Accounting > TEST BANKS > Test Bank for Accounting Tools for Business Decision Making, 7e Paul Kimmel, Jerry Weygandt, Donald (All)

Test Bank for Accounting Tools for Business Decision Making, 7e Paul Kimmel, Jerry Weygandt, Donald Kieso

Document Content and Description Below

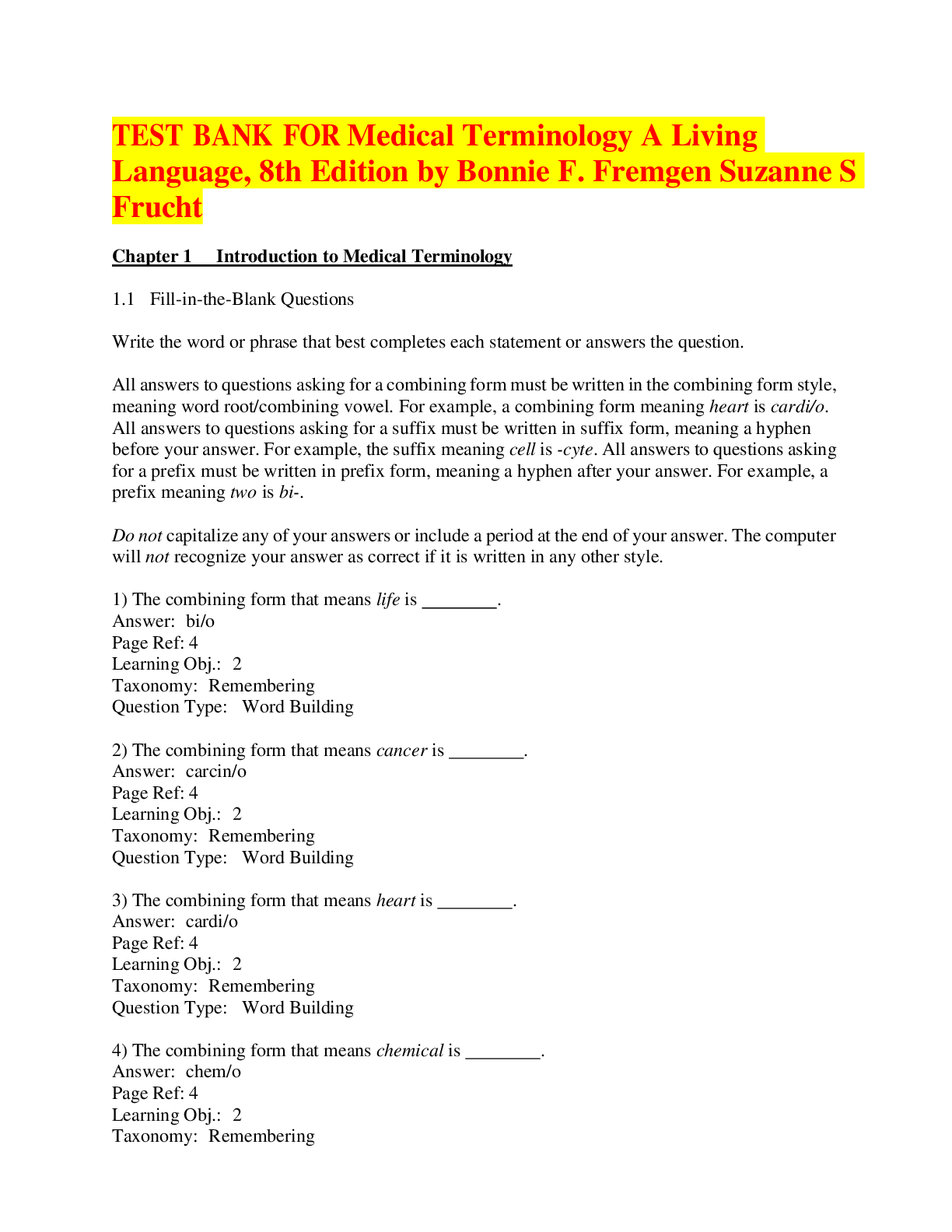

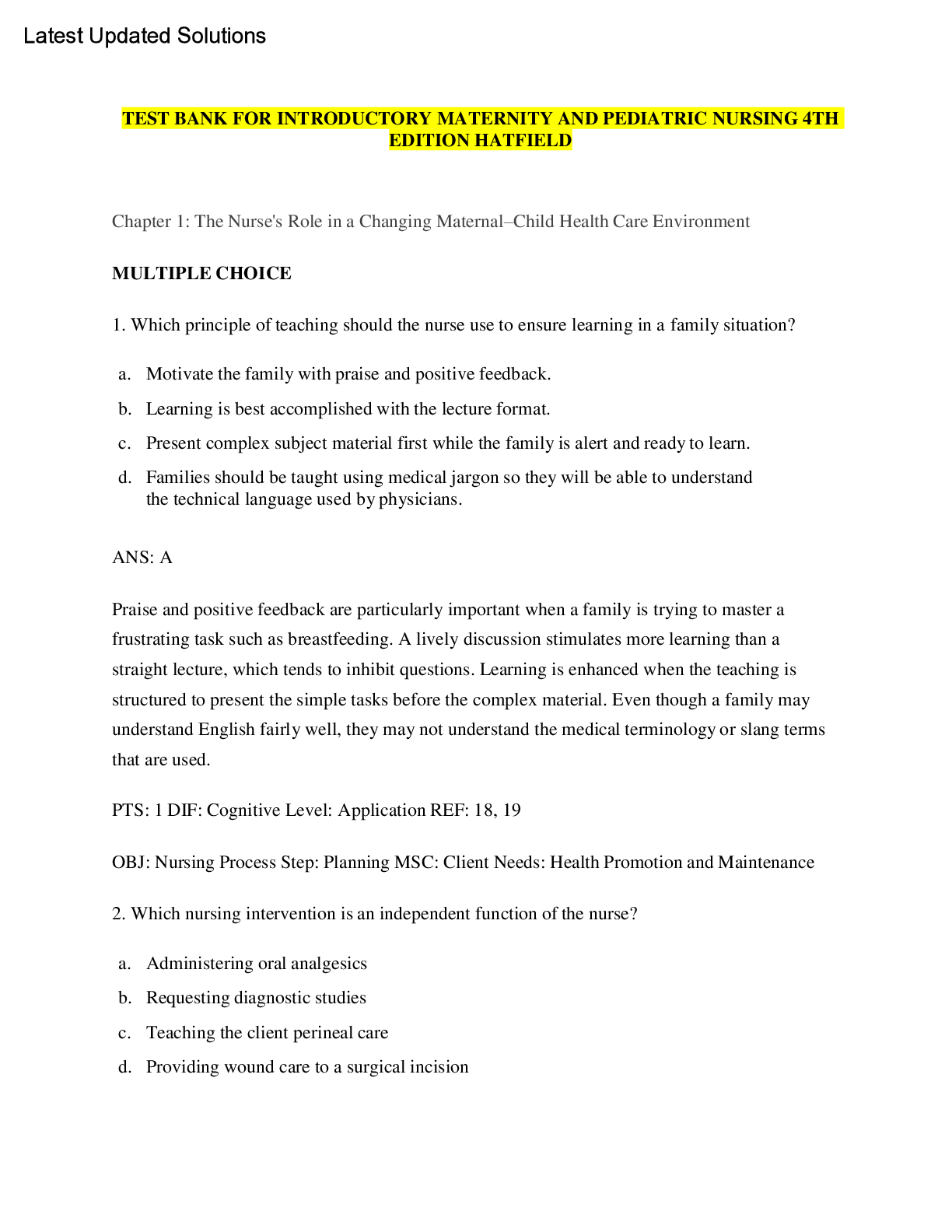

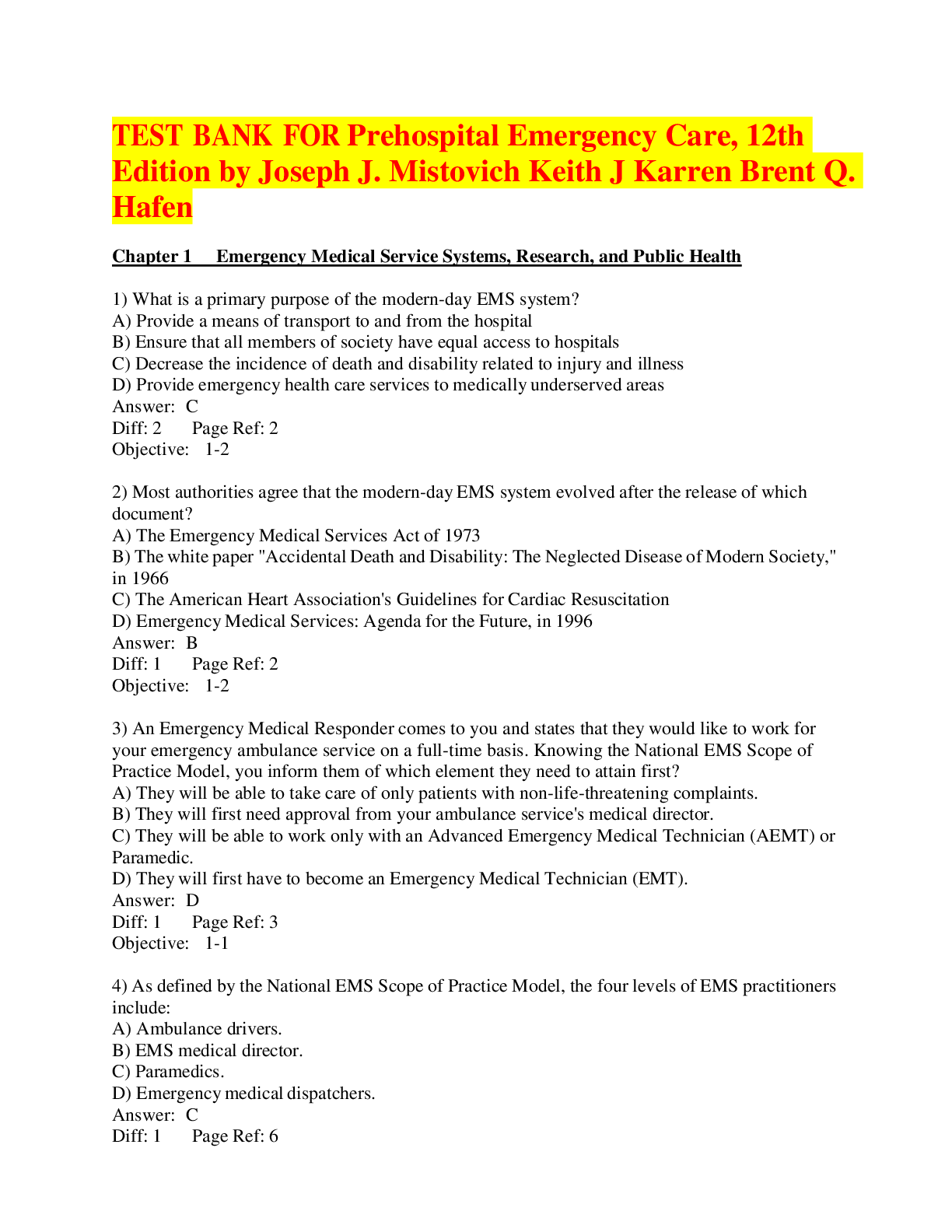

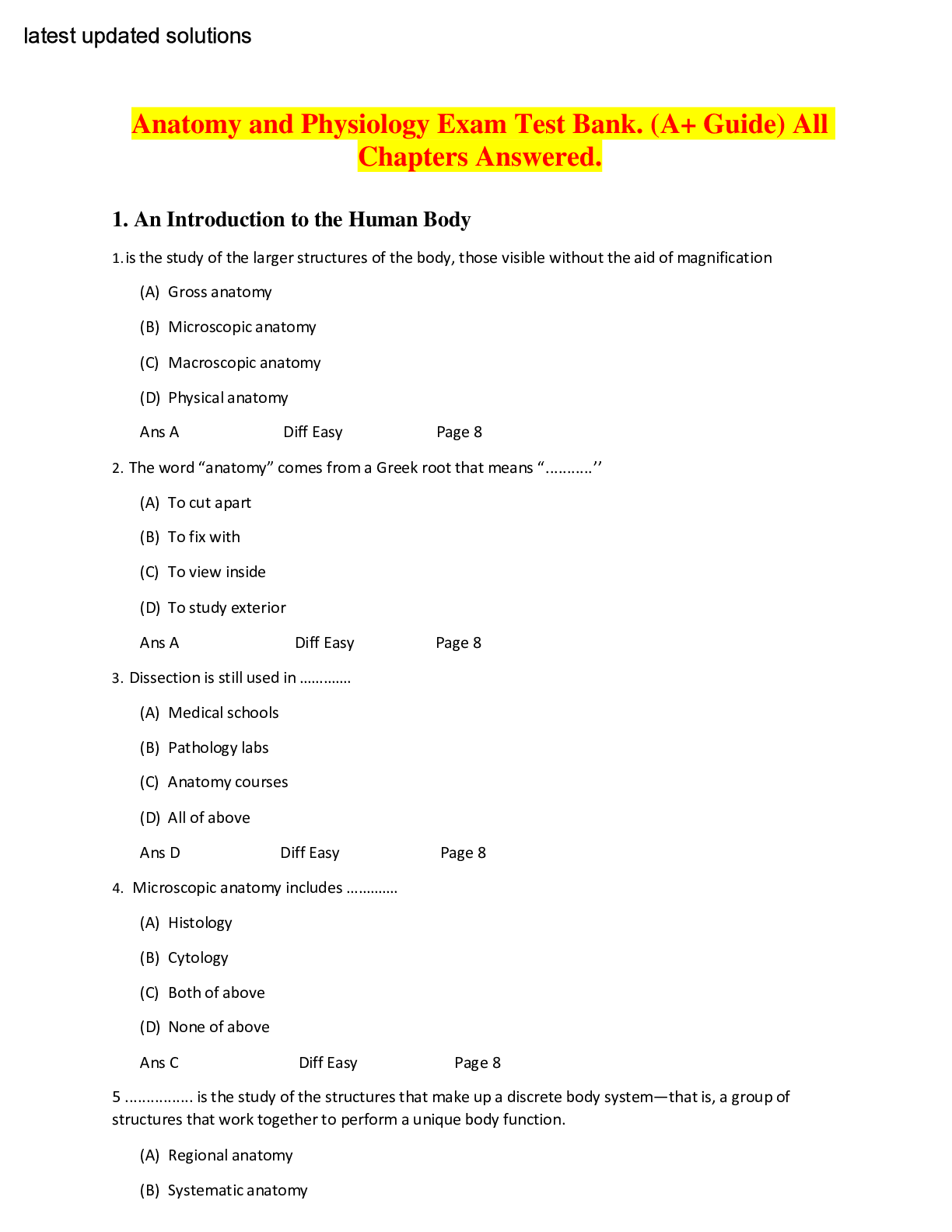

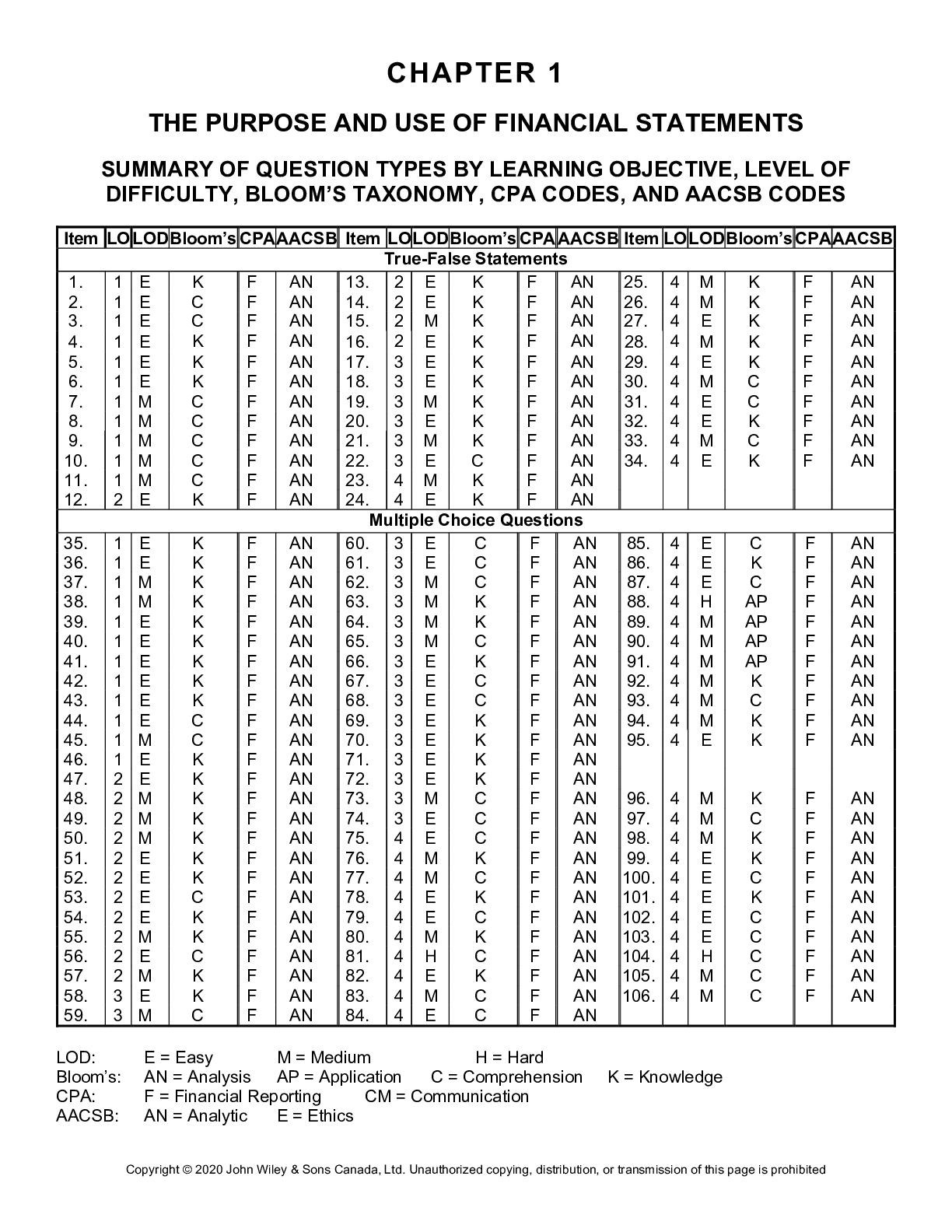

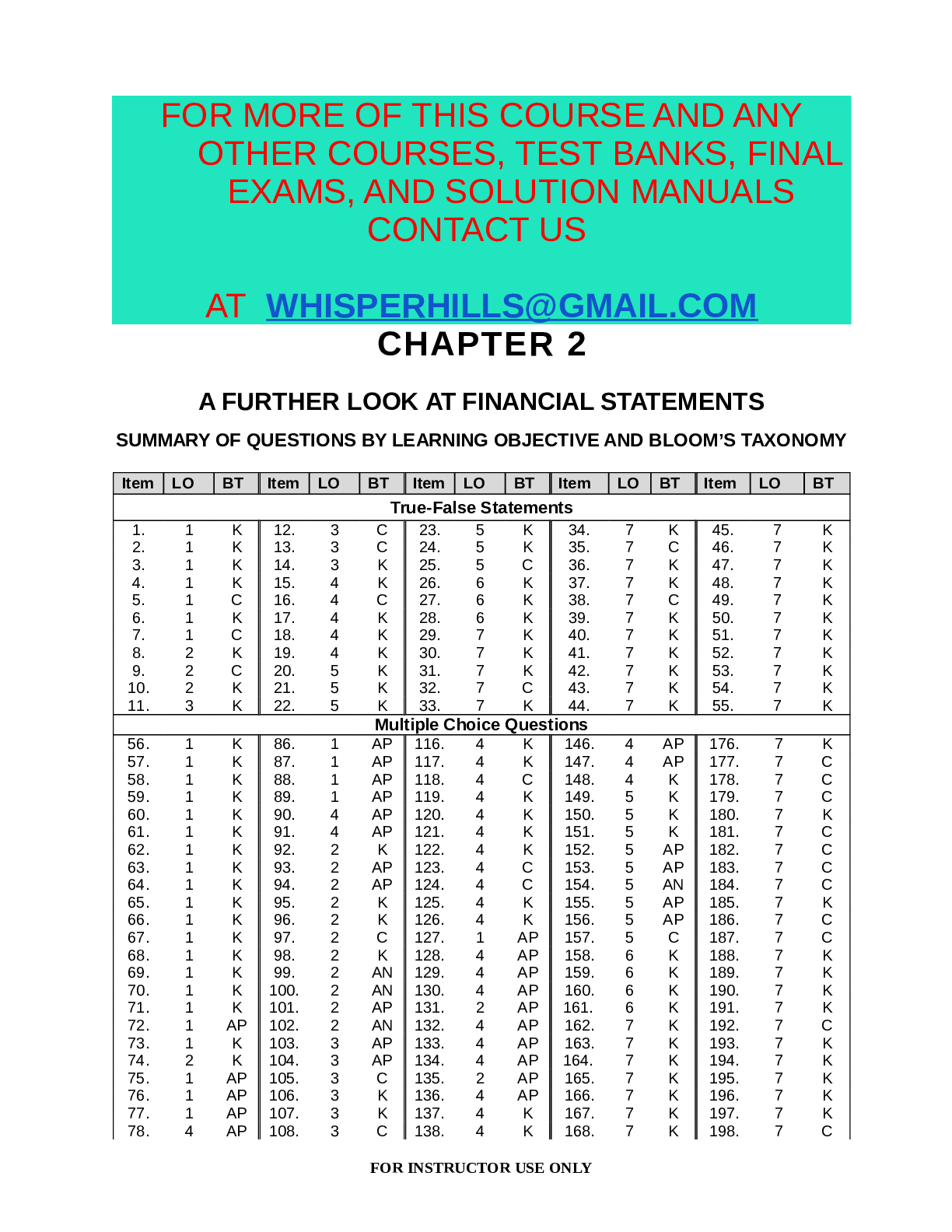

