2025 AQA A-LEVEL ECONOMICS Paper 1 Markets and Market Failure Question Paper & Mark Scheme (Merged) Monday 12 May 2025 [VERIFIED]

$ 8

NURS 6551 Midterm Exam 1 – Question and Answers

$ 24.5

BIO 353 - Exam 2A Key Cell Biology Spring 2019

$ 14

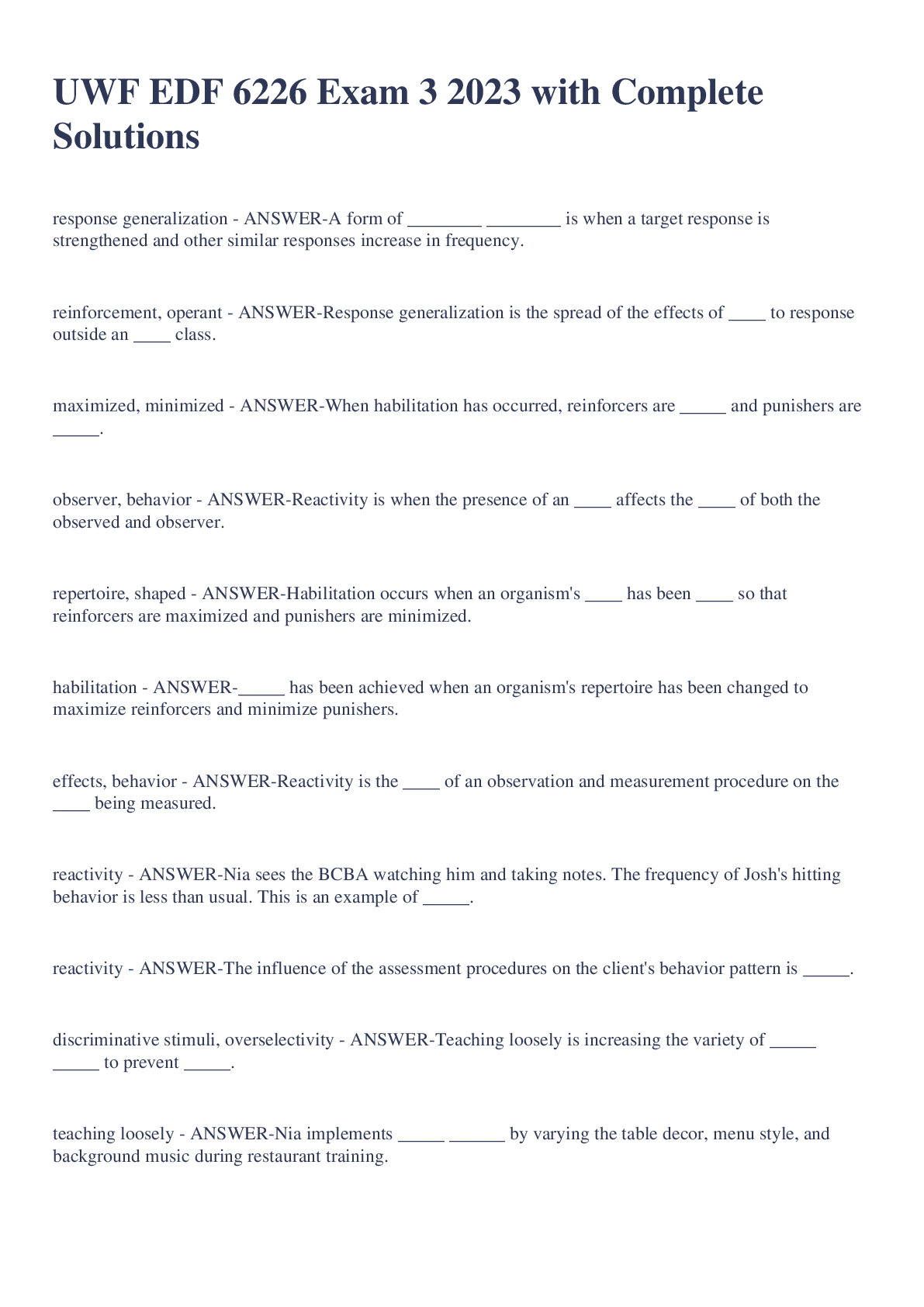

UWF EDF 6226 Exam 3 2023 with Complete Solutions

$ 14

Starbucks ServSafe Food Safety Certification / Score 100% / New 2025 Update / Complete Study Guide & Practice Exam

