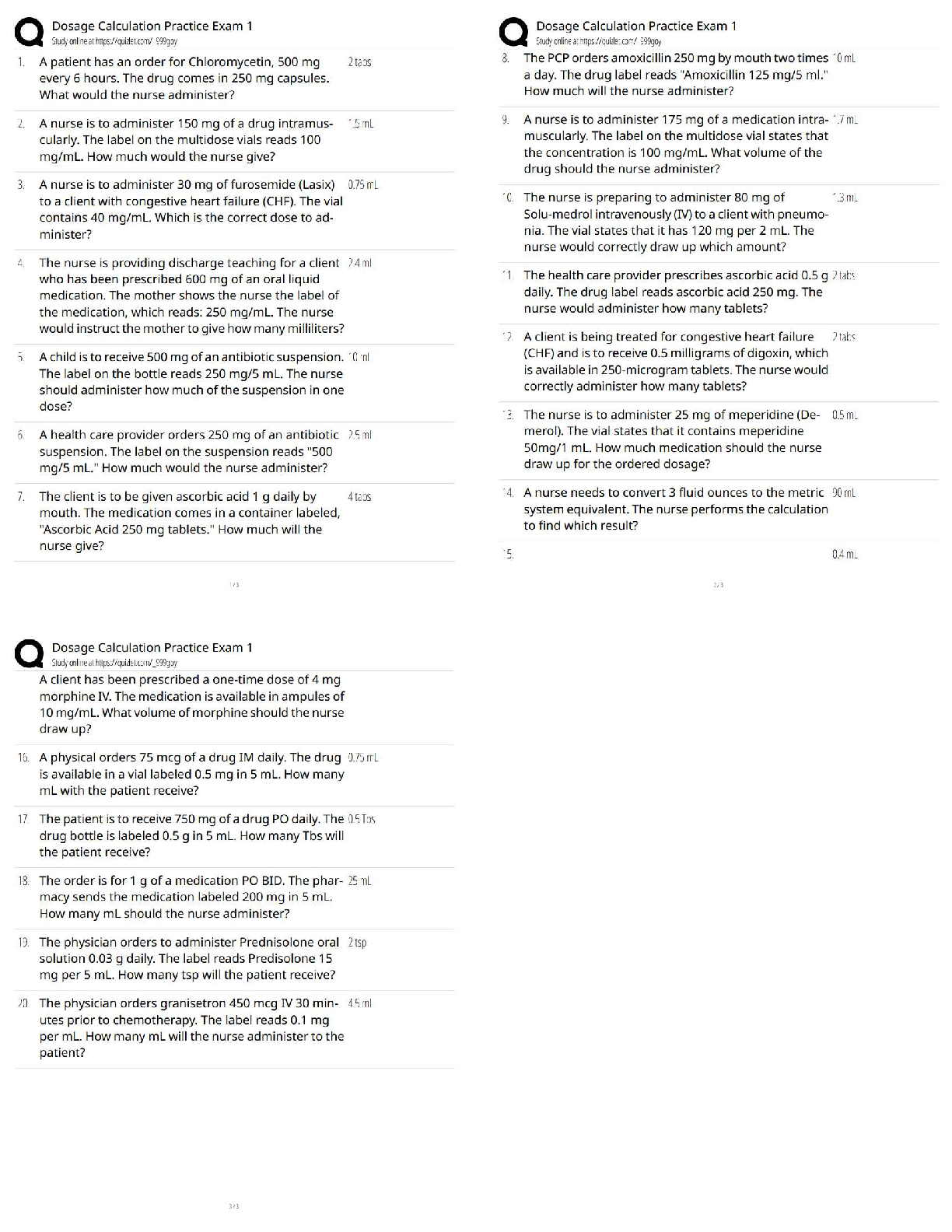

AUDITING PROBLEMS

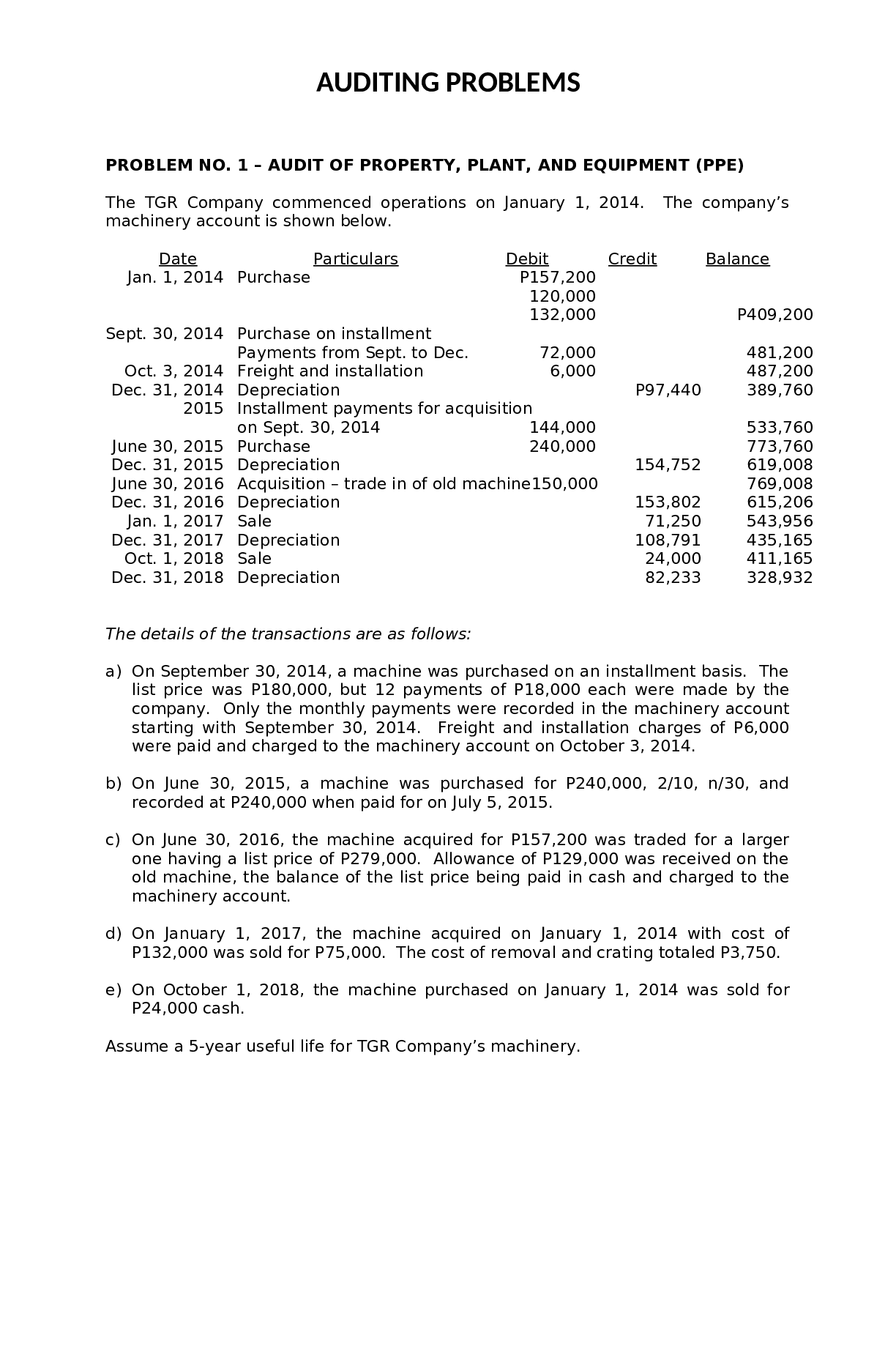

PROBLEM NO. 1 – AUDIT OF PROPERTY, PLANT, AND EQUIPMENT (PPE)

The TGR Company commenced operations on January 1, 2014. The company’s

machinery account is shown below.

