Circular 230 Test

Which fees are a tax preparer NOT allowed to charge a client? - ✔✔Contingent

How long does a preparer have to hold onto a copy of their client's tax return? - ✔✔3 years

Of the four types of sanctions

...

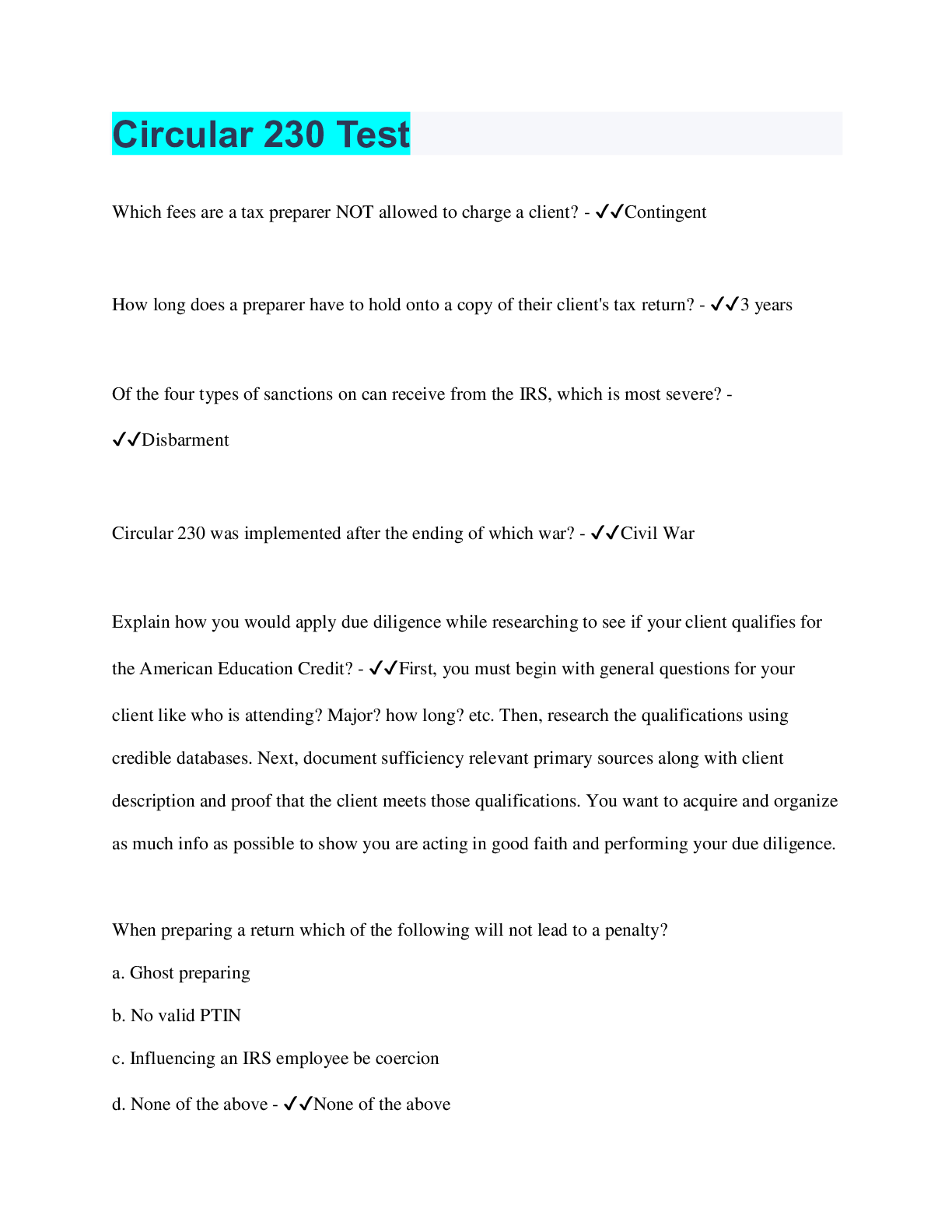

Circular 230 Test

Which fees are a tax preparer NOT allowed to charge a client? - ✔✔Contingent

How long does a preparer have to hold onto a copy of their client's tax return? - ✔✔3 years

Of the four types of sanctions on can receive from the IRS, which is most severe? -

✔✔Disbarment

Circular 230 was implemented after the ending of which war? - ✔✔Civil War

Explain how you would apply due diligence while researching to see if your client qualifies for

the American Education Credit? - ✔✔First, you must begin with general questions for your

client like who is attending? Major? how long? etc. Then, research the qualifications using

credible databases. Next, document sufficiency relevant primary sources along with client

description and proof that the client meets those qualifications. You want to acquire and organize

as much info as possible to show you are acting in good faith and performing your due diligence.

When preparing a return which of the following will not lead to a penalty?

a. Ghost preparing

b. No valid PTIN

c. Influencing an IRS employee be coercion

d. None of the above - ✔✔None of the above

List 5 things a paid tax preparer should not do - ✔✔1. willfully not sign a tax return you

prepared

2. mislead an threaten clients

3. attempt to influence an employee of the IRS by bribes, false accusations or threats

4. assist a client to violate federal tax law

5. retain or withhold client records beyond the scope allowed by state law

it is required for a paid tax preparer to have _______ before legally being able to prepare returns

- ✔✔valid PTIN

Circular 230 is a regulation issued by what major section of the US government? - ✔✔Treasury

Dept.

