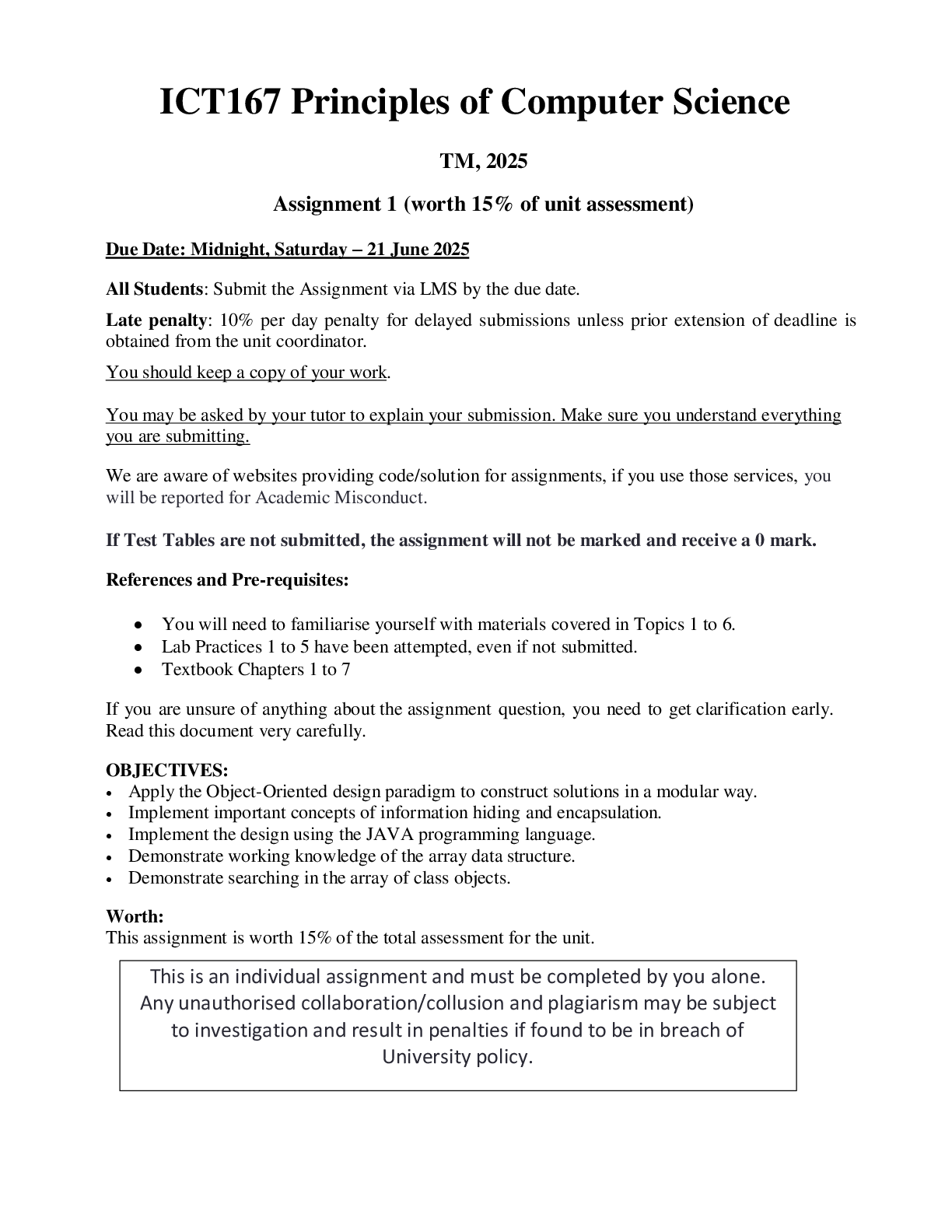

Business Law > EXAM > BSAD 4210 Test 2 | Verified with 100% Correct Answers (All)

