Finance > TEST BANKS > Solution Manual with Appendix For Income Tax Fundamentals 2023, 41st Edition By Gerald E. Whittenbur (All)

Solution Manual with Appendix For Income Tax Fundamentals 2023, 41st Edition By Gerald E. Whittenburg, Steven Gill

Document Content and Description Below

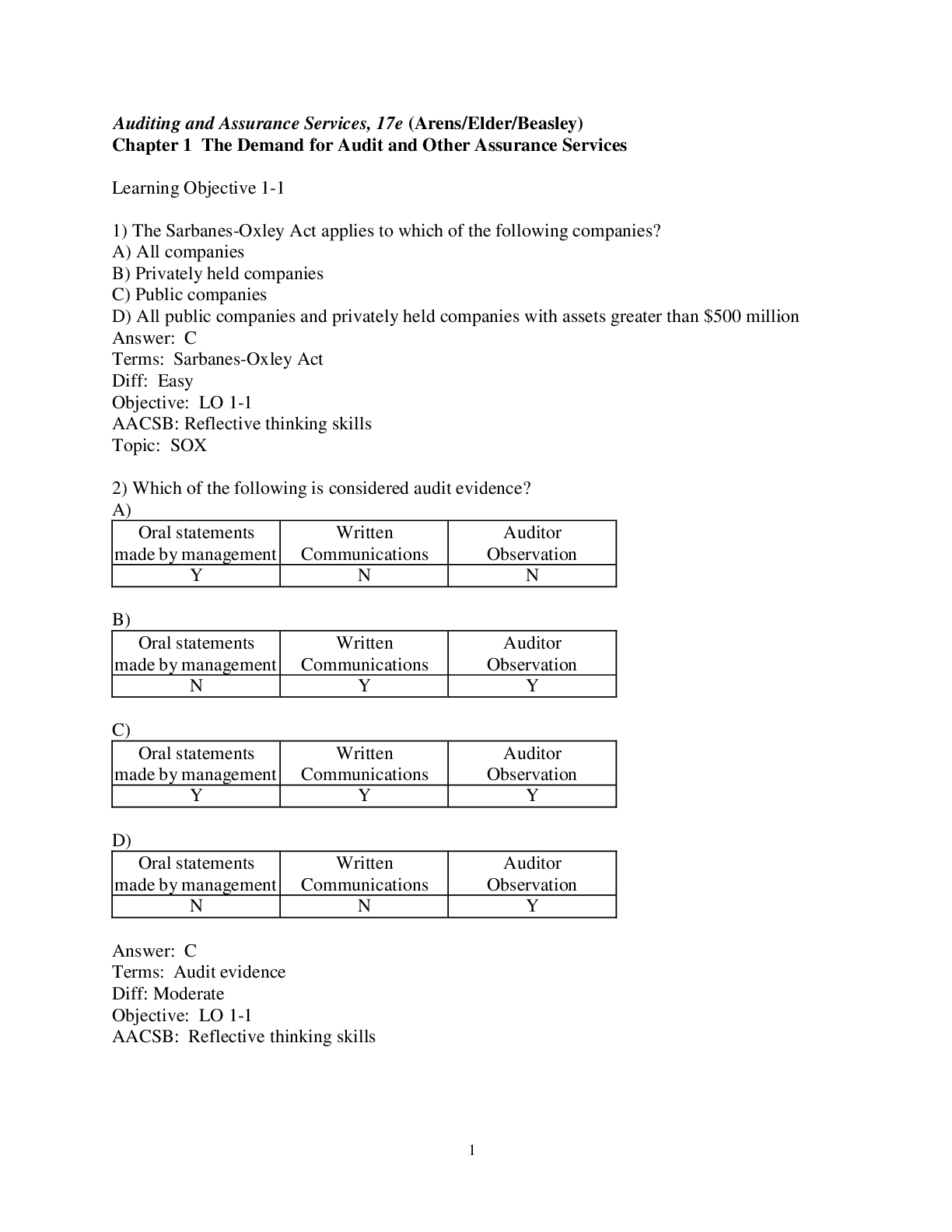

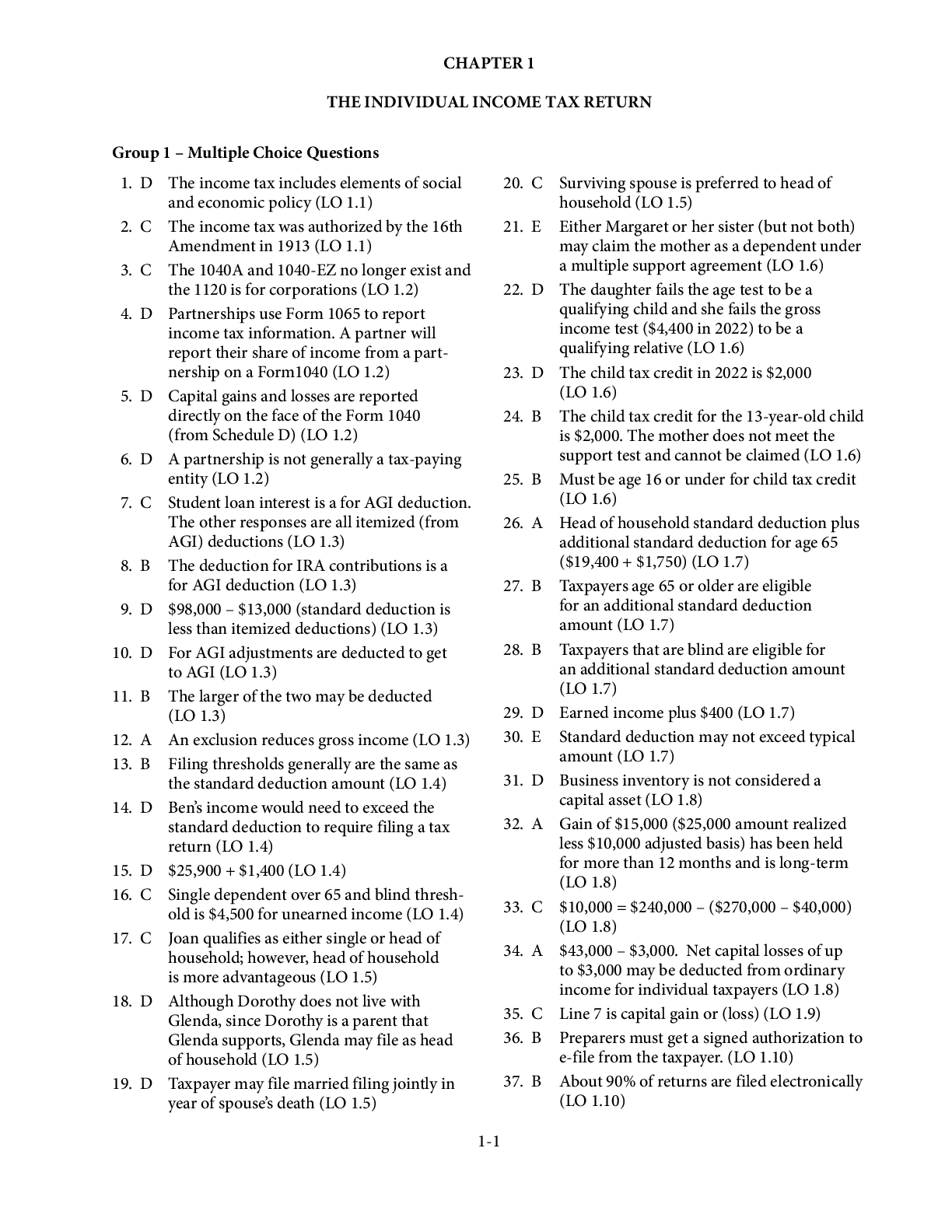

Solution Manual with Appendix For Income Tax Fundamentals 2023, 41st Edition By Gerald E. Whittenburg, Steven Gill-Group 1 – Multiple Choice Questions 1-1 1. D The income tax includes elements of ... social and economic policy (LO 1.1) 2. C The income tax was authorized by the 16th Amendment in 1913 (LO 1.1) 3. C The 1040A and 1040-EZ no longer exist and the 1120 is for corporations (LO 1.2) 4. D Partnerships use Form 1065 to report income tax information. A partner will report their share of income from a part- nership on a Form1040 (LO 1.2) 5. D Capital gains and losses are reported directly on the face of the Form 1040 (from Schedule D) (LO 1.2) 6. D A partnership is not generally a tax-paying entity (LO 1.2) 7. C Student loan interest is a for AGI deduction. The other responses are all itemized (from AGI) deductions (LO 1.3) 8. B The deduction for IRA contributions is a for AGI deduction (LO 1.3) 9. D $98,000 – $13,000 (standard deduction is less than itemized deductions) (LO 1.3) 10. D