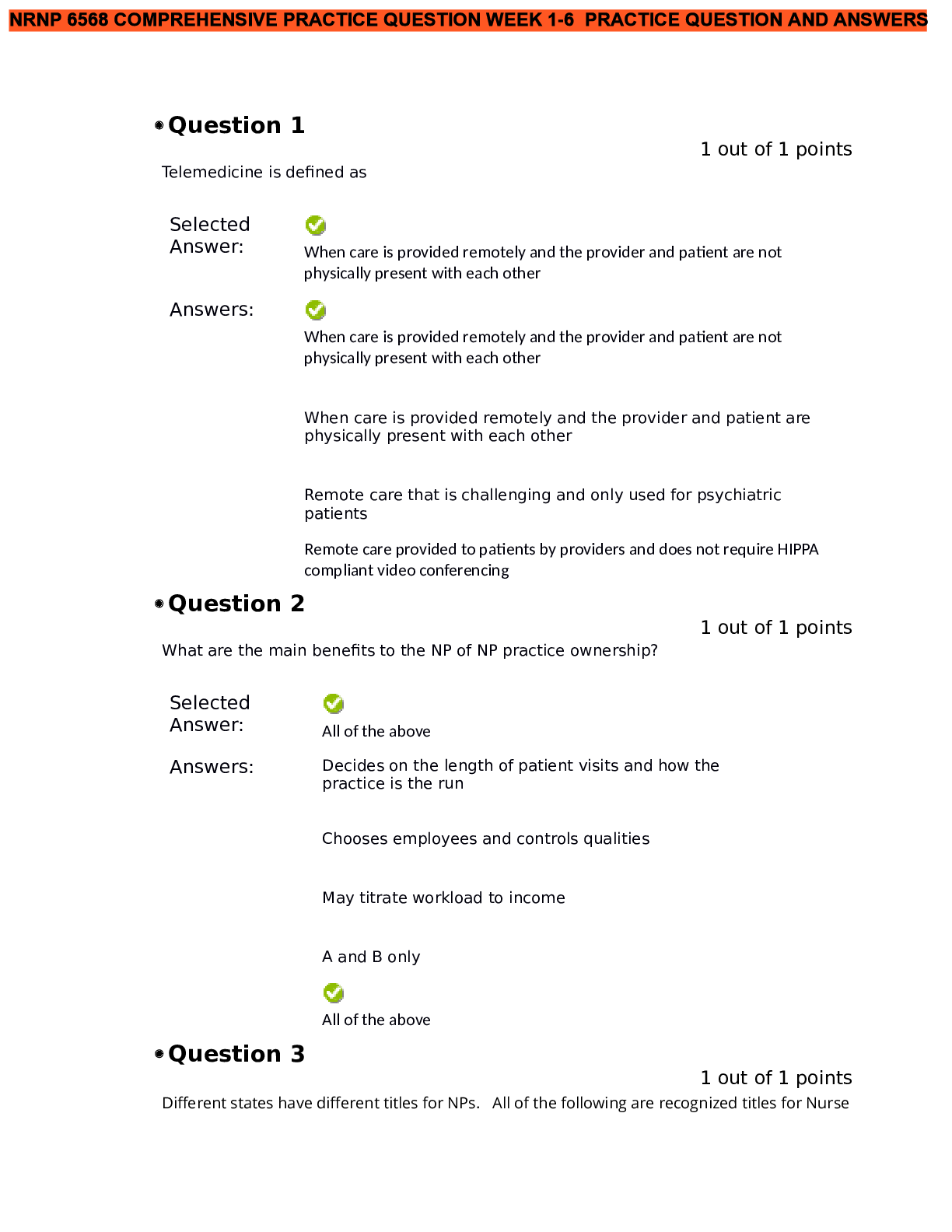

NRNP 6568 Comprehensive Practice Question and answer Week 1-6 Graded A+

$ 14.5

Quiz Submissions - Homework | Download for quality grades |

$ 2

Questions and Answers with Explanations (latest Update), 100% Correct, Download to Score A.png)

ATI Exit Practice Question Notes (Complete) Questions and Answers with Explanations (latest Update), 100% Correct, Download to Score A

$ 9

Test Bank For Advanced Accounting 10th Edition By Floyd Beams, Joseph Anthony

$ 30

EDEXCEL AS LEVEL JUNE 2022 HISTORY QUESTION PAPER 1E

$ 1

Advanced Accounting by Susan S. Hamlen. ISBN-13 978-1618532619. (Complete Download) 705 Pages SOLUTIONS MANUAL & TEST BANK

