Finance > Solutions Guide > Bloomberg Notes: Portfolio Management Strategies & Stock Analysis | complete 2025/2026. (All)

Bloomberg Notes: Portfolio Management Strategies & Stock Analysis | complete 2025/2026.

Document Content and Description Below

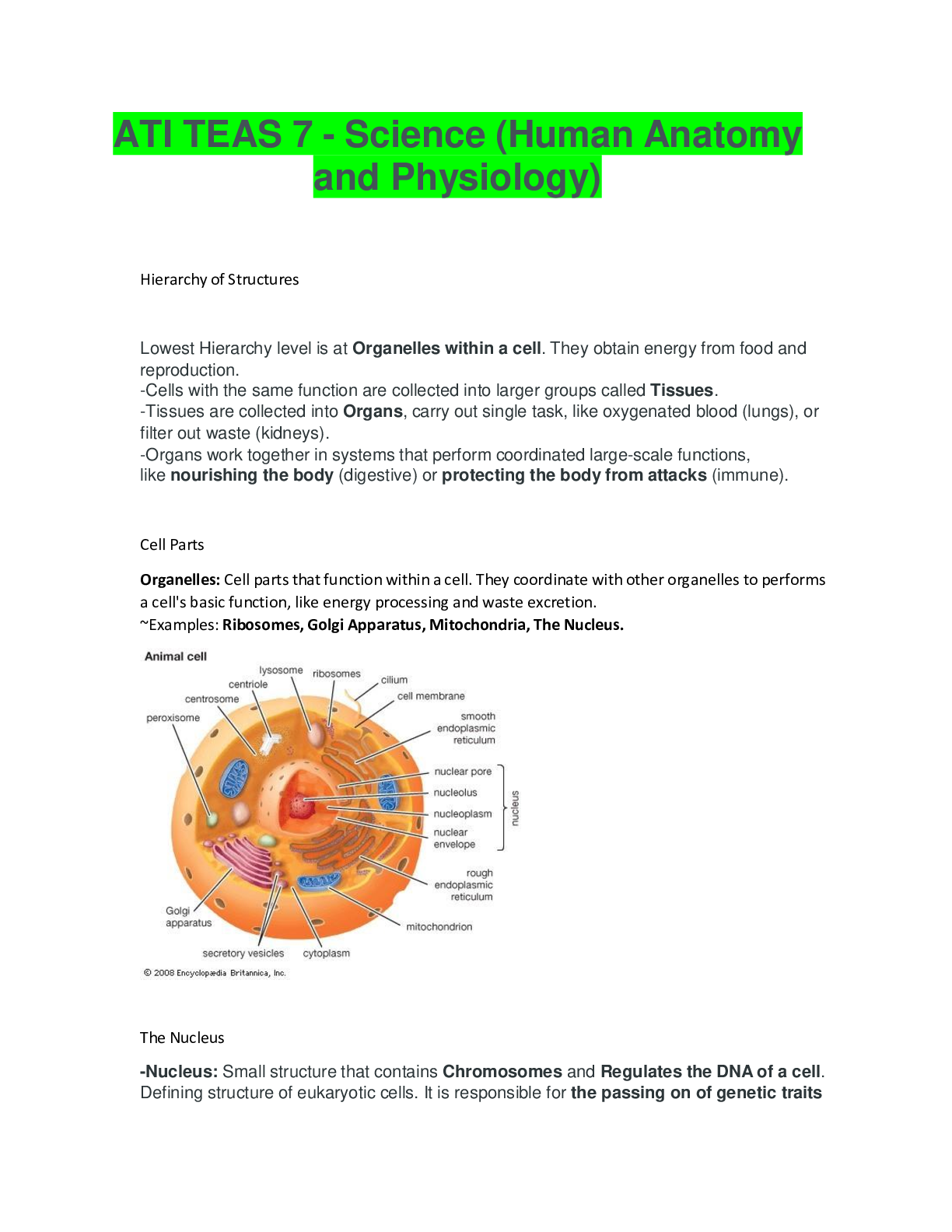

Bloomberg notes Portfolio management • Different stock o Value Stock ▪ High dividend yield, low p/e ratio ▪ Often neglected stocks that maverick investors go in to ▪ Reached the end of th... e business cycle (not growing) o Growth Stock ▪ High p/e ratio, low dividend yield ▪ Could grow but don’t have the earnings history to back this up ▪ Bigger risk that value stocks ▪ High chance of growth means investors will pay more for them o Garp stocks ▪ Target stocks in the middle ground between growth and value • Price earnings ratio o Price/eps o How much are investors willing to pay for a dollar of earnings above the stock o If eps is 2.8, and price is 374.23, then the p/e ratio is 133.7 ▪ Meaning investors are willing to pay 374.23 dollars for every 2.8 dollars of that companies earnings • 133.7 times earnings to price willing to pay o 16 is a low p/e but not to low (value) ▪ Not growing anymore, but paying regular dividends o Over 100 is high (growth) • Dividend yield o The measure of returns from a company paying dividends to its investors o Annuals dividends per share/price per share ▪ It’s a percent so times by 100 o Don’t need to pay dividends (skipping them does not affect credit score), but regular payments are a sign of stability • Could also look at price to book ratio instead of p/e raito • p/b ratio o price/book value per share o book value=(liabilities-assets on balance sheet)/shares outstanding o a measure of how much your willing to pay for a dollar of book value for that shareholders equity per share o a p/b ratio of 0.9 represents a very distressed company o p/b of less than 1 (or p/e of less than 5) is aggressive ▪ value investors go for these while everyone else is running away ▪ for a value investor, a price to book ration below 1.5 is good, while below one is distressed • Could look to invest in a company with the following parameters (value strategy) [Show More]

Last updated: 2 weeks ago

Preview 3 out of 5 pages

Loading document previews ...

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$10.50

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Jul 07, 2025

Number of pages

5

Written in

Additional information

This document has been written for:

Uploaded

Jul 07, 2025

Downloads

0

Views

12

Van Blarcom, Jeff - Wiley Series 65 Exam Review 2016 + Test Bank_ the Uniform Investment Advisor Law Examination-Wiley (2015).png)