For AGI adjustments are deducted to get to AGI (LO 1.3) 11. B The larger of the two may be deducted (LO 1.3) 12. A An exclusion reduces gross income (LO 1.3) 13. B Filing thresholds generally are the same as the standard deduction amount (LO 1.4) 14. D Ben’s income would need to exceed the standard deduction to require filing a tax return (LO 1.4) 15. D $25,900 + $1,400 (LO 1.4) 16. C Single dependent over 65 and blind thresh- old is $4,500 for unearned income (LO 1.4) 17. C Joan qualifies as either single or head of household; however, head of household is more advantageous (LO 1.5) 18. D Although Dorothy does not live with Glenda, since Dorothy is a parent that Glenda supports, Glenda may file as head of household (LO 1.5) 19. D Taxpayer may file married filing jointly in year of spouse’s death (LO 1.5) 20. C Surviving spouse is preferred to head of household (LO 1.5) 21. E Either Margaret or her sister (but not both) may claim the mother as a dependent under a multiple support agreement (LO 1.6) 22. D The daughter fails the age test to be a qualifying child and she fails the gross income test ($4,400 in 2022) to be a qualifying relative (LO 1.6) 23. D The child tax credit in 2022 is $2,000 (LO 1.6) 24. B The child tax credit for the 13-year-old child is $2,000. The mother does not meet the support test and cannot be claimed (LO 1.6) 25. B Must be age 16 or