WGU C214 Financial Management > Quiz > WGU C214 Financial Management Overview: Calculation Quiz (100 OUT OF 100) WITH TYPED OUT FORMULAS (All)

WGU C214 Financial Management Overview: Calculation Quiz (100 OUT OF 100) WITH TYPED OUT FORMULAS

Document Content and Description Below

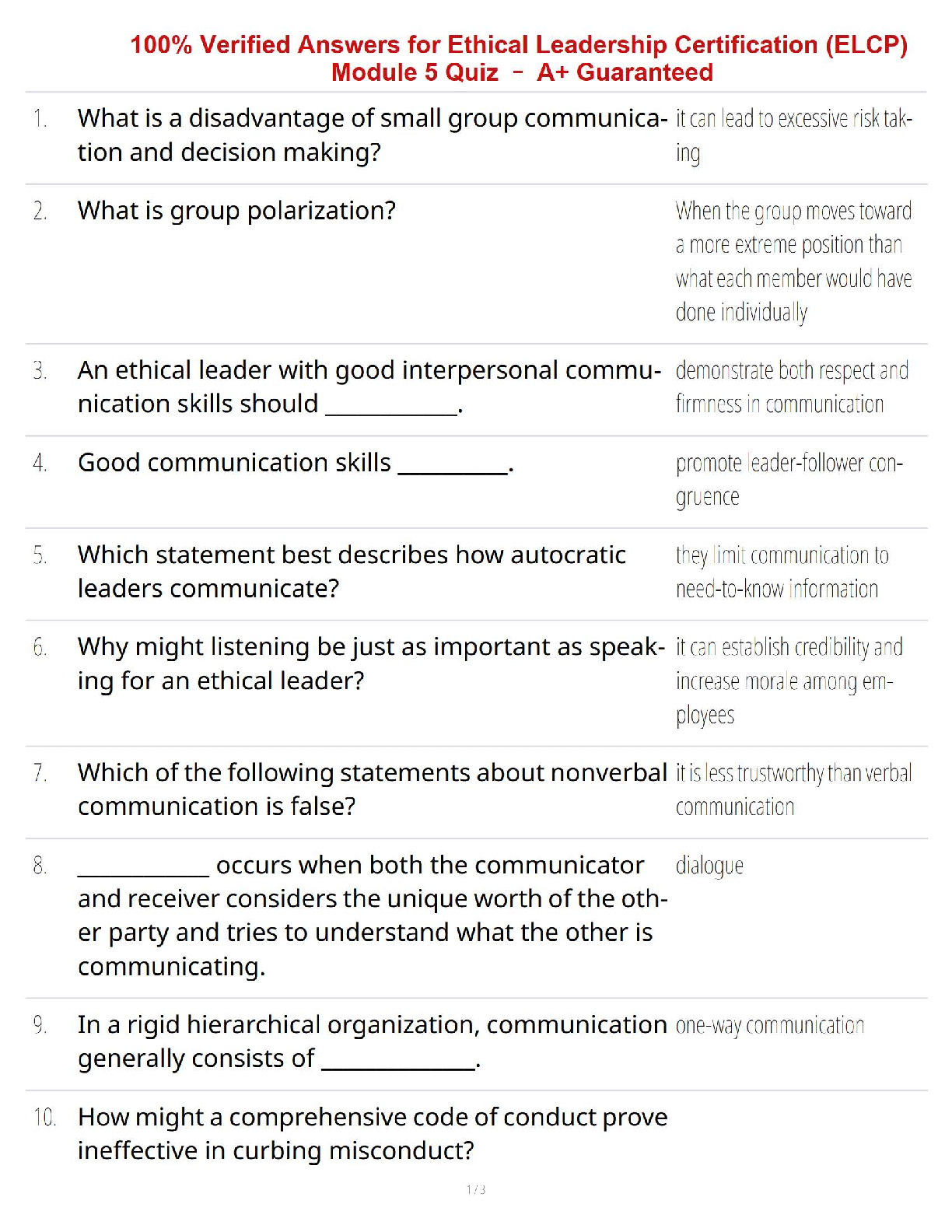

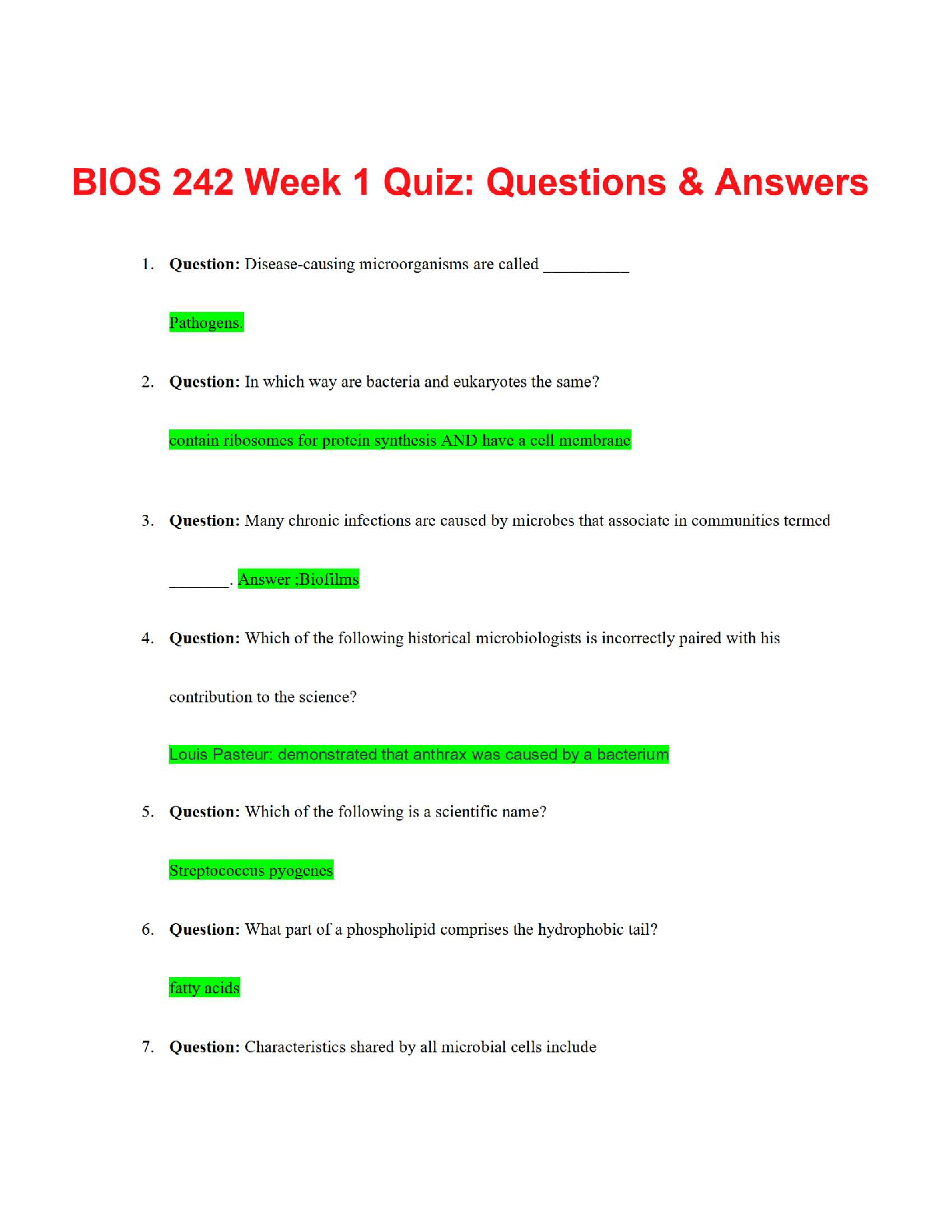

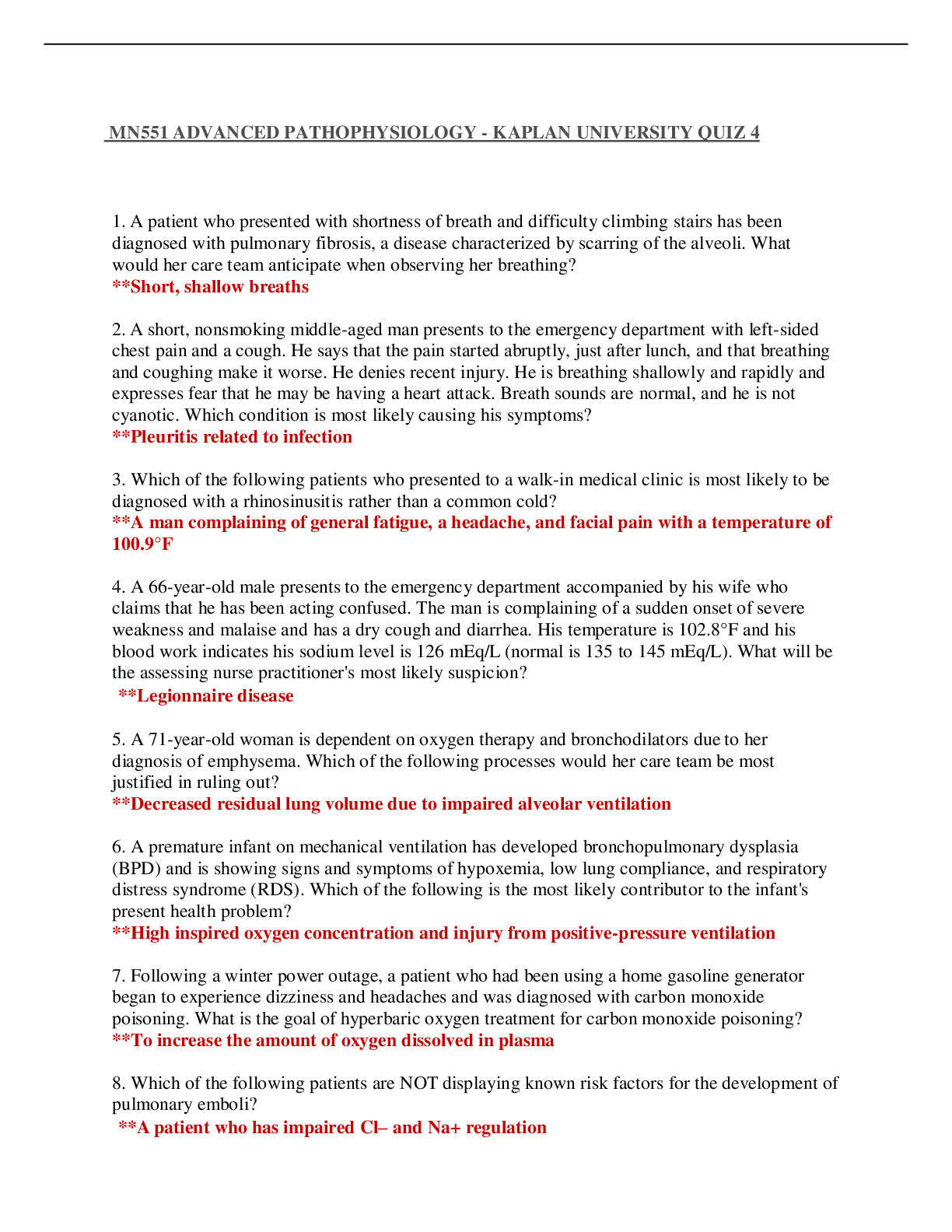

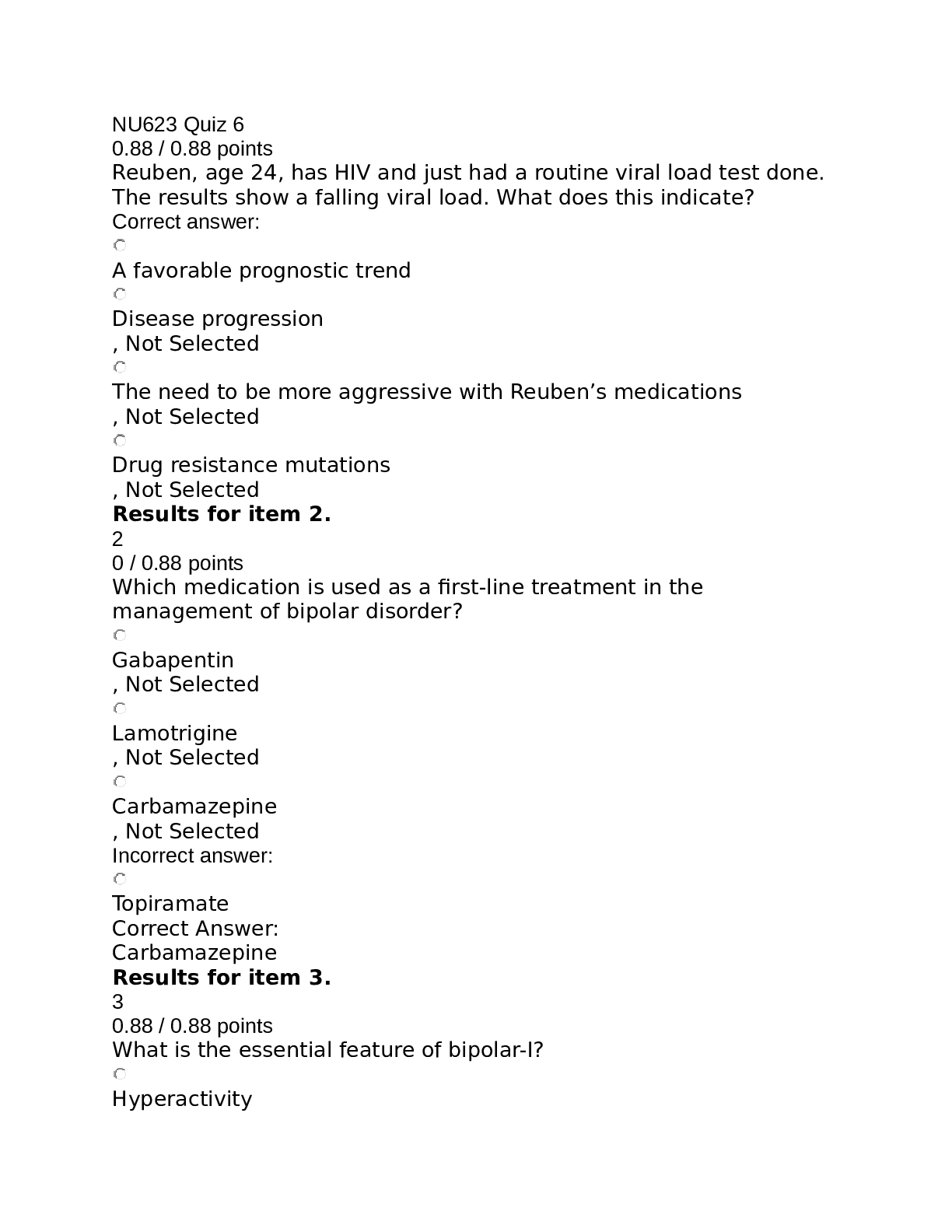

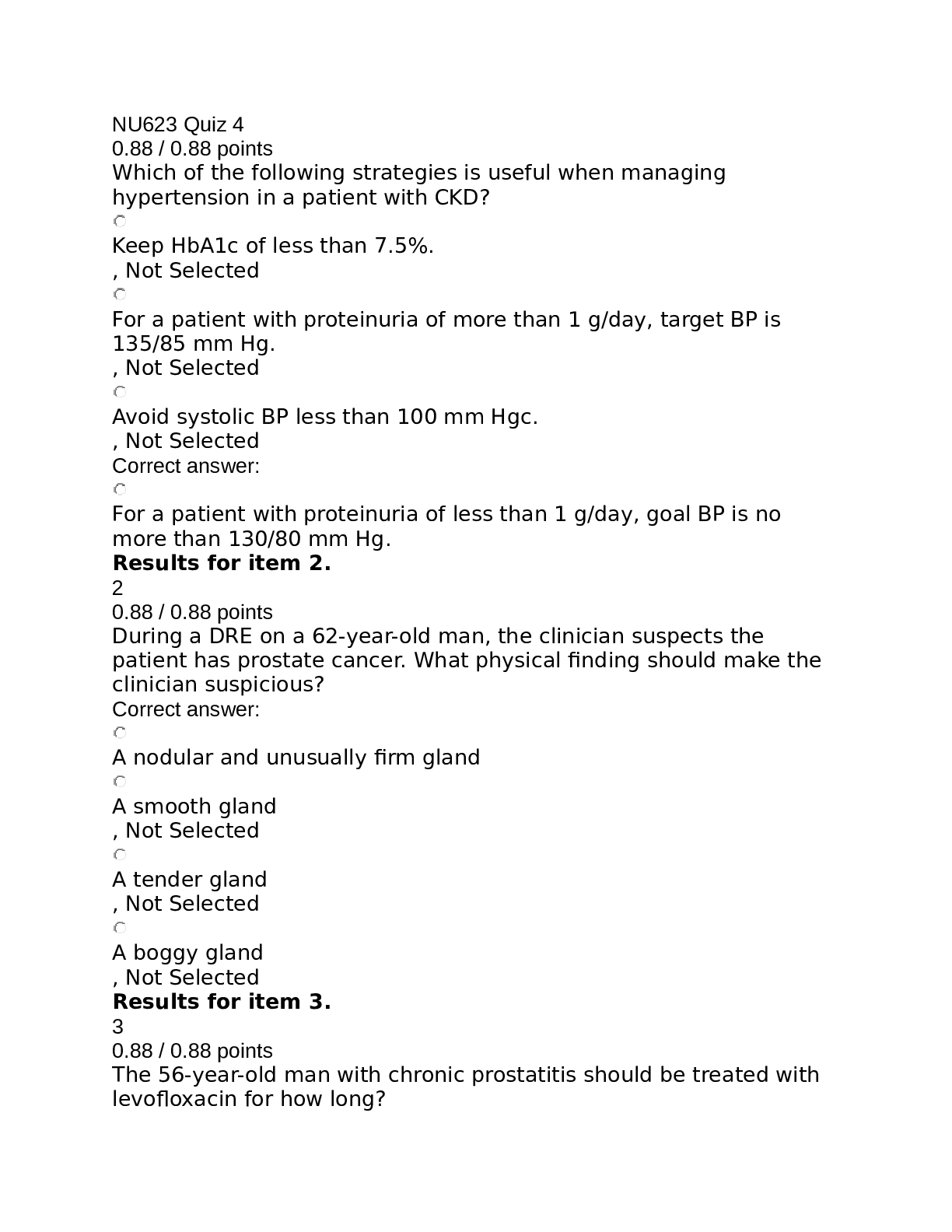

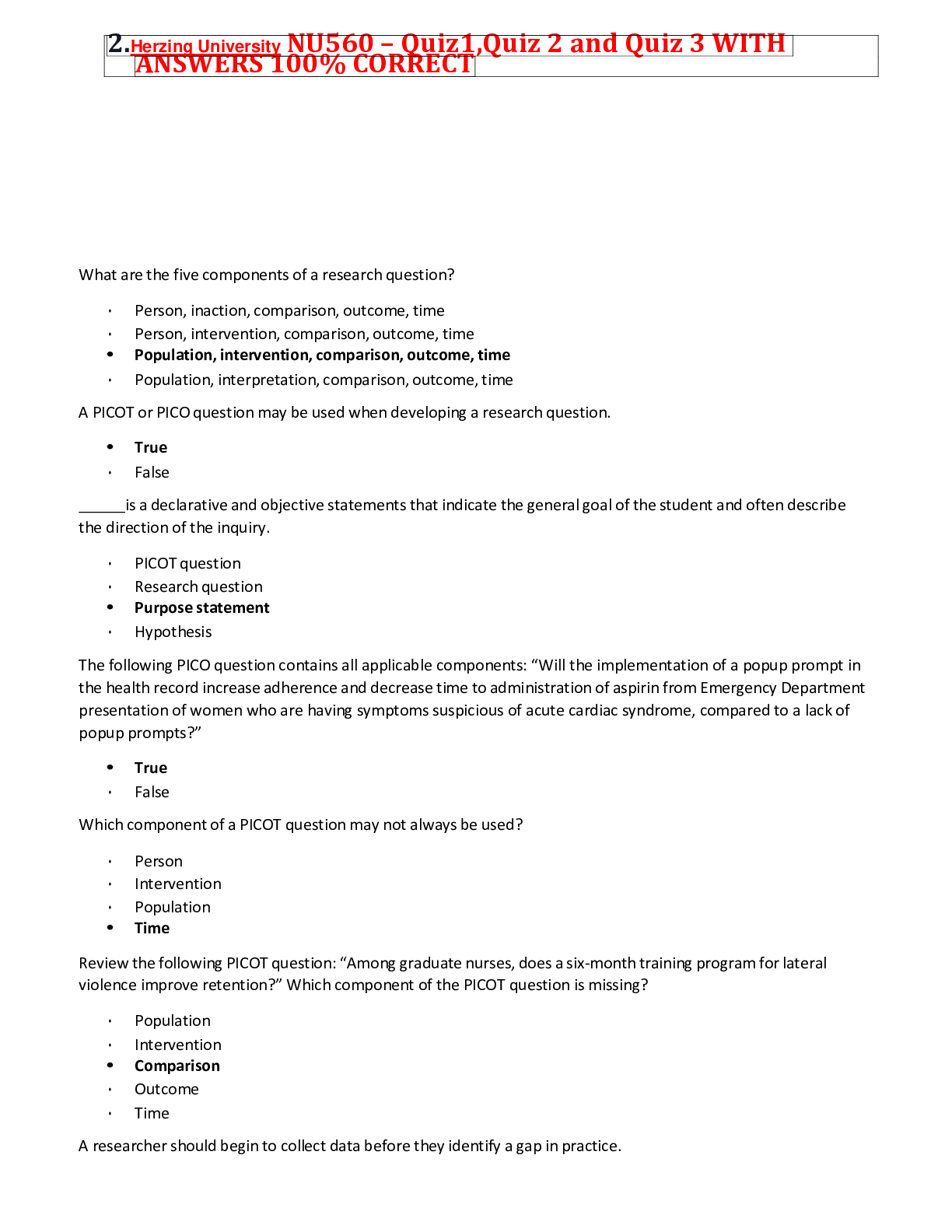

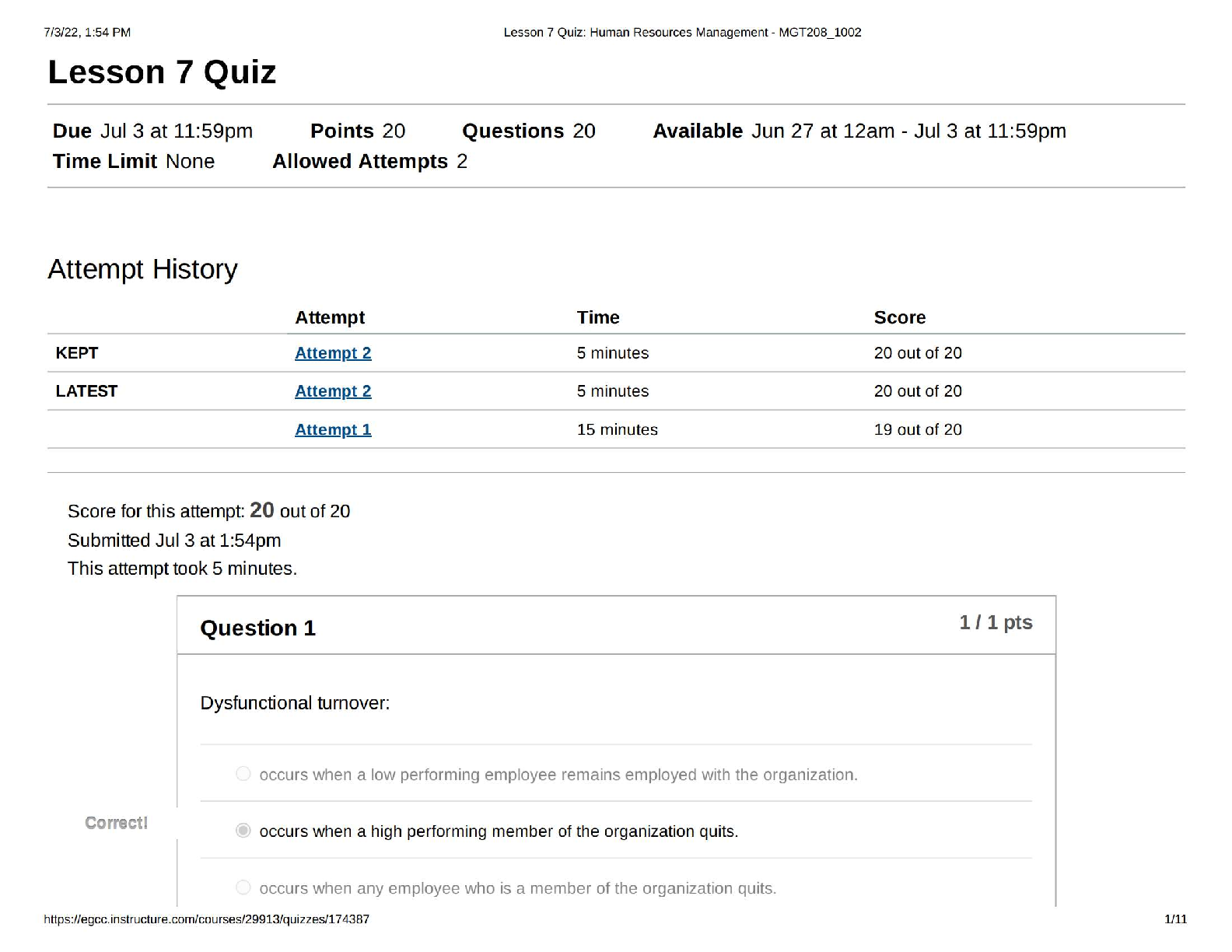

