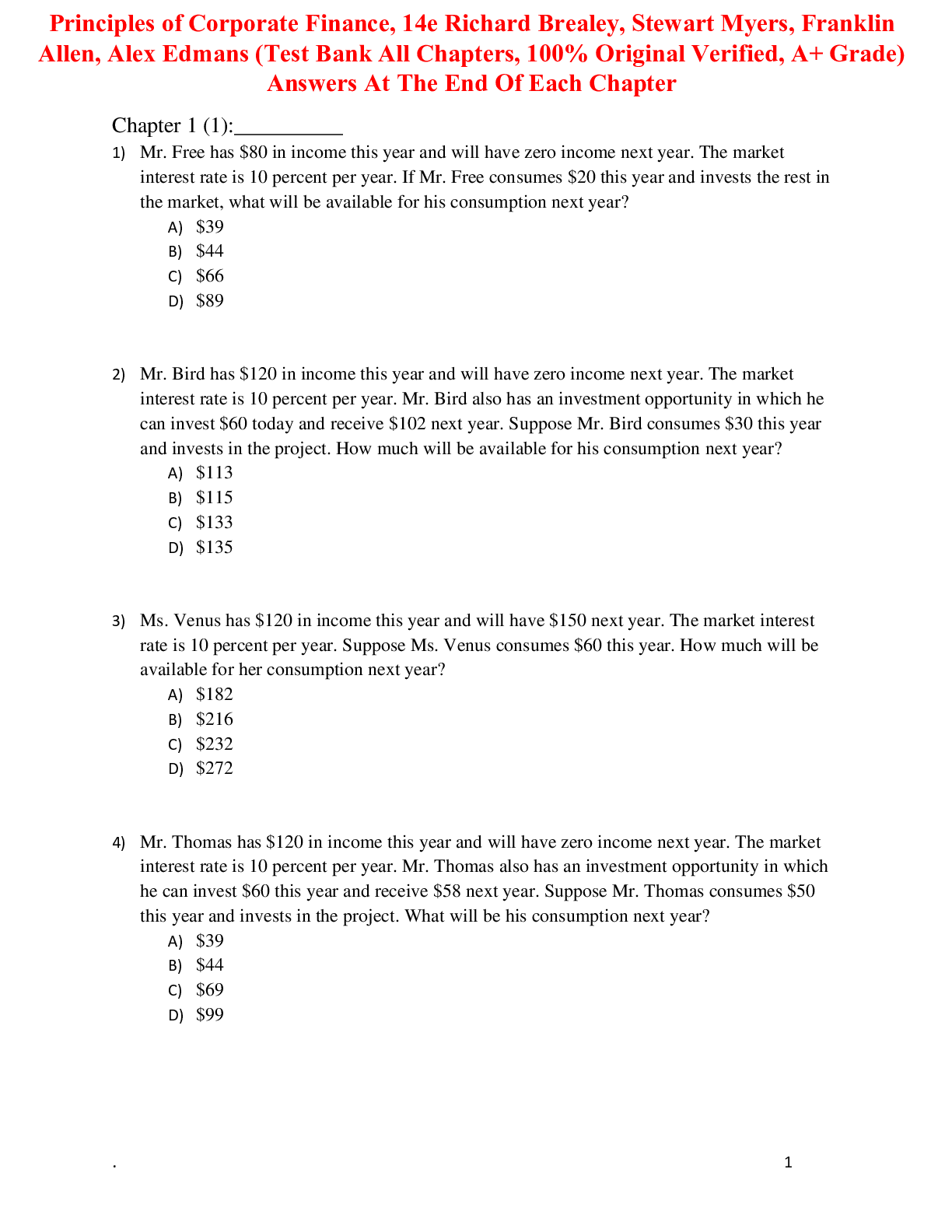

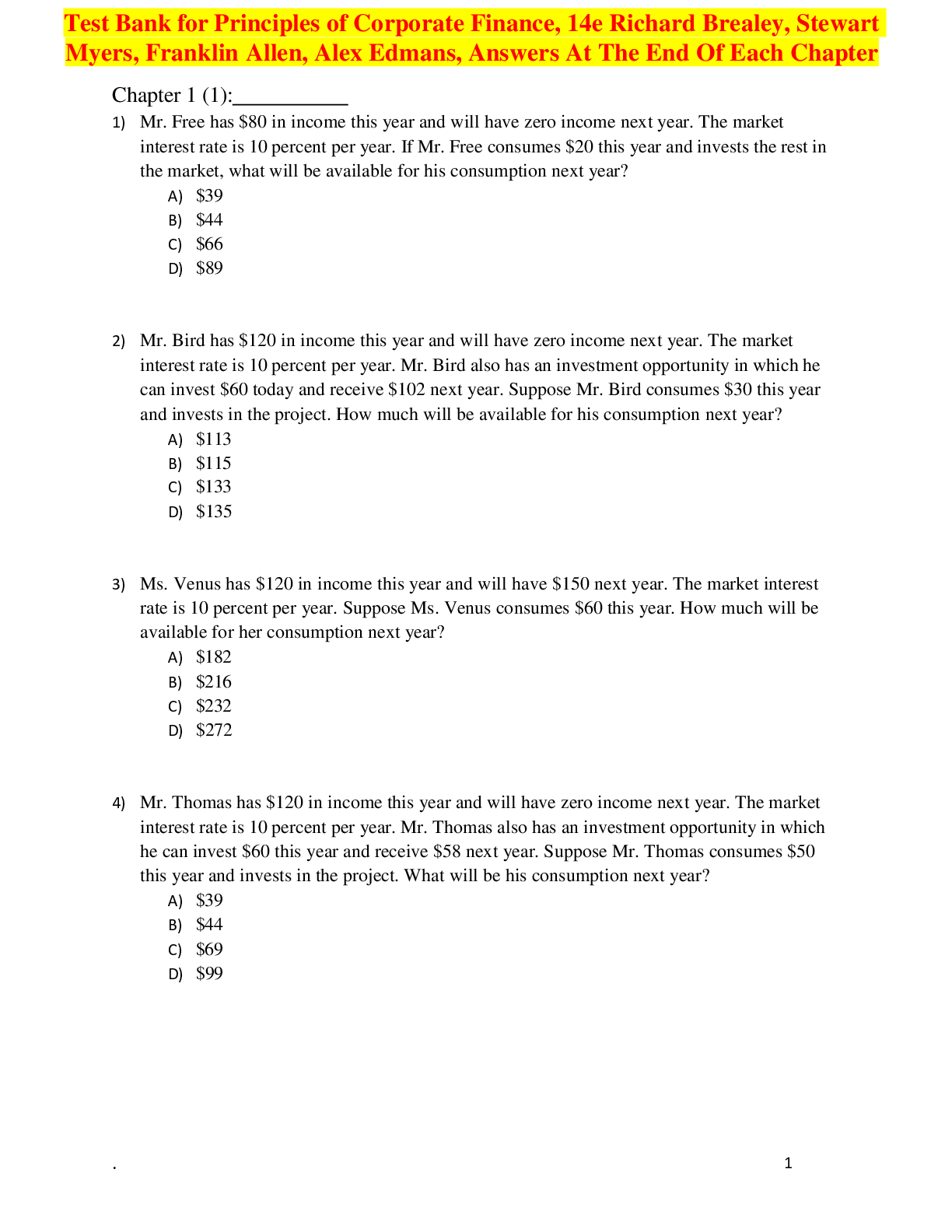

Finance > TEST BANK > TESTBANK FOR Principles of Corporate Finance, 14e Richard Brealey, Stewart Myers, Franklin Allen, Al (All)

TESTBANK FOR Principles of Corporate Finance, 14e Richard Brealey, Stewart Myers, Franklin Allen, Alex Edmans

Document Content and Description Below

TESTBANK FOR Principles of Corporate Finance, 14e Richard Brealey, Stewart Myers, Franklin Allen, Alex Edmans-Mr. Free has $80 in income this year and will have zero income next year. The market inte... rest rate is 10 percent per year. If Mr. Free consumes $20 this year and invests the rest in the market, what will be available for his consumption next year? A) $39 B) $44 C) $66 D) $89 2) Mr. Bird has $120 in income this year and will have zero income next year. The market interest rate is 10 percent per year. Mr. Bird also has an investment opportunity in which he can invest $60 today and receive $102 next year. Suppose Mr. Bird consumes $30 this year and invests in the project. How much will be available for his consumption next year? A) $113 B) $115 C) $133 D) $135 3) Ms. Venus has $120 in income this year and will have $150 next year. The market interest rate is 10 percent per year. Suppose Ms. Venus consumes $60 this year. How much will be available for her consumption next year? A) $182 B) $216 C) $232 D) $272 4) Mr. Thomas has $120 in income this year and will have zero income next year. The market interest rate is 10 percent per year. Mr. Thomas also has an investment opportunity in which he can invest $60 this year and receive $58 next year. Suppose Mr. Thomas consumes $50 this year and invests in the project. What will be his consumption next year? A) $39 B) $44 C) $69 D) $99 . 2 5) Mr. Dell has $110 in income this year and will have zero income next year. The expected return from investing in the stock market is 10 percent a year. Mr. Dell also has an investment opportunity—having the same risk as the market in which he can invest $30 this year and receive $94 next year. Suppose Mr. Dell consumes $50 this year and invests in the project. What is the NPV of the investment opportunity? A) $0 B) $6 C) $35.45 D) none of the options 6) Ms. Delgado has $80,000 in income this year and will have $60,000 next year. The market interest rate is 10 percent per year. Suppose Ms. Delgado consumes $100,000 this year. How much will be available for her consumption next year? [Show More]

Last updated: 7 months ago

Preview 5 out of 708 pages

Loading document previews ...

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$16.50

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Oct 17, 2024

Number of pages

708

Written in

Additional information

This document has been written for:

Uploaded

Oct 17, 2024

Downloads

0

Views

16

(1).png)