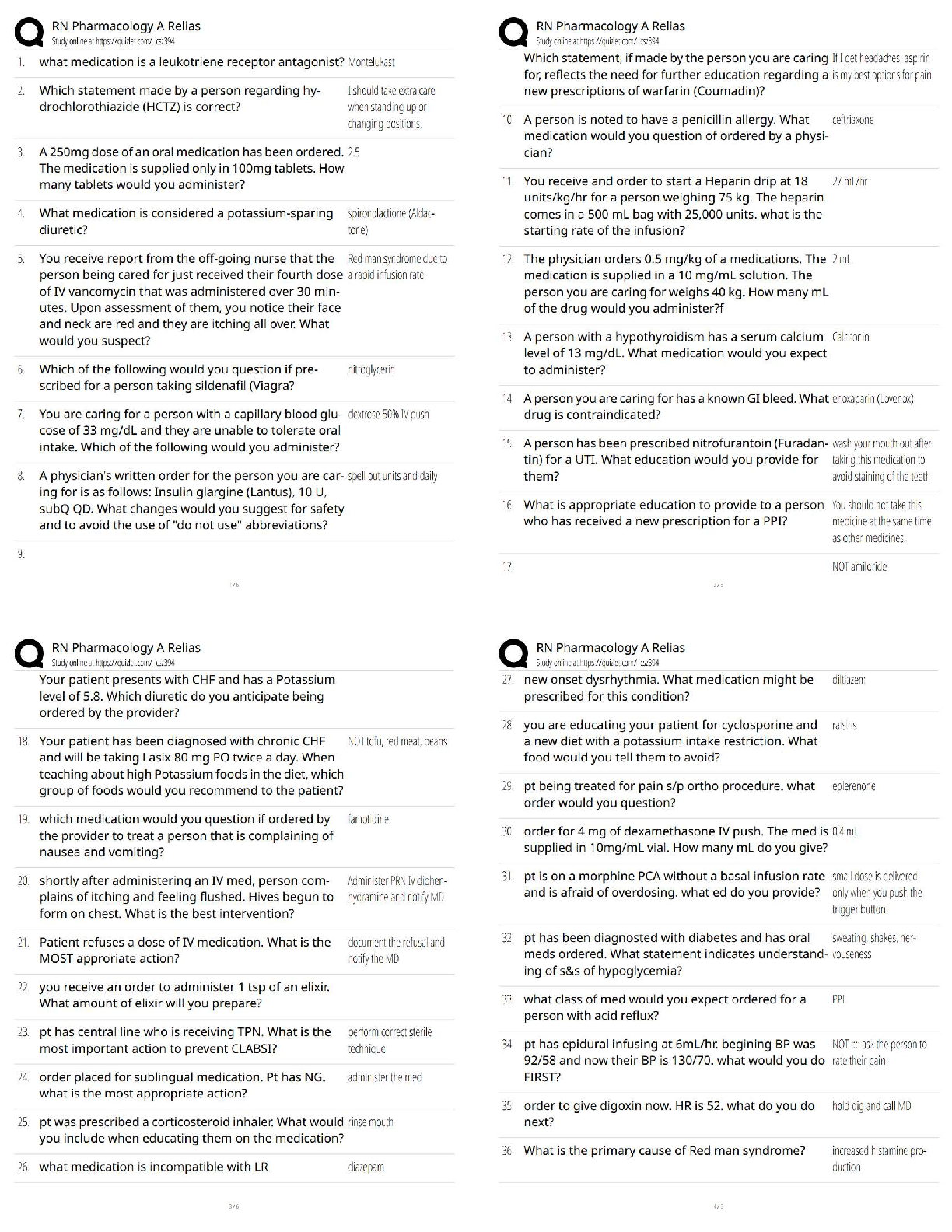

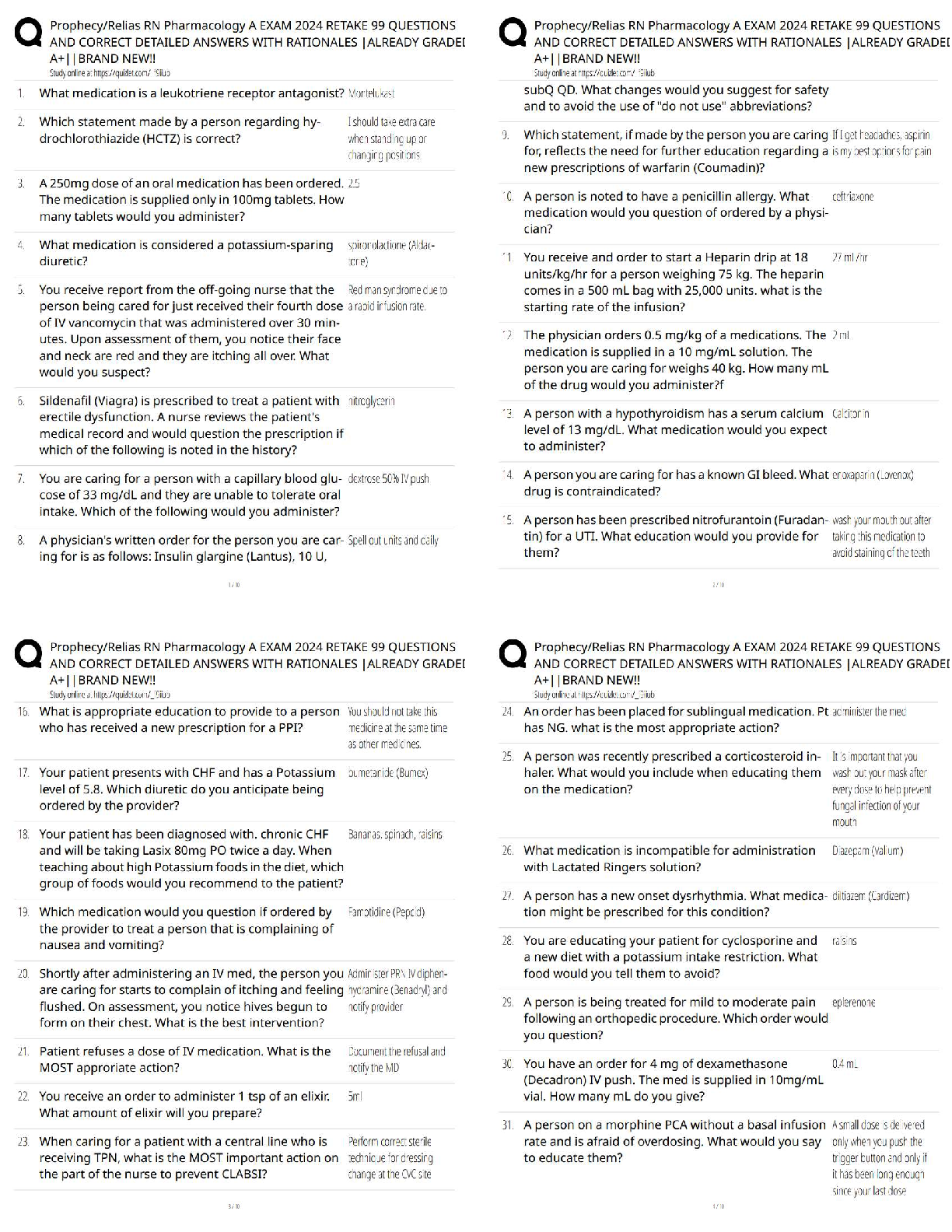

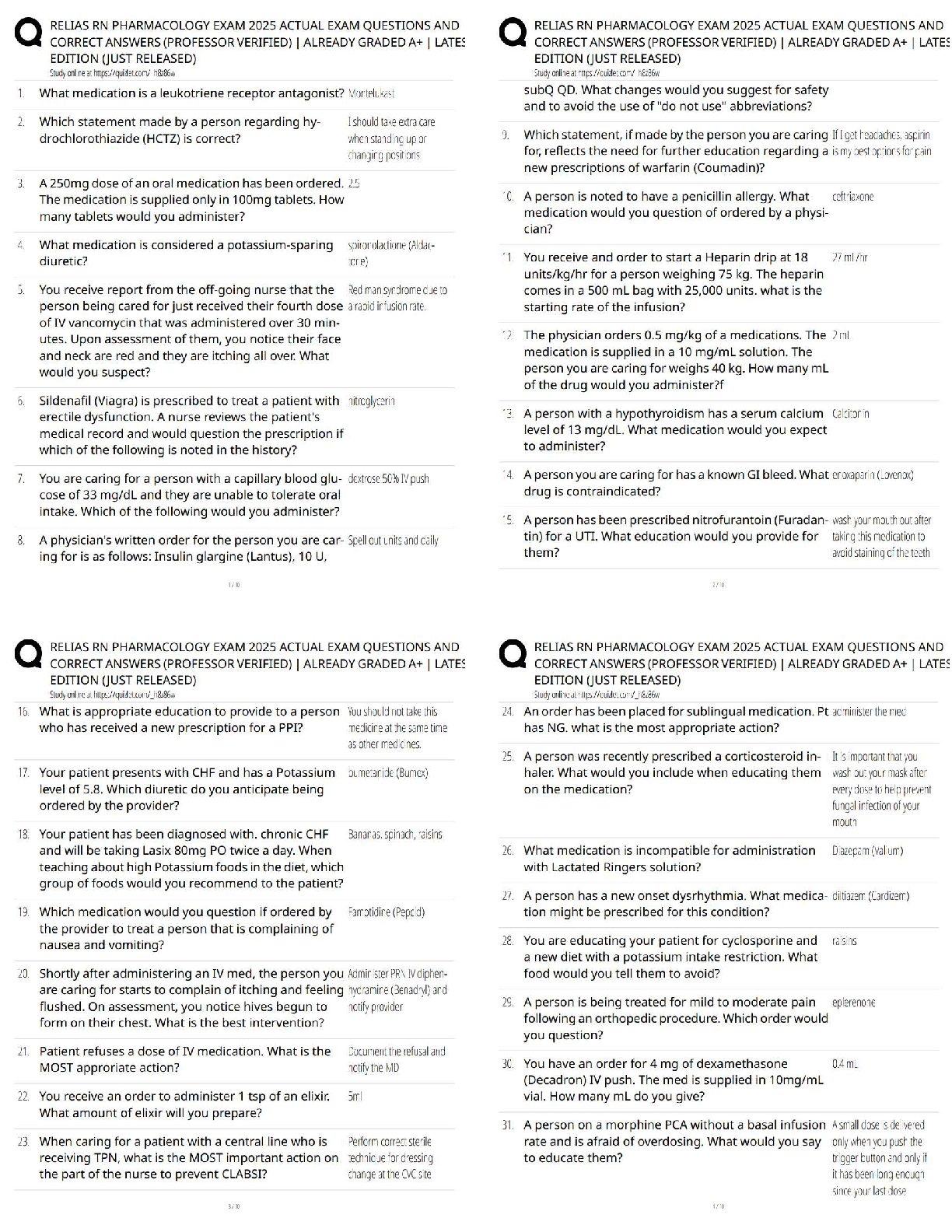

Date Particulars Debit Credit B

...

AUDITING PROBLEMS

PROBLEM NO. 1 – AUDIT OF PROPERTY, PLANT, AND EQUIPMENT (PPE)

The TGR Company commenced operations on January 1, 2014. The company’s

machinery account is shown below.

Date Particulars Debit Credit Balance

Jan. 1, 2014 Purchase P157,200

120,000

132,000 P409,200

Sept. 30, 2014 Purchase on installment

Payments from Sept. to Dec. 72,000 481,200

Oct. 3, 2014 Freight and installation 6,000 487,200

Dec. 31, 2014 Depreciation P97,440 389,760

2015 Installment payments for acquisition

on Sept. 30, 2014 144,000 533,760

June 30, 2015 Purchase 240,000 773,760

