Financial Modeling & Analysis Exam I

3 Equivalent ways of calculating the present value of a single cash flow - ✔✔

1. The Present Value Formula

2. Present Value PV Excel Function

3. A Present Value Timeline where eac

...

Financial Modeling & Analysis Exam I

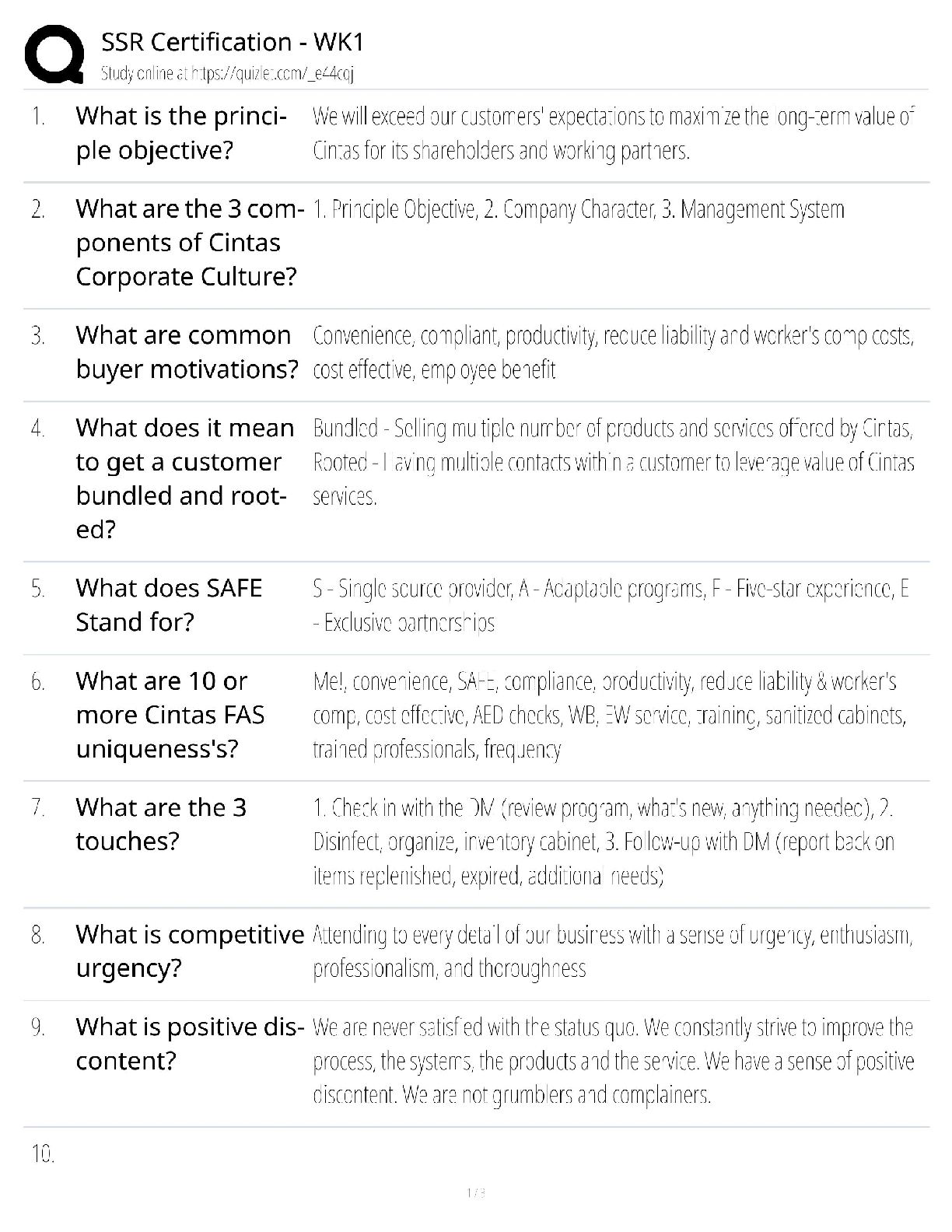

3 Equivalent ways of calculating the present value of a single cash flow - ✔✔

1. The Present Value Formula