BSAD 4210 Test 2 | Verified with 100% Correct Answers

Document Content and Description Below

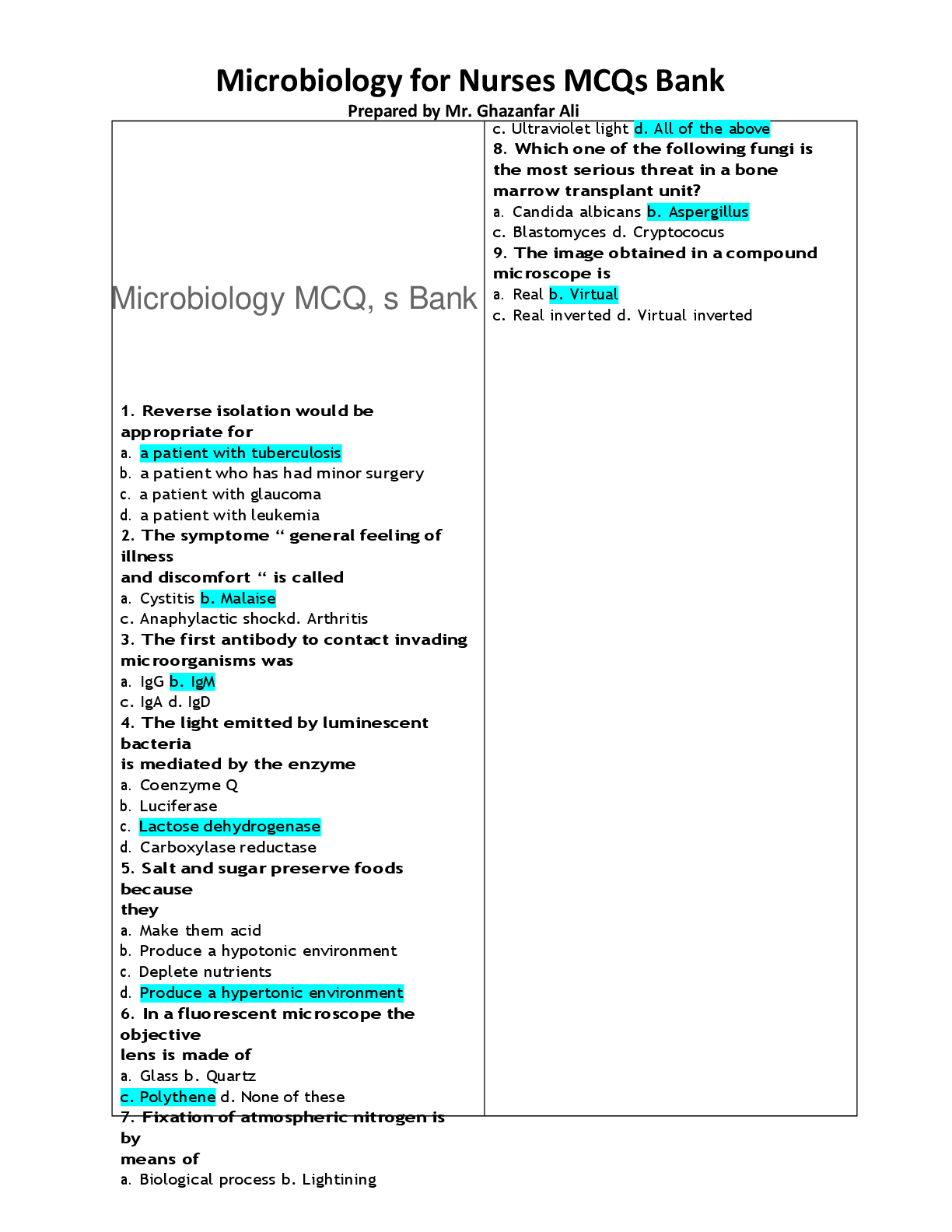

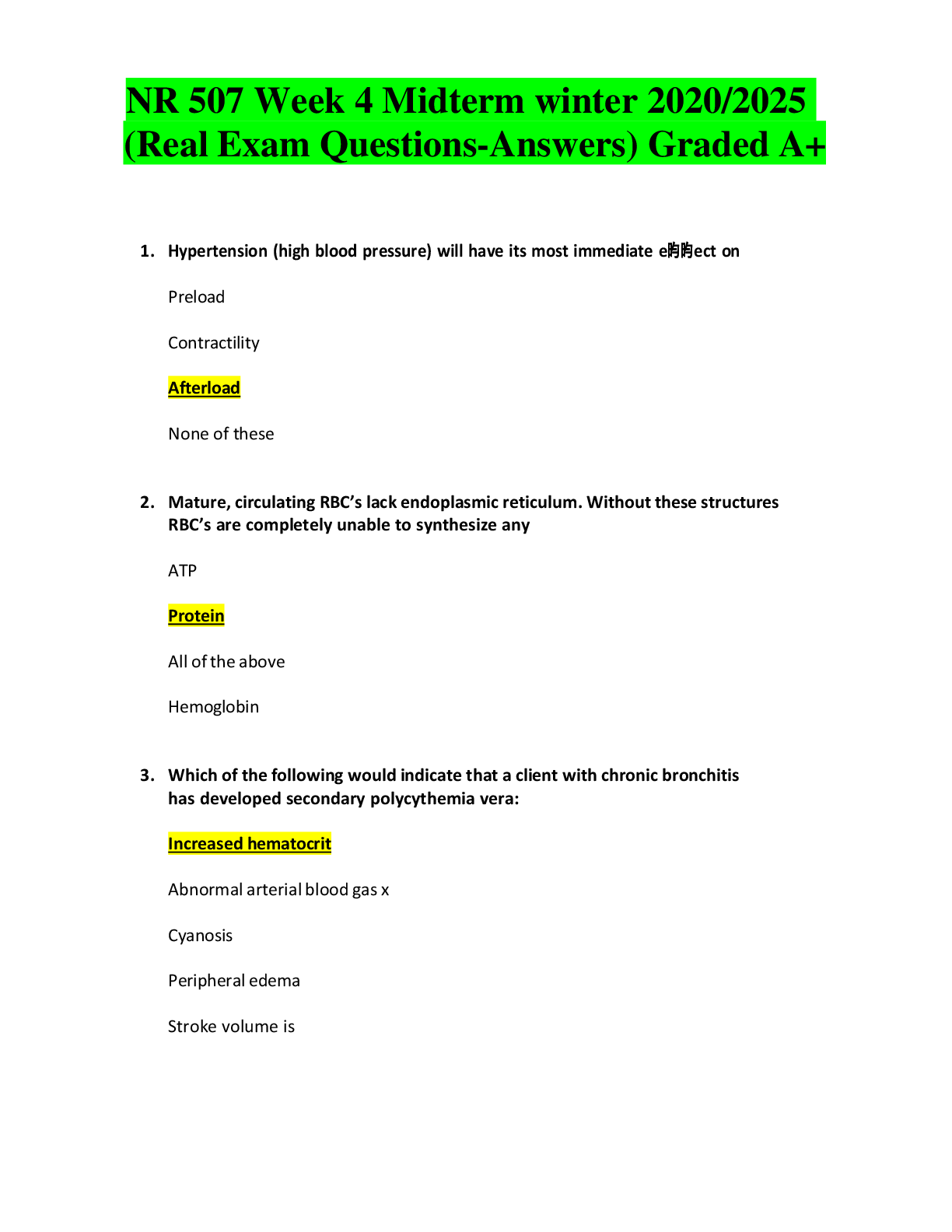

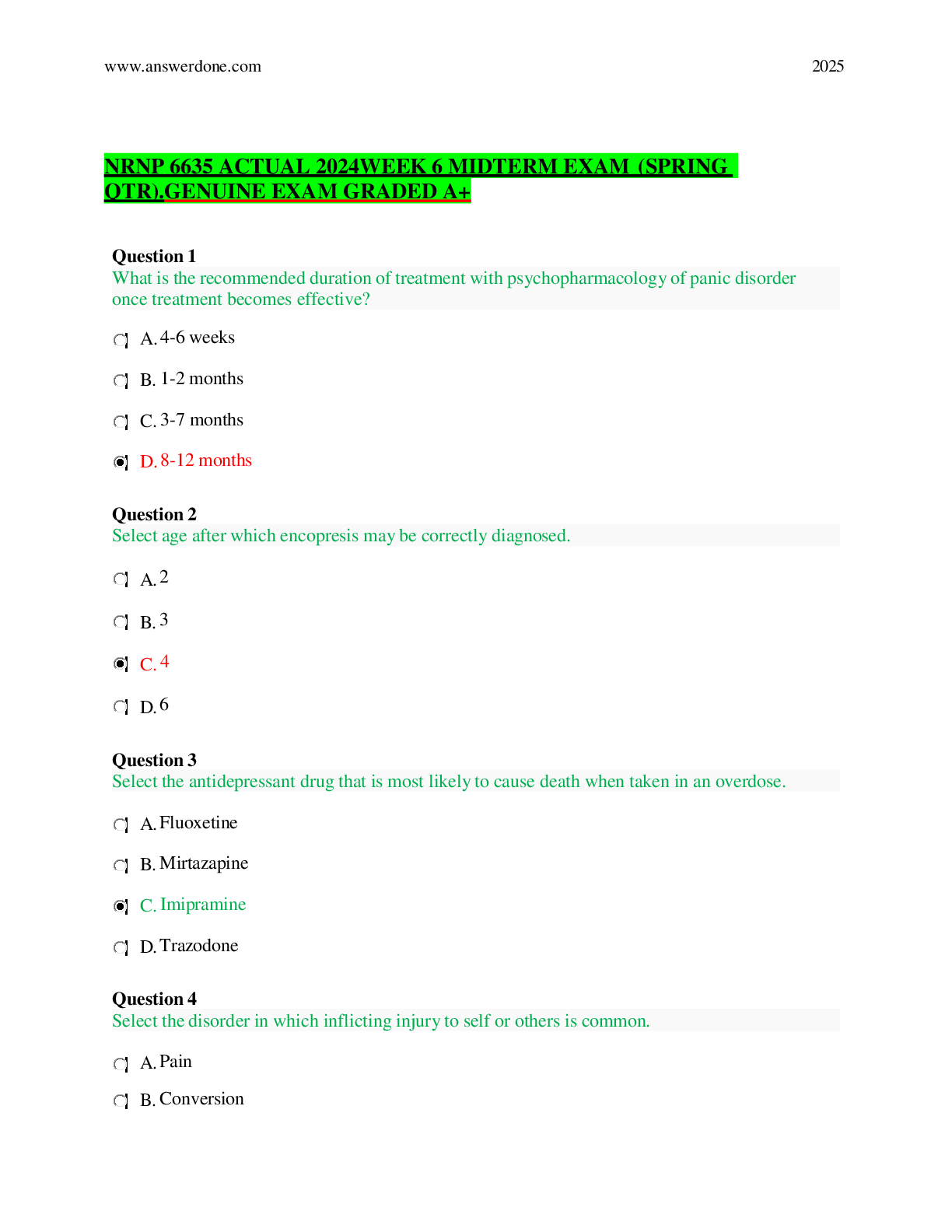

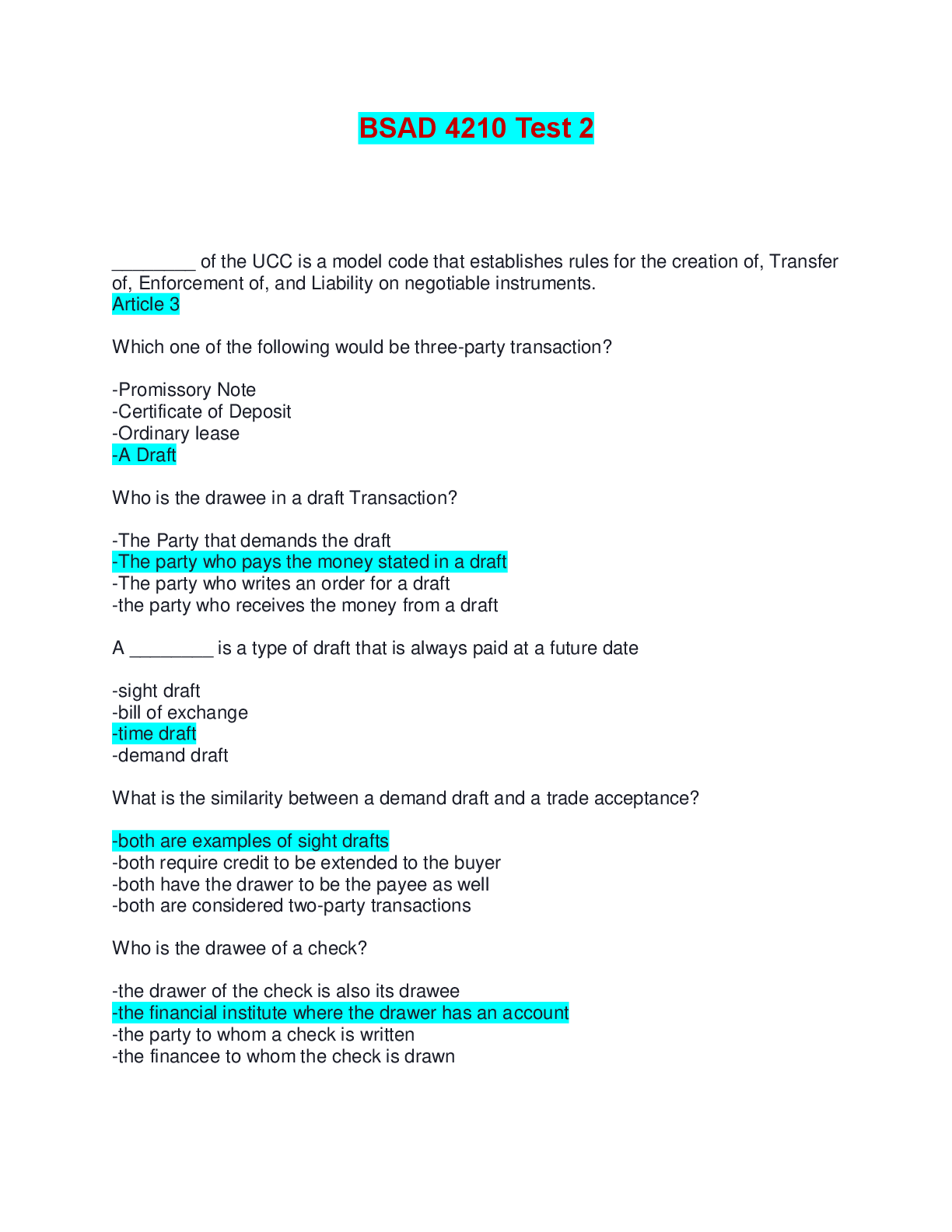

BSAD 4210 Test 2 | Verified with 100% Correct Answers ________ of the UCC is a model code that establishes rules for the creation of, Transfer of, Enforcement of, and Liability on negotiable instru ... ments. Article 3 Which one of the following would be three-party transaction? -Promissory Note -Certificate of Deposit -Ordinary lease -A Draft Who is the drawee in a draft Transaction? -The Party that demands the draft -The party who pays the money stated in a draft -The party who writes an order for a draft -the party who receives the money from a draft A ________ is a type of draft that is always paid at a future date -sight draft -bill of exchange -time draft -demand draft What is the similarity between a demand draft and a trade acceptance? -both are examples of sight drafts -both require credit to be extended to the buyer -both have the drawer to be the payee as well -both are considered two-party transactions Who is the drawee of a check? -the drawer of the check is also its drawee -the financial institute where the drawer has an account -the party to whom a check is written -the financee to whom the check is drawn If a promissory not is secured by a piece of real estate, then the note is called a(n) ____________. -collateral note -mortgage note -demand note -installment note A two-party negotiable instrument that is a special form of note created when a person deposits money at a financial institution in exchange for the institution's promise to pay back the amount of the deposit plus an agreed-upon rate of interest upon the expiration of a set time period agreed