Accounting > TEST BANKS > Test Bank For Accounting for Governmental & Nonprofit Entities, 18e Jacqueline Reck, Suzanne Lowenso (All)

Test Bank For Accounting for Governmental & Nonprofit Entities, 18e Jacqueline Reck, Suzanne Lowensohn, Earl Wilson

Document Content and Description Below

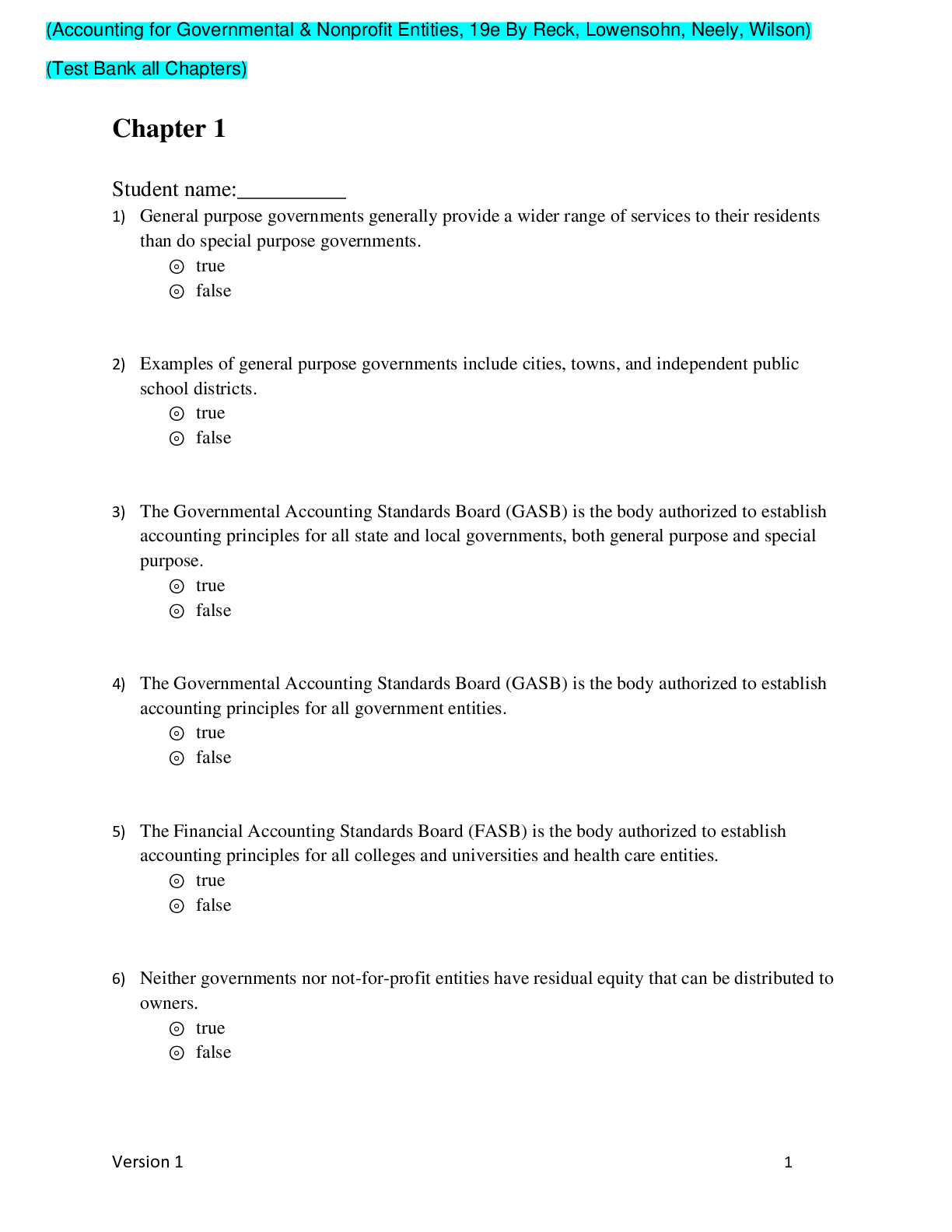

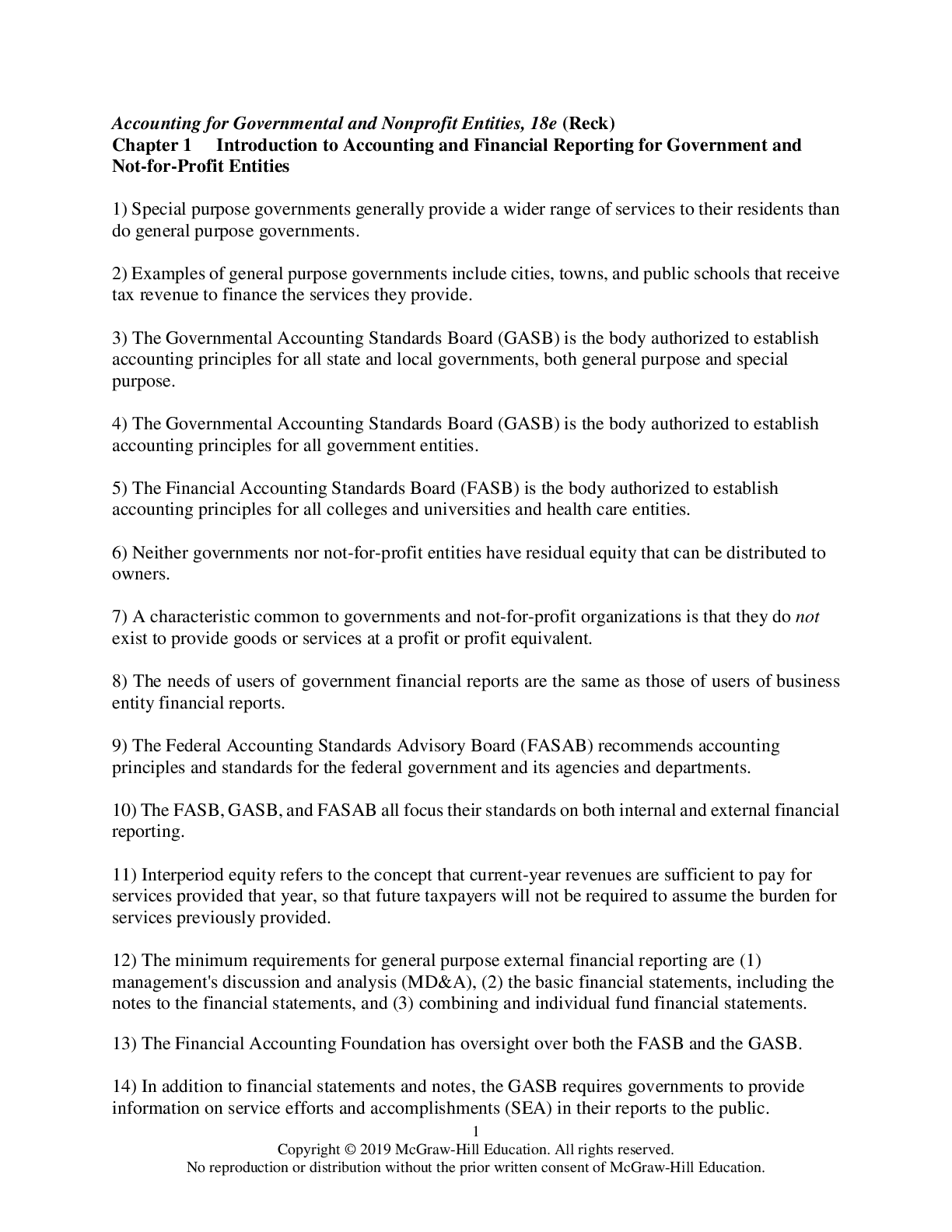

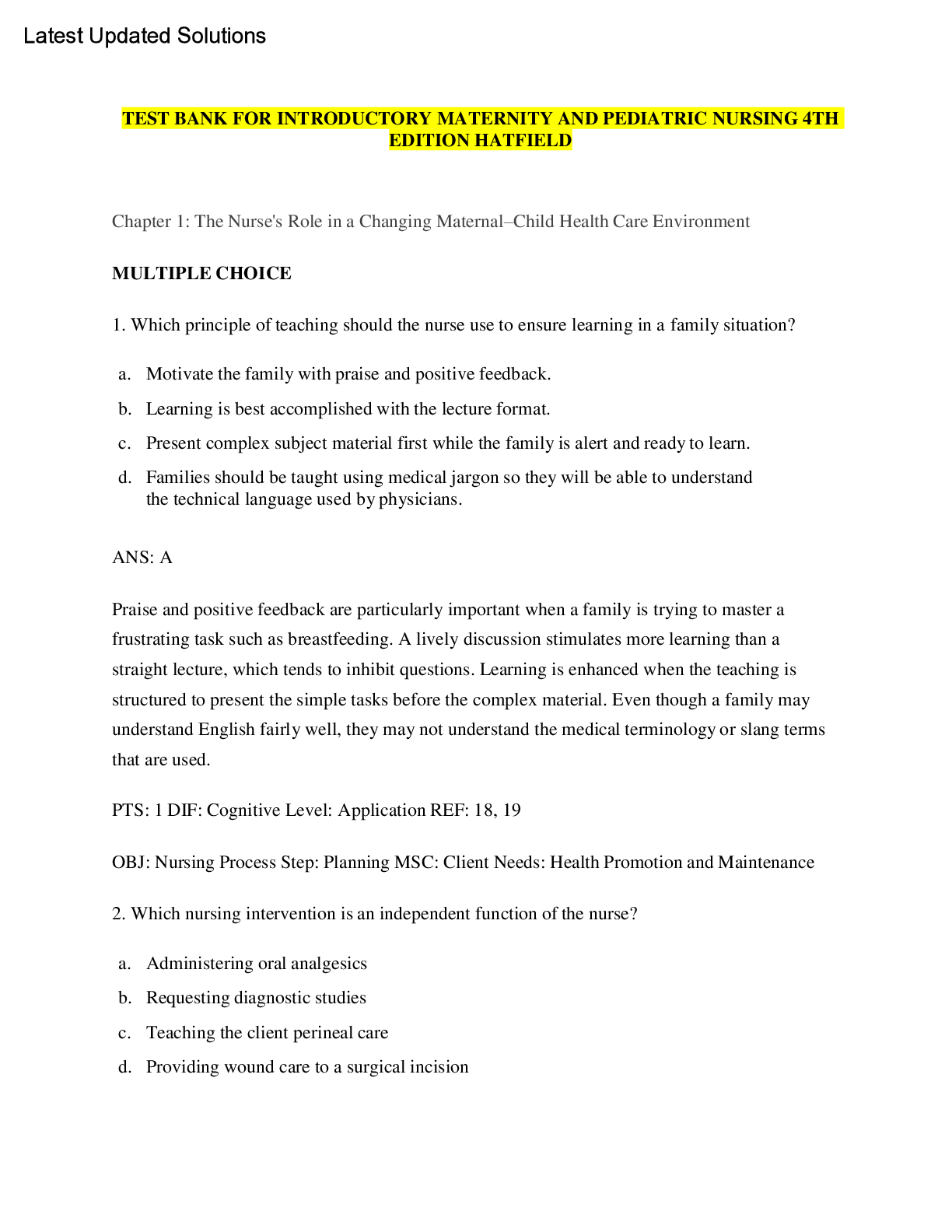

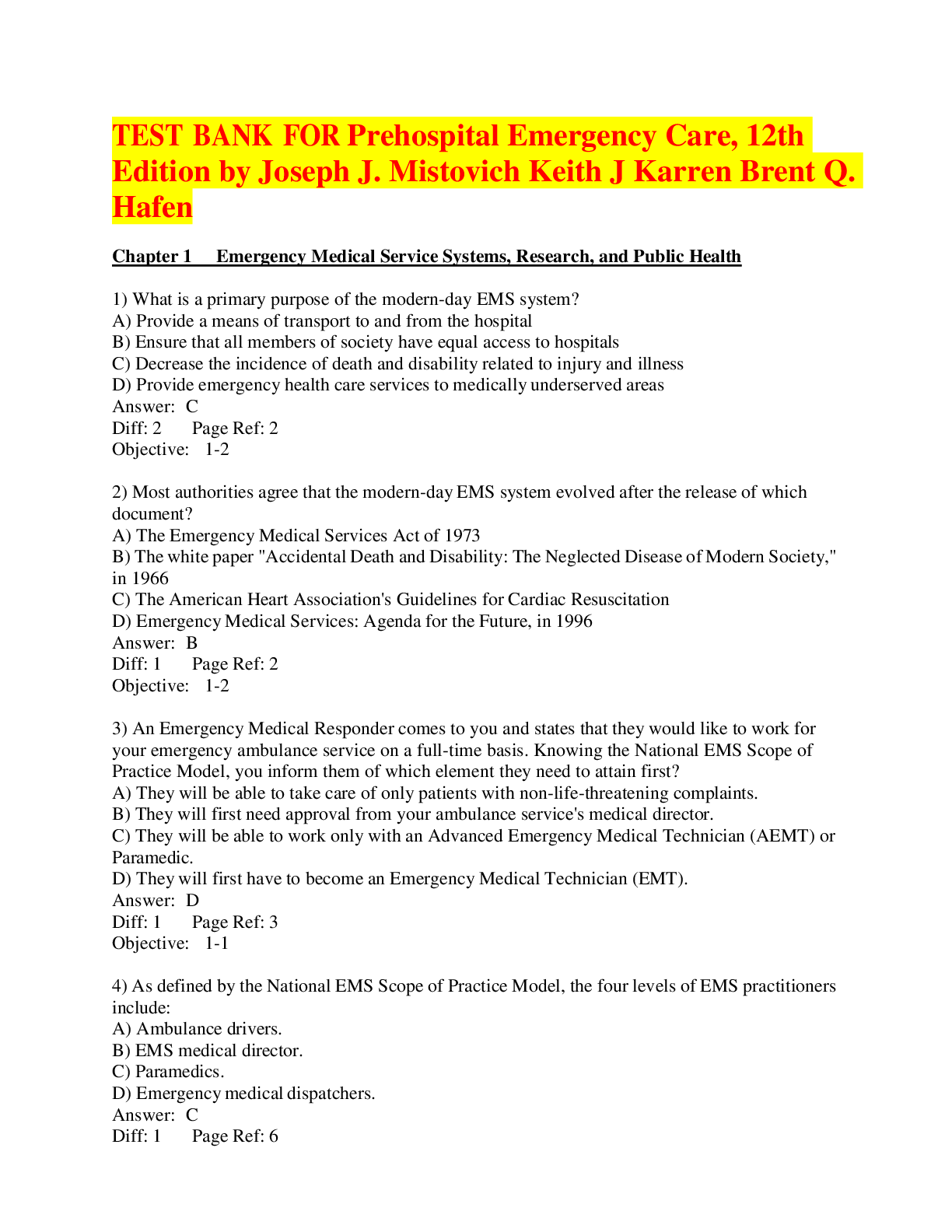

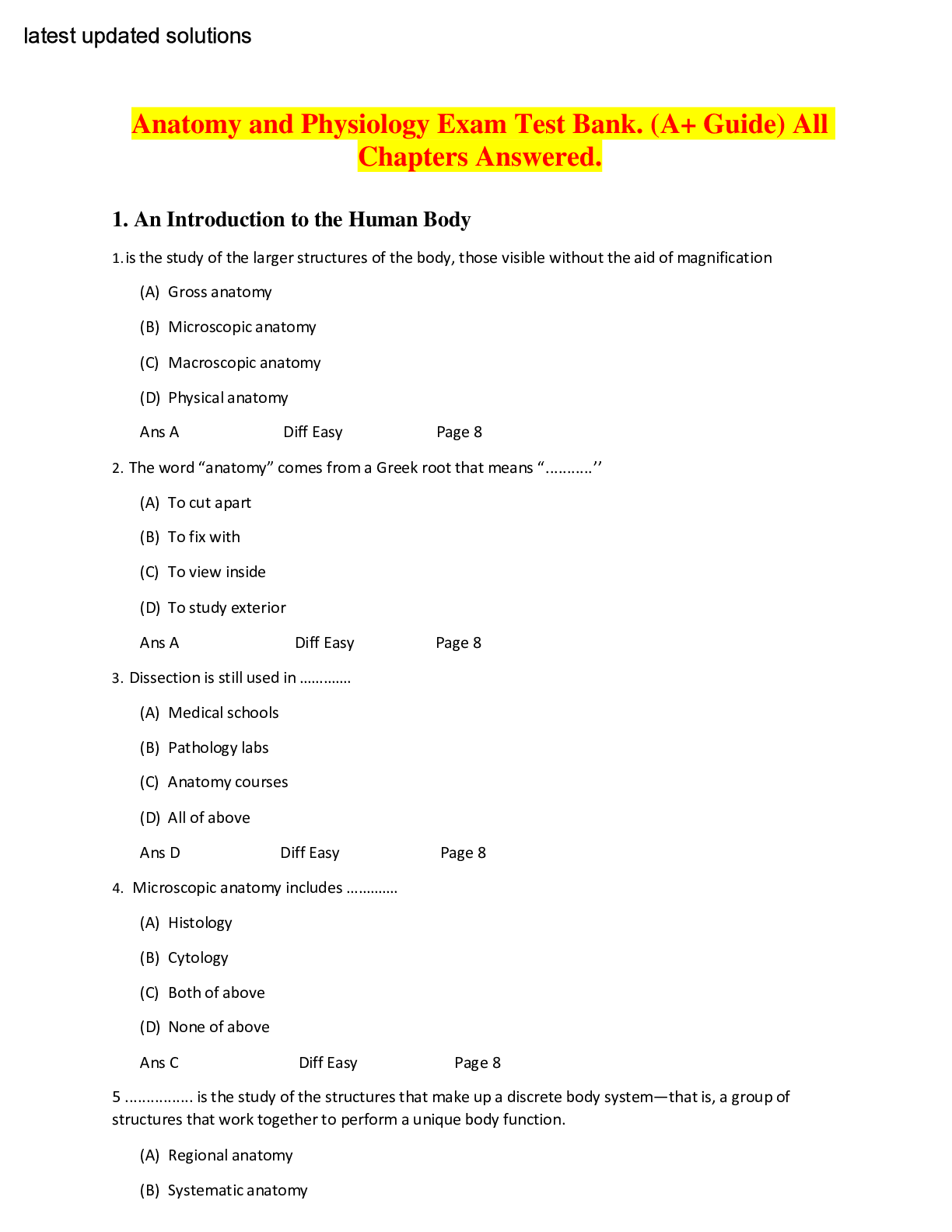

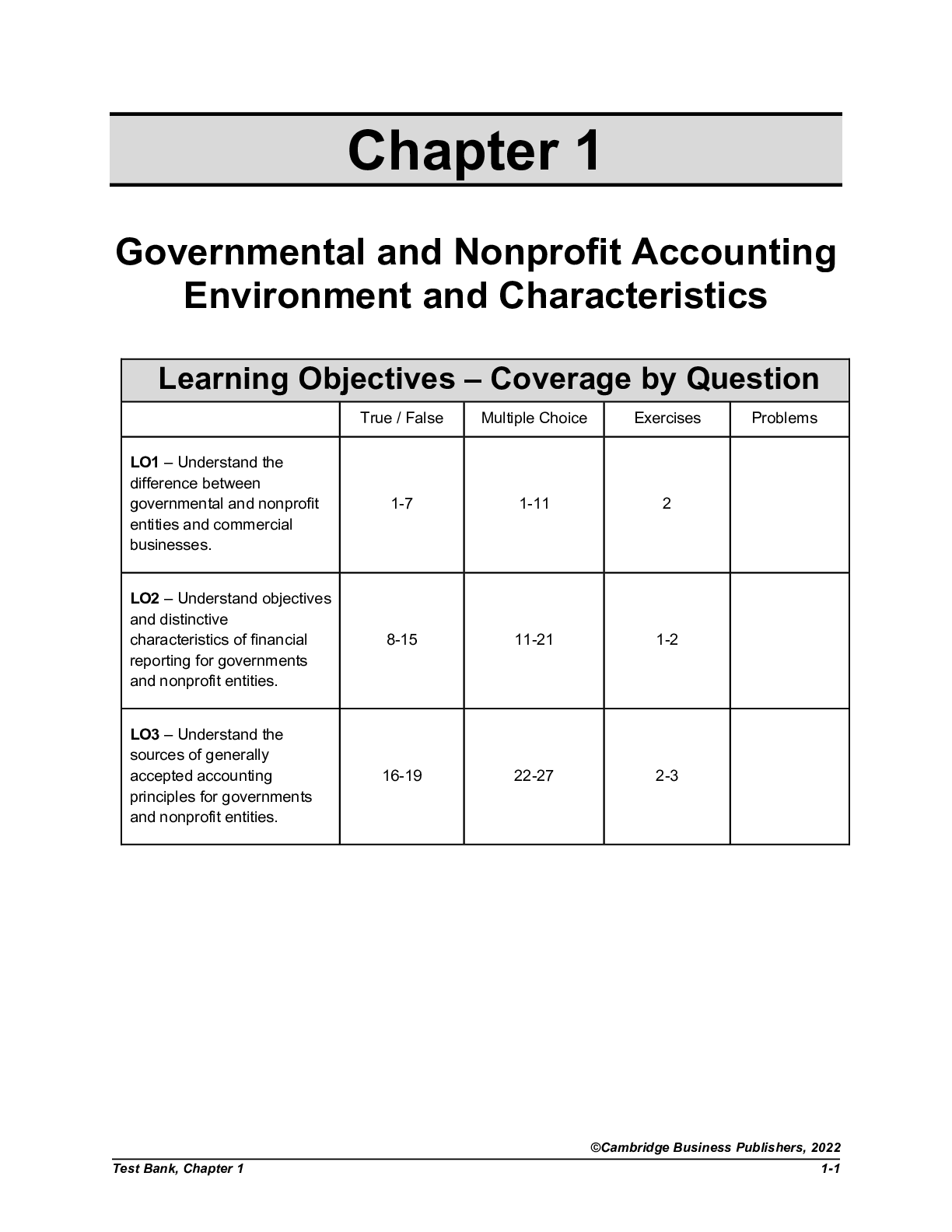

Test Bank For Accounting for Governmental & Nonprofit Entities, 18e Jacqueline Reck, Suzanne Lowensohn, Earl Wilson-1) Special