under for child tax credit (LO 1.6) 26. A Head of household standard deduction plus additional standard deduction for age 65 ($19,400 + $1,750) (LO 1.7) 27. B Taxpayers age 65 or older are eligible for an additional standard deduction amount (LO 1.7) 28. B Taxpayers that are blind are eligible for an additional standard deduction amount (LO 1.7) 29. D Earned income plus $400 (LO 1.7) 30. E Standard deduction may not exceed typical amount (LO 1.7) 31. D Business inventory is not considered a capital asset (LO 1.8) 32. A Gain of $15,000 ($25,000 amount realized less $10,000 adjusted basis) has been held for more than 12 months and is long-term (LO 1.8) 33. C $10,000 = $240,000 – ($270,000 – $40,000) (LO 1.8) 34. A $43,000 – $3,000. Net capital losses of up to $3,000 may be deducted from ordinary income for individual taxpayers (LO 1.8) 35. C Line 7 is capital gain or (loss) (LO 1.9) 36. B Preparers must get a signed authorization to e-file from the taxpayer. (LO 1.10) 37. B About 90% of returns are filed electronically (LO 1.10) [Show More]

Last updated: 1 year ago

Preview 1 out of 382 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$15.50

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Oct 21, 2024

Number of pages

382

Written in

All

Additional information

This document has been written for:

Uploaded

Oct 21, 2024

Downloads

0

Views

34