upon by the parties is known as a ________. -collateral note -check -certificate of deposit bill exchange Which of the following is a fundamental requirement for a negotiable instrument? -that it must be supplemented with interest upon payment -that it must be secured with collateral -that it must contain a drawer, drawee, and payee -that it must be in a permanent state The UCC signature requirement indicates that a negotiable instrument must be signed by _______? -a witness -the maker or drawer -the drawee -the financee Which of the following must a promissory note contain to make it negotiable? -an acknowledgement of debt -an implied promise to pay -an unconditional affirmative to pay -a promise to negotiate A promise of order is only considered negotiable if _______. -the promise or order to pay is unconditional -it states the promise or order is subject to or governed by another writing The transfer of rights under a nonnegotiable contract is known as a(n) ________. assignment The transfer of a negotiable instrument by a person other than the issuer to a person who thereby becomes a holder is referred to as ________. Negotiation Which one of the following is a similarity between bearer paper and order paper? both require delivery to be considered negotiable An instrument that is not payable to a specific payee or indorsee is known as a ________. the bearer paper Which one of the following would be a legitimate method to convert an order paper to a bearer paper? by indorsement A separate piece of paper attached to an instrument on which an indorsement is written is known as a(n) ________. Allonge ________ are required to negotiate order paper, but they are not required to negotiate bearer paper. Indorsement Which of the following indorsements can be negotiated just by delivery? Blank Indorsement Which of the following is true