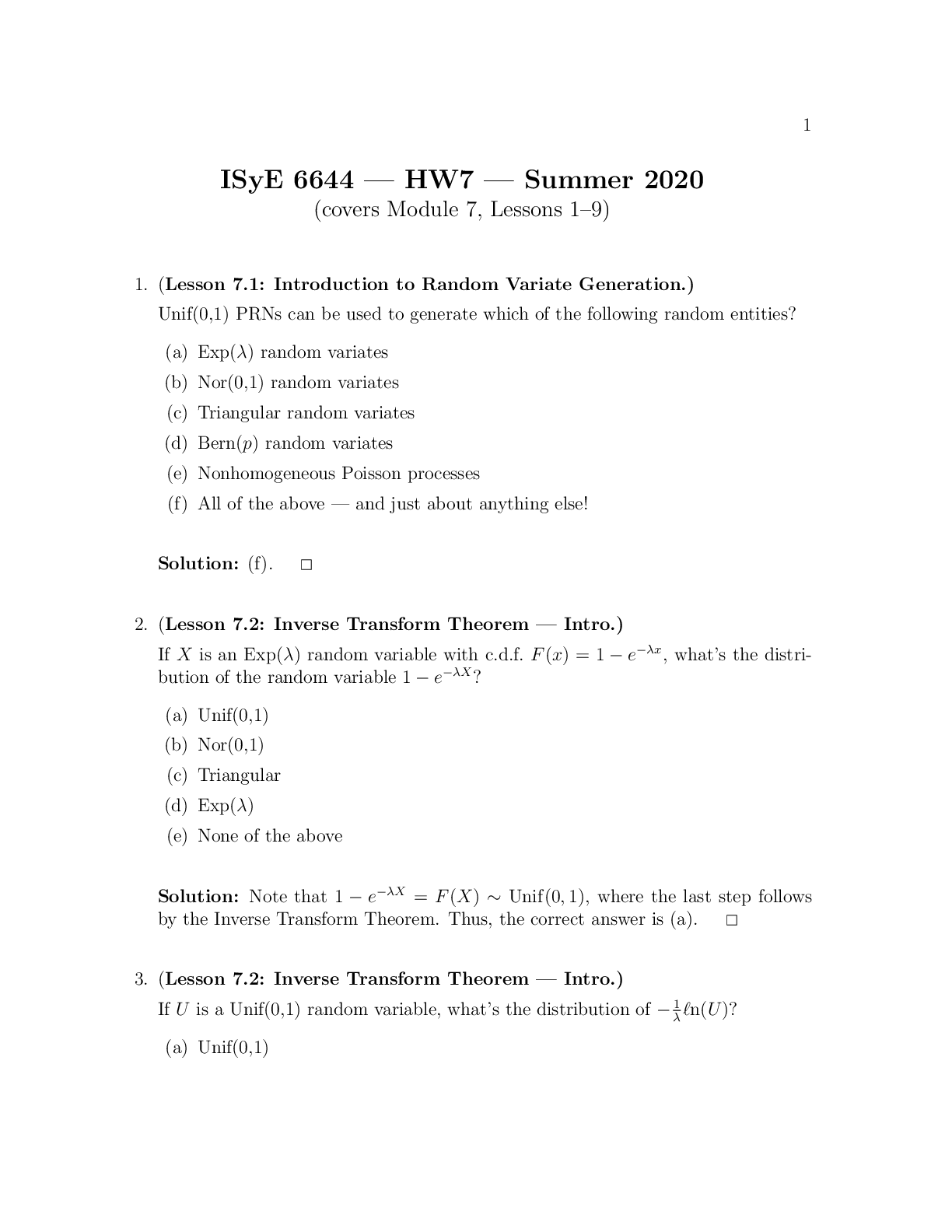

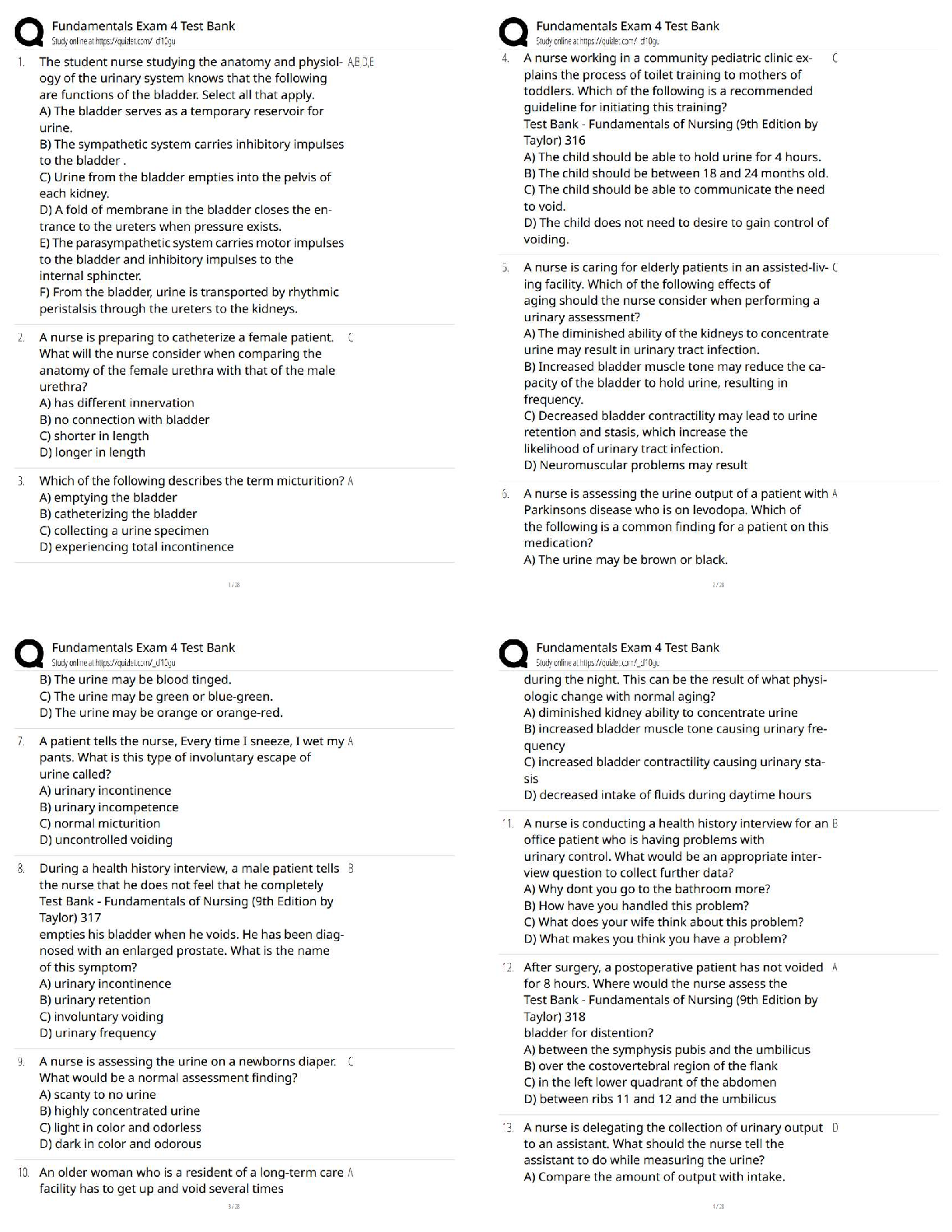

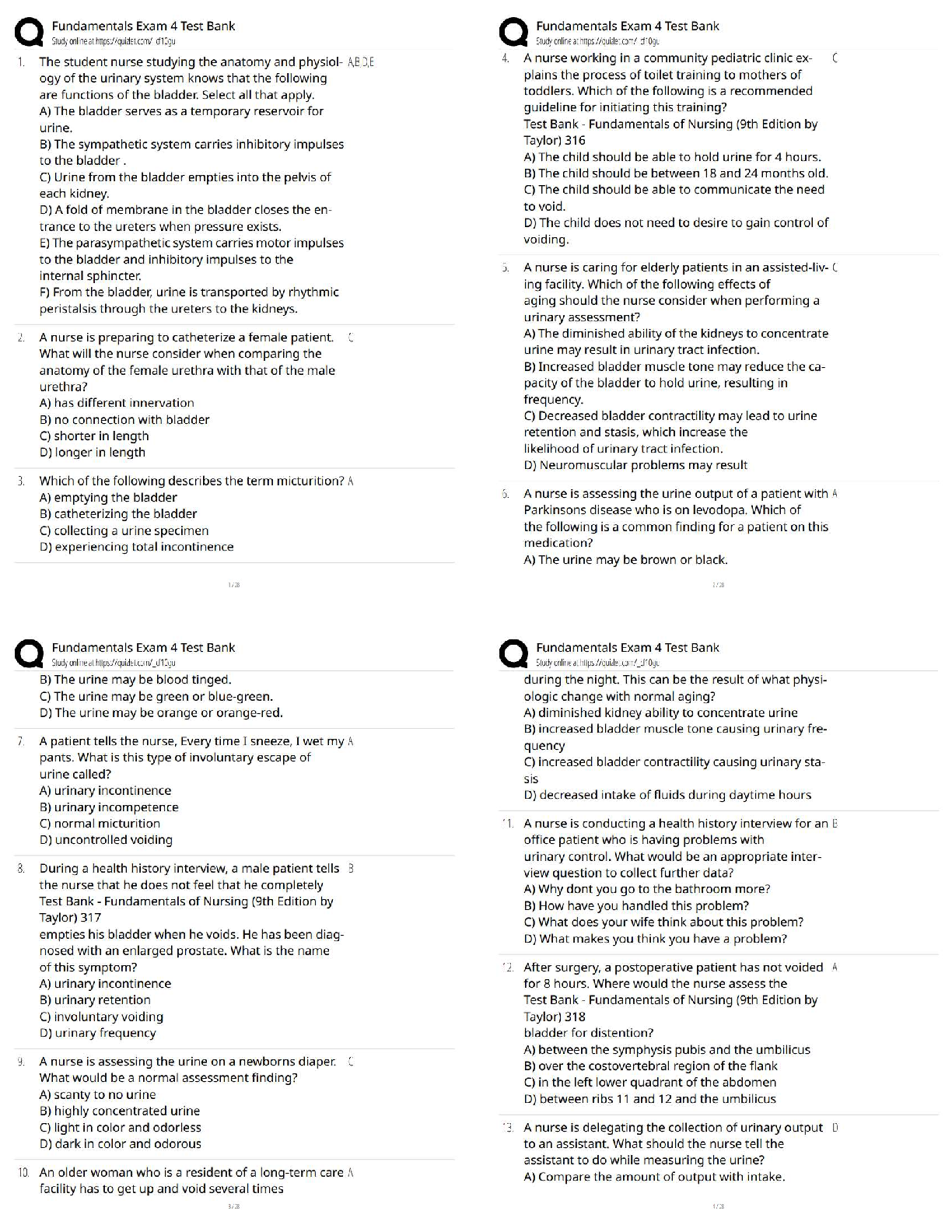

Finance > QUESTIONS & ANSWERS > tutorial question on return, risk, and security market line with solution 2 - COMM 2202tutorial ques (All)

tutorial question on return, risk, and security market line with solution 2 - COMM 2202tutorial question on return, risk, and security market line with solution 2

Document Content and Description Below

Last updated: 3 years ago

Preview 1 out of 4 pages

Instant download

.png)

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$7.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Apr 06, 2021

Number of pages

4

Written in

All

Additional information

This document has been written for:

Uploaded

Apr 06, 2021

Downloads

0

Views

92