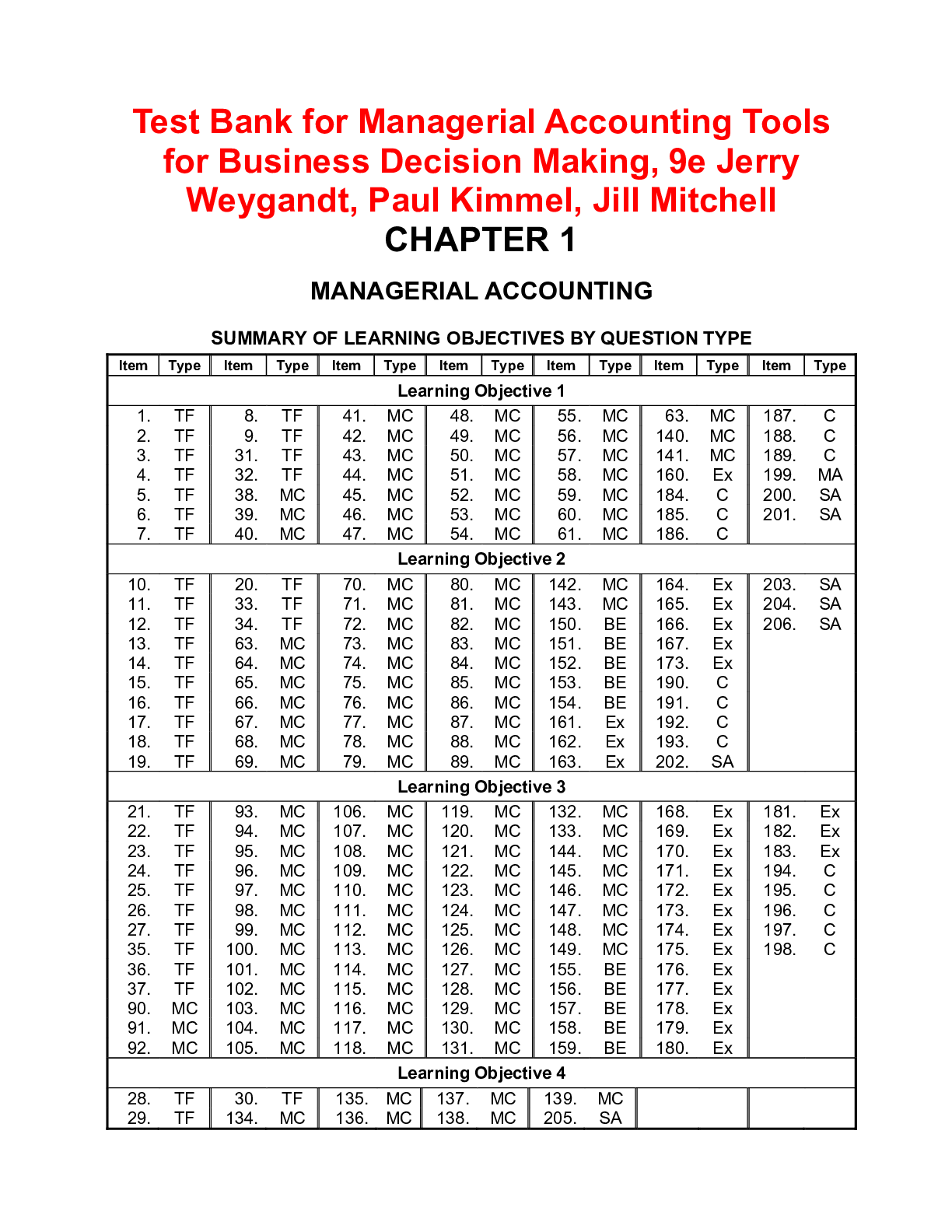

Test Bank for Accounting Tools for Business Decision Making, 7e Paul Kimmel, Jerry Weygandt, Donald Kieso-1. Describe the forms of business organization and the uses of accounting information. A sole... proprietorship is a business owned by one person. A partnership is a business owned by two or more people associated as partners. A corporation is a separate legal entity for which evidence of ownership is provided by shares of stock. Internal users are managers who need accounting information to