about an unqualified indorsement? It does not limit or disclaim liability Which of the following is true for a qualified indorsement? A qualified indorsement protect only the indorser who wrote the indorsement What happens if the name of the indorsee or payee is misspelled in an indorsement? The instrument can be indorsed with the misspelled name. An instrument that is refused payment when presented for payment is called a(n) ________. dishonored instrument Liability in which a person cannot be held contractually liable on a negotiable instrument unless his or her signature appears on the instrument is referred to as ________. Contract liability Absolute liability to pay a negotiable instrument, subject to certain universal or real defenses is known as ________. Primary liability In which of the following conditions is a drawee primarily liable to a draft? When the drawee is an acceptor to the instrument Those who are secondarily liable on negotiable instruments they endorse are known as ________. Unqualified indorser Those who disclaim liability and are not secondarily liable on instruments they endorse are referred to as ________. Qualified indorsers A person who signs an instrument and lends his or her name, and credit to another party to the instrument is referred to as a(n) ________. Accommodation Party Calvin, a college student, wants to purchase an automobile on credit from IronTilt Motors. He does not have sufficient income or the credit history to justify the extension of credit to him alone. Calvin asks his father to cosign a note to IronTilt Motors, which he does. What role does Calvin's father fulfill here so that Calvin can buy the car? An accommodation Party What kind of liability does Calvin's father come under? Primary Liability A person who authorizes an agent to sign a negotiable instrument on his or her behalf