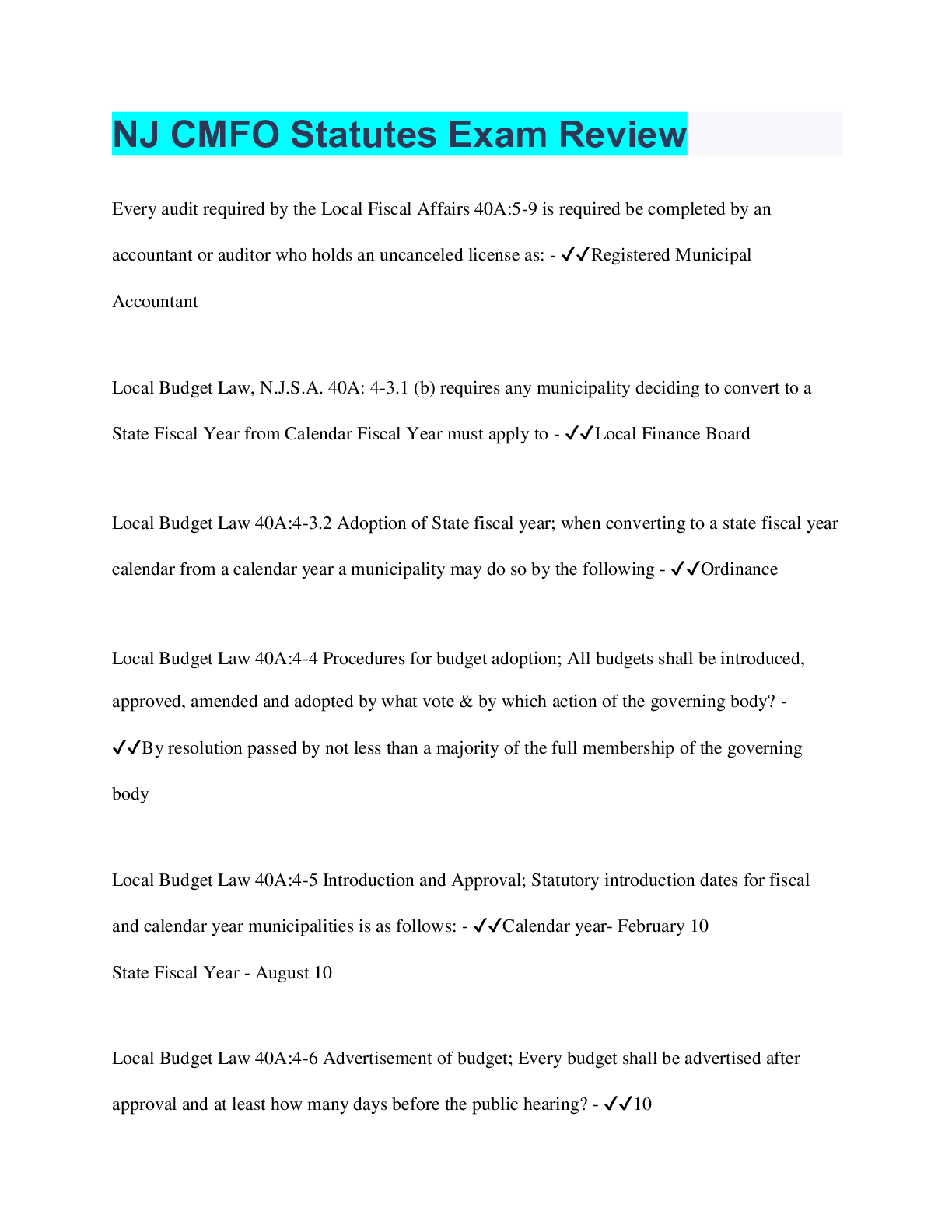

NJ CMFO Statutes Exam Review

Every audit required by the Local Fiscal Affairs 40A:5-9 is required be completed by an

accountant or auditor who holds an uncanceled license as: - ✔✔Registered Municipal

Accountant

Local

...

