Business Studies > EXAMs > COMPULSORY QUESTION: THE ECONOMIC RISK ANALYSIS OF A DEVELOPING COUNTRY (All)

COMPULSORY QUESTION: THE ECONOMIC RISK ANALYSIS OF A DEVELOPING COUNTRY

Document Content and Description Below

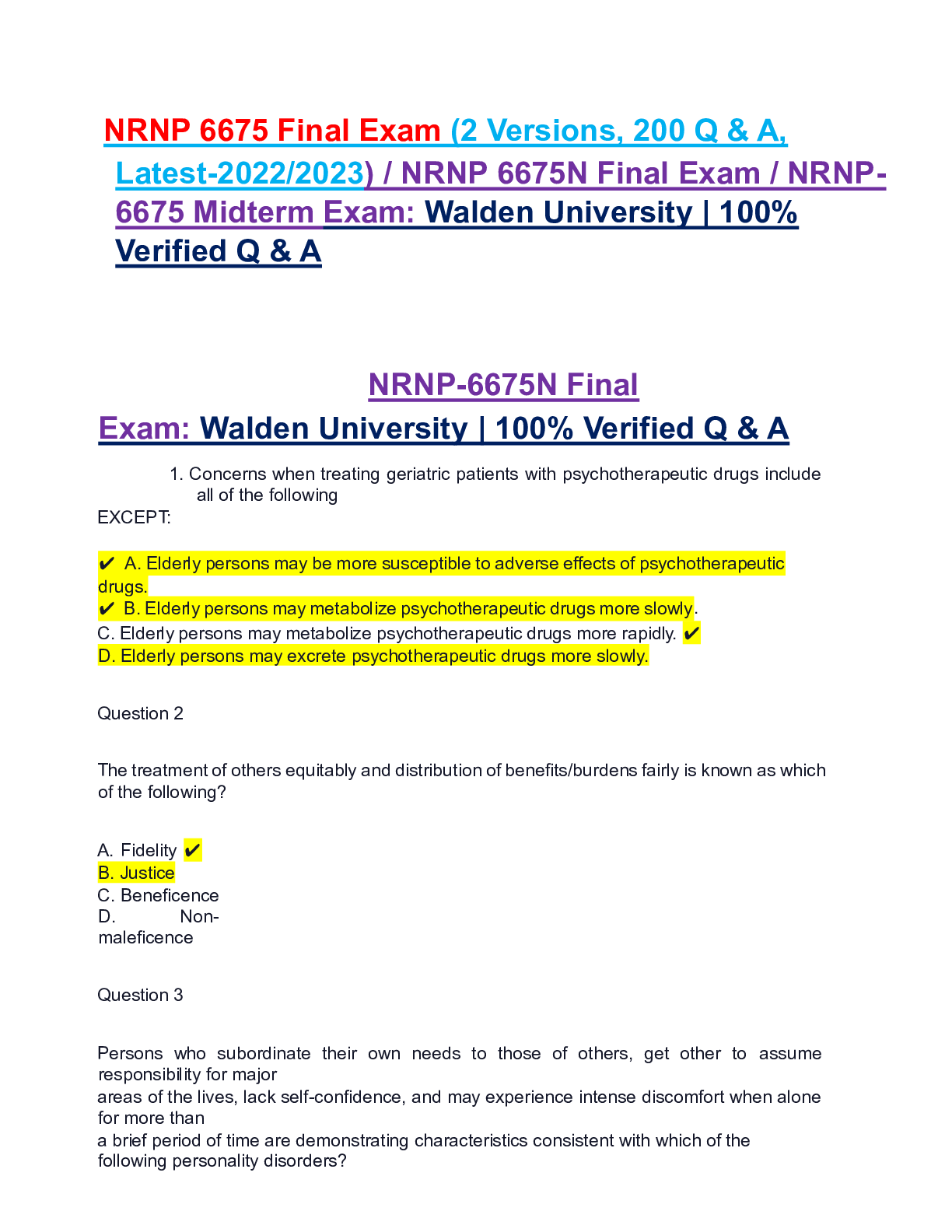

Part I: CURRENT ACCOUNT DEFICIT – CAD Question: how great is the short-term trade burden? Answer: compare the current account deficit (CAD) and the gross domestic product (GDP) ... “Country X has a CAD/GDP rate of Y%, which is considered a high/low rate compared to the benchmark for an emerging economy, associated with a high/low risk and requiring a high/low rate of return.” GDP “Country X has GDP growth rate of Y%, which is considered a booming/sustainable/low/recessionary rate compared with the benchmark for an emerging economy, associated with a high/medium/low risk and requiring a high/medium/low rate of return.” INFLATION “Country X has an inflation rate of Y%, which is considered a high/stable/low/deflationary rate compared to the benchmark for an emerging economy, associated with a high/medium/low risk and requiring a high/medium/low rate of return.” Part II: THE MOST RELEVANT DATE FOR FDI INVESTMENT TO A FOREIGN COUNTRY 1. G – GDP per capita growth rate (the trend). May indicate a growing productivity, higher spending. 2. L - Life expectancy. Gives you an idea of the general well being of the population and the degree to which the government is looking after everyone 3. I – Inflation (GDP deflator): is the trend steady or out of control? Indicates the economic competency of the government 4. F – FDI, measure of how well the country is attracting foreign investors, particularly the trend 5. T – Technology 6. S – School 1.1) A. How do the multinational corporation benefit from the principles of the comparative advantage theory of international trade? Comparative advantage is defined as one country's ability to produce a good or service more efficiently and inexpensively than another. International trade has benefited for multinational corporation by encouraging more trade among nations, more open financial institutions, the efficient flow of information over the Internet enables business to share knowledge about products, production processes and pricing in real time lead to improve economic output and opportunities for multinational corporation included the cost of labor, cost of capital, natural resources, geographic location, and workforce productivity. In a globalized economy together with international trade, transportation networks between countries and businesses have enabled the cost-effective shipment of goods across the world. Thus, corporations have shifted manufacturing and other labor-intensive operations to these countries to take advantage of lower