plan, organize, and run business operations. The primary external users are investors and creditors. Investors (stockholders) use accounting information to decide whether to buy, hold, or sell shares of a company’s stock. Creditors (suppliers and bankers) use accounting information to assess the risk of granting credit or loaning money to a business. Other groups who have an indirect interest in a business are taxing authorities, customers, labor unions, and regulatory agencies. 2. Explain the three principal types of business activity. Financing activities involve collecting the necessary funds to support the business. Investing activities involve acquiring the resources necessary to run the business. Operating activities involve putting the resources of the business into action to generate a profit. 3. Describe the four financial statements and how they are prepared. An income statement presents the revenues and expenses of a company for a specific period of time. A retained earnings statement summarizes the changes in retained earnings that have occurred for a specific period of time. A balance sheet reports the assets, liabilities, and stockholders’ equity of a business at a specific date. A statement of cash flows summarizes information concerning the cash inflows (receipts) and outflows (payments) for a specific period of time. Assets are resources owned by a business. Liabilities are the debts and obligations of the business. Liabilities represent claims of creditors on the assets of the business. Stockholders’ equity represents the claims of owners on the assets of the business. Stockholders’ equity is subdivided into two parts: common stock and retained earnings. The basic accounting equation is Assets = Liabilities + Stockholders’ Equity. Within the annual report, the management discussion and analysis provides management’s interpretation of the company’s results and financial position as well as a discussion of plans for the future. Notes to the financial statements provide additional explanation or detail to make the financial statements more informative. The auditor’s report expresses an opinion as to whether the financial statements present fairly the company’s results of operations and financial position. [Show More]

Last updated: 4 months ago

Preview 5 out of 1946 pages

Loading document previews ...

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$18.50

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Mar 10, 2025

Number of pages

1946

Written in

Additional information

This document has been written for:

Uploaded

Mar 10, 2025

Downloads

0

Views

15

_compressed.png)

.png)

.png)

.png)

.png)

.png)