$ 27

[eBook][PDF] Atkins' Physical Chemistry, 11th Edition By Peter Atkins, Julio de Paula, James Keeler

$ 14.5

LETRS UNIT 1 POST TEST | with 100% Correct Answers

$ 4

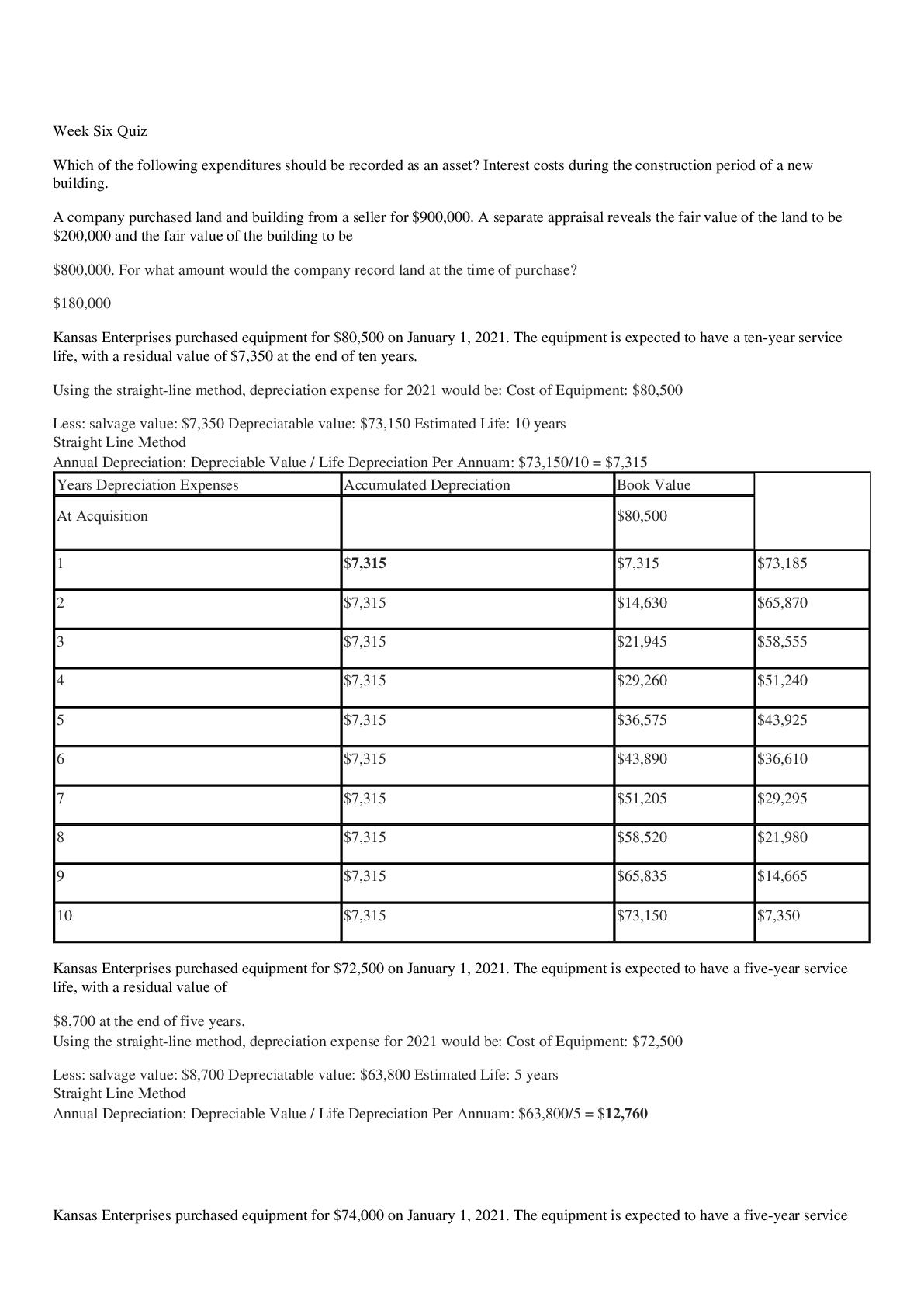

ACCT 212 Week 6 Quiz (100% Guaranteed Pass) | Download To Score An A

$ 7

eBook The AASM Manual For The Scoring of Sleep and Associated Events - Terminology and Technical Specifications. Version 3.-American Academy of Sleep Medicine By Trung Nguyễn Bảo

