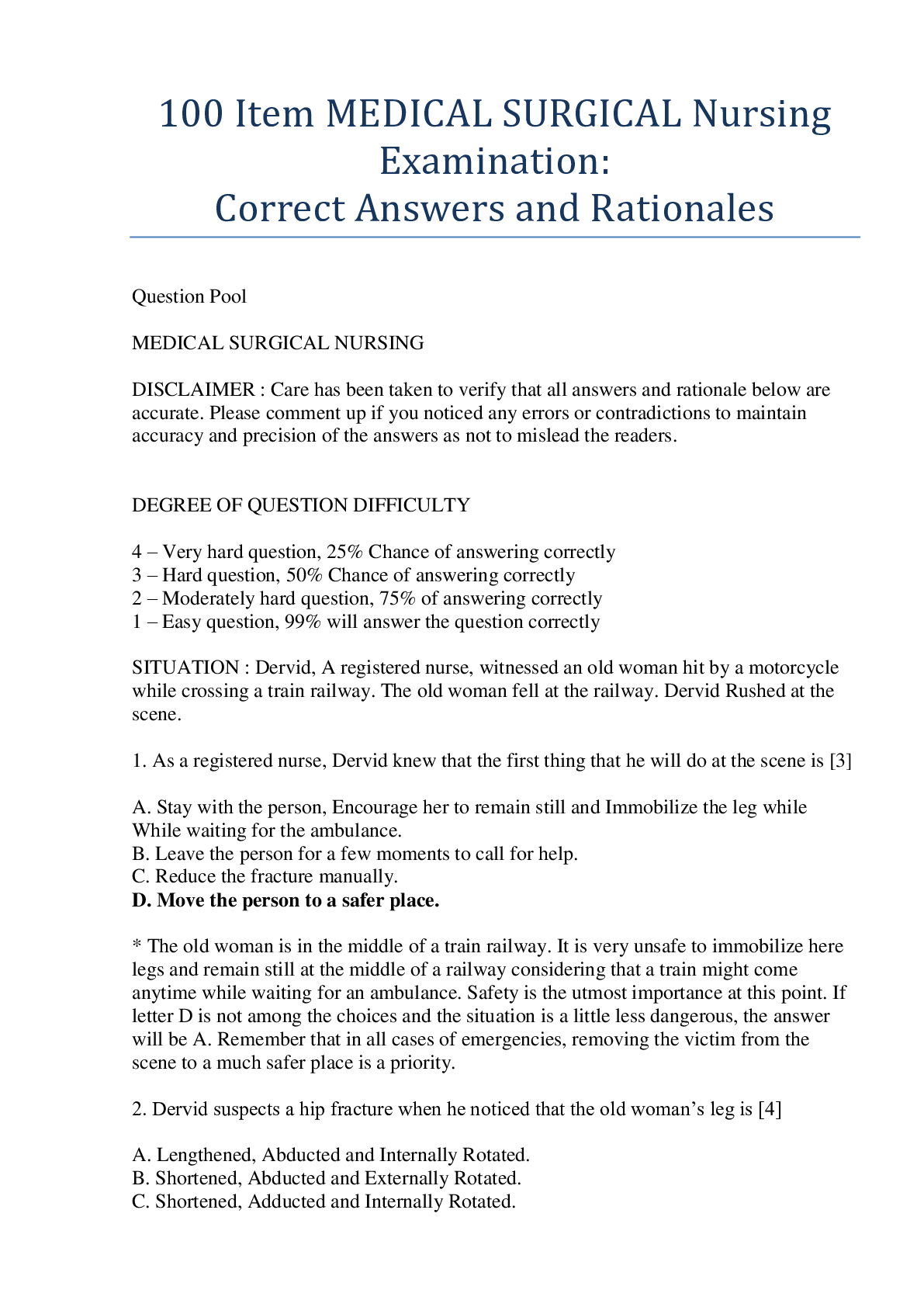

WebCe Group Life Insurance > EXAM > Texas Life Insurance Exam With 100% Correct Answers 2023 (All)