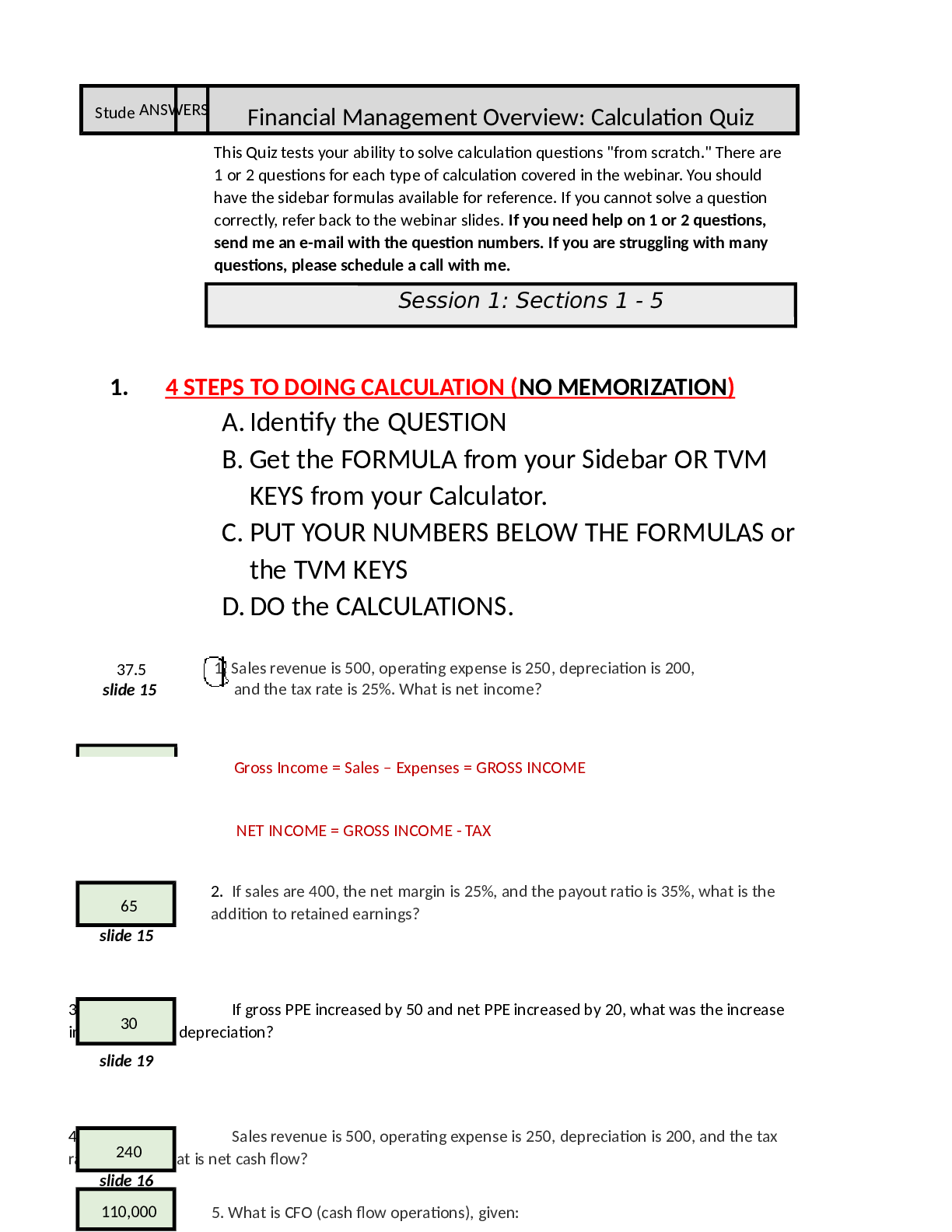

ANSWERSStudeFinancial Management Overview: Calculation QuizThis Quiz tests your ability to solve calculation questions "from scratch." There are1 or 2 questions for each type of calculation covered in ... the webinar. You shouldhave the sidebar formulas available for reference. If you cannot solve a questioncorrectly, refer back to the webinar slides.If you need help on 1 or 2 questions,send me an e-mail with the question numbers. If you are struggling with manyquestions, please schedule a call