$ 29

EDEXCEL A LEVEL JUNE 2022 HISTORY OF ART QUESTION PAPER 2

$ 1

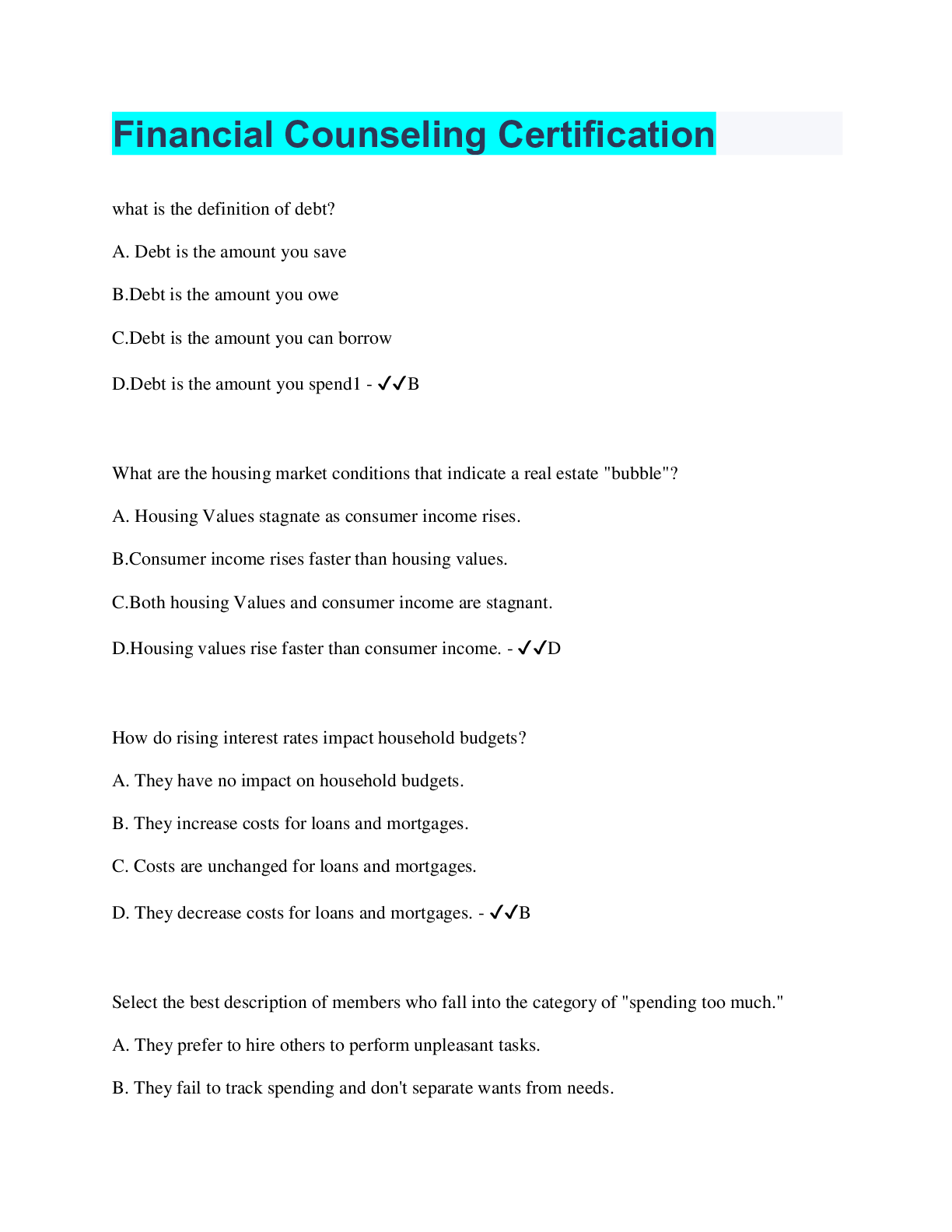

FI 360 UNIT 4: MIDTERM EXAM WITH QUESTIONS AND ANSWERS. LATEST

$ 15

TSI EXAM QUESTIONS AND ANSWERS

$ 35

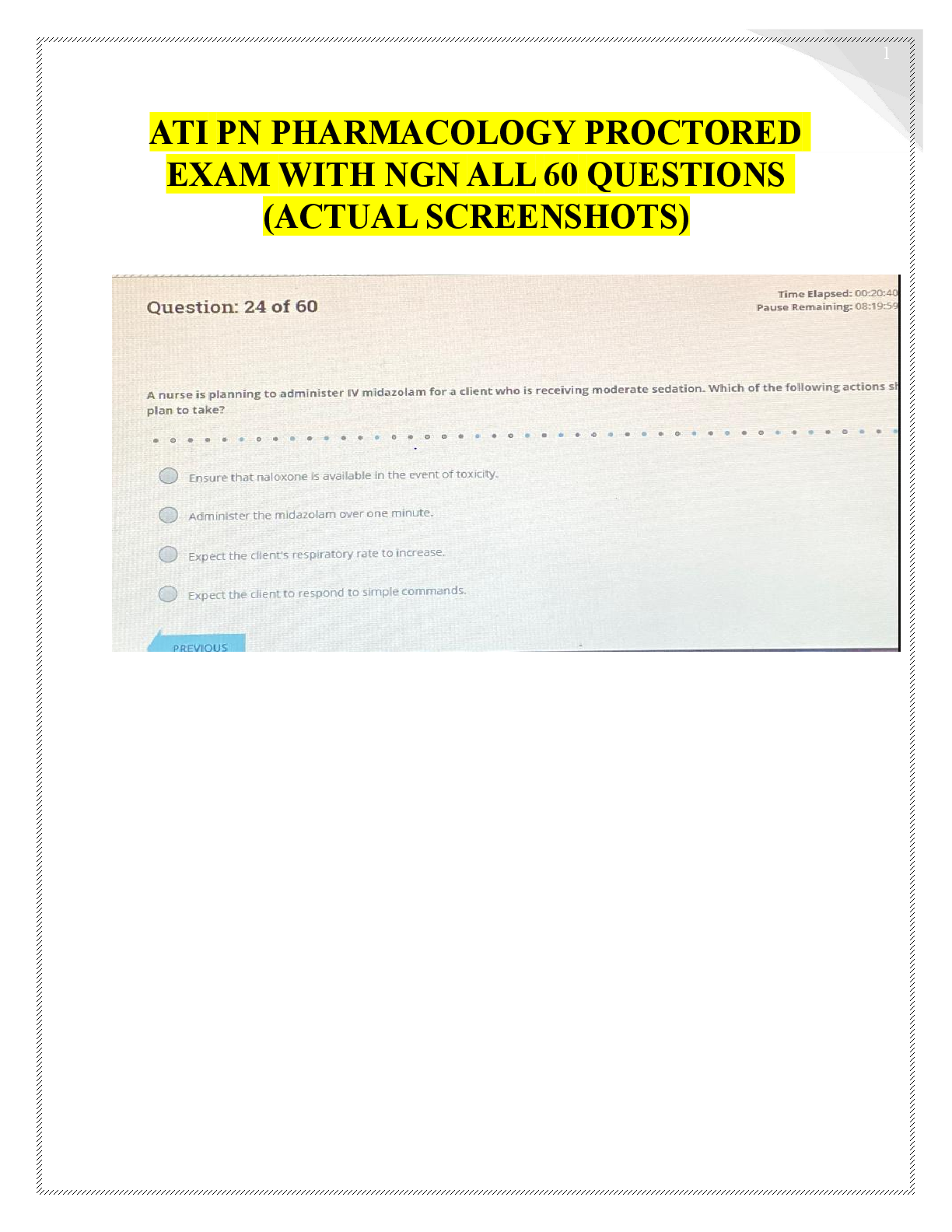

NURSING EXAM (ATI PN PHAMACOLOGY EXAM)

$ 77.5

Corporate Finance Final Exam 75 Questions with 100% Correct Answers. Rated A

$ 9

ATI FUNDAMENTAL EXAMS LATEST

$ 14.5

Comprehensive Note (Tina Jones) (A GUARANTEED)

$ 8

[eBook] [PDF] Rogers Handbook of Pediatric Intensive Care, South Asian Edition By Wynne, Kristen, Donald, Deepika, Shrishu

$ 30

Corporate Tax Final Exam Prep 2022 with complete solution. 2022/2023, Rated A

$ 8

CIST2921 Quiz All Chapters

$ 11

eBook PDF A Compendium of Principles and Practice of Laser Biophotonics in Oral Medicine By Fakir Mohan Debta, Ekagrata Mishra, Neha Paty