purpose governments generally provide a wider range of services to their ... residents than do general purpose governments. Answer: FALSE Difficulty: 1 Easy Topic: Distinguishing Government and Not-For-Profit Organizations Learning Objective: 01-01 Identify and explain the characteristics that distinguish government and not-for-profit entities from for-profit entities. Bloom's: Remember AACSB: Knowledge Application AICPA: BB Industry 2) Examples of general purpose governments include cities, towns, and public schools that receive tax revenue to finance the services they provide. Answer: TRUE Difficulty: 1 Easy Topic: Distinguishing Government and Not-For-Profit Organizations Learning Objective: 01-01 Identify and explain the characteristics that distinguish government and not-for-profit entities from for-profit entities. Bloom's: Remember AACSB: Knowledge Application AICPA: BB Industry 3) The Governmental Accounting Standards Board (GASB) is the body authorized to establish accounting principles for all state and local governments, both general purpose and special purpose. Answer: TRUE Difficulty: 1 Easy Topic: Sources of financial reporting standards Learning Objective: 01-02 Identify the authoritative bodies responsible for setting financial reporting standards for (1) state and local governments, (2) the federal government, and (3) not-for-profit organizations. Bloom's: Remember AACSB: Knowledge Application AICPA: BB Industry 2 4) The Governmental Accounting Standards Board (GASB) is the body authorized to establish accounting principles for all government entities. Answer: FALSE Difficulty: 1 Easy Topic: Sources of financial reporting standards Learning Objective: 01-02 Identify the authoritative bodies responsible for setting financial reporting standards for (1) state and local governments, (2) the federal government, and (3) not-for-profit organizations. Bloom's: Remember AACSB: Knowledge Application AICPA: BB Industry 5) The Financial Accounting Standards Board (FASB) is the body authorized to establish accounting principles for all colleges and universities and health care entities. Answer: FALSE Difficulty: 1 Easy Topic: Sources of financial reporting standards Learning Objective: 01-02 Identify the authoritative bodies responsible for setting financial reporting standards for (1) state and local governments, (2) the federal government, and (3) not-for-profit organizations. Bloom's: Remember AACSB: Knowledge Application AICPA: BB Industry 6) Neither governments nor not-for-profit entities have residual equity that can be distributed to owners. Answer: TRUE Difficulty: 2 Medium Topic: Distinguishing Government and Not-For-Profit Organizations Learning Objective: 01-01 Identify and explain the characteristics that distinguish government and not-for-profit entities from for-profit entities. Bloom's: Understand AACSB: Knowledge Application AICPA: FN Reporting [Show More]

Last updated: 4 months ago

Preview 5 out of 524 pages

Loading document previews ...

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$16.50

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Mar 10, 2025

Number of pages

524

Written in

Additional information

This document has been written for:

Uploaded

Mar 10, 2025

Downloads

0

Views

23

_compressed.png)

.png)

.png)

.png)

.png)