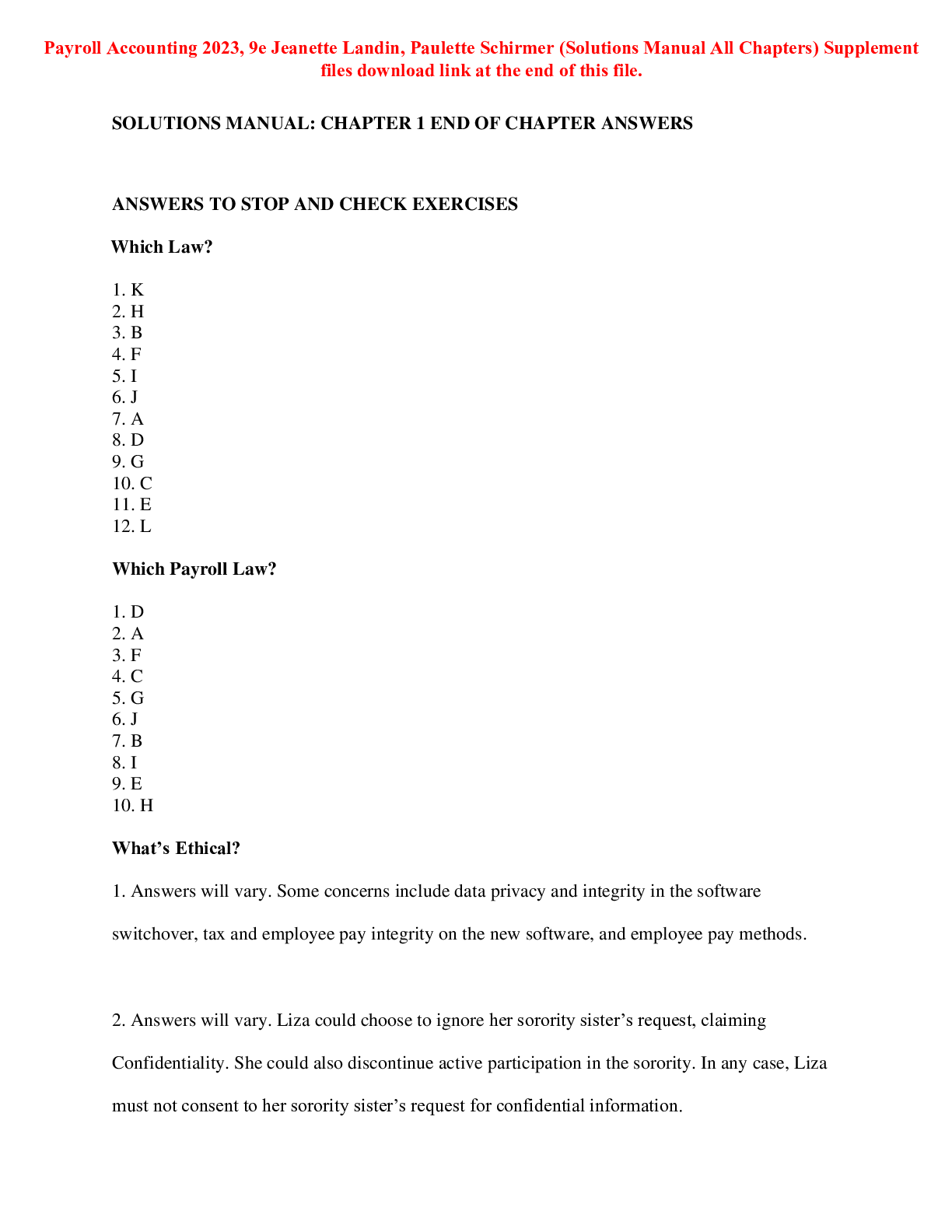

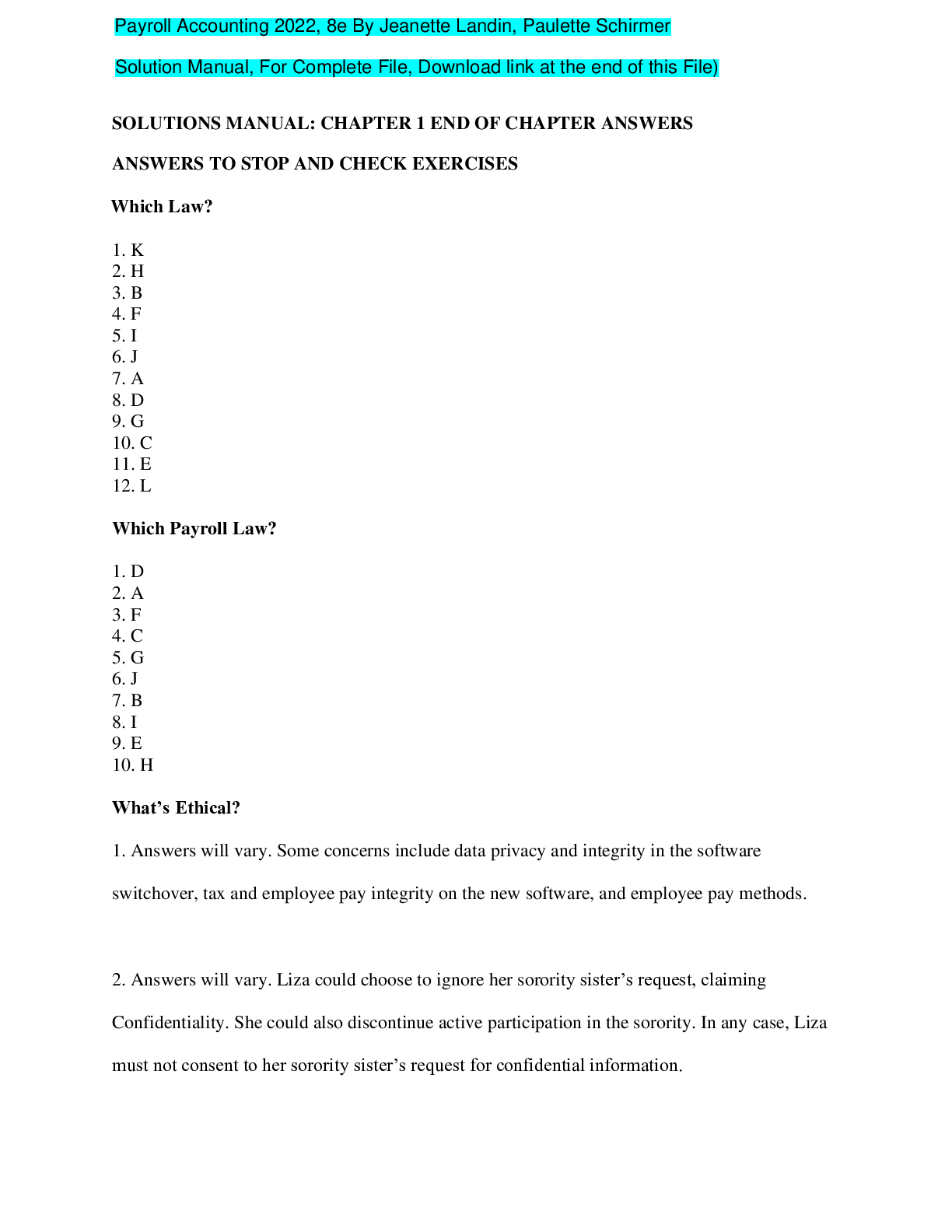

Accounting > SOLUTIONS MANUAL > Payroll Accounting 2022 8th Edition By Jeanette Landin, Paulette Schirmer (Solution Manual) (All)

Payroll Accounting 2022 8th Edition By Jeanette Landin, Paulette Schirmer (Solution Manual)

Document Content and Description Below

Payroll Accounting continues the author’s tradition of providinga modern approach to payrollaccounting through a "practitioners view" focusing on relevancy andcareer readiness. The author team has m... ade content updates including the tax implications of the Cares Act due to COVID-19. We havealso improved our accessibility of the end-of-chapter material within McGrawHill Connect®. The content updates and Connect updates in this newedition will ensure your students are career ready! Payroll Accounting continues the author’s tradition of providinga modern approach to payrollaccounting through a "practitioners view" focusing on relevancy andcareer readiness. The author team has made content updates including the tax implications of the Cares Act due to COVID-19. We havealso improved our accessibility of the end-of-chapter material within McGrawHill Connect®. The content updates and Connect updates in this newedition will ensure your students are career ready! [Show More]

Last updated: 1 year ago

Preview 1 out of 135 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$20.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Aug 12, 2023

Number of pages

135

Written in

Additional information

This document has been written for:

Uploaded

Aug 12, 2023

Downloads

0

Views

97