WGU C213 FINAL EXAM QUESTIONS AND ANSWERS 2025 ALL CORRECT!

Document Content and Description Below

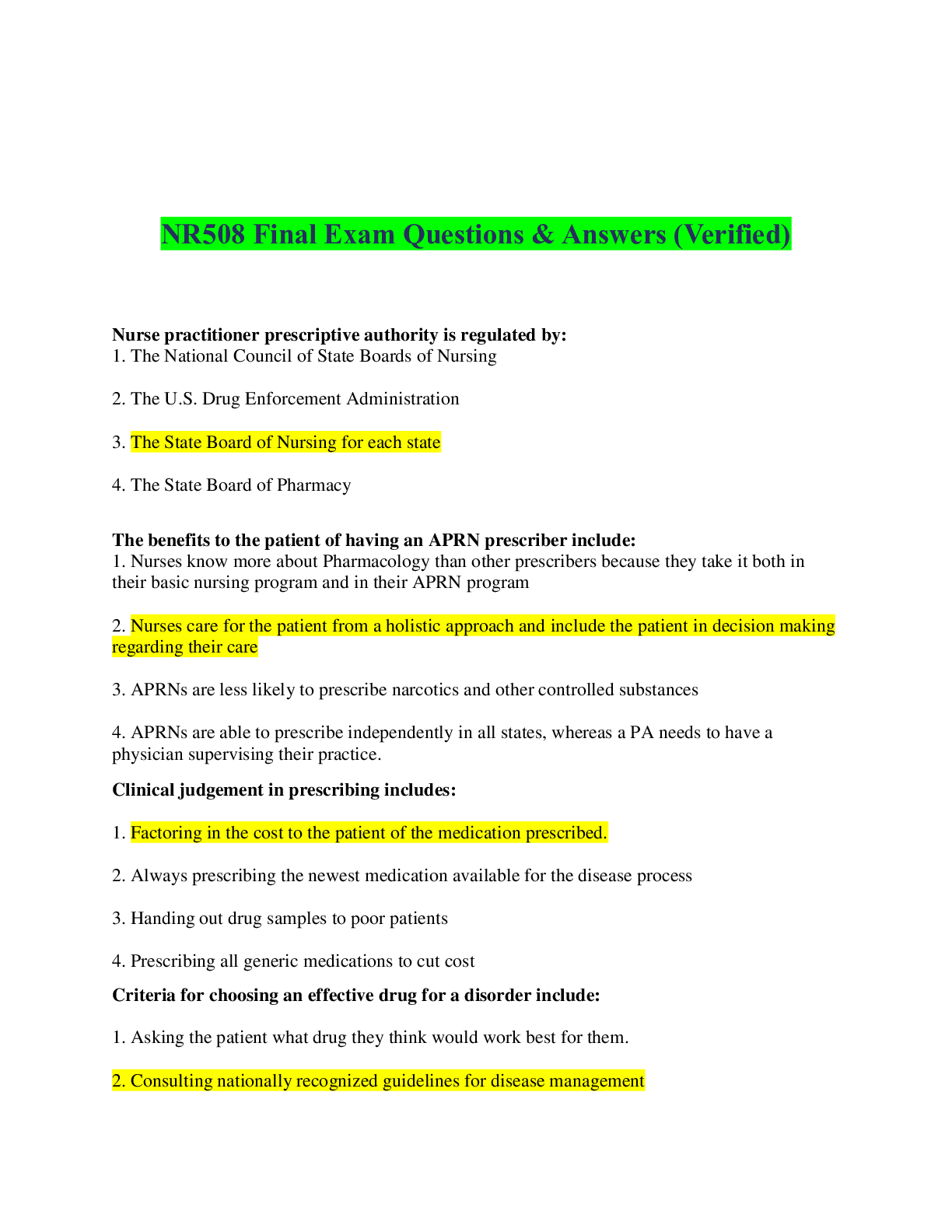

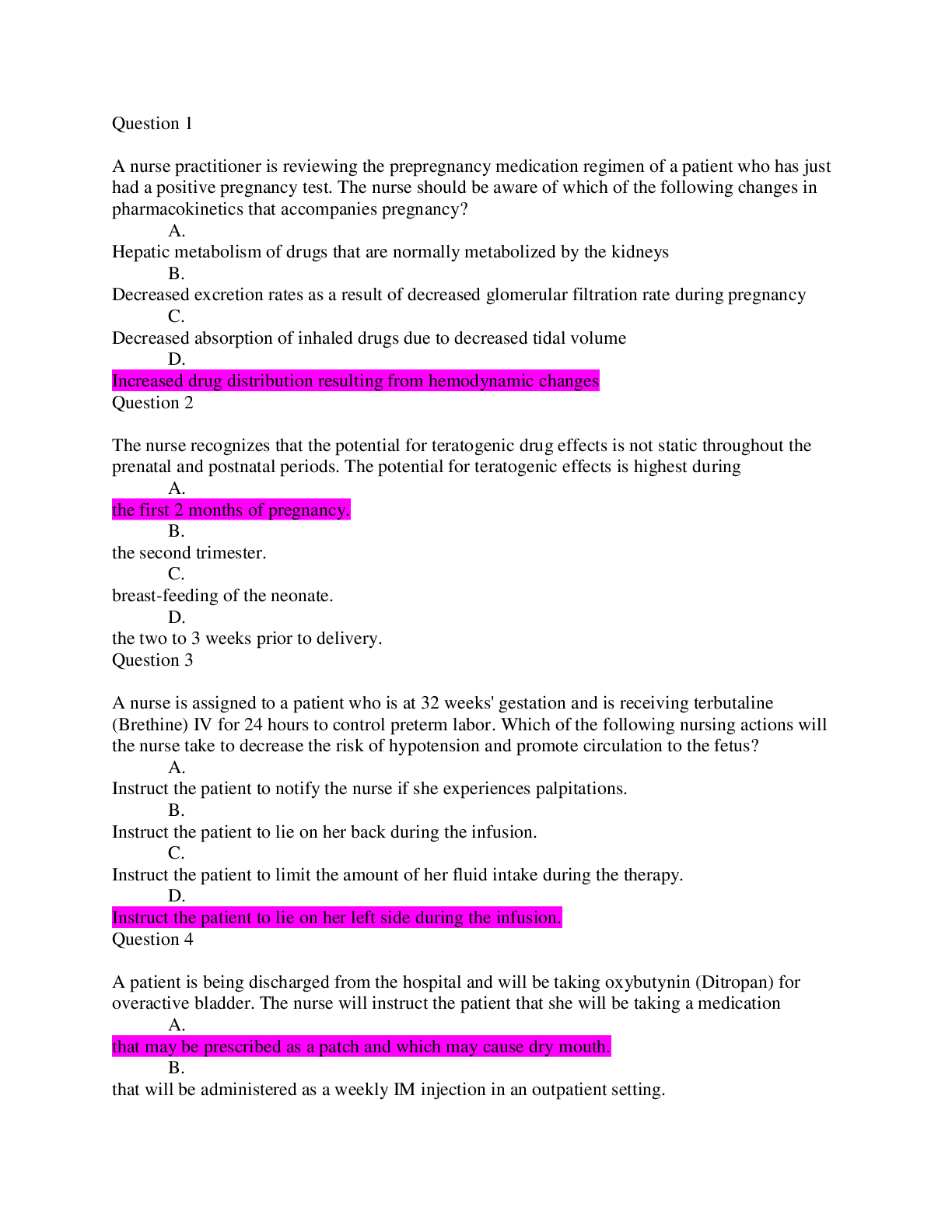

WGU C213 FINAL EXAM QUESTIONS AND ANSWERS 2025 ALL CORRECT!! 1. Order of assets listed on the balance sheet: Assets are listed in the order of liquidity. Liquidity is the amount of time it would usual... ly take to covert an asset into cash. Obviously, cash would be listed first, followed by marketable investments (a company can quickly convert a short-term investment into cash). Accounts receivable would be listed next followed by inventory, and long-term investments, fixed assets, and intangibles. Current assets are listed before long-term assets. Current liabilities are listed before long-term liabilities, but there is no specific order they are listed in outside of current and long-term. There is also no specific order equity accounts are listed on the balance sheet; although, typically you will see paid-in-capital followed by retained earnings followed by accumulated other comprehensive income, and lastly, treasury stock. 2. Difference between a manufacturing company and a service company. Period Costs Product Costs Service Co. Selling Costs Direct Labor Administrative Costs Service Overhead Manufacturing Co Selling Costs Direct Labor Administrative Costs Manufacturing Overhead Direct Materials (inventory: The only difference is - a manufacturing company has direct materials (inventory). 3. Evaluating a historical income statement to project a future income statement. Projected growth for 2017 = 10% increase over 2016 sales. Step 1: Convert the income statement into a common-sized income statement. Step 2: Multiply 2016 sales by 1.10 (10% growth) to get the forecasted 2017 sales. Then multiply the projected 2017 sales by the percentages from step 1. Now, what would you do if you were given the 2017 sales figure and you need to calculate the 2016 sales figure based off the 10% growth for 2017?: Calculation for 2016: 110,000 / 1.10 = 100,000 4. Role of the U. S. Securities and Exchange Commission (SEC) in financial reporting.: Regulates the U.S. Stock exchanges. Seeks to create a fair [Show More]

Last updated: 6 months ago

Preview 4 out of 13 pages

Loading document previews ...

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$9.50

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Jan 27, 2025

Number of pages

13

Written in

Additional information

This document has been written for:

Uploaded

Jan 27, 2025

Downloads

0

Views

7