is known as a(n) ________. Principal The ________ states that a drawer or maker is liable on a forged or unauthorized indorsement if the person signing as or on behalf of a drawer or maker intends the named payee to have no interest in the instrument or when the person identified as the payee is a fabricated person. Fictitious payee rule Maria is the treasurer of Rex Caldwell Corporations. As treasurer, she makes out and signs the payroll checks for the company. Maria draws a payroll check payable to the order of her maid Carolyn Doss, who does not work for the company. Maria does not intend Carolyn to receive this money. She indorses Carolyn's name on the check and names herself as the indorsee. She cashes the check at a liquor store. Under which rule of forged instruments is Maria accountable? fictitious payee rule To which of the following placements of a negotiable instrument would transfer warranties be applicable? Indorsement of the instrument Jill Scott is an accountant with Cameron and Associates, a law firm in downtown Seattle. The firm maintains a checking account with Southern Rock Bank for its operating expenses. On the 10th of every month, Jill gets an inventory report from the office manager listing the office supplies that are needed. Jill places the appropriate orders with Office Depot and writes them a check against the office's checking account. Who is the drawee in this banking transaction? Southern Rock Bank In the above banking transaction, Cameron and Associates is the ________. Drawer Which of the following is implied when a bank certifies a check? The bank agrees to accept the check when it is presented for payment How is a cashier's check different from an ordinary check? unlike ordinary checks, cashier's checks do not require the purchaser to hold a checking account at that bank When a bank pays the