2. Present Value PV Excel Function

3. A Present Value Timeline where each column corresponds to a period

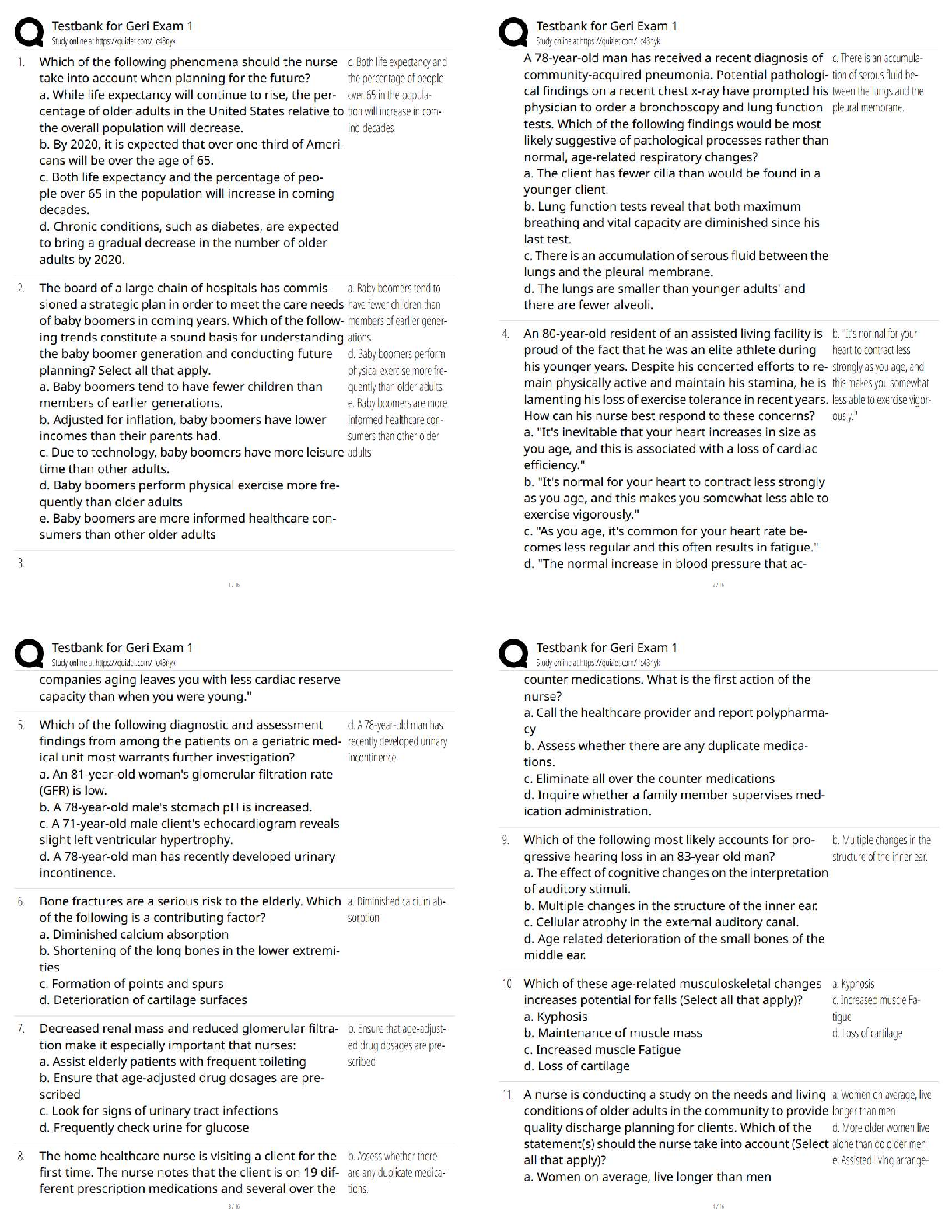

What is the effect on the FV of a single cash flow when you increase:

a.Present Value

b.Discount Rate

c. Number of Periods - ✔✔An increase in the FV

Explain the Future of Cash Flow Formula - ✔✔Each cash flow is compounded at a Discounted