$ 22.5

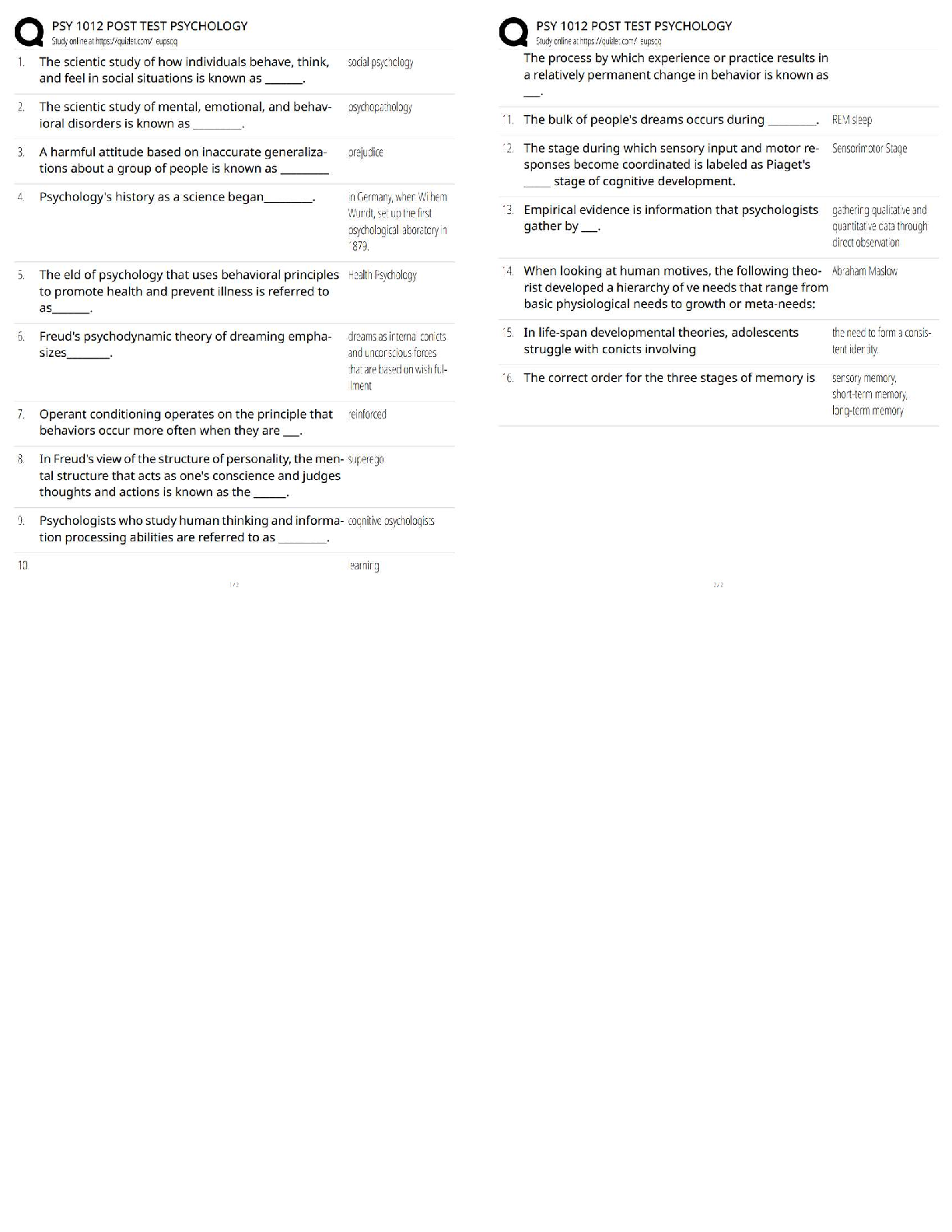

PSY 1012 Post Test Psychology Practice Questions / Score 100% / New Version / 2025 Update

