Architecture > EXAM > 12535 Development Feasibility and Modelling - May 2020QuizzesONLINE TEST 1 - 2020. Correct ANswers P (All)

12535 Development Feasibility and Modelling - May 2020QuizzesONLINE TEST 1 - 2020. Correct ANswers Provided

Document Content and Description Below

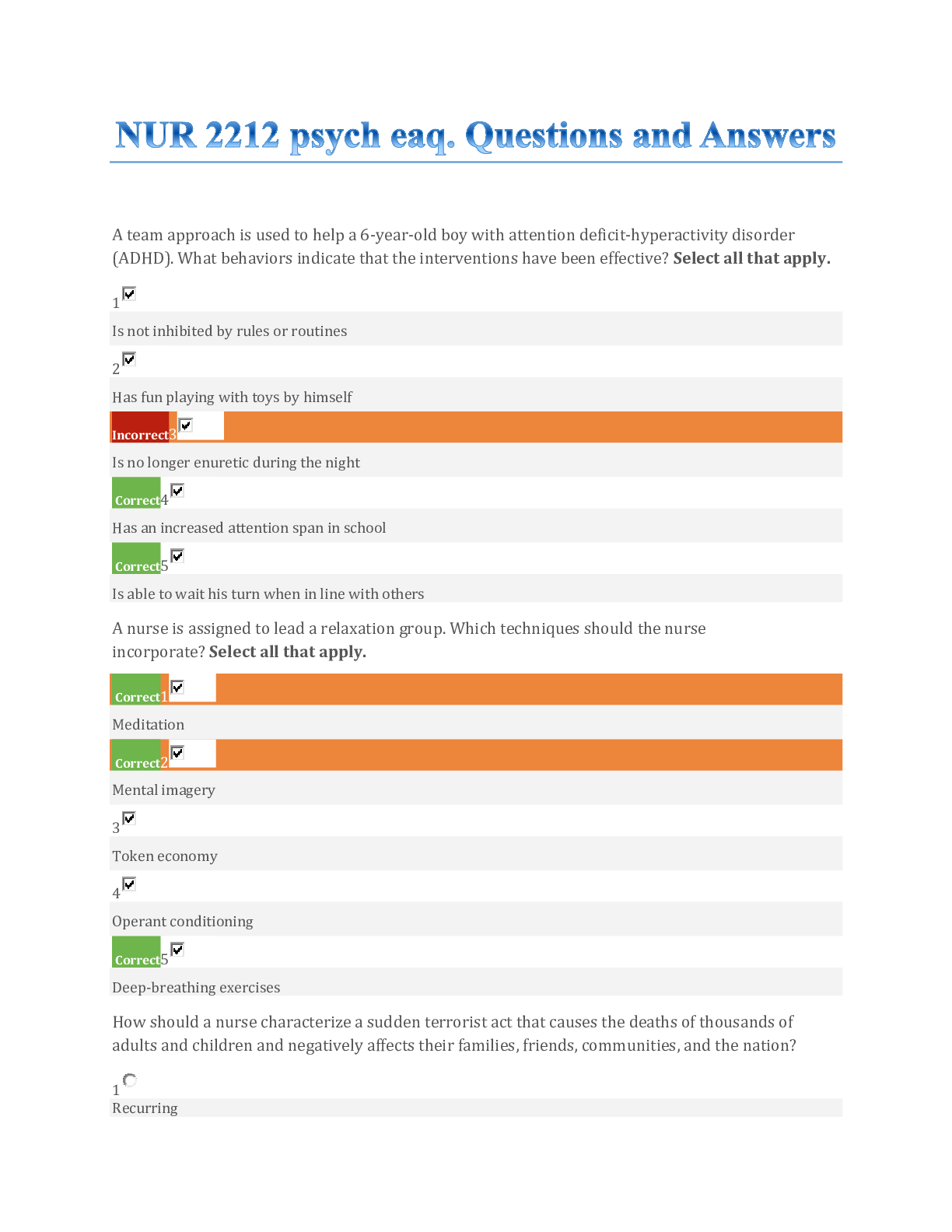

15 years ago you invested $50,000 into shares. Today the shares are worth $135,000. Calculate the annual effective rate of return you have achieved over the investment period. NOTE: Round your a ... nswer to 2 decimal places. You Answered Question 2 2 / 2 pts You invest $35,000 in an interest bearing account for 5 years where it will earn 3% interest per annum (nominal), paid monthly in arrears. How much will you have in the account at the end of five years? NOTE: Round your answer to 2 decimal places. Question 3 2 / 2 pts You have inherited some bonds due to mature in 6 years time at which point they will pay out $130,000. How much are they worth to you in today's dollars if you can earn 9% per annum (effective) in an alternate investment vehicle? NOTE: round your answer to 2 decimal places. You Answered Question 4 2 / 2 pts You have taken out a mortgage of $500,000 over 25 years, with the payments due monthly in arrears. The interest rate is 6.00% per annum (NOMINAL). Calculate the monthly payment. NOTE - Round your answer to 2 decimal places. You Answered Question 5 2 / 2 pts You have an existing mortgage loan with monthly payments in arrears. Your monthly payment is $2,400 and the mortgage has 13 years left to go. On the basis that the interest rate is 3.60% p.a nominal, how much would it cost you to pay out the mortgage today? NOTE: Round your answer to 2 decimal places. You Answered Question 6 0 / 4 pts You have an existing mortgage loan which has 6 years to go. Your payments are $ 3,000 per month (in arrears). The interest rate is 4.8% per annum (nominal). How many months sooner would you pay of the mortgage if you increased your monthly payment by $400? NOTE: Round your answer to 2 decimal places. You Answered Question 7 0 / 2 pts A sinking fund has been set up to allow for the replacement of air-conditioning plant in 7 years time. The payment into the fund was $ 50,000 per