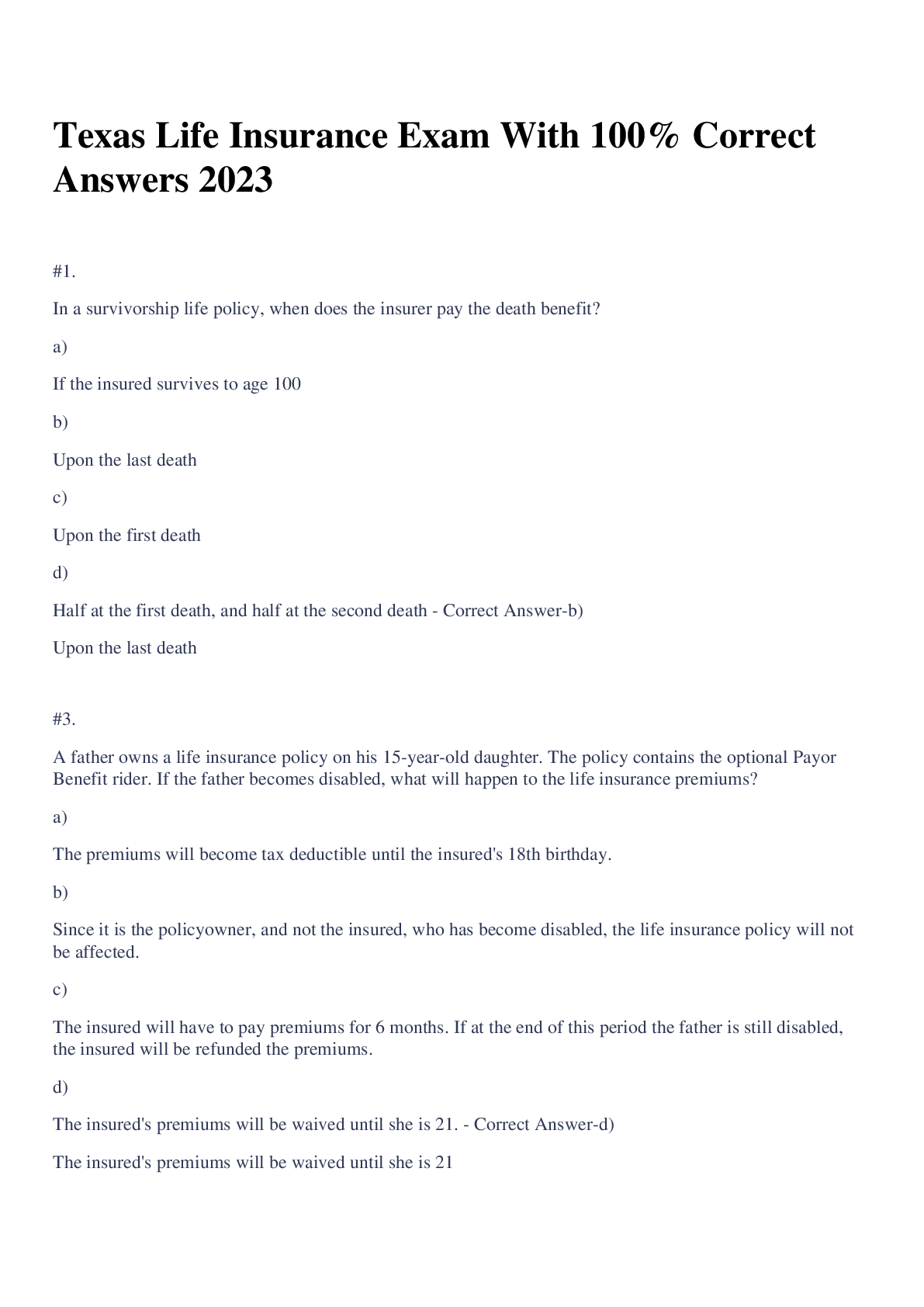

Texas Life Insurance Exam With 100% Correct Answers 2023

Document Content and Description Below

#1. In a survivorship life policy, when does the insurer pay the death benefit? a) If the insured survives to age 100 b) Upon the last death c) Upon the first death d) Half at the first death... , and half at the second death - Correct Answer-b) Upon the last death #3. A father owns a life insurance policy on his 15-year-old daughter. The policy contains the optional Payor Benefit rider. If the father becomes disabled, what will happen to the life insurance premiums? a) The premiums will become tax deductible until the insured's 18th birthday. b) Since it is the policyowner, and not the insured, who has become disabled, the life insurance policy will not be affected. c) The insured will have to pay premiums for 6 months. If at the end of this period the father is still disabled, the insured will be refunded the premiums. d) The insured's premiums will be waived until she is 21. - Correct Answer-d) The insured's premiums will be waived until she is 21 #7. A rider attached to a life insurance policy that provides coverage on the insured's family members is called the a) Other-insured rider. b) Change of insured rider. c) Juvenile rider. d) Payor rider. - Correct Answer-a) Other-insured rider. #9. Annually renewable term policies provide a level death benefit for a premium that a) Fluctuates. b) Increases annually. c) Decreases annually. d) Remains level. - Correct Answer-b) Increases annually. #10. An insured owns a life insurance policy. To be able to pay some of her medical bills, she withdraws a portion of the policy's cash value. There is a limit for a withdrawal and the insurer charges a fee. What type of policy does the insured most likely have? a) Adjustable life b) Term life c) Limited pay d) Universal life - Correct Answer-d) Universal life #11. When an annuity is written, whose life expectancy is taken into account? a) Beneficiary b) Life expectancy is not a factor when writing an annuity. c) Owner d) Annuitant - Correct Answer-d) Annuitant #12. Which of the following is TRUE regarding the accumulation period of an annuity? a) It is limited to 10 years. b) It is a period during which the payments into the annuity grow tax deferred. c) It is also referred to as the annuity period. d) It is a period of time during which the beneficiary receives income - Correct Answer-b) It is a period during which the payments into the annuity grow tax deferred. [Show More]

Last updated: 1 year ago

Preview 1 out of 21 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$7.50

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Nov 24, 2023

Number of pages

21

Written in

Additional information

This document has been written for:

Uploaded

Nov 24, 2023

Downloads

0

Views

57