FIN-516 – WEEK 4 – CHAPTER 20 - HOMEWORK_Vy Tran

(20–1) Profit or Loss on New Stock Issue

Security Brokers Inc. specializes in underwriting new issues by small firms. On a recent offering

of Beedles Inc., the terms we

...

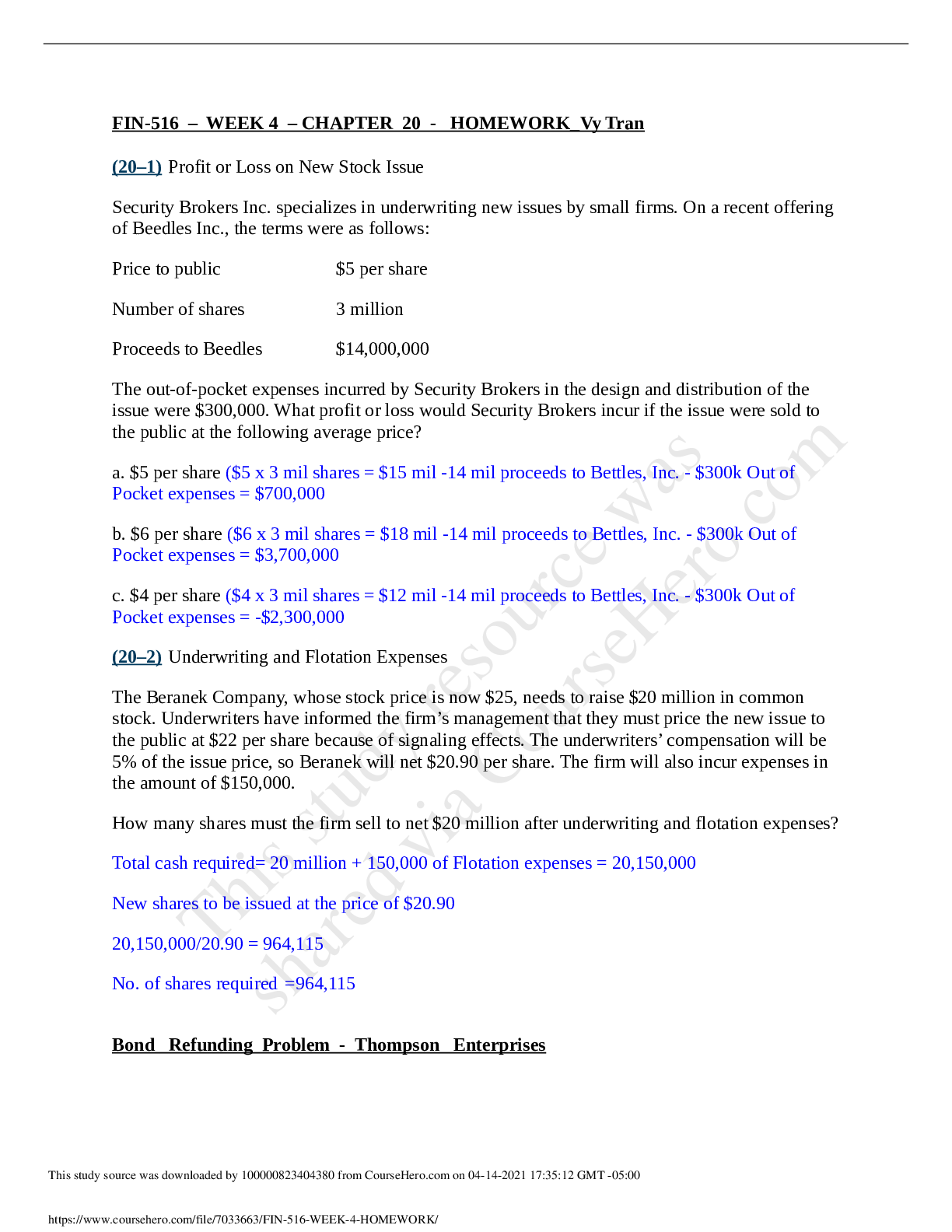

FIN-516 – WEEK 4 – CHAPTER 20 - HOMEWORK_Vy Tran

(20–1) Profit or Loss on New Stock Issue

Security Brokers Inc. specializes in underwriting new issues by small firms. On a recent offering

of Beedles Inc., the terms were as follows:

Price to public $5 per share

Number of shares 3 million

Proceeds to Beedles $14,000,000

The out-of-pocket expenses incurred by Security Brokers in the design and distribution of the

issue were $300,000. What profit or loss would Security Brokers incur if the issue were sold to

the public at the following average price?

The Beranek Company, whose stock price is now $25, needs to raise $20 million in common

stock. Underwriters have informed the firm’s management that they must price the new issue to

the public at $22 per share because of signaling effects. The underwriters’ compensation will be

5% of the issue price, so Beranek will net $20.90 per share. The firm will also incur expenses in

the amount of $150,000.

How many shares must the firm sell to net $20 million after underwriting and flotation expenses?

The company's decision of whether to call the bonds depends critically on the current interest

rate on newly issued bonds. What is the breakeven interest rate, the rate below which it would

be profitable to call in the bonds?

Face value of bonds $ 5,00,000

Maturity value =F = $ 1000

Annual coupon =12%

No of years left to maturity = n =15

Calling price of bond = $1000 +50 = $ 1050 at any time . Put this equal to the present value of

the bond

2) Adding flotation costs upfront to the market price.

[Show More]