Health Care > EXAM > TEXAS LIFE HEALTH INSURANCE EXAM QUESTIONS AND CORRECT VERIFIED ANSWERS 2024 NEW EDIT (All)

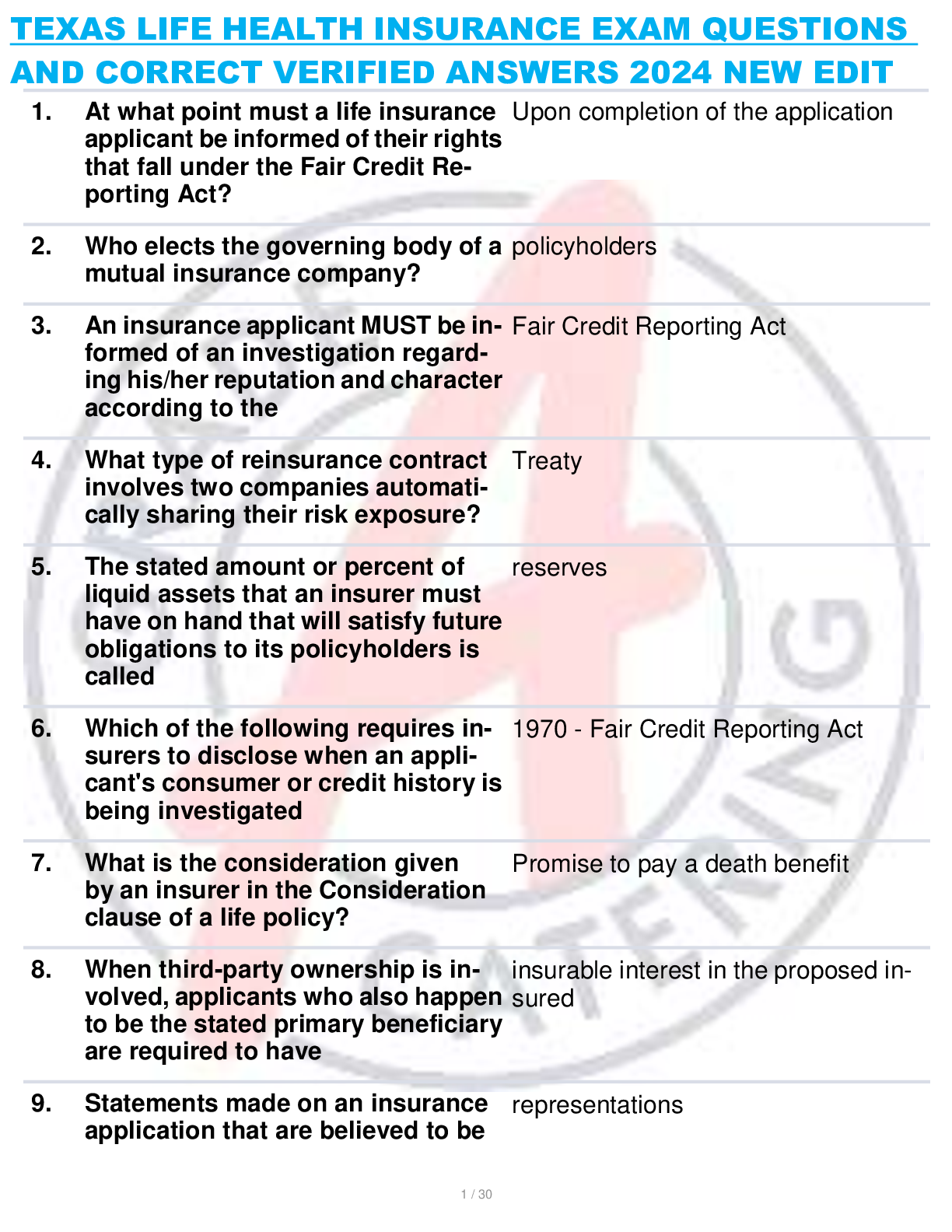

TEXAS LIFE HEALTH INSURANCE EXAM QUESTIONS AND CORRECT VERIFIED ANSWERS 2024 NEW EDIT

Document Content and Description Below

TEXAS LIFE HEALTH INSURANCE EXAM QUESTIONS AND CORRECT VERIFIED ANSWERS 2024 NEW EDIT 1. At what point must a life insurance applicant be informed of their rights that fall under the Fair Credit Re-... porting Act? 2. Who elects the governing body of a mutual insurance company? 3. An insurance applicant MUST be in- formed of an investigation regard- ing his/her reputation and character according to the 4. What type of reinsurance contract involves two companies automati- cally sharing their risk exposure? 5. The stated amount or percent of liquid assets that an insurer must have on hand that will satisfy future obligations to its policyholders is called 6. Which of the following requires in- surers to disclose when an appli- cant's consumer or credit history is being investigated 7. What is the consideration given by an insurer in the Consideration clause of a life policy? 8. When third-party ownership is in- volved, applicants who also happen to be the stated primary beneficiary are required to have 9. Statements made on an insurance application that are believed to be Upon completion of the application policyholders Fair Credit Reporting Act Treaty reserves 1970 - Fair Credit Reporting Act Promise to pay a death benefit insurable interest in the proposed in- sured representations true to the best of the applicant's knowledge are called 10. The part of a life insurance policy guaranteed to be true is called a(n) 11. Which of these is NOT a type of agent authority? Express Implied Principal Apparent 12. The Consideration clause of an in- surance contract includes 13. E and F are business partners. Each takes out a $500,000 life insurance policy on the other, naming him- self as primary beneficiary. E and F eventually terminate their business, and four months later E dies. Al- though E was married with three children at the time of death, the primary beneficiary is still F. How- ever, an insurable interest no longer exists. Where will the proceeds from E's life insurance policy be directed to? 14. Which of the following terms defines the legally enforceable promise in an insurance contract by the insurer? 