$ 10.5

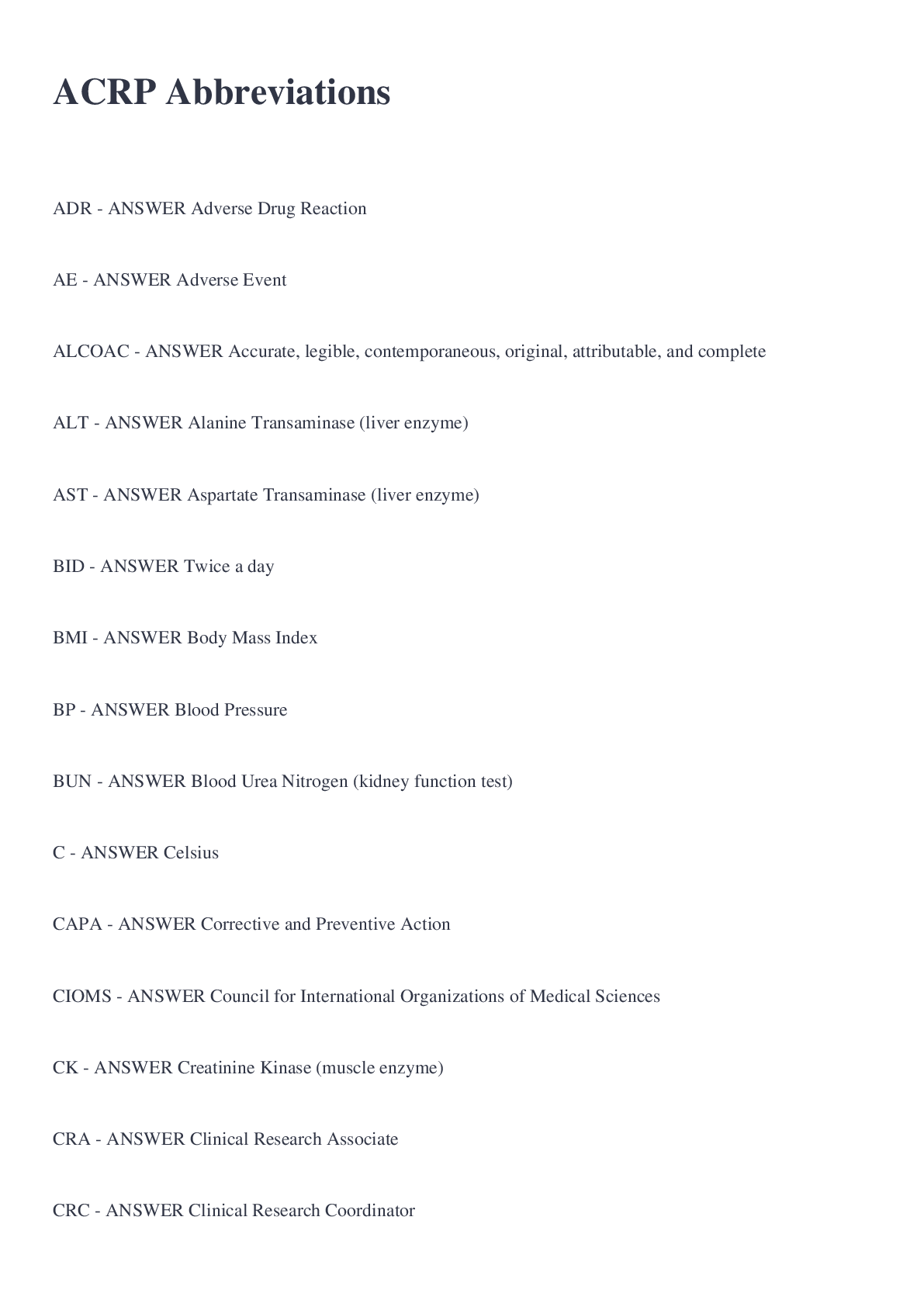

ACRP Abbreviations

$ 5

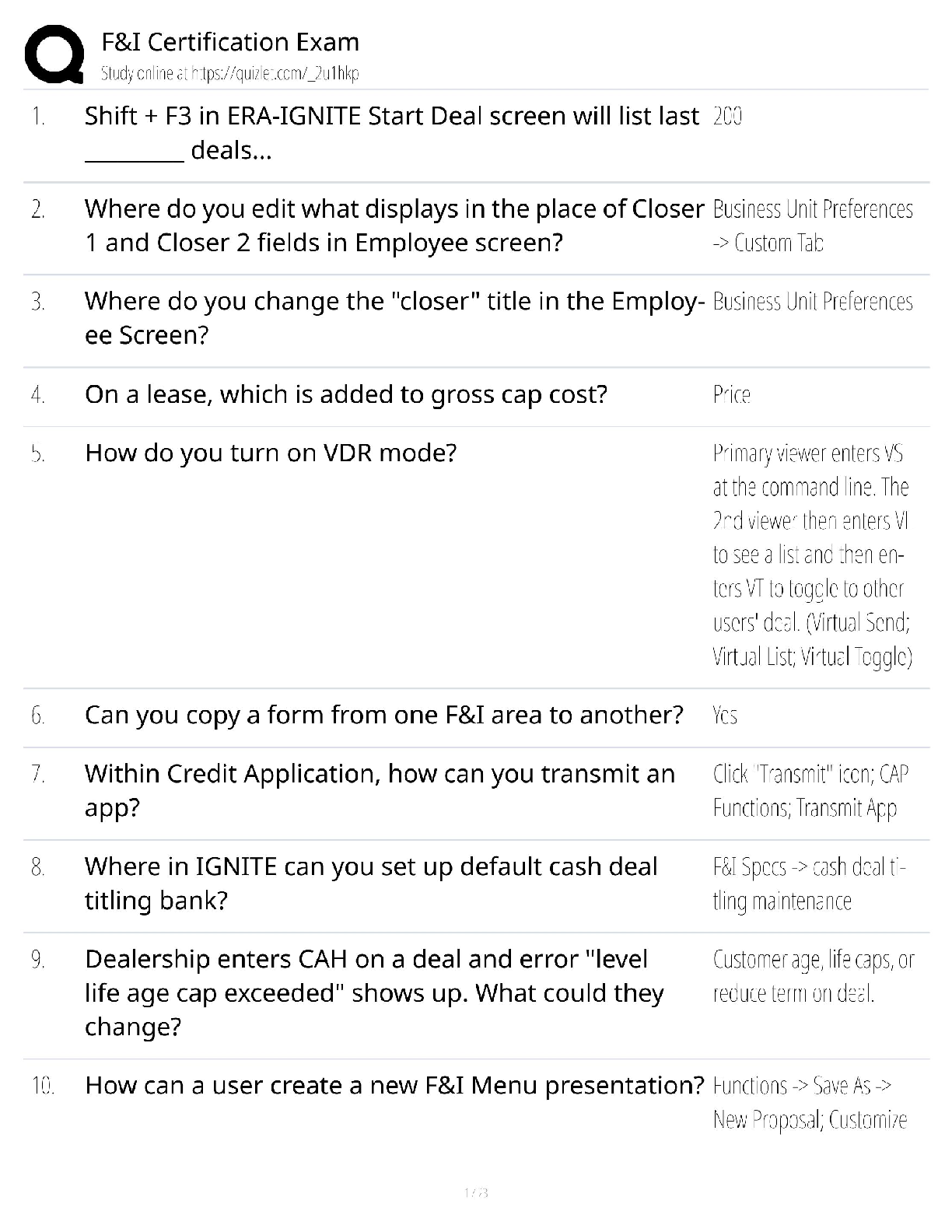

F&I Certification Exam / Finance & Insurance Manager / Study Guide & Test Bank / Score 100% / 2025 Update

$ 21

Test Bank For Basic Marketing Research 6th Edition By Churchill Brown

$ 30

.png)