Dec. 31, 2015 Depreciation 154,752 619,008

June 30, 2016 Acquisition – trade in of old machine150,000 769,008

Dec. 31, 2016 Depreciation 153,802 615,206

Jan. 1, 2017 Sale 71,250 543,956

Dec. 31, 2017 Depreciation 108,791 435,165

Oct. 1, 2018 Sale 24,000 411,165

Dec. 31, 2018 Depreciation 82,233 328,932

The details of the transactions are as follows:

a) On September 30, 2014, a machine was purchased on an installment basis. The

list price was P180,000, but 12 payments of P18,000 each were made by the

company. Only the monthly payments were recorded in the machinery account

starting with September 30, 2014. Freight and installation charges of P6,000

were paid and charged to the machinery account on October 3, 2014.

b) On June 30, 2015, a machine was purchased for P240,000, 2/10, n/30, and

recorded at P240,000 when paid for on July 5, 2015.

c) On June 30, 2016, the machine acquired for P157,200 was traded for a larger

one having a list price of P279,000. Allowance of P129,000 was received on the

old machine, the balance of the list price being paid in cash and charged to the

machinery account.

d) On January 1, 2017, the machine acquired on January 1, 2014 with cost of

P132,000 was sold for P75,000. The cost of removal and crating totaled P3,750.

e) On October 1, 2018, the machine purchased on January 1, 2014 was sold for

P24,000 cash.

Assume a 5-year useful life for TGR Company’s machinery.

[Show More]