C784) MATH 1100 APPLIED HEALTHCARE STATISTICS FINAL EXAM REVIEW Q & A 2024

$ 10

Pearson Edexcel International GCSE In Information and Communication Technology (4IT1) Paper 01: Written Paper Mark Scheme (Provisional) Summer 2021. latest graded A+