Rate for the remaining periods

Show the Annuity Future Value formula - ✔✔AFV=APV*(1+r)^t

Show the Annuity Present Value formula - ✔✔APV=AFV/(1+r)^t

Explain why dividing the APV by the PVIFA gives the Payment amount of the Annuity -

✔✔APV=PMT*PVIFA

What happens to the PV of a single cash flow when you increase Discount Rate and the Number

of Periods - ✔✔Decreases

List the two components of the annuity payment of an amortized loan - ✔✔a.)Interest

b.)Principal

State the effect of increasing the payment amount on the APV and AFV - ✔✔An Increase in the

Future Value

In which year is the principal component of the payment amount of a 30-year amortized loan at

its highest level? Why? - ✔✔Year 30 because the interest componet is at its lowes

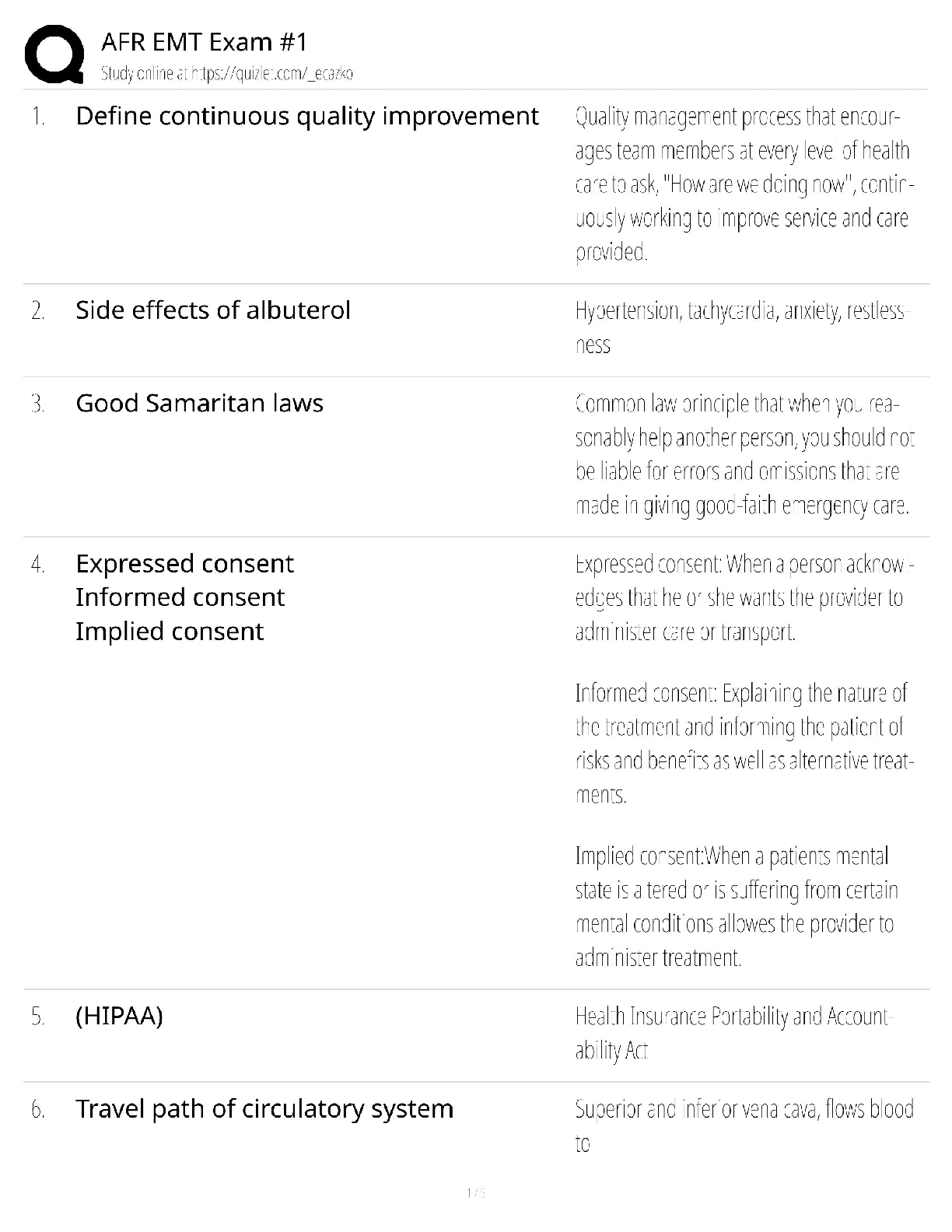

State the intuitive interpretation of the following component of the Return on Equity in the

DuPont System of Ratio Analysis: EBIT/Sales - ✔✔Profit Margin

State whether a firm's interest-burden ratio will be higher or lower if it pays more interest

relative to EBIT. Explain. - ✔✔Lower because its pretax profit will be lower relative to EBIT.

State what Excel's YEARFRAC function calculates - ✔✔The fraction of a year between two

calendar dates

Why does the yield curve often have lower yields at the short end due to market segmentation -

✔✔There is more demand for short-term bonds for cash management, which increases prices,

resulting in low yields at the short end

State the two dynamic properties regarding the volatility of the U.S. yield curve - ✔✔a.) short

rates of 0 to 5 years are more volatile than long rates 15 to 30 years

b.)Overall volatility of the yield curve is higher when its level is higher

State and explain what happens to the bond price when the number of payments per year is

decreased from 2 to 1 - ✔✔The bond price decreases because interest is compounded less

frequently

How do you calculate the Nominal Discount Rate - ✔✔Compound the inflation rate and the real