holder of a properly drawn check, it is said to have ________ the check. Honored A check that has been outstanding for more than ________ is considered stale. six months Francis Jeffers purchased a cashier's check in the amount of $5,000 from Northern Star Bank. The check was made payable to Kyle Naughton and was delivered to him. Twelve months later, the Northern Star Bank branch manager informed Jeffers that the cashier's check was still outstanding. Jeffers subsequently signed a form, requesting that payment be stopped and a replacement check be issued. Northern Star Bank issued a replacement check to Jeffers. Eight months later, Naughton deposited the original cashier's check in his bank, which was paid by Northern Star Bank. Northern Star Bank requested that Jeffers repay the bank $5,000. When he refused, Northern Star Bank sued Jeffers to recover this amount and the court awarded Northern Star Bank damages amounting to $5,500. Which of the following, had it happened, would have resulted in the court ruling in Jeffers' favor? Jeffers renewed the stop-paymnet order on the original check at the end of six months In which of the following cases is an overdraft created in a drawer's account? When a properly payable check issued by the drawer is presented for payment, but the drawer's account does not have sufficient funds in it. Which of the following is an accurate description of wrongful dishonor of a check? A bank refuses to honor a properly payable check when there are sufficient funds in the drawer's account A check that has been modified without authorization and thus modifies the legal obligation of a party is known as a(n) ________. Altered check Which of the following describes a situation in which a collecting bank gives credit to a check in the collection process prior to its final settlement? provisional credit A