Finance > EXAM > Midterm II Assignment / Principles of Finance / Spring 2020 ( ALL ANSWERS 100% CORRECT ) (All)

Midterm II Assignment / Principles of Finance / Spring 2020 ( ALL ANSWERS 100% CORRECT )

Document Content and Description Below

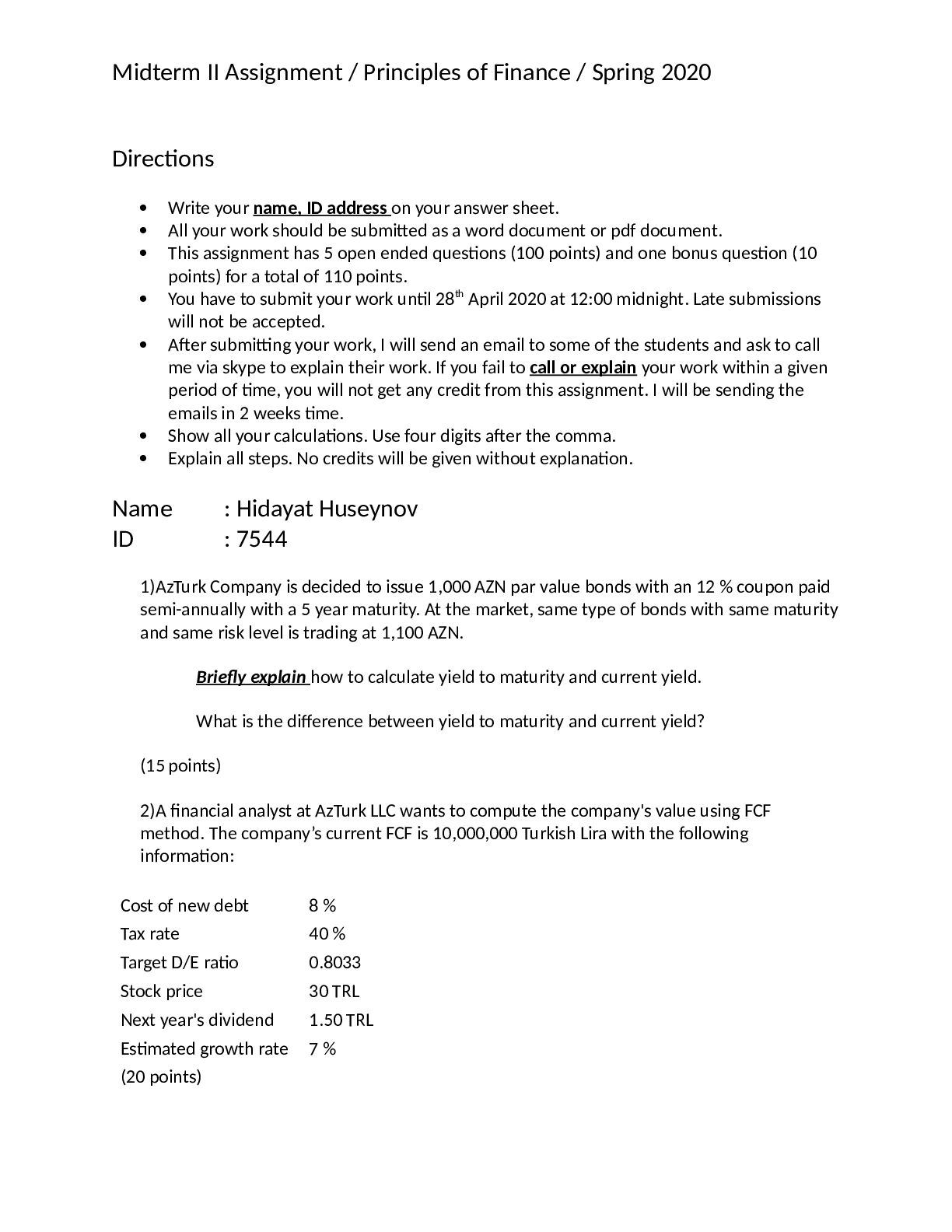

Midterm II Assignment / Principles of Finance / Spring 2020 Directions Write your name, ID address on your answer sheet. All your work should be submitted as a word document or pdf document... . This assignment has 5 open ended questions (100 points) and one bonus question (10 points) for a total of 110 points. You have to submit your work until 28th April 2020 at 12:00 midnight. Late submissions will not be accepted. After submitting your work, I will send an email to some of the students and ask to call me via skype to explain their work. If you fail to call or explain your work within a given period of time, you will not get any credit from this assignment. I will be sending the emails in 2 weeks time. Show all your calculations. Use four digits after the comma. Explain all steps. No credits will be given without explanation. Name : Hidayat Huseynov ID : 7544 1)AzTurk Company is decided to issue 1,000 AZN par value bonds with an 12 % coupon paid semi-annually with a 5 year maturity. At the market, same type of bonds with same maturity and same risk level is trading at 1,100 AZN. Briefly explain how to calculate yield to maturity and current yield. What is the difference between yield to maturity and current yield? (15 points) 2)A financial analyst at AzTurk LLC wants to compute the company's value using FCF method. The company’s current FCF is 10,000,000 Turkish Lira with the following information: Cost of new debt 8 % Tax rate 40 % Target D/E ratio 0.8033 Stock price 30 TRL Next year's dividend 1.50 TRL Estimated growth rate 7 % (20 points)Midterm II Assignment / Principles of Finance / Spring 2020 3) What is the value of the company? AzerTurk Company currently has 1.2 million common shares of stock outstanding and the stock has a beta of 1.5. It also has $10 million face value of bonds that matures ……….* and 7 % coupon with annual payments, and are priced to yield 14%. Use 30/360 convention method. Settlement date is 28 April 2020. If AzerTurk issues up to $ 2,500,000 of new bonds, the bonds will be priced at par and have a yield of 14 %; if it issues bonds beyond $2,500,000, the expected yield on the entire issuance will be 15 %. AzerTurk has known that market value of its shares are traded at the value of $10 a share and the new shares can be sold at the same price. The current risk-free rate is 3 % and the expected market return is 10 %. AzerTurk’s tax rate is 30 %. What is the WACC if AzerTurk raises $7.5 million of new capital (both equity and debt) while maintaining the same debt-to-equity ratio. * 28 April 2020 + Your ID number as number of days Example ID number = 1234 than maturity date = 28 April 2020 + 1234 days = 14 September 2023 (25 points) [Show More]

Last updated: 2 years ago

Preview 1 out of 10 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$7.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Apr 10, 2021

Number of pages

10

Written in

Additional information

This document has been written for:

Uploaded

Apr 10, 2021

Downloads

0

Views

59

.png)

.png)