IACCP (QE) Test Questions

Which THREE persons or firms may be excluded from having to register under the Investment

Advisers Act of 1940? (Choose three.)

A. Accountants whose advisory services pertain solely to incide

...

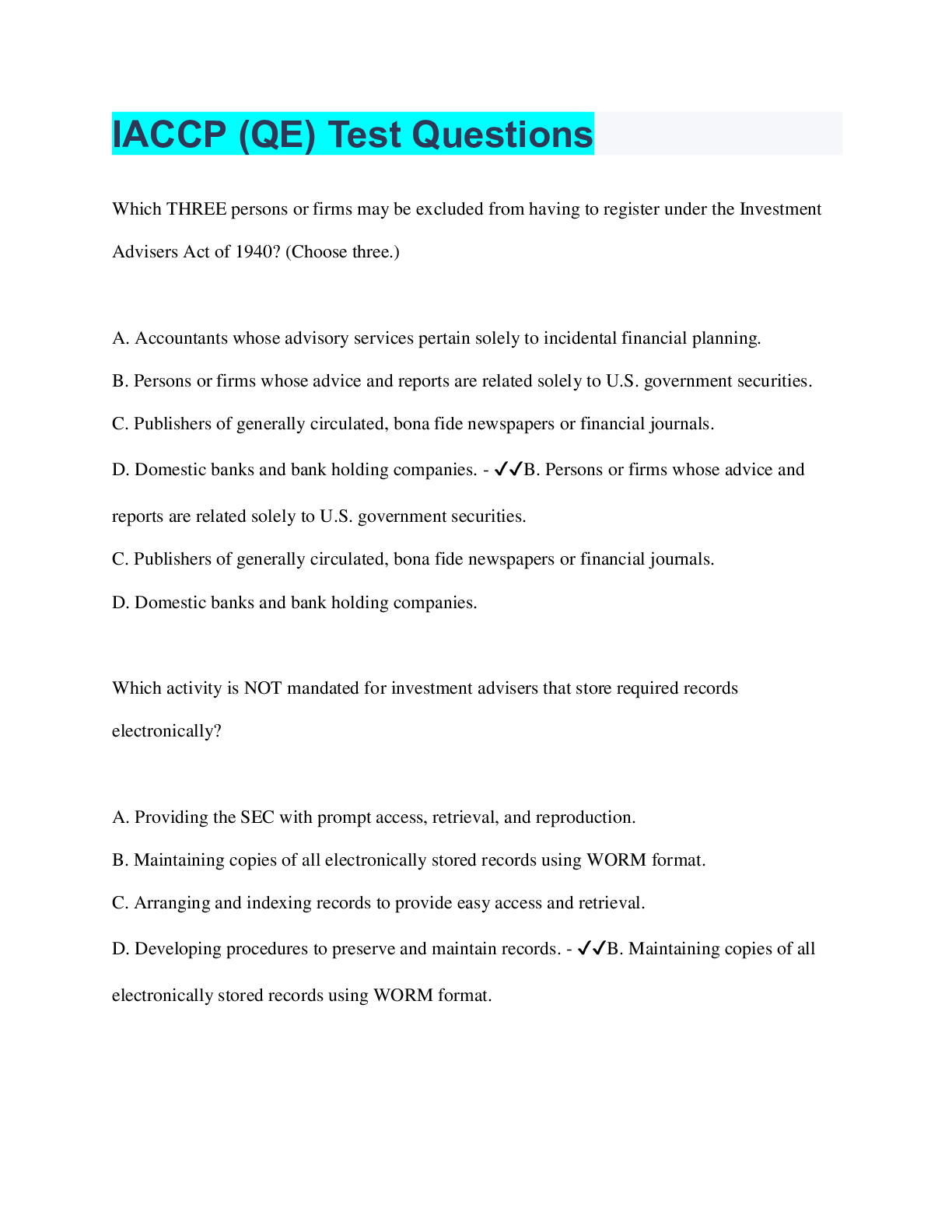

IACCP (QE) Test Questions

Which THREE persons or firms may be excluded from having to register under the Investment

Advisers Act of 1940? (Choose three.)

A. Accountants whose advisory services pertain solely to incidental financial planning.

B. Persons or firms whose advice and reports are related solely to U.S. government securities.

C. Publishers of generally circulated, bona fide newspapers or financial journals.

D. Domestic banks and bank holding companies. - ✔✔B. Persons or firms whose advice and

reports are related solely to U.S. government securities.

C. Publishers of generally circulated, bona fide newspapers or financial journals.

D. Domestic banks and bank holding companies.

Which activity is NOT mandated for investment advisers that store required records

electronically?

A. Providing the SEC with prompt access, retrieval, and reproduction.

B. Maintaining copies of all electronically stored records using WORM format.

C. Arranging and indexing records to provide easy access and retrieval.

D. Developing procedures to preserve and maintain records. - ✔✔B. Maintaining copies of all

electronically stored records using WORM format.

The Investment Advisers Act of 1940 defines the scope of the anti-fraud provisions as extending

to:

A. SEC-registered advisers and foreign advisers with a place of business in the U.S., whether

registered or exempt.

B. SEC-registered advisers and foreign advisers doing business in the U.S., whether registered or

exempt.

C. SEC-registered investment advisers.

D. All investment advisers, whether registered or exempt. - ✔✔D. All investment advisers,

whether registered or exempt.

The fiduciary duty imposed on advisers under the Investment Advisers Act of 1940 can BEST be

described as:

A. providing equal disclosure to all clients.

B. imposing an ERISA fiduciary standard.

C. putting the client's interests ahead of the adviser's.

D. acting in a custodial capacity. - ✔✔C. putting the client

[Show More]