Economics > Research Paper > Research Paper > University of New South Wales - FINS 3623; Blackstone Celeanese Simulation. (All)

Research Paper > University of New South Wales - FINS 3623; Blackstone Celeanese Simulation.

Document Content and Description Below

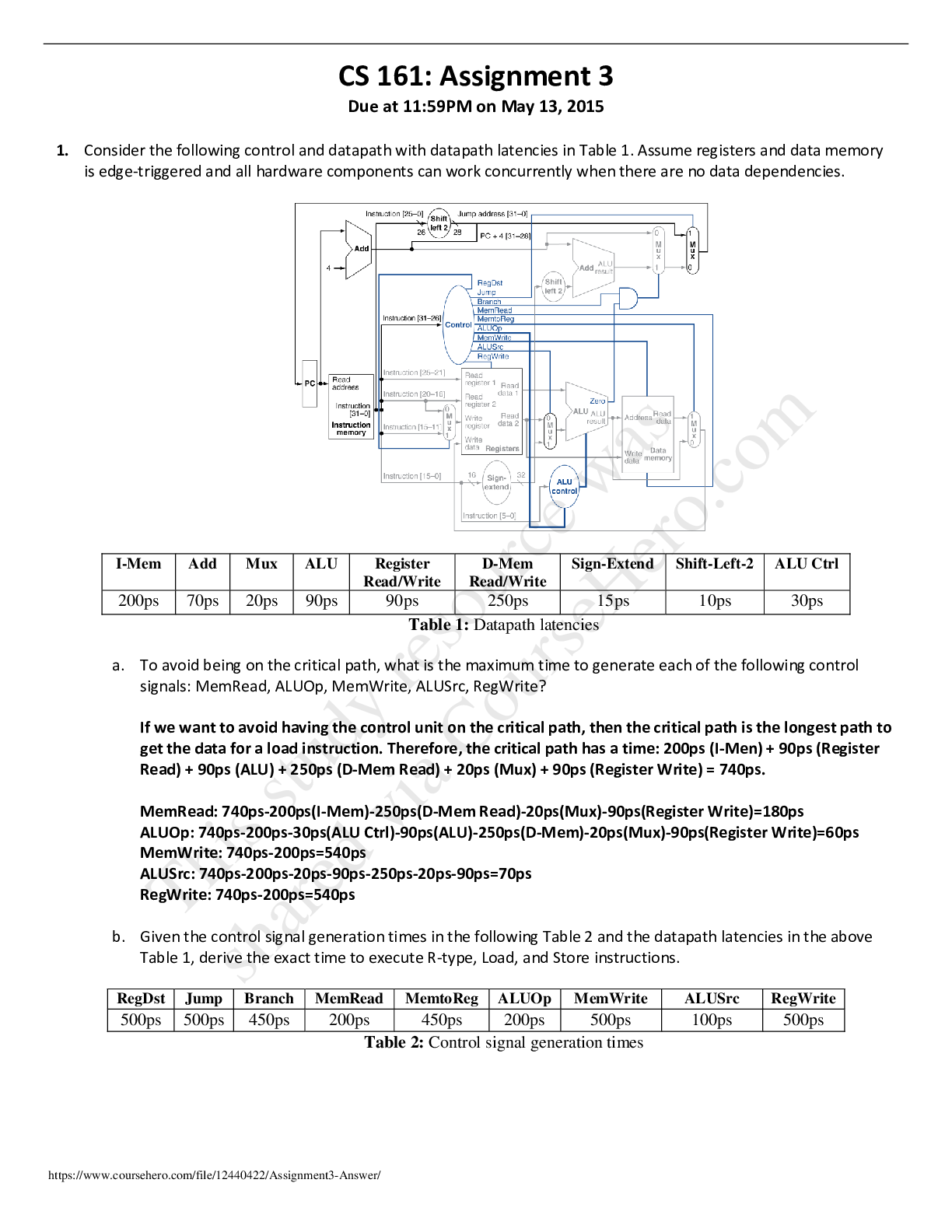

Blackstone/Celanese Simulation General Instructions Overview • A ga Celanese by Blackstone (a PE fund) • Each role has its own objective in the game: – The Blackstone objective is to get a... deal done within the parameters established by the Blackstone investment Committee – The Celanese objective is maximise value for Celanese shareholders while taking into account the interest of other stakeholders such as pension scheme members. Timeline • Before week 12 tutorial: – Register and read all background materials • First session, Week 12 tutorial, in class: Play Round 1 – Understand the simulation and conduct valuation • Second session, at home b/w classes: Play Round 2: – Both teams conduct due diligence and update valuations and reservation prices • Third session, week 13 tutorial, in class: Play Round 3 – Teams negotiate face‐to‐face in class and potentially agree to a deal. – If both parties can not agree, the simulation ends here. – If agreement is reached the deal goes back to the Celanese Board (played by the program) and the Blackstone investment committee (played by the program) for final approval. Some renegotiation may be necessary. – Regardless outcomes, the simulation will end at the conclusion of wk 13 tutorial • After week 13 – Write a reflection report (together with simulation score makes 10%) Operating Assumptions • The first item under the “Analyze” tab is the operating assumptions/forecasts for Celanese over the next 5 years. • These are the parameters that Blackstone aims to improve through their restructuring of the firm, e.g. Sales, Margins, other expenses etc. • You are in control of most of these parameters and must decide on them. • Learning how each of these variables drives the valuation of Celanese (understanding their sensitivity to valuation) will help you decide which items to spend your due diligence budget on. • The information you enter here feeds in to the valuation models and balance sheet and income s [Show More]

Last updated: 2 years ago

Preview 1 out of 19 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$9.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Apr 08, 2021

Number of pages

19

Written in

Additional information

This document has been written for:

Uploaded

Apr 08, 2021

Downloads

0

Views

128

.png)

.png)