labor costs. B. What kinds of businesses are threaten by them? International trade has greatly impacted the world business through the form of partnership between organizations all around the world led to minimize costs and maximize quality related to the opportunities of tax reduction for multinational corporations with low corporate tax rates, thus, there are some businesses threaten by its such as the computer and electronics industry and the furniture industry, contributed together with the total decline of metal and textiles industries. 1.2) Critical Michael Porter’s Diamond Model of international trade and discuss how industrial clusters can form. How can domestic industries use these clusters as a defense against overseas competitors which may enjoys comparative advantages in their home location? A. Discussing how industrial clusters can form • Factor Conditions: These factors can be grouped into material resources- human resources (labor costs, qualifications and commitment) – knowledge resources and infrastructure. Quality of research or liquidity on stock markets and natural resources like climate, minerals, oil creating an international competitive position. • Related and supporting Industries: Competitive suppliers and related organizations reinforce by innovation and internationalization. They can benefit from each other’s know-how by producing complementary products. • Home Demand Conditions: There always exists an interaction between economies of scale, transportation costs and the size of the home market. • Strategy, Structure and Rivalry: Regions, provinces and countries are shaped differently in different cultures from one another and factors like management, working morale and interactions between companies. • Governments: Governments finance and construct infrastructure and invest in education and healthcare B. How can domestic industries use these clusters as a defense against overseas competitors which may enjoys a comparative advantage in their home location? China use these comparative advantage as a defense against overseas competitors: a. Industry [Show More]

Last updated: 2 years ago

Preview 1 out of 7 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Also available in bundle (1)

Click Below to Access Bundle(s)

A PACKAGE DEAL FOR IBM -INTERNATIONAL BUSINESS MANAGEMENT EXAMS WITH ANSWERS /SUMMARIES AND NOTES 2024

A PACKAGE DEAL FOR IBM -INTERNATIONAL BUSINESS MANAGEMENT EXAMS WITH ANSWERS /SUMMARIES AND NOTES 2024

By EXCELLENCE NURSING LIBRARY 2 years ago

$162

17

Reviews( 0 )

$16.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Jan 02, 2024

Number of pages

7

Written in

All

Additional information

This document has been written for:

Uploaded

Jan 02, 2024

Downloads

0

Views

75