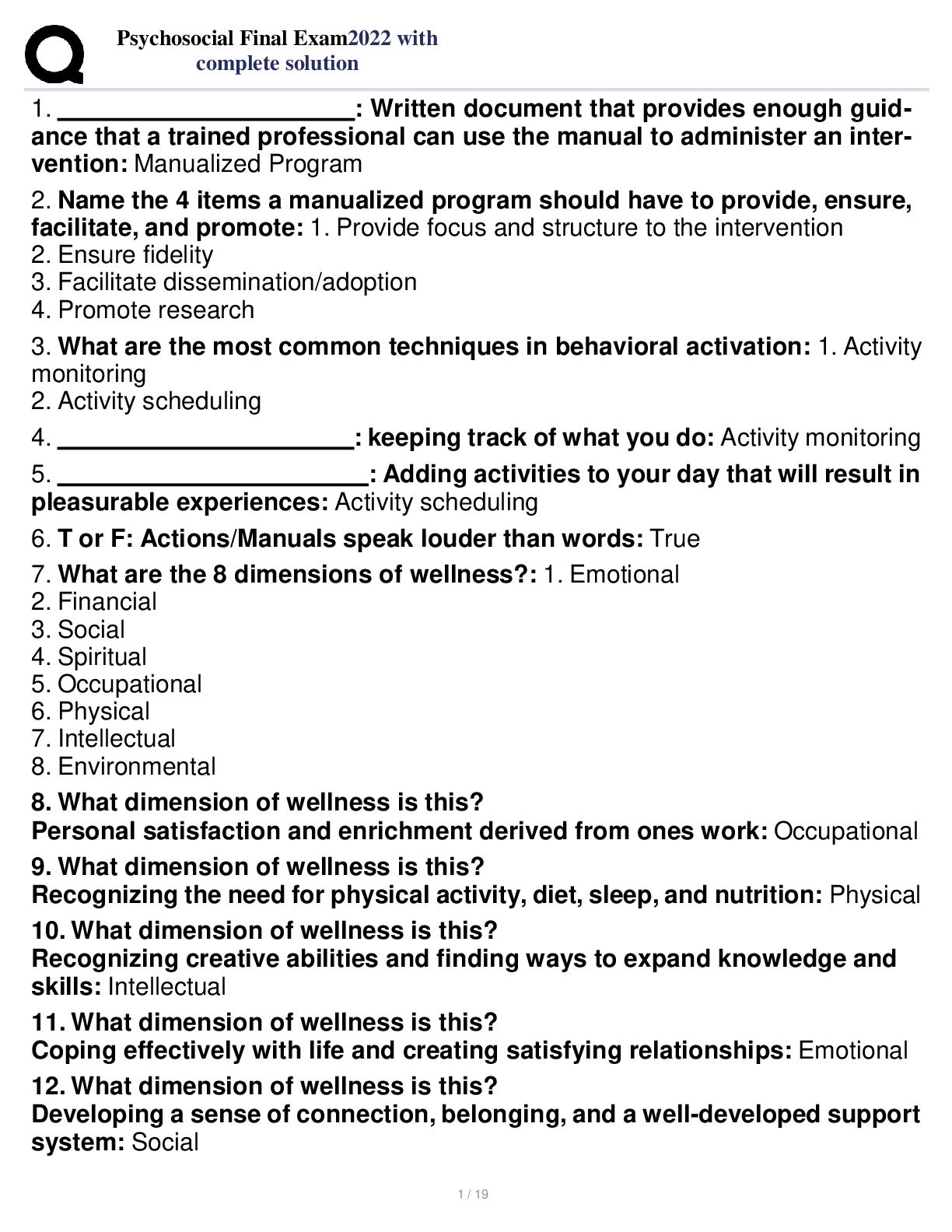

Psychosocial Final Exam 2022 with complete solution

Finance > QUESTIONS & ANSWERS > Finance Final Exam - Practice Exam Questions (All)

Finance Final Exam - Practice Exam Questions The cost of preferred stock is computed the same as the __________ A. pre-tax cost of debt. B. rate of return on an annuity. C. after-tax cost of debt ... . D. rate of return on a perpetuity. E. cost of an irregular growth common stock. - ✔✔Rate of return on a perpetuity Which one of the following statements concerning net present value (NPV) is most CORRECT? A. An investment should be accepted if, and only if, the NPV is exactly equal to zero. B. An investment should be accepted only if the NPV is equal to the initial cash flow. C. An investment should be accepted if the NPV is positive and rejected if it is negative. D. An investment with greater cash inflows than cash outflows, regardless of when the cash flows occur, will always have a positive NPV and therefore should always be accepted. E. Any project that has positive cash flows for every time period after the initial investment should be accepted. - ✔✔An investment should be accepted if the NPV is positive and rejected if it is negative The internal rate of return is defined as them: A. Maximum rate of return a firm expects to earn on a project. B. Rate of return a project will generate if the project is financed solely with internal funds. C. Discount rate that equates the net cash inflows of a project to zero. D. Discount rate which causes the net present value of a project to equal zero. E. Discount rate that causes the profitability index for a project to equal zero. - ✔✔Discount rate which causes the net present value of a project to equal zero The length of time a firm must wait to recoup, in present value terms, the money it has in invested in a project is referred to as the ______ A. net present value period. B. internal return period. C. payback period. D. discounted profitability period. E. discounted payback period. - ✔✔Discounted payback period You are viewing a graph that plots the NPVs of a project to various discount rates that could be applied to the project's cash flows. What is the name given to this graph? A. Breakeven analysis graph B. project risk profile C. NPV profile D. NPV route E. present value sequence - ✔✔NPV profile A project has a net present value (NPV) of zero. Which one of the following best describes this project? A. The project has a zero percent rate of return. B. The project requires no initial cash investment. C. The project has no cash flows. D. The project's cash inflows equal its cash outflows in present dollar terms. E. The total project cash flows equals zero. - ✔✔The project's cash inflows equal its cash outflows in present dollar terms Last year, T-bills returned 2 percent while your investment in large-company stocks earned an average of 5 percent. Which one of the following terms refers to the difference between these two rates of return? A. Risk premium B. Geometric return C. Arithmetic D. Standard deviation E. V ariance - ✔✔Risk premium Which of the following statement is most CORRECT? [Show More]

Last updated: 2 years ago

Preview 1 out of 25 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Can't find what you want? Try our AI powered Search

Connected school, study & course

About the document

Uploaded On

Sep 02, 2023

Number of pages

25

Written in

All

This document has been written for:

Uploaded

Sep 02, 2023

Downloads

0

Views

148

Scholarfriends.com Online Platform by Browsegrades Inc. 651N South Broad St, Middletown DE. United States.

We're available through e-mail, Twitter, and live chat.

FAQ

Questions? Leave a message!

Copyright © Scholarfriends · High quality services·