FIN 370 /FIN 370 FINAL EXAM Finance for Business. (Latest)

Document Content and Description Below

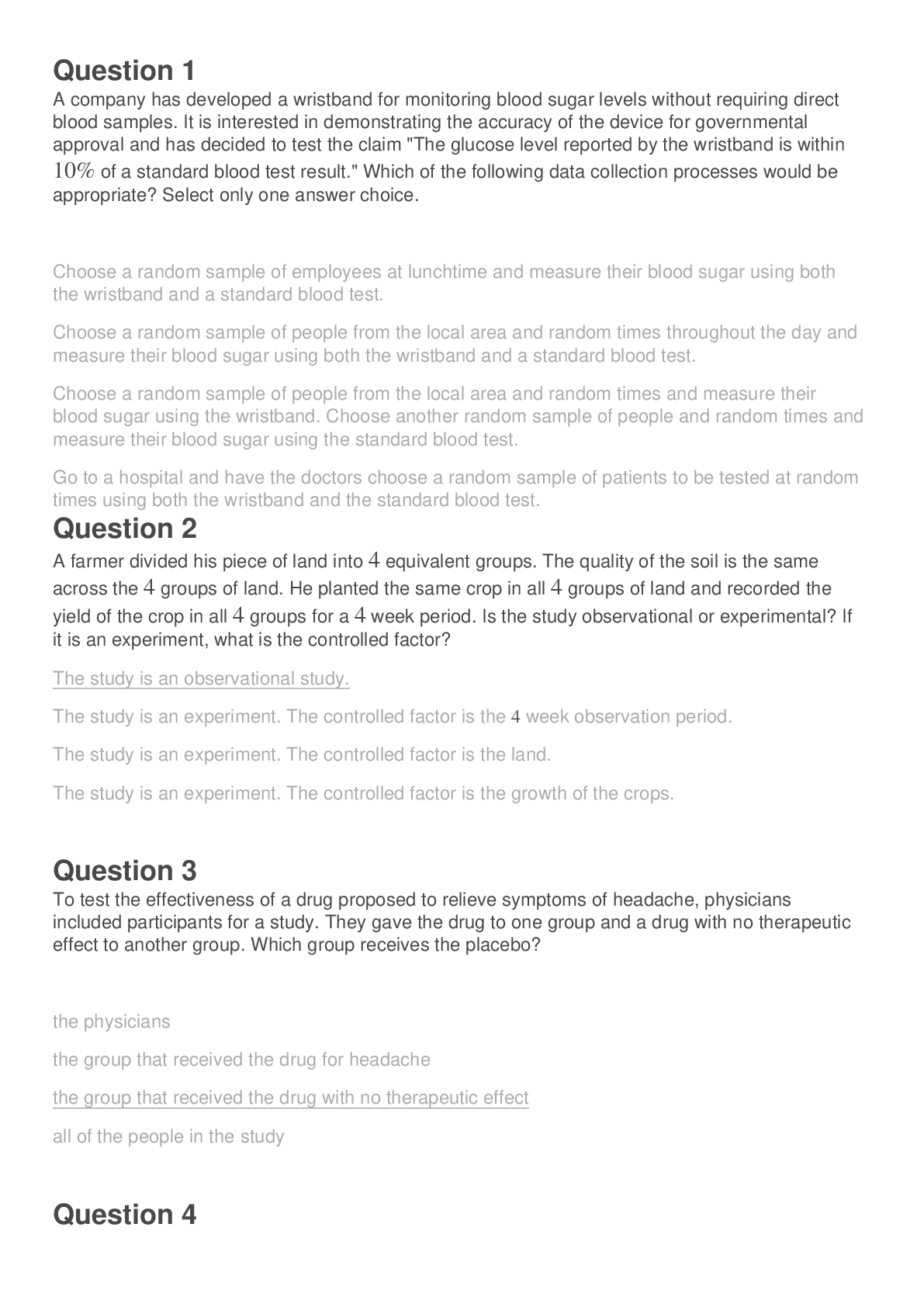

FIN 370 /FIN 370 FINAL EXAM Finance for Business. (Latest)Exam Details Summary header Summary value Your exam has been submitted Status: Submitted on Aug 16, 2017, 9:14 PM Results: 30/30 (100%) N... umber of Questions: 30 questions Time Limit: 3 hours Available: Jun 20, 2017, 12:00 AM - Mar 02, 2018, 11:59 PM FINAL EXAM FIN/370 1. A news flash just appeared that caused about a dozen stocks to suddenly drop in value by 20 percent. What type of risk does this news flash best represent? Market Unsystematic Portfolio Total Non-diversifiable 2. Which one of the following is a source of cash? Granting credit to a customer Purchase of inventory Acquisition of debt Payment to a supplier Repurchase of common stock 3. Nadine’s Home Fashions has $2.12 million in net working capital. The firm has fixed assets with a book value of $31.64 million and a market value of $33.9 million. The firm has no long-term debt. The Home Centre is buying Nadine’s for $37.5 million in cash. The acquisition will be recorded using the purchase accounting method. What is the amount of goodwill that The Home Centre will record on its balance sheet as a result of this acquisition? $5.86 million $3.34 million $4.14 million $1.48 million $3.74 million 4. You are comparing two investment options that each pay 6 percent interest compounded annually. Both options will provide you with $12000 of income. Option A pays $2,000 the first year followed by two annual payments of $5,000 each. Option B pays three annual payments of $4,000 each. Which one of the following statements is correct given these two investment options? Assume a positive discount rate. Option B is a perpetuity. Option B has a higher present value at time zero. Both options are of equal value since they both provide $12,000 of income. Option A has the higher future value at the end of year three. Option A is an annuity. 5. When utilizing the percentage of sales approach, managers: I. Estimate company sales based on a desired [Show More]

Last updated: 2 years ago

Preview 1 out of 7 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$10.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Feb 23, 2021

Number of pages

7

Written in

Additional information

This document has been written for:

Uploaded

Feb 23, 2021

Downloads

0

Views

57

.png)

.png)

.png)