University of the People - BUS 1102 Final Exam1

Document Content and Description Below

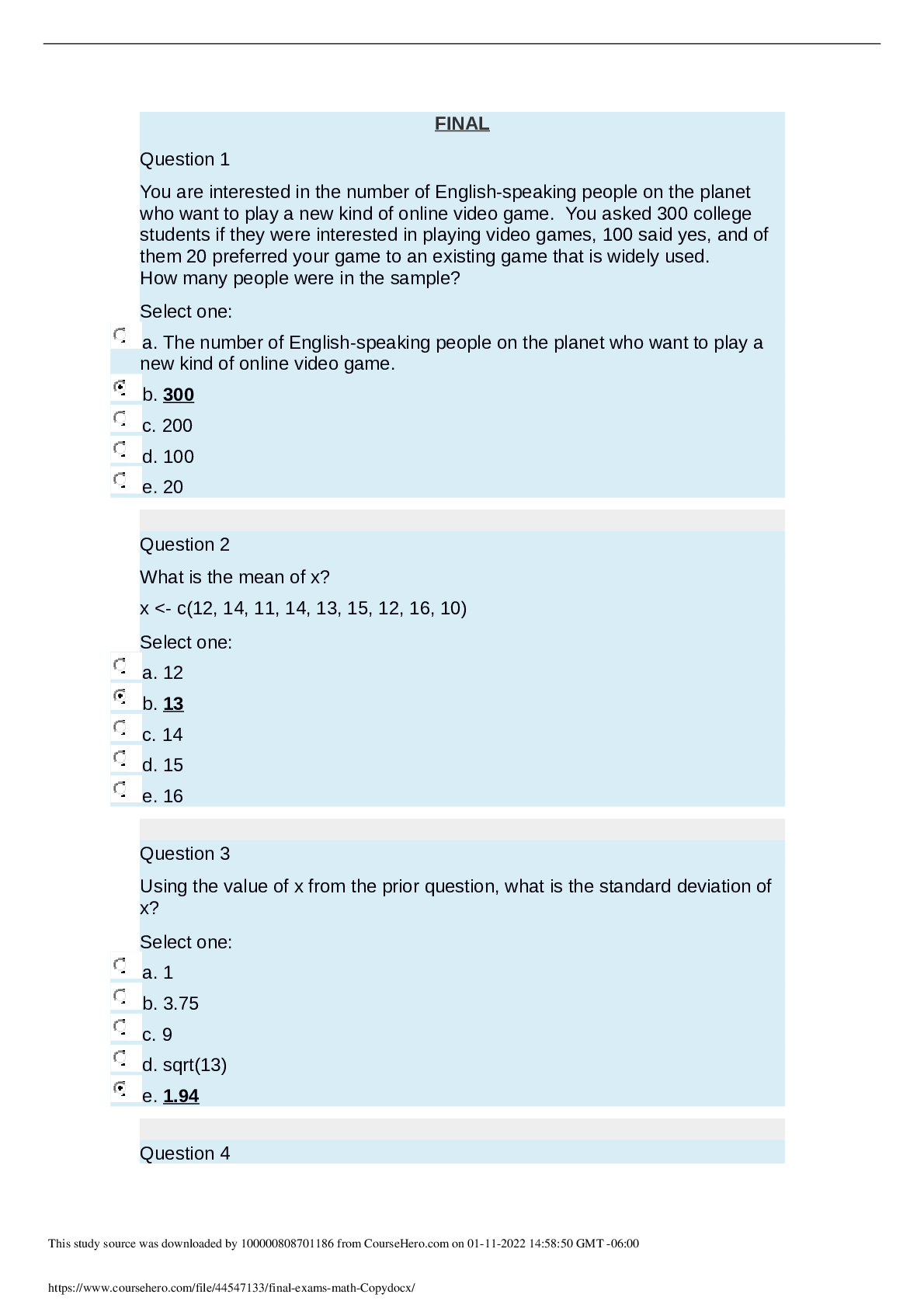

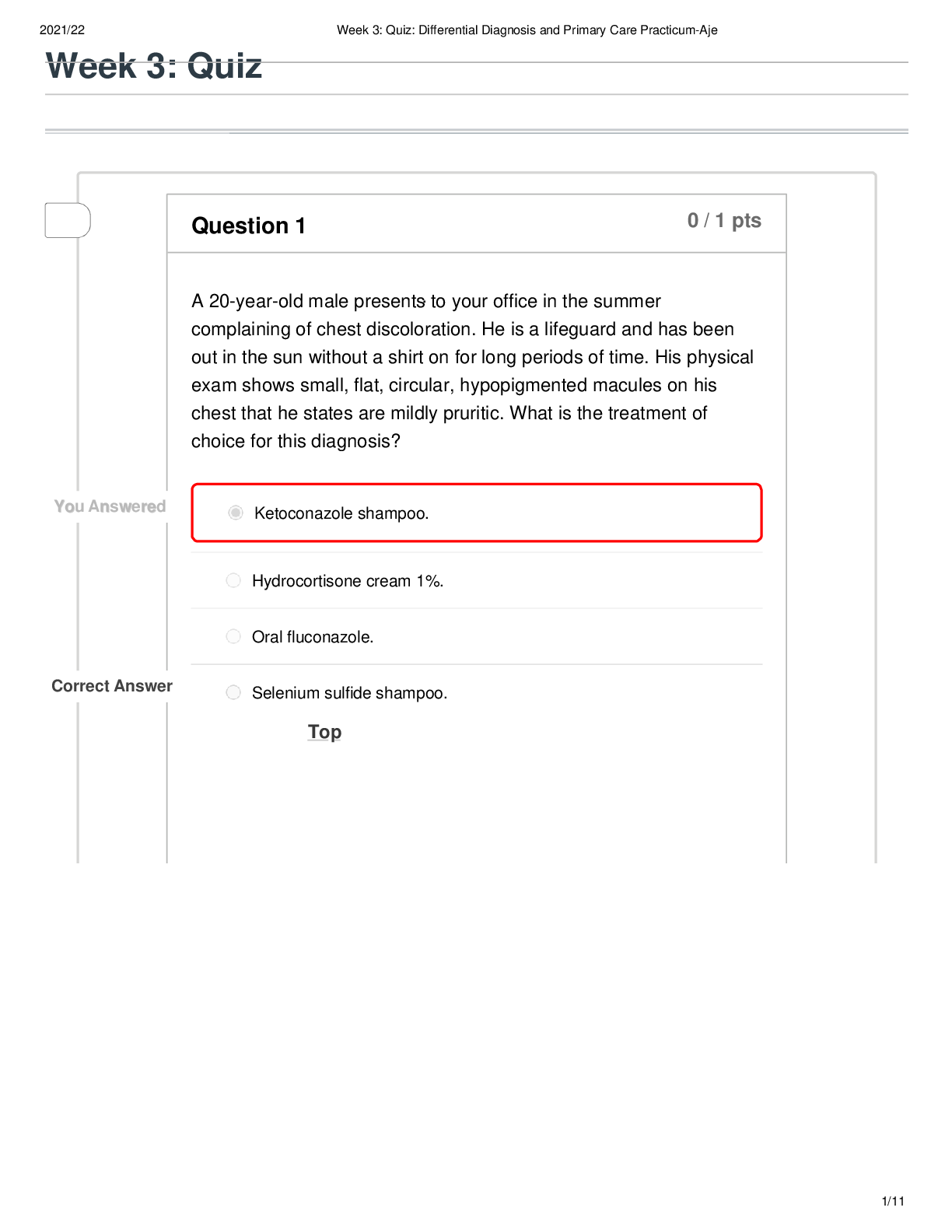

University of the People - BUS 1102 Final Exam1Shop –N-Go Systems purchased cash registers on April 1 for $6,000. If this asset has an estimated useful life of four years, what is the netbook valu... e of the cash registers on May 31 if the company uses the straightline method of depreciation? Select one: a. $125. b. $1,500. c. $6,000. d. $5,750. Which of the following would not be considered a user of nancial information? Select one: a. A large pension fund b. A real estate investor c. Company management d. All the above are considered interested in nancial information. Assets are listed on the: Select one: a. Balance sheet. b. Income statement. c. Statement of Retained Earnings. d. Statement of cash ows. BUS 1102 Basic Accounting - Term 1, 2019-2020 This study source was downloaded by 100000823831472 from CourseHero.com on 04-17-2021 17:49:08 GMT -05:00 https://www.coursehero.com/file/54397907/Final-Exam1pdf/ This study resource was shared via CourseHero.com / Question 4 Not yet answered Marked out of 1.00 Question 5 Not yet answered Marked out of 1.00 Question 6 Not yet answered Marked out of 1.00 Question 7 Not yet answered Marked out of 1.00 Merchandising companies that are small and do not use a perpetual inventory system may elect to use: Select one: a. A physical inventory system b. A periodic inventory