15. When must insurable interest exist for a life insurance contract to be valid? warranty Principal the schedule and amount of premium payments In this situation, the proceeds from E's life insurance policy will go to F. Unilateral Inception of the contract 16. conditional Insurance contracts are known as because certain future condi- tions or acts must occur before any claims can be paid. 17. Which of these require an offer, ac- ceptance, and consideration? 18. Which of these arrangements al- lows one to bypass insurable inter- est laws? 19. Which of these is NOT considered to be an element of an insurance contract? the offer acceptance negotiating consideration 20. An agent is an individual that repre- sents whom? 21. Insurable interest must exist at what time? 22. Which policy requires an agent to register with the National Associ- Contract Investor-Originated Life Insurance Investor-originated life insurance (or IOLI), sometimes called stranger-originated life insurance (or STOLI) is used to circumvent state in- surable interest statutes. This is done when an investor (or stranger) per- suades an individual to take out life insurance specifically for the purpose of selling the policy to the investor. The investor compensates the in- sured and makes the premiums, then collects the death benefit when the insured dies. negotiating Insurer at the time of application Variable Life ation of Securities Dealers (NASD) before selling? 23. Which of the following actions re- quire a policy owner to provide proof of insurability in an Ad- justable Life policy? 24. When a policy owner exchanges a term policy for a whole life poli- cy without providing proof of good health, which of these apply? 25. What type of life insurance are cred- it policies issued as? 26. How long does the coverage nor- mally remain on a limited-pay life policy? 27. All of these statements about Equity Indexed Life Insurance are correct EXCEPT Cash value has a minimum rate of accumulation If the gain on the index goes beyond the policy's minimum rate of return, the cash value will mirror that of the index The premiums can be lowered or raised, based on investment perfor- mance Tied to an equity index such as the S&P 500 28. Which of these is an element of a Variable Life policy? increase face amount Conversion provision Term age 100 The premiums can be lowered or raised, based on investment perfor- mance A fixed, level premium 29. Universal Life [Show More]

Last updated: 1 year ago

Preview 1 out of 30 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$17.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Jan 05, 2024

Number of pages

30

Written in

Additional information

This document has been written for:

Uploaded

Jan 05, 2024

Downloads

0

Views

42

.png)

.png)