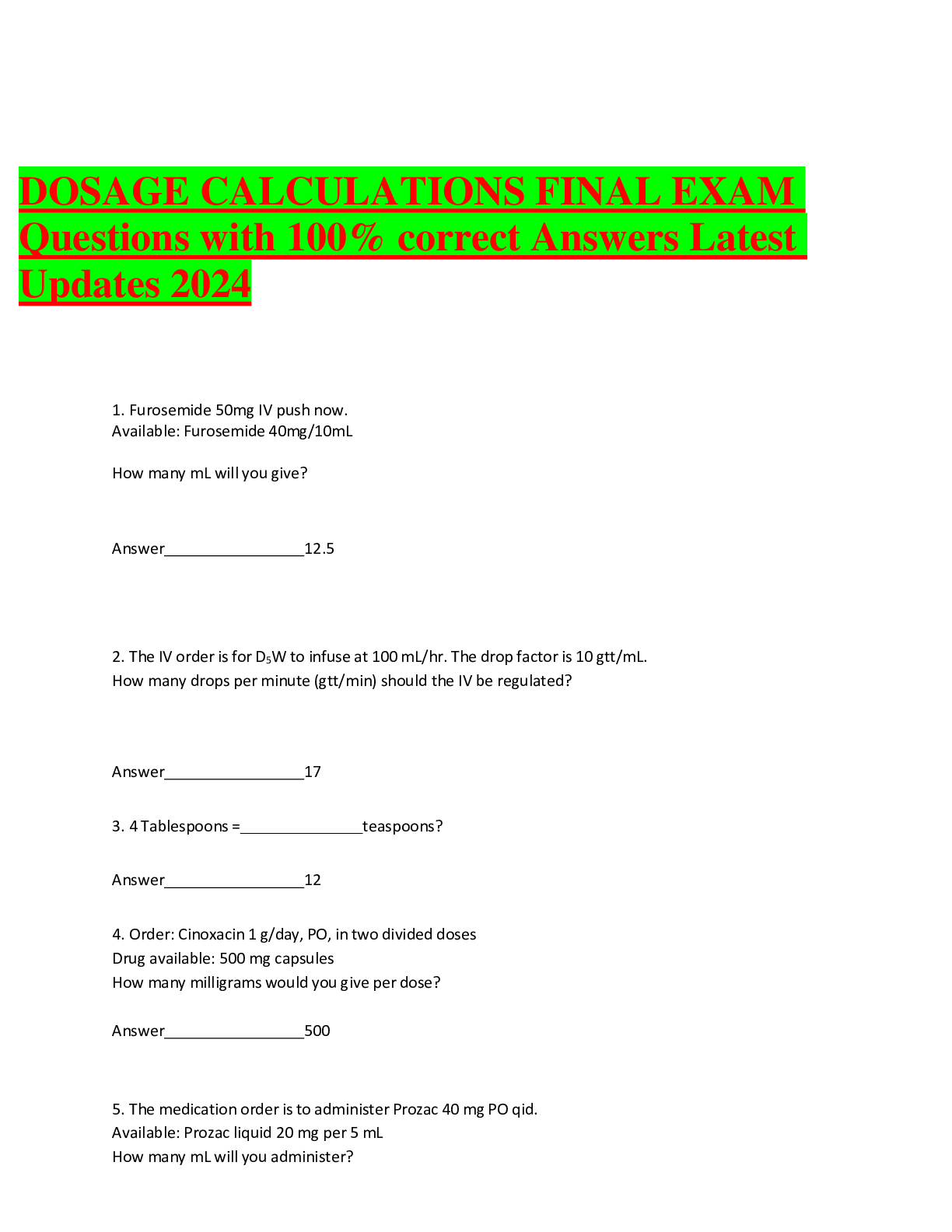

DOSAGE CALCULATIONS FINAL EXAM Questions with 100% correct Answers Latest Updates 2024

A321 KSV > EXAM > WGU C239 PA Questions | 99 Questions with 100% Correct Answers | Verified | Latest Update | 2024 (All)

An individual has taxable income of $60,000. The first $20,000 is taxed at 20%, the next $20,000 is taxed at 20%, and all income above $40,000 is taxed at 20%.Which tax structure is being applied t ... o the individual's taxable income? Base Regressive Progressive Proportional - ✔️✔️Proportional Which federal income tax structure imposes an increasing marginal tax rate as the tax base Regressive tax Incremental tax Progressive tax Proportional tax - ✔️✔️Progressive What would a graph look like for Progressive, Proportional, Incremental, and Regressive tax structures? - ✔️✔️Progressive- ascending Proportional- flat line Incremental- stair-steps Regressive- descending What describes a gift tax? Tax on the retail sale of particular products Tax on the fair market value of wealth transfers Tax on the retail price of goods and services Tax on income earned by an individual - ✔️✔️Tax on the fair market value of wealth transfers What is a key element of an economy tax structure? Attracts and stimulates investment Helps ensure equality and ability to pay Assists in reducing unemployment and inflation Requires minimal compliance and administration costs - ✔️✔️Requires minimal compliance and administration costs [Show More]

Last updated: 1 year ago

Preview 1 out of 37 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Can't find what you want? Try our AI powered Search

Connected school, study & course

About the document

Uploaded On

Apr 18, 2024

Number of pages

37

Written in

All

This document has been written for:

Uploaded

Apr 18, 2024

Downloads

0

Views

58

Scholarfriends.com Online Platform by Browsegrades Inc. 651N South Broad St, Middletown DE. United States.

We're available through e-mail, Twitter, Facebook, and live chat.

FAQ

Questions? Leave a message!

Copyright © Scholarfriends · High quality services·