Finance > QUESTIONS & ANSWERS > Boston University FINANCE RISK MANAGEMENT 5 Assignment Answers (All)

Boston University FINANCE RISK MANAGEMENT 5 Assignment Answers

Document Content and Description Below

