Business > EXAM > Oracle FCCS Certification Questions | 100% Correct Answers | Verified | Latest 2024 Version (All)

Oracle FCCS Certification Questions | 100% Correct Answers | Verified | Latest 2024 Version

Document Content and Description Below

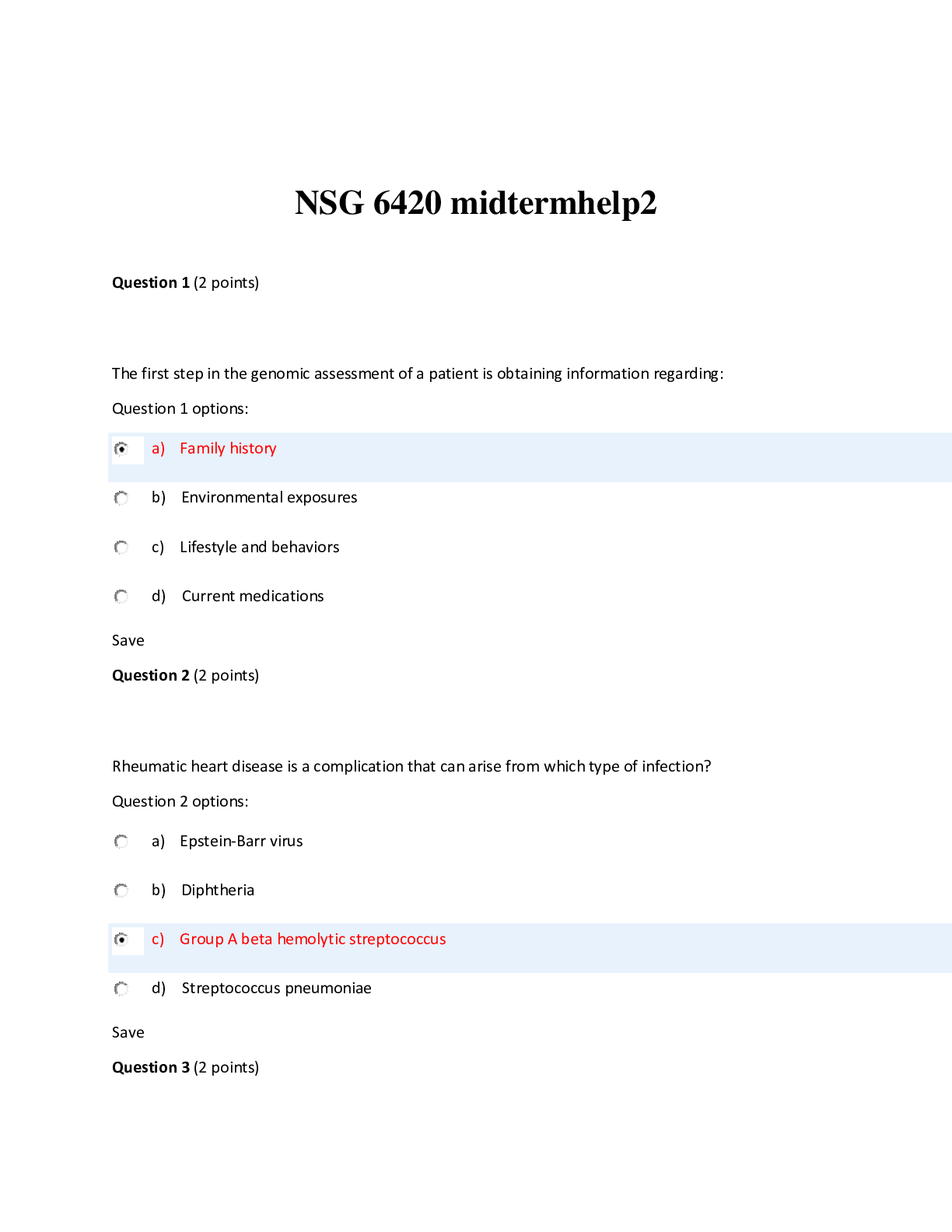

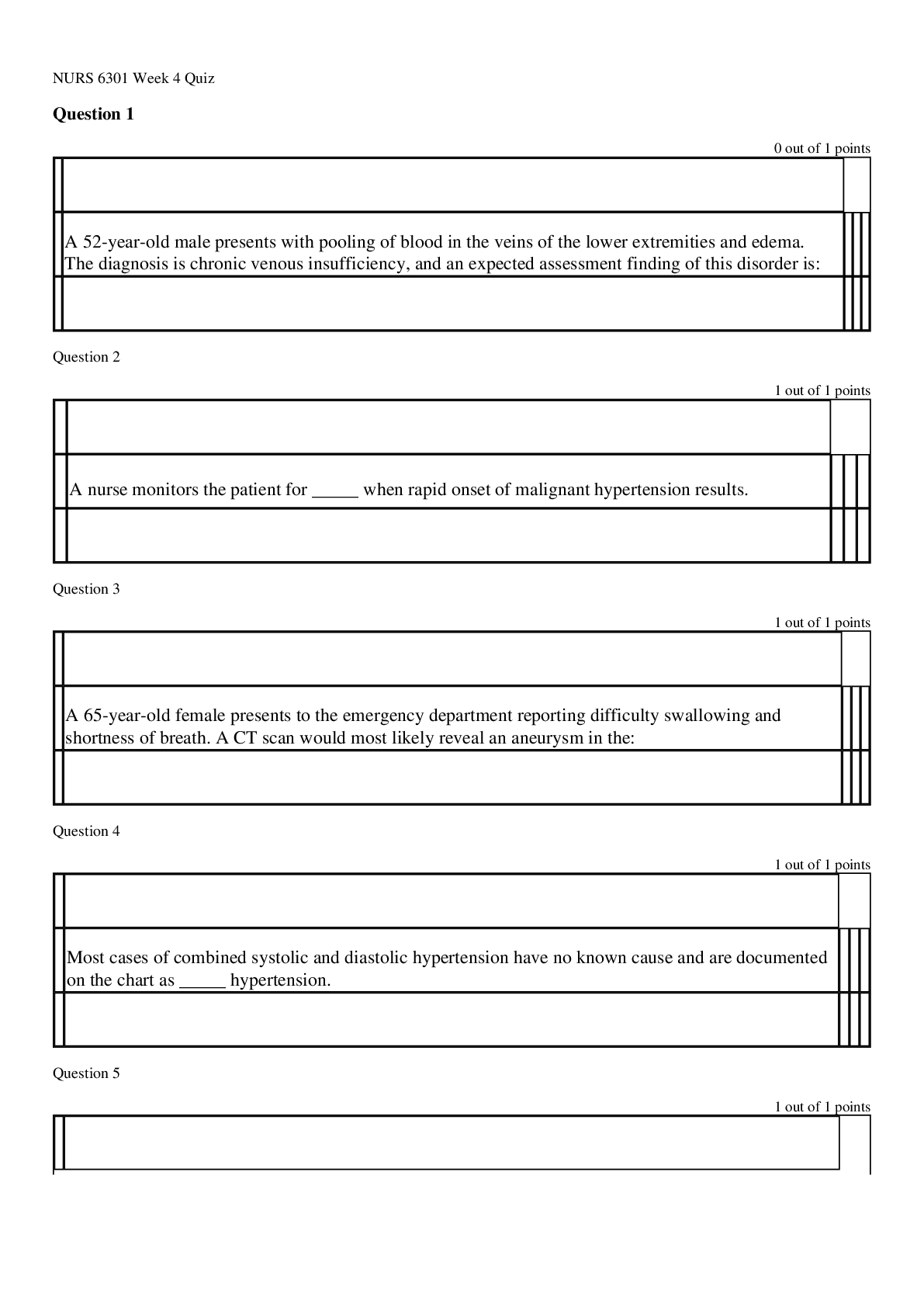

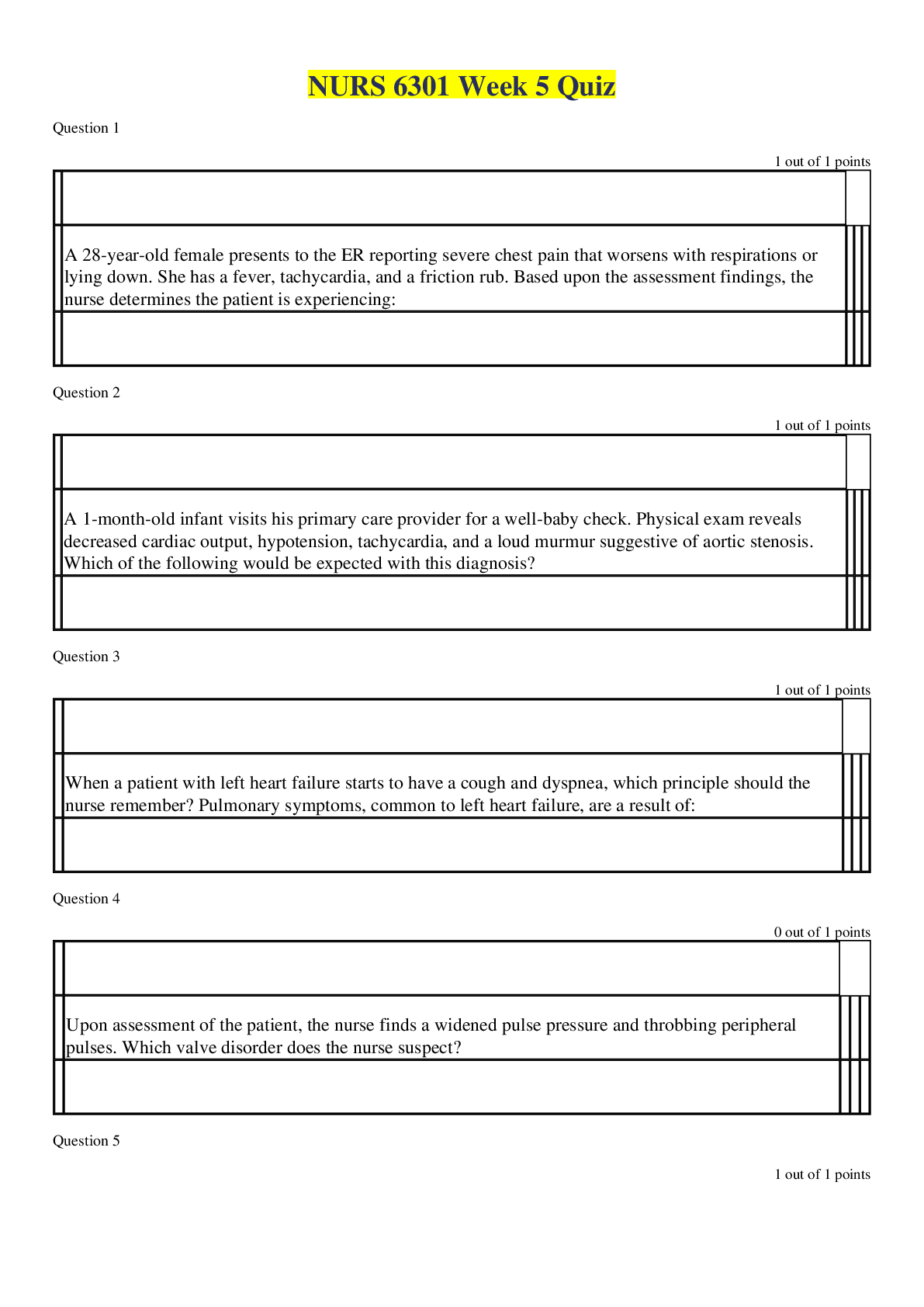

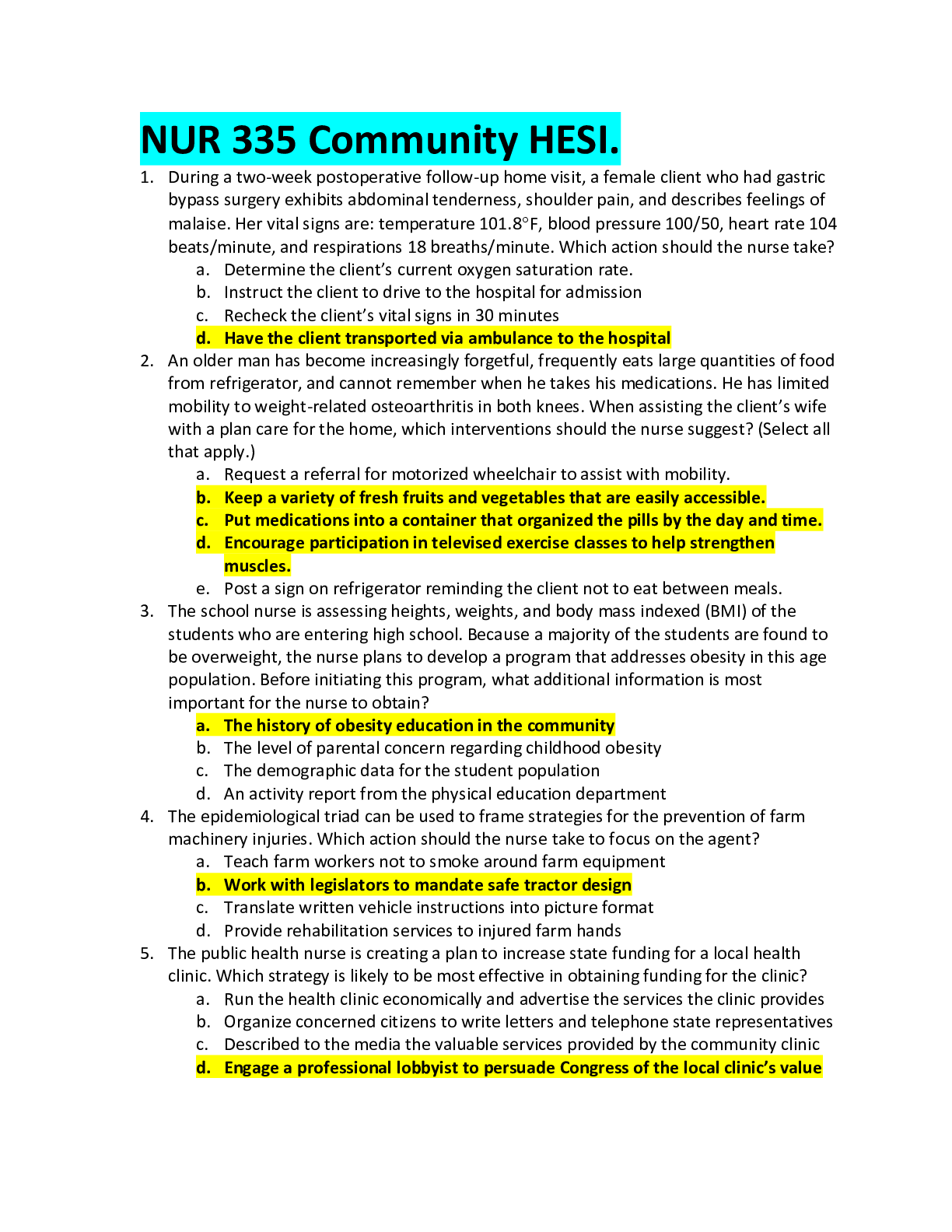

Company 123 is a public company that reports in US Dollars. Company 123 owns Company XYZ, a European company that consolidates in Euro. One of the Company XYZ's subsidiaries is Company IOU, headquar... tered in Switzerland with a functional currency of the Swiss Franc. Which process produces USD balances for Company IOU? A. A translation to the USD_Reporting currency member for Company IOU B. A translation of Company IOU C. A consolidation of Company 123 D. A consolidation of Company XYZ E. A translation of Company XYZ to Parent Currency - ✔✔E. A translation of Company XYZ to Parent Currency Which statement is correct regarding intercompany eliminations? A. Intercompany eliminations are generally required to remove the effect of transactions within the company B. Intercompany eliminations are required for sustainability reporting to show the company's waste output. C. Intercompany eliminations are optional in FCCS and use one of the custom dimensions when enabled. [Show More]

Last updated: 10 months ago

Preview 5 out of 65 pages

Loading document previews ...

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$8.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Sep 19, 2024

Number of pages

65

Written in

Additional information

This document has been written for:

Uploaded

Sep 19, 2024

Downloads

0

Views

8