check is finally paid when ________. the payer bank fails to dishonor the check within certain statutory time periods The term ________ refers to the computer and electronic technology that makes it possible for banks to offer electronic payment and collection systems to bank customers. Electronic Funds Transfer System (EFTS) When is credit said to have occurred? when one party gives a loan to another party Credit that requires collateral that protects payment of the loan is referred to as ________. secured credit An arrangement where an owner of real property borrows money from a lender and pledges the real property as collateral to secure the repayment of the loan is known as a(n) ________. Mortgage The ________ requires a mortgage or deed of trust to be recorded in the county recorder's office of the county in which the real property is located. Recording statute A legal procedure by which a secured creditor causes the judicial sale of the secured real estate to pay a defaulted loan is known as ________. foreclosure sale A power stated in a mortgage or deed that permits foreclosure without court proceedings and sale of the property through an auction is known as ________. power of sale To which of the following type of mortgages does the antideficiency statute apply? first purchase money mortgages [Show More]

Last updated: 6 months ago

Preview 4 out of 11 pages

Loading document previews ...

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Also available in bundle (1)

Click Below to Access Bundle(s)

BSAD 4210 TEST 2 & 3 BUNDLE

BSAD 4210 TEST 2 & 3 BUNDLE

By Ajay25 6 months ago

$16

2

Reviews( 0 )

$15.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

May 29, 2025

Number of pages

11

Written in

All

Additional information

This document has been written for:

Uploaded

May 29, 2025

Downloads

0

Views

43