Management > QUESTIONS & ANSWERS > Georgia Institute Of Technology - MGT 6203HW3_Solutions GRADED HOMEWORK #3 WITH COMPLETE ANSWERS AND (All)

Georgia Institute Of Technology - MGT 6203HW3_Solutions GRADED HOMEWORK #3 WITH COMPLETE ANSWERS AND EXPLANATIONS

Document Content and Description Below

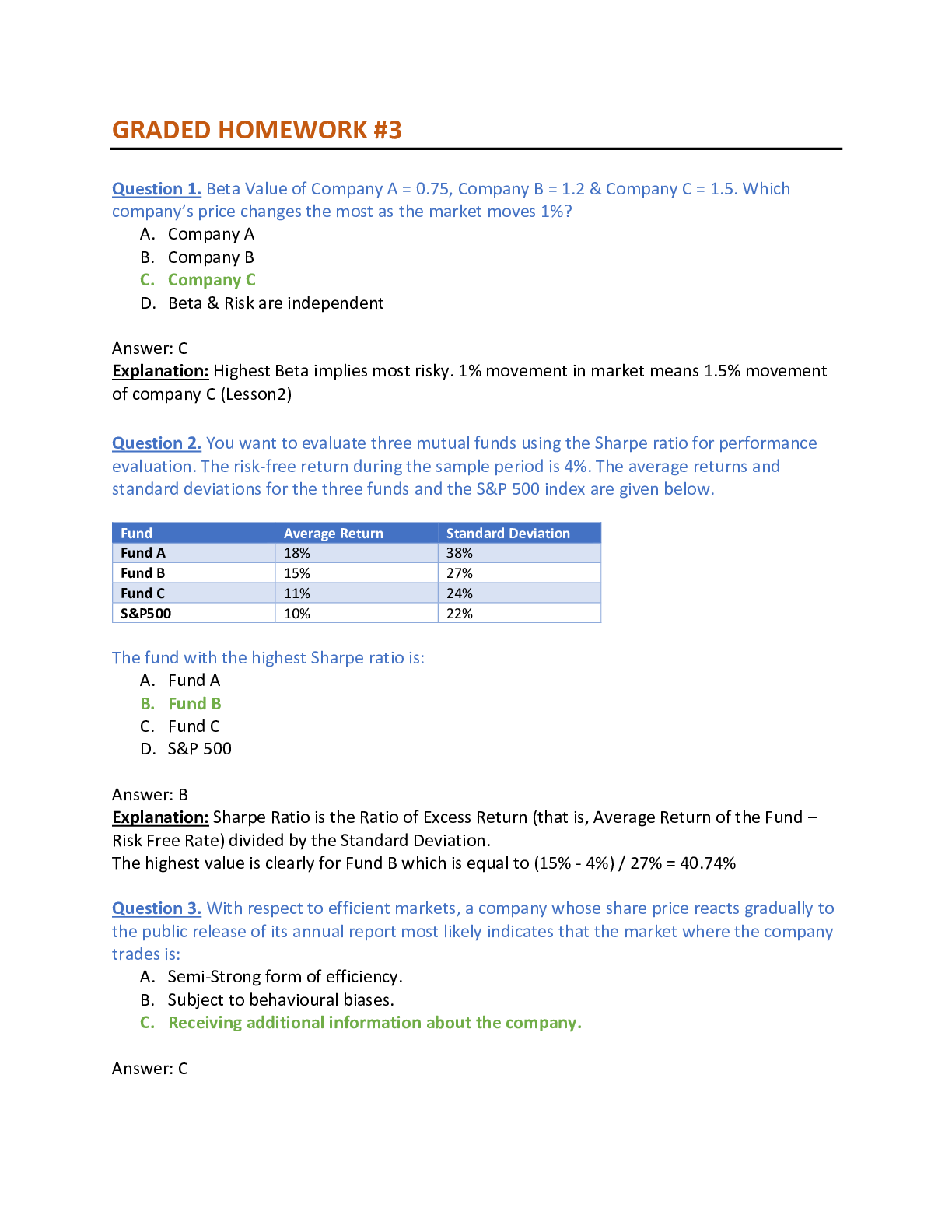

GRADED HOMEWORK #3 Question 1. Beta Value of Company A = 0.75, Company B = 1.2 & Company C = 1.5. Which company’s price changes the most as the market moves 1%? A. Company A B. Company B C. Com... pany C D. Beta & Risk are independent Answer: C Explanation: Highest Beta implies most risky. 1% movement in market means 1.5% movement of company C (Lesson2) Question 2. You want to evaluate three mutual funds using the Sharpe ratio for performance evaluation. The risk-free return during the sample period is 4%. The average returns and standard deviations for the three funds and the S&P 500 index are given below. Fund Average Return S [Show More]

Last updated: 2 years ago

Preview 1 out of 9 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$7.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Mar 28, 2021

Number of pages

9

Written in

Additional information

This document has been written for:

Uploaded

Mar 28, 2021

Downloads

0

Views

131