WGU Information Management - C468 with complete solution

$ 6

OCR A chemistry 2019 depth (as level) paper & markscheme 2019

$ 8

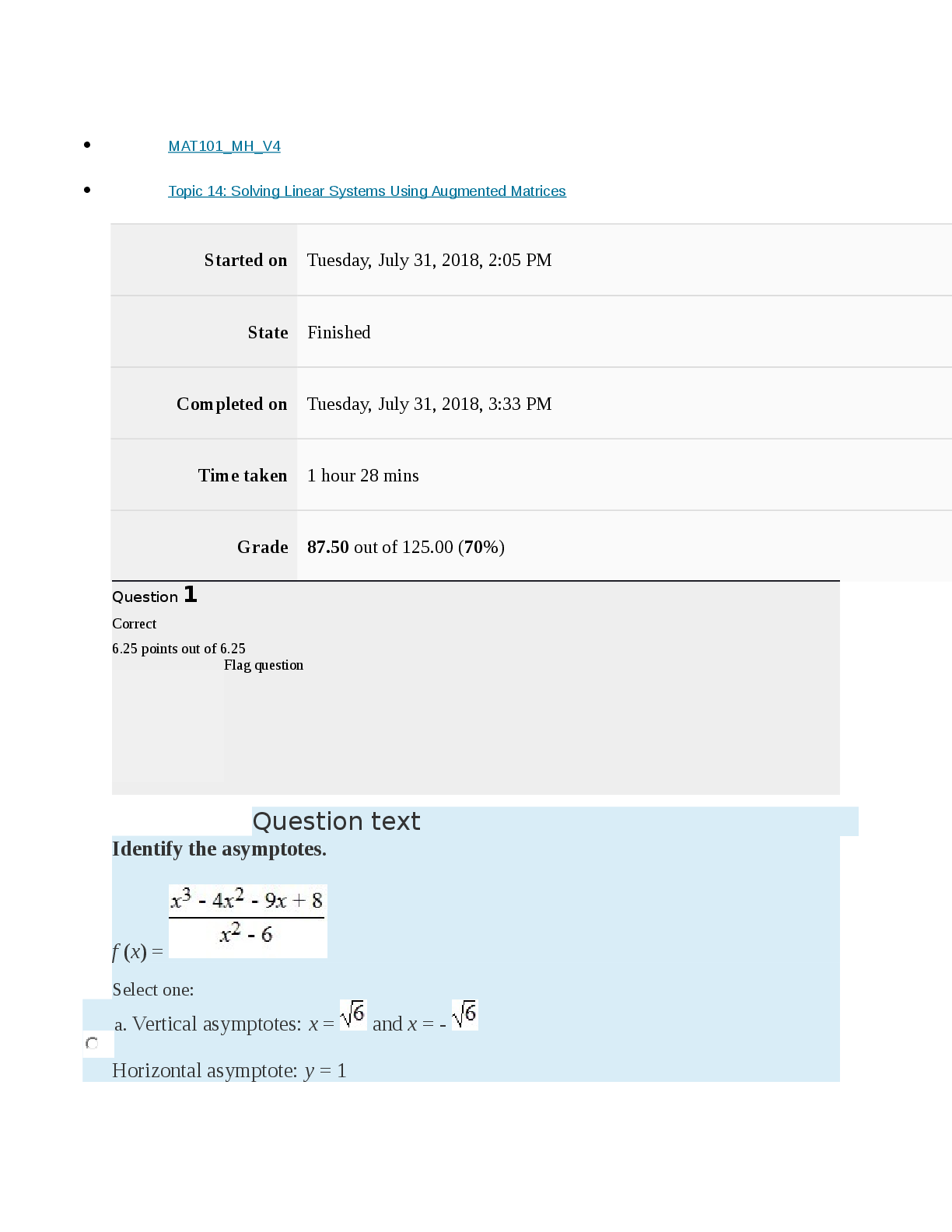

MAT 101 Algebra week 4 exam (1)