with me.Session 1: Sections 1 - 51.4 STEPS TO DOING CALCULATION (NO MEMORIZATION)A. Identify the QUESTIONB. Get the FORMULA from your Sidebar OR TVMKEYS from your Calculator.C. PUT YOUR NUMBERS BELOW THE FORMULAS orthe TVM KEYSD. DO the CALCULATIONS. 1. Sales revenue is 500, operating expense is 250, depreciation is 200,37.5and the tax rate is 25%. What is net income?slide 15Gross Income = Sales - Expenses = GROSS INCOMENET INCOME = GROSS INCOME - TAX 2.If sales are 400, the net margin is 25%, and the payout ratio is 35%, what is the 65addition to retained earnings?slide 153.If gross PPE increased by 50 and net PPE increased by 20, what was the increase30in accumulated depreciation?slide 194.Sales revenue is 500, operating expense is 250, depreciation is 200, and the tax240rate is 20%. What is net cash flow? slide 16 110,0005. What is CFO (cash flow operations), given:slide 20Net Income 100,000 6. What is the CFO, given the following information?505,000Net Income450,000slide 20,Change in Accounts Receivable120,00013Change in Inventory( 90,000)Depreciation Expense110,000Change in Accounts Payable50,000Change in Accrued Expenses(75,000)CFO = Net Income + Depreciation - Increase NWC(Current Assets - Current Liabilities)-15,0007. What is CFI (cash flow investing), given:slide 19Gross Equipment (1/1/18)50,000 Gross Equipment (12/31/18) 65,000Net income100,000Depreciation20,000GROSS METHODCFI = (Change in Gross PPE) x (-1) -90,0008. What is the CFI, given:slide 21Beginning Net PP&E250,000Ending Net PP&E300,000Depreciation Expense40,000Ending Gross PPE500,000NET METHODCFI = (Change in Net PPE + Depreciation Expense) x (-1)145,0009. What is CFF (Cash Flow