discount rate

Can you use the NPV function to calculate NPV where the discount rate is changes over time? -

✔✔No, because the NPV function requires one Discount Rate

State whether a firm's tax-burden ratio will be higher or lower if it pays more taxes relative to

pretax profit. Explain - ✔✔Tax-burden ratio will be lower because it would decrease net profit in

the numerator of the tax-burden ratio formula, which will decrease the amount that the pretax

income is being divided into creating a smaller tax-burden ratio

State the appropriate discount rate for a corporate lease vs. buy analysis. - ✔✔after-tax cost of

debt, where the corporation's cost of debt is assumed to be the same as the loan rate

Forward Rates Curve vs. Yield Curve - ✔✔Forward Rates Curve show an approximate forecast

of future interests during different periods of time and the curve is not smooth.

Yield Curve is an average of the Forward Rates so it has more smoother curve. Often helps give

am idea of future economic activity.

List the static features regarding the shape, level, and curvature of the U.S. yield curve. - ✔✔a.)

4 different shapes: upward-sloping, downward-sloping,flat,hump-shaped

b.)the overall level of the yield curve ranges from low to high

c.)the amount of the curvature at the short end ranges from a little to a lot.

4 Equivalent ways of calculating bond prices are: - ✔✔1. PV of the bond's cash flows Timeline

2. PV formula for the bond price

3. Excel's PV function for the bond price

4.Excel's Analysis ToolPak Add-in price function

Relationship between Bond Price and Yield to Maturity - ✔✔Inversely Related

What is the main advantage of forecasting the inflation rate separately for calculating Net Present

Value - ✔✔Guarantees that we are consistent in the way that we are treating the inflation

component of cash flows in the numerator of NPV calculation and the inflation component of the

discount rate of the denominator of the NPV value

[Show More]

.png)

.png)