$ 18

Sophia___Human_Biology___Unit_6_Milestone_6

$ 7

Maternal Newborn ATI Study Guide_LATEST | Maternal Newborn ATI_Graded A

$ 12.5

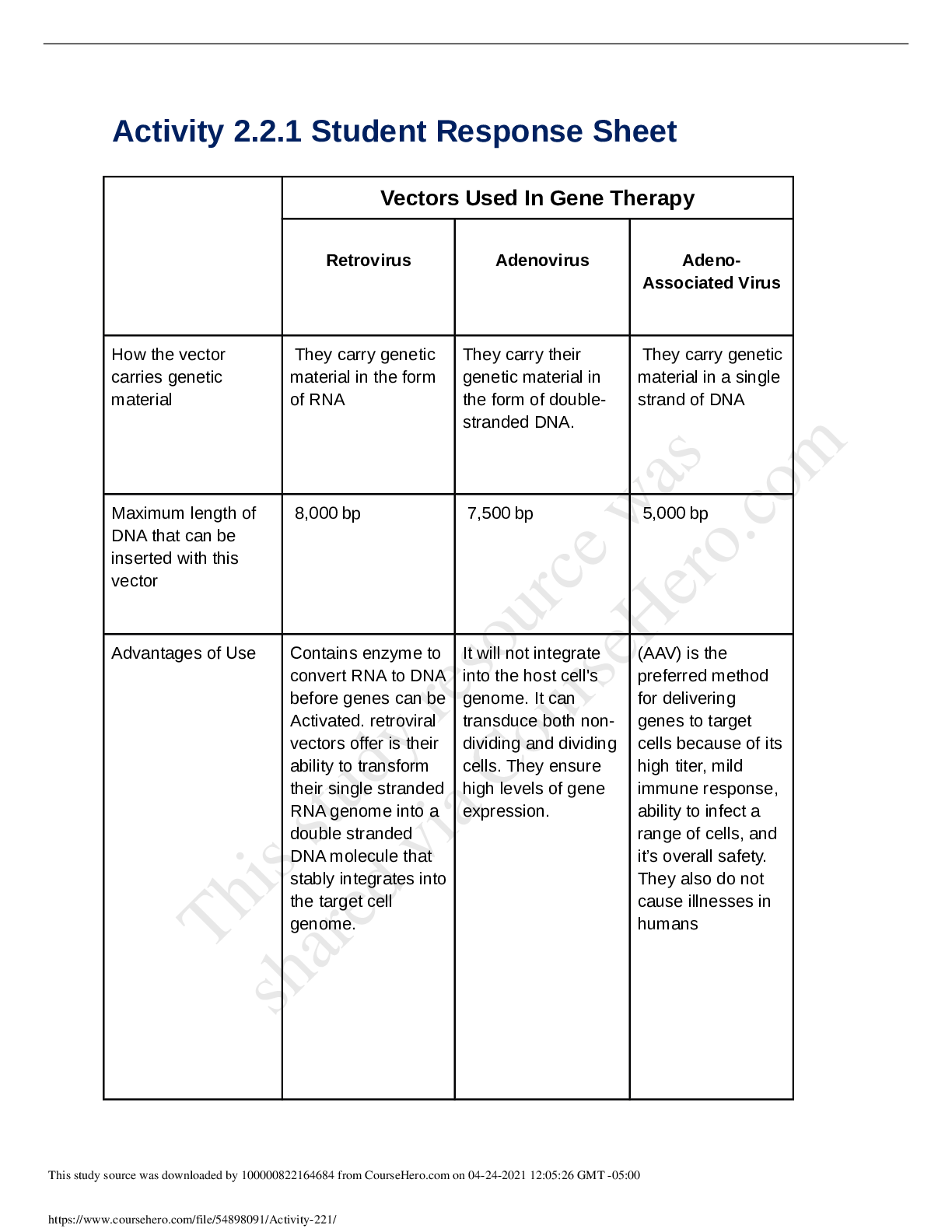

Activity 2.2.1 Student Response Sheet..-BIOLOGY MISCActivity 2.2.1,100% score