NJ CMFO Statutes Exam Review

Every audit required by the Local Fiscal Affairs 40A:5-9 is required be completed by an

accountant or auditor who holds an uncanceled license as: - ✔✔Registered Municipal

Accountant

Local Budget Law, N.J.S.A. 40A: 4-3.1 (b) requires any municipality deciding to convert to a

State Fiscal Year from Calendar Fiscal Year must apply to - ✔✔Local Finance Board

Local Budget Law 40A:4-3.2 Adoption of State fiscal year; when converting to a state fiscal year

calendar from a calendar year a municipality may do so by the following - ✔✔Ordinance

Local Budget Law 40A:4-4 Procedures for budget adoption; All budgets shall be introduced,

approved, amended and adopted by what vote & by which action of the governing body? -

✔✔By resolution passed by not less than a majority of the full membership of the governing

body

Local Budget Law 40A:4-5 Introduction and Approval; Statutory introduction dates for fiscal

and calendar year municipalities is as follows: - ✔✔Calendar year- February 10

State Fiscal Year - August 10

Local Budget Law 40A:4-6 Advertisement of budget; Every budget shall be advertised after

approval and at least how many days before the public hearing? - ✔✔10

Local Budget Law 40A:4-7 Time of public hearing; Public hearing post budget approval shall be

held no earlier than how many days for a county and municipality? - ✔✔18 and 28

Local Budget Law 40A:4-9 Ammendment to an introduced budget; an increase or decrease to

any item of appropriation by more than what percent would require a public hearing on said

amendment? - ✔✔Ten Percent

Local Budget Law 40A:4-13 Inclusion of amount required for school purposes; The amount to

be raised by taxes for school purposes, required to be certified to the governing body of a

municipality for inclusion in its budget, shall set forth in a separate section of the budget upon

adoption and shall be added to the amount to be raised by taxes is called what rate? - ✔✔School

Tax Rate

Local Budget Law 40A:4-19 temporary budget; The governing body may by resolution authorize

temporary budget Appropriations to provide for the period between the beginning of the fiscal

year and the adoption of the budget. The resolution shall be adopted within how many days of

the beginning of the fiscal year? - ✔✔Thirty Days

Local Budget Law 40A:4-20 emergency temporary appropriations; the governing body is

prevented from making appropriations during the last 10 days of the year preceding a new fiscal

year for CIF purposes. What appropriation is allowed? - ✔✔Debt Service Only

One tax point is equal to - ✔✔One ten-thousandth of the net valuation

Request to review vouchers must be released when - ✔✔Immediately

Financial Disclosure Forms should list the following - ✔✔Income greater than $2000, Gifts

greater than $400, property in NJ only

Three different bond ordinances are introduced at the same meeting. How many Supplemental

Debt Statements do you need? - ✔✔One

Which debt statement is due upon introduction of a bond ordinance - ✔✔Supplemental Debt

Statement

Federal Single Audit is required if Federal Grant expenditures equal or exceed what amount? -

✔✔$750,000

When can the cash management plan be amended? - ✔✔Any time

Gross Debt - Deductions equals - ✔✔Net Debt

The Chairperson of the Local Finance Board holds what other title? - ✔✔Director of the

Division Local Government Services

Old Escrow Accounts escheat as unclaimed property to whom? - ✔✔State of NJ

Interest on Utility Assessment Debt is appropriated in which budget? - ✔✔Utility Operating

Budget

Vote required by the governing body for budget transfers? - ✔✔2/3 Majority of Full

Membership

A municipality carries a statutory excess in Reserve for an Animal Control Fund at year end;

Excess is due to what fund and recorded as what kind of revenue? - ✔✔Excess is due to Current

Fund and recorded as MRNA

The number of miles of roads paved in terms of expenditures would be an example of which type

of budgeting? - ✔✔Performance Based Budgeting

A bond detail that does not need to be included in the bond ordinance? - ✔✔Bond Maturity

Schedule

The statutory responsibility for filing the Unaudited Annual Financial Statements is assigned to

which local government official? - ✔✔The CFO

Financial Information on your Municipality Website should include the following: - ✔✔Best

Practices, 3 years of adopted budgets, current year proposed budget, audit and recent financial

statements

The true value of all taxable property in the municipality is represented by what term? -

✔✔Equalized Valuation

The period of usefulness can never exceed how many years? - ✔✔40 years

As defined in the "Local Government Ethics Law" a local government officer that serves on a

local government agency that approves development applications would refer to a member of

which board? - ✔✔Planning Board

Budget Transfers during the last two months of the year may NOT be made to: ? - ✔✔Deferred

Charges, RUT, Down Payment on Improvements and CIF

Items that must be approved by the DLGS include: - ✔✔Petty Cash, Change in Title and Text,

Dedication by Rider and Emergent Appropriations in excess of 3% of operating appropriations