Financing), given:slide 22Accounts Payable100,000 Accrued Expenses50,000Increase in Mortgage Payable300,000Decrease in Bonds Payable75,000Dividends Paid80,000CFF = Increase in Debt + Increase in Stock - Dividends Paid 10. What is Cash Flow Financing?75,000slide 22Stock issued50,000Bonds issued65,000Bonds maturing25,000 11. What is the current ratio?2.80slide 24A/R600Inventory800Fixed Assets1,000AP500Long Term Debt900Common Stock400Current Ratio = Current Assets/Current Liability12. If cash is 100, accounts receivable is 250, inventory is 300, and accounts payable1.17is 300. What is the quick ratio?slide 24Quick Ratio = Current Assets - Inventory / Current Liability13.If a firm has current assets of 80, fixed assets of 120, Sales are 150 and EBIT is 35, what1.25is the Fixed Asset Turnover?slide 24Fixed Asset Turnover (FAT) = Sales/Fixed Assets14.If a company has current assets of 90 and fixed assets of 140, if it has debt of 125,0.54what is its debt ratio?slide 24 15.A lottery winner can receive annual payments of $1 million per year for 20 years or $125.45million in cash immediately. What discount rate is being used?slide 3716. A woman was bequeathed a trust fund that pays $50,000 per year to her and to herdescendants forever. If the trust fund earns 3.5% interest, what is the amount of the trust1,428,571fund?slide 37 [Show More]

Last updated: 2 years ago

Preview 1 out of 10 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$10.50

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Aug 25, 2023

Number of pages

10

Written in

All

Additional information

This document has been written for:

Uploaded

Aug 25, 2023

Downloads

0

Views

91