$ 7

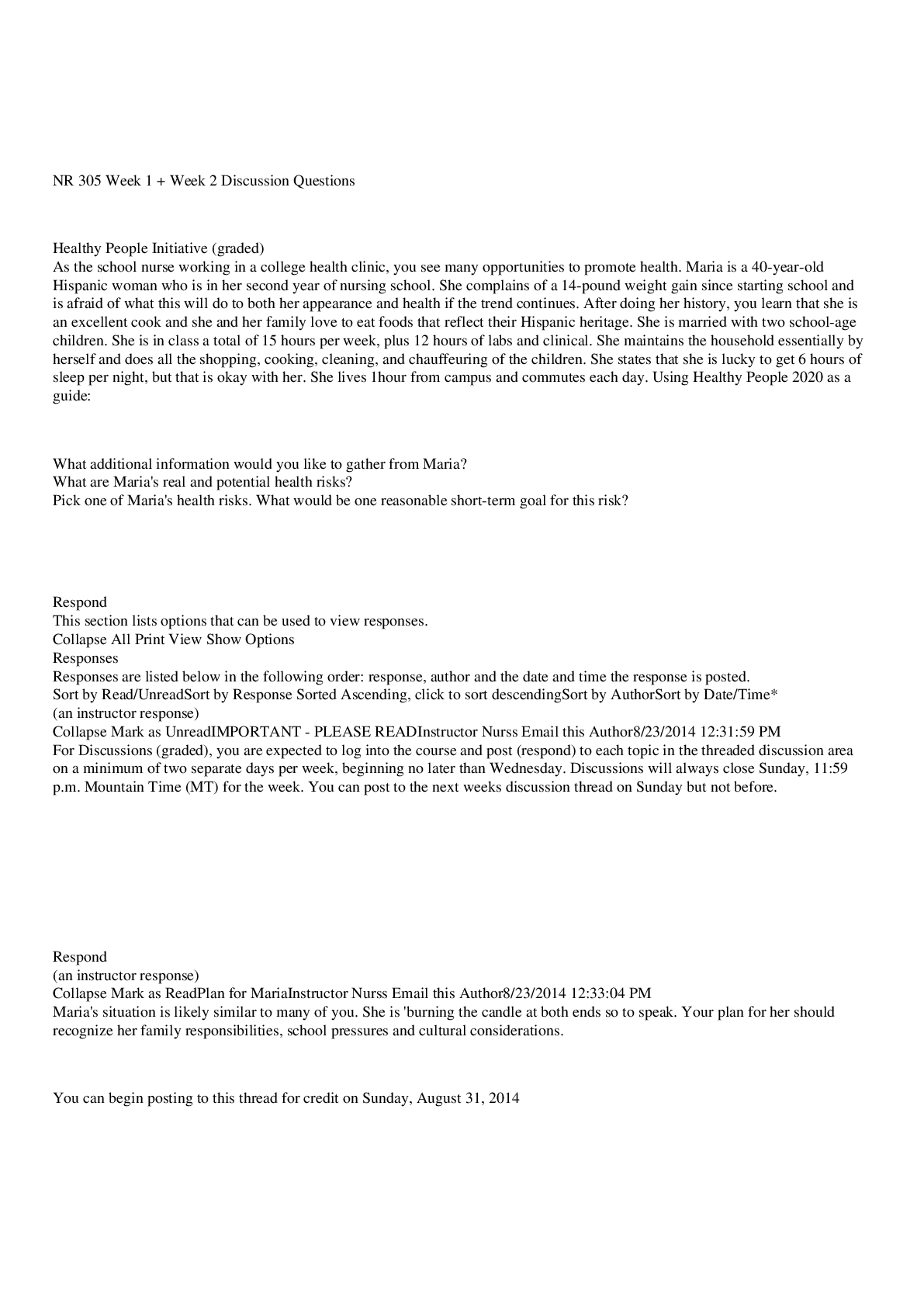

NR 305 Week 1 + Week 2 Discussion Questions GRADED A

$ 18

NR 327: Chapter 10: Antepartum Fetal Assessment

$ 5

.png)

AS Level Chemistry A H032/01 Breadth in chemistry September 23 2020( Question paper)