system c. An inventory shrinkage method d. An inventory subsidiary ledger system. If total assets equal $180,000 and total liabilities equal $135,000, the total owners' equity must equal: Select one: a. $ 315,000. b. $45,000. c. Cannot be determined from the information given. d. Some other amount. The accrual of interest on a note payable will Select one: a. Reduce total liabilities. b. Increase total liabilities. c. Have no eect upon total liabilities. d. Will have no eect upon the income statement but will aect the balance sheet. Generally accepted accounting principles Select one: a. Are established by the International Accounting Standards Board b. May change over time c. Both A & B This study source was downloaded by 100000823831472 from CourseHero.com on 04-17-2021 17:49:08 GMT -05:00 d. Neither A nor B https://www.coursehero.com/file/54397907/Final-Exam1pdf/ This study resource was shared via CourseHero.com / Question 8 Not yet answered Marked out of 1.00 Question 9 Not yet answered Marked out of 1.00 Before any month-end adjustments are made, the net income of Russell Company is $66,000. However, the following adjustments are necessary: oce supplies used, $2,160; services performed for clients but not yet recorded or collected, $2,640; interest accrued on note payable to bank, $2,040. After adjusting entries are made for the items listed above, Russell Company's net income would be: Select one: a. $72,840. b. $67,560. c. $64,440. d. Some other amount. Hefty Company wants to