WebCe Group Life Insurance > EXAM > REAL Life Insurance Exam: Questions & Answers 2023 (All)

REAL Life Insurance Exam: Questions & Answers 2023

Document Content and Description Below

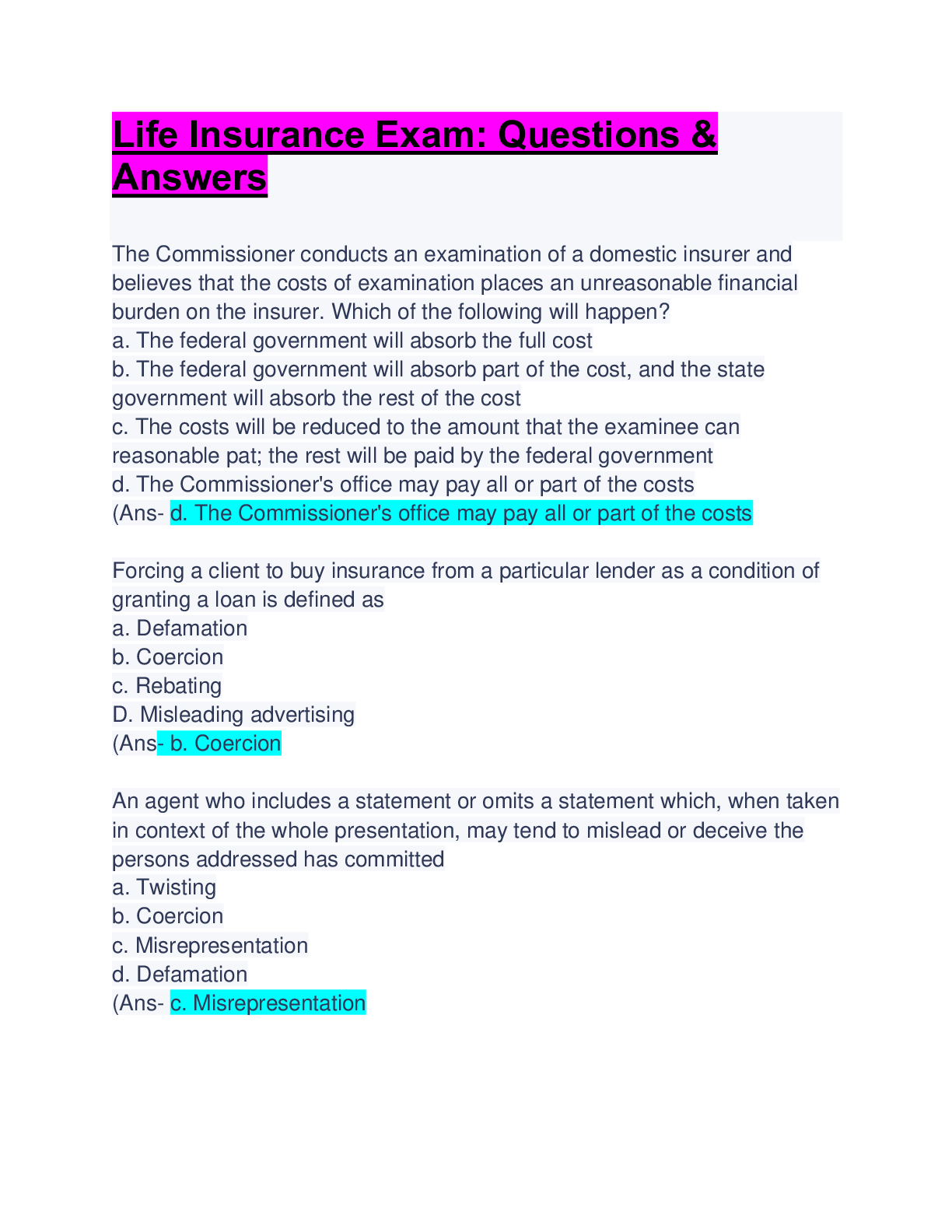

The Commissioner conducts an examination of a domestic insurer and believes that the costs of examination places an unreasonable financial burden on the insurer. Which of the following will happen? ... a. The federal government will absorb the full cost b. The federal government will absorb part of the cost, and the state government will absorb the rest of the cost c. The costs will be reduced to the amount that the examinee can reasonable pat; the rest will be paid by the federal government d. The Commissioner's office may pay all or part of the costs (Ans- d. The Commissioner's office may pay all or part of the costs Forcing a client to buy insurance from a particular lender as a condition of granting a loan is defined as a. Defamation b. Coercion c. Rebating D. Misleading advertising (Ans- b. Coercion An agent who includes a statement or omits a statement which, when taken in context of the whole presentation, may tend to mislead or deceive the persons addressed has committed a. Twisting b. Coercion c. Misrepresentation d. Defamation (Ans- c. Misrepresentation If a consumer requests additional information concerning an investigative consumer report, how long does the insurer or reporting agency have to comply? a. 7 days b. 10 days c. 3 days d. 5 days (Ans- d. 5 days After the original hearing and a final order is issued, an aggrieved person may request a re-hearing within a. 30 days b. 40 days c. 15 days d. 20 days (Ans- 20 days Which of the following is an example of a producer being involved in an unfair trade practice of rebating? a. Telling a client that his first premium will be waived if he purchases the insurance policy today b. Inducing the insured to drop a policy in favor of another one when it is not the insured's best interest c. Charging a client a higher premium for the same policy as another client in the same insuring class d. Making deceptive statements about a competitor (Ans- a. Telling a client that his first premium will be waived if he purchases the insurance policy today [Show More]

Last updated: 1 year ago

Preview 1 out of 40 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$20.50

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Nov 24, 2023

Number of pages

40

Written in

Additional information

This document has been written for:

Uploaded

Nov 24, 2023

Downloads

0

Views

73