$ 9

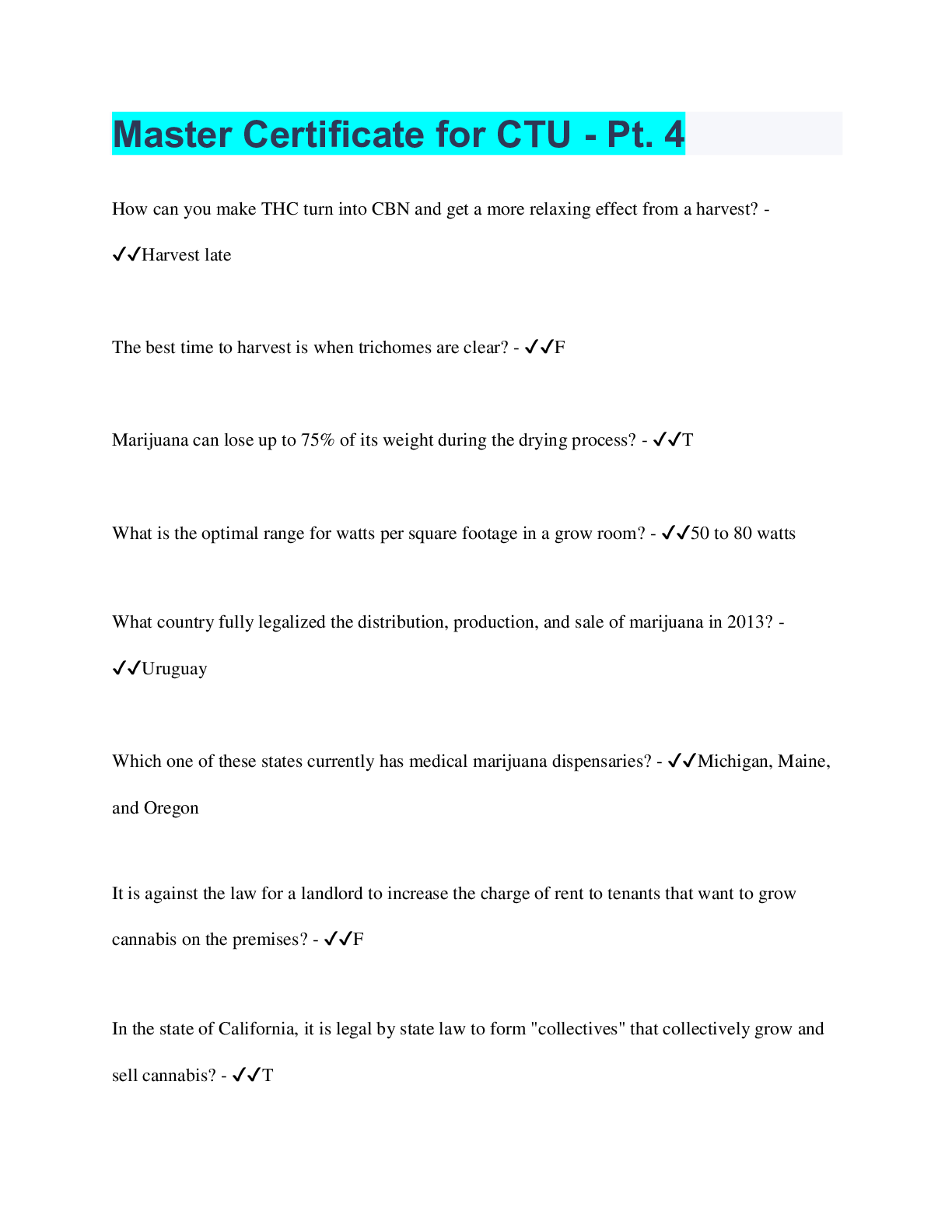

Master Certificate for CTU - Pt. 4

$ 10

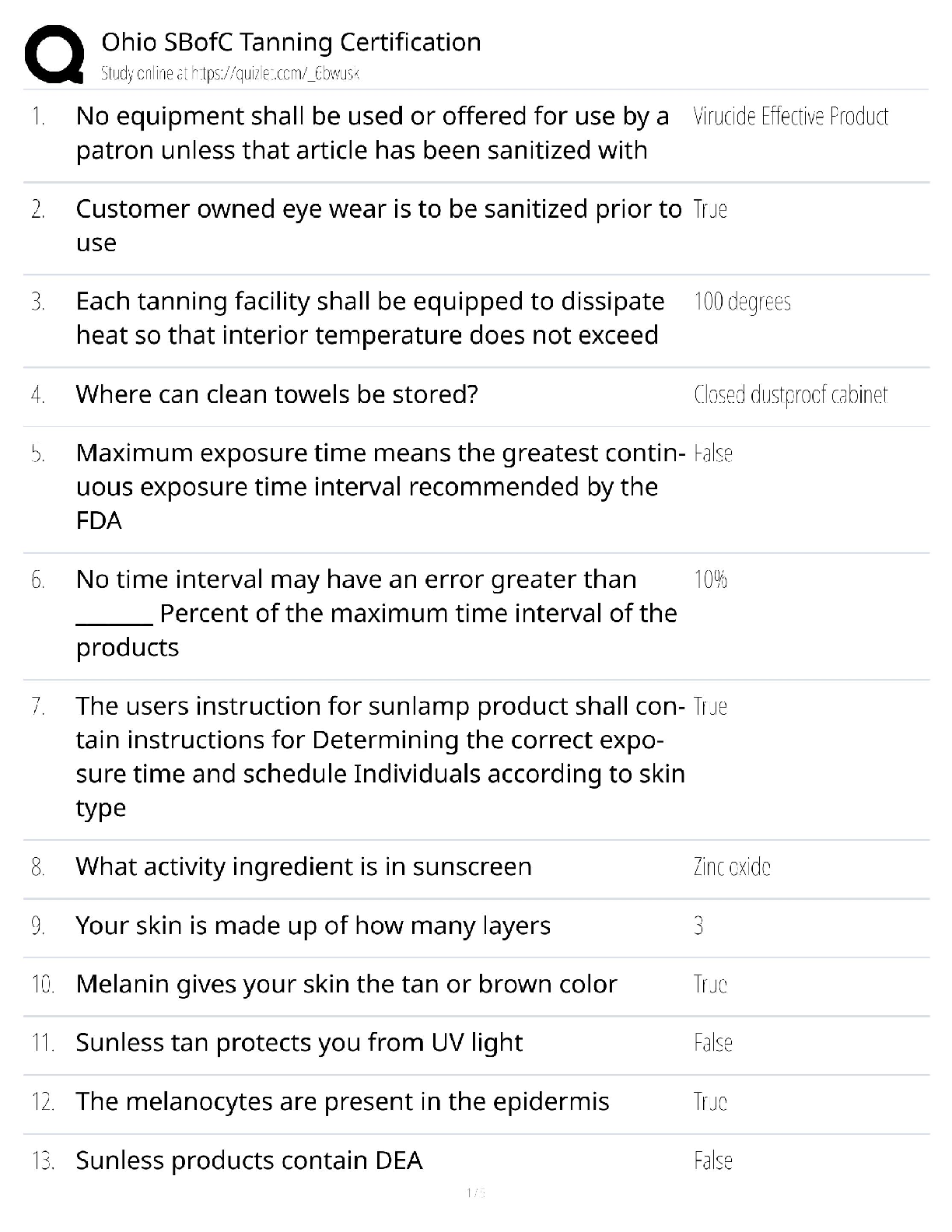

Ohio Tanning Certification Exam / SBofC Operator Study Guide / 2025 Test Bank & Practice Quiz

.png)