Borrowing capacity is based on gross debt or net debt? - ✔✔Net Debt

Local Government Bonds may be sold privately, except? - ✔✔When the total of bonds is MORE

than $1,000,000

Examples of shared services - ✔✔Joint Tax Collection, Joint Municipal Court, Joint Solid Waste

Collection/Disposal

The budget message should contain the following: - ✔✔Explanation of appropriation, levy

CAPS, and a listing of appropriation split by CAP

Correct Procedure to adopt a budget: - ✔✔1. Introduction &Approval

2. Public Advertisement

3. Public Hearing

4. Amendments if needed

5. Advertising & Public Hearing on Ammendments

6. Adoption

If a municipality does not have a local ethics board, who would act as their ethics board -

✔✔Local Finance Board

What is the official type of budget required to be adopted? - ✔✔Line Item Budget

Payment of Utility Assessment Bond Principal is recorded as an expenditure in what fund? -

✔✔Utility Assessment Trust Fund

Where should you never apply a tax overpayment? - ✔✔Amount to be Raised by Taxation

Pension fund(s) a Town Administratoe can be enrolled in? - ✔✔PERS and DCRP

2010 CAP eliminated the add-on increases to what line item? - ✔✔Reserve for Uncollected

Taxes

Why must Transitional Aid demonstrate that user fees have been established for discretionary

services? - ✔✔To ensure taxpayers are not subsidizing nonessential propgrams

What can Storm Recovery Reserve be used for? - ✔✔Salt and Sand purchases, snow removal,

salaries and wages

The responsibility of the local assessment receivable for each parcel of property falls on whom? -

✔✔The Tax Collector

In what fund is gross utility debt reflected? - ✔✔Utility Capital Fund

Method of accounting for transactions is called? - ✔✔Modified Accrual Basis

Annual Financial Statements must be filed with? - ✔✔EMMA

The Local Fiscal Affairs Law mandates that a Cash Management plan be approved annually by?

- ✔✔The Governing Body

The effective date of a bond ordinance is at what length of time? - ✔✔Twenty days after the first

publication after adoption

An increase in anticipated revenue for a known and recurring source may have what affect on the

appropriation for the Reserve for Uncollected Taxes? - ✔✔Decrease the appropriation for RUT

NJAC outlines the procedure to certify funds when entering into any contract. what must be

present on either the resolution and/or certification of funds? - ✔✔exact line item appropriation

or ordinance to be charged

NJ Budget Law specifically requires that the budget shall consist of a tabulated statement of

what? - ✔✔All anticipated revenues applicable to expenditures for which appropriations are

made

Four classifications of revenue are: - ✔✔Surplus Anticipated, Misc. Revenues, Receipts for

Delinquent Taxes and Amount to be Raised by Taxation

Implementation of a dedicated tax program for open space, recreation, farmland and historic

preservation trust fund taxing districts are authorized by which what? - ✔✔Referendum held at a

general or special election

When the tax collection rate has been affected by refunds and adjustments from successful tax

appeals, Local Budget Law allows an average of how many years to be used to calculate RUT? -

✔✔Three

Emergency temporary appropriations not included in the budget due to adoption post budget

approval, the ETA is added by what action - ✔✔Amendment

The excess of quick assets such as cash, investments, state or other public Aid Receivable, and

deferred charges over legal and demand liabilities is called - ✔✔Surplus

Revenue amounts that may reasonable be expected to be realized in cash during the fiscal year

from known and regular sources, or from sources reasonably capable of anticipation are called

what? - ✔✔Miscellaneous Revenues Anticipated

Miscellaneous Revenues Anticipated are limited by what when preparing the budget? -

✔✔limited by actual realized cash from same source in preceding fiscal year

In order to anticipate revenue from a land sale in the municipal budget when must the obligation

to make payment occur? - ✔✔Prior to the adoption of the budget

NJSA 40A:4-28 Misc. revenues, sinking fund surplus; a sinking fund cash surplus would be what

revenue source and in which budget if approved by the sinking fund commission and the

director? - ✔✔Miscellaneous Revenues anticipated in the current fund budget

Matters not required to be contained in a bond ordinance may be acted on in subsequent

resolutions passed by the affirmative votes of what portion of the governing body? - ✔✔Majority

of the full membership of the governing body

An increase in Revenue does what to RUT - ✔✔Decreases it

A municipality's debt limit shall be a percentage of the average of the preceding 3 years

equalized assessed valuation - ✔✔

[Show More]

.png)