CMFO - Finance Admin Exam Study Guide

The debt limit of a municipality may not exceed what percentage of the prior three years

equalized assessed real property valuations - ✔✔3.5%

The corrective action plan must descr

...

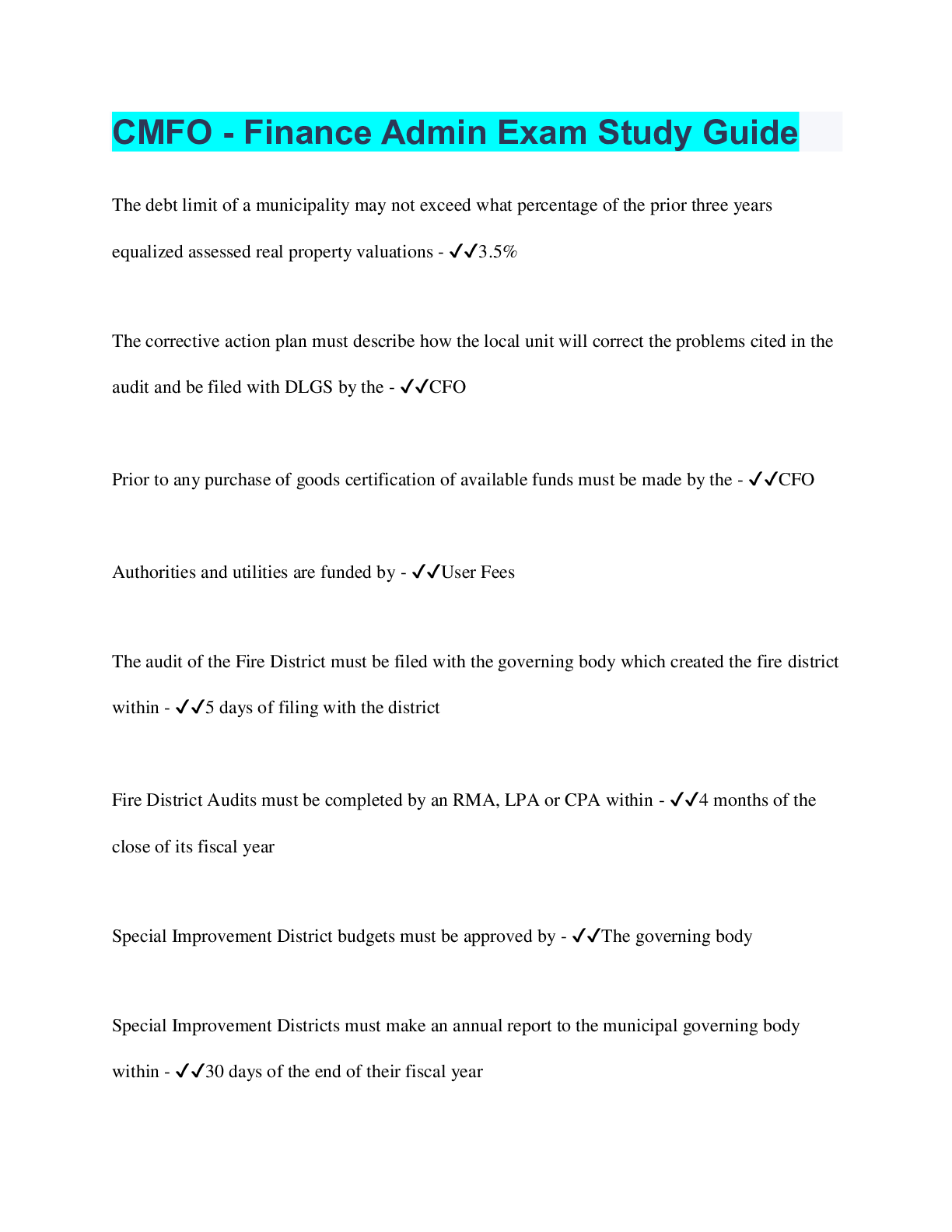

CMFO - Finance Admin Exam Study Guide

The debt limit of a municipality may not exceed what percentage of the prior three years

equalized assessed real property valuations - ✔✔3.5%

The corrective action plan must describe how the local unit will correct the problems cited in the

audit and be filed with DLGS by the - ✔✔CFO

Prior to any purchase of goods certification of available funds must be made by the - ✔✔CFO

Authorities and utilities are funded by - ✔✔User Fees

The audit of the Fire District must be filed with the governing body which created the fire district

within - ✔✔5 days of filing with the district

Fire District Audits must be completed by an RMA, LPA or CPA within - ✔✔4 months of the

close of its fiscal year

Special Improvement District budgets must be approved by - ✔✔The governing body

Special Improvement Districts must make an annual report to the municipal governing body

within - ✔✔30 days of the end of their fiscal year

Special District Budgets are approved by - ✔✔The voters

Type I school district budgets are approved by - ✔✔The board of school estimate

Special meetings of a governing body must be noticed to - ✔✔2 newspapers, including the

official newspapers, which have the ability to publish the notice at least 48 hours in advance of

the meeting

In self balancing accounts - ✔✔Assets must equal liabilities plus fund balance

Municipal Authority finances must be - ✔✔Self-Liquidating and funded by user fees

NJSA 40A:2 - ✔✔Local Bond Law

NJSA 40A:4 - ✔✔Local Budget Law

NJSA 40A:5 - ✔✔Local Fiscal Affairs Law

NJSA 40A:11 - ✔✔Local Public Contracts Law

NJSA 40A:12 - ✔✔Local Public Lands & Building Laws

NJSA 52:27BB-1 is also known as - ✔✔The Local Government Supervision Act

Regulations concerning fiscal controls are established in - ✔✔NJAC 5:30 et seq

The technical accounting directives are now codified in - ✔✔NJAC 5:30 et seq

Pursuant to NJAC 5:30-5.2 a full encumbrance system and general ledger must be in place for -

✔✔All funds

New Jersey Budget Law limits the annual increase, subject to limited exceptions, in the amount

to be raised by taxation in a municipal budget to - ✔✔2%

A tax lien sale held before the close of the budget year is known as - ✔✔an Accelerated Lien

Sale

Local government unit employees appointed in a manner that is

[Show More]