When preparing a client's tax return, they express to you some information that you deem to be

suspicious and incomplete. You have done this client's return for the past 3 years but are worried

that this might be an issue. What do you do as a CPA in this situation? - ✔✔Practice due

diligence and ask the appropriate questions so that you can complete the return correctly.

Define and elaborate on two examples of frivolous positions a tax preparer can take - ✔✔A

frivolous position is a position that is knowingly in bad faith and patently improper. Two

examples could be paying federal income tax is "voluntary" and refusing to pay taxes based upon

"religious or personal beliefs". Such positions can lead to penalties such as up to $100,000 fine

for taxpayer for individual returns and willful or reckless conduct: $5,000 minimum penalty for

tax preparer.

The AFTRC covers which main topic?

a. New law/updates

b. general review

c. ethics and practices

d. all of the above - ✔✔all of the above

Which of the following is not an example of a frivolous position? - ✔✔Persons that receive gifts

do not owe any tax on such gifts

Which of the following is not a type of sanction that can be issued by the IRS? - ✔✔criminal

prosecution

Please explain due diligence. - ✔✔Due diligence is steps taken by a person to fulfill a legal

standard of care. Usually this term is used when referencing an audit or review of tax documents.

Due diligence is used to provide the buyer with an assurance of what they are receiving.

Who was one of the key figures to help the treasury dept? - ✔✔Alexander Hamilton

All of the following can practice before the IRS except: - ✔✔Certified Management Accountant

The act of preparing a return and instructing a client to sign as "self prepared" is known as: -

✔✔Ghost Preparers

What 3 domains of tax law to the AFTRC cover? - ✔✔disclosures

When did Circular 230 come about? - ✔✔1700s and 1800s

Which situation can a RTRP engage in with their clients - ✔✔Registered preparers can represent

the client before an IRS examiner

According to Circular 230, in which scenario would it be okay for a preparer to sign a return? -

✔✔If the preparer is related to, or personally knows, the taxpayer for which they are preparing

the return

How long does a PTIN get renewed for - ✔✔1 year

Which statement is NOT true? - ✔✔Preparers can withhold tax documents from their clients if

the bill has not been paid

IRS is also empowered to suspend or disbar persons from practice for being which of the

following?

a. incompetent

b. disreputable

c. unqualified

d. deliberately fraudulent/criminal

e. all of the above - ✔✔e. all of the above

Describe the Freedom of Info Act and the consequences of it. - ✔✔When you get a PTIN, The

Freedom of Info Act allows your contact info to be made available when there is a public

request. The consequences are that your info is made available a lot easier and that is why you

receive SPAM through emails, calls, letter, etc.

As a tax return preparer why is it important to file your personal tax return on time and pay any

federal tax due? - ✔✔Circular 230 mandates that anyone representing a taxpayer before the IRS

adheres to the ethical and legal requirements set forth by the government. If the preparer does not

follow the dame ethical and legal guidelines as their clients, the how can they be trusted to

perform their due diligence when filing their client's tax return?

What is the purpose of Circular 230? - ✔✔To regulate the practice of those who represent others

before the Treasury

Explain 3 ways you could avoid potential penalties by the IRS for understating a client's income

or overstating deductions. - ✔✔Disclose questionable position, show a reasonable basis for the

position, show that you acted in good faith

If you are an EA but your enrollment begins mid-year, how many hours of ethics are you

required to take before the end of the year? - ✔✔2

You are responsible for all of the following regarding your CE courses except: - ✔✔Reporting

your participation to the IRS

If you renew your PTIN in December 2019 and specify it is for the 2020 tax season, then you

may prepare a tax return between which dates? - ✔✔jan 1, 2020-dec 31, 2020

What do you do if you know a client has omitted relevant info from a tax return? - ✔✔Inform

the client of the omission and the consequences

Give an example of an explain what constitutes a "frivolous position" regarding the IRS. -

✔✔Taking a position such as "filing a tax return or paying income tax is voluntary" is an

example of a frivolous position. A frivolous argument is a deliberate attempt to evade tax or

illegally file a return by committing fraud or knowing going against case law and precedent. This

is different than simply making a mistake in calculations or not understanding the law.

Which of the following is known to be the "core" ethical requirement according to the IRS? -

✔✔Due diligence

Which of the following is an example of a frivolous position?

a. paying federal income tax is voluntary

b.refusing to pay taxes based upon religious or personal beliefs

c. only federal government employees are required to pay income tax

d. all of the above - ✔✔all of the above

How is CE coursework measured? - ✔✔Contact hours

Which of the following best describes Circular 230? - ✔✔Are rules and regulations governing

practice before the IRS and what defines regulations for professionals

Describe the 3 levels of sanctions - ✔✔1. Censure- publicly reprimanded, and you can still

practice but may be subject to some conditions.

2. Suspension is when you are temporarily taken away the right to practice, but this can be

appealed immediately and will be subject to some conditions if allowed to practice again.

3. Disbarment- permanent termination of the right to practice and can only be appealed after 5

years at the earliest.

[Show More]