know the eect of dierent inventory methods on nancial statements. The information provided below relates to beginning inventory and purchases for the current year: January 2 Beginning Inventory 500 units at $3.00 per unit April 7 Purchased 1,100 units at $3.20 per unit June 30 Purchased 400 units at $4.00 per unit December 7 Purchases 1,600 units at $4.40 per unit Sales during the year were 2,700 units at $5.00. If Hefty used the rst-in rst-out method, ending inventory would be: Select one: a. $2,780. b. $3,960. c. $9,700. d. $10,880. This study source was downloaded by 100000823831472 from CourseHero.com on 04-17-2021 17:49:08 GMT -05:00 https://www.coursehero.com/file/54397907/Final-Exam1pdf/ This study resource was shared via CourseHero.com / Question 10 Not yet answered Marked out of 1.00 ◀ Review Quiz Jump to... The allowance for Doubtful Accounts represents: Select one: a. Cash set aside to make up for bad debt losses b. The amount of uncollectible accounts previously written o c. The dierence between the face value of accounts receivable and the net realizable value of the accounts receivable d. The dierence between total credit sales and cash sales [Show More]

Last updated: 2 years ago

Preview 1 out of 4 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$5.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Apr 18, 2021

Number of pages

4

Written in

Additional information

This document has been written for:

Uploaded

Apr 18, 2021

Downloads

0

Views

119

.png)