$ 27

Phlebotomy test latest update with Questions and Answers

$ 8

EMSE 4410 Survey of Finance & Engineering Economy

$ 9

NSG 6430 Week 1 Knowledge Check-Question and Answers

$ 4

RVE STUDY GUIDE QUESTIONS AND ANSWERS GRADED A

$ 2

MOA 100 Test 1 Review

$ 10

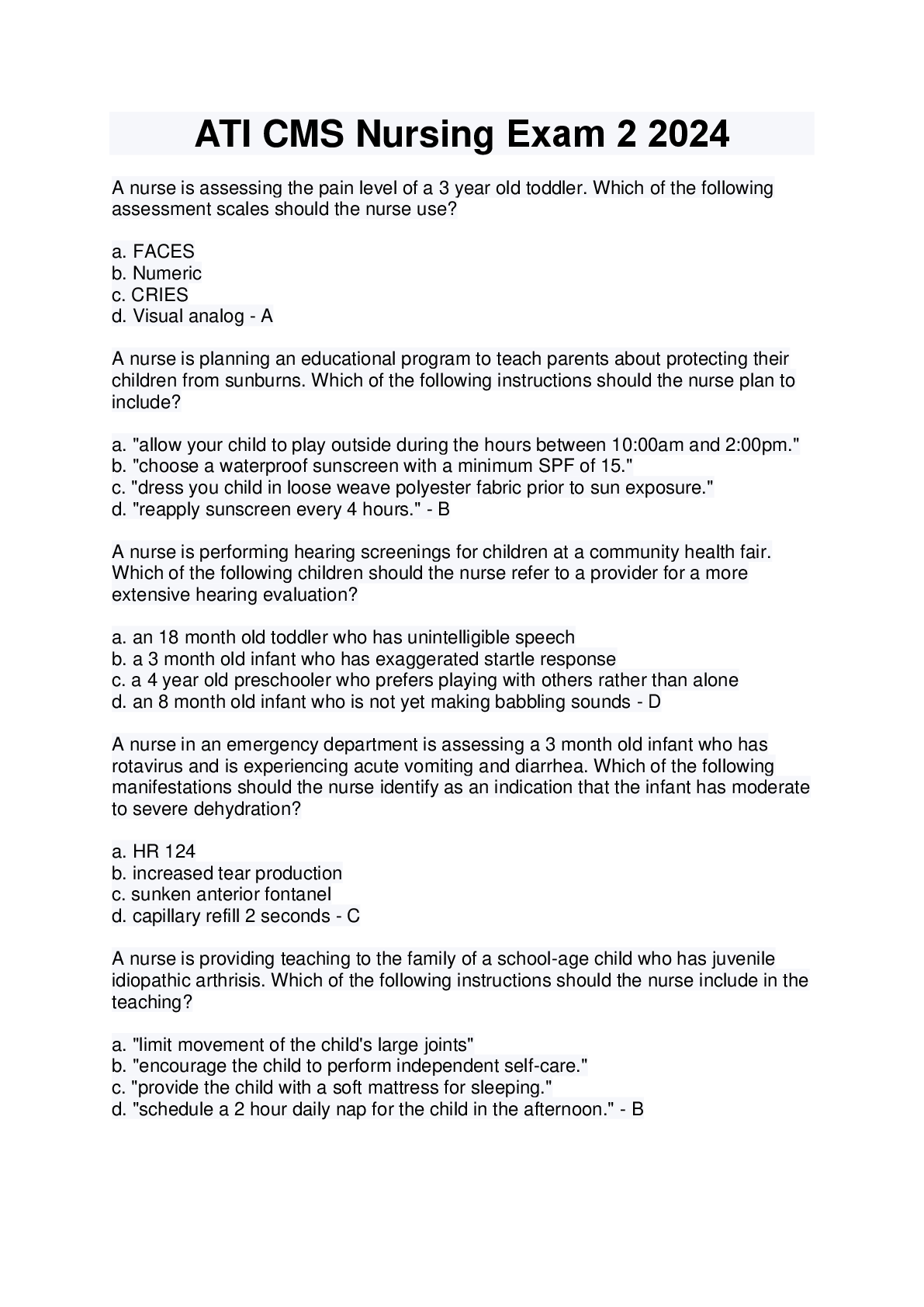

ATI CMS Nursing Exam 2 2024.pdf (2)

.png)