annum, paid in quarterly installments (in arrears) of $12,500. Using a discount rate of 3% per annum (nominal), calculate the forecast cost of the works at the end of year 7. NOTE: Round your answer to 2 decimal places. You Answered Question 8 0 / 2 pts A commercial strata owners corporation has established a sinking fund to ensure that $1,200,000 will be available in 8 years time. On the basis that quarterly (in arrears) sinking fund contributions are invested at 4.2% p.a (nominal), how much will each quarterly sinking fund contribution need to be? NOTE: Round your answer to 2 decimal places. You Answered Question 9 2 / 2 pts You are paying a loan with an annual nominal rate (APR) of interest of 3.6%, paid monthly. What is the annual effective rate of interest? NOTE: round your answer to 2 decimal places Correct! Question 10 0 / 2 pts A loan has been taken out on the basis of an interest rate of 5.6% Nominal at quarterly rests. What is the effective annual rate of interest? NOTE: Round your answer to 2 decimal places You Answered Question 11 0 / 2 pts The effective rate of interest on a loan is 0.25% per month. What is the effective annual rate of interest? NOTE: Round your answer to 2 decimal places You Answered Question 12 0 / 1 pts The number of rest periods need to be specified for an effective annual rate to have meaning You Answered Question 13 5 / 5 pts Calculate the Equivalent Cash Price reflected in the following sale. The contract sales price is $ 3,600,000. The deposit, released on exchange of contracts, is 30% of the contract sales price. The balance is repayable on the following terms: Interest only mortgage for the first 2 years at 9.0 % per annum (NOMINAL), paid monthly in arrears; THEN by a final payment at the end of year 2 The outside ruling interest rate is 12 % per annum (NOMINAL), with monthly discounting. NOTE: Round your answer to the nearest whole dollar [Show More]

Last updated: 3 years ago

Preview 1 out of 7 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$12.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Jun 13, 2020

Number of pages

7

Written in

All

Additional information

This document has been written for:

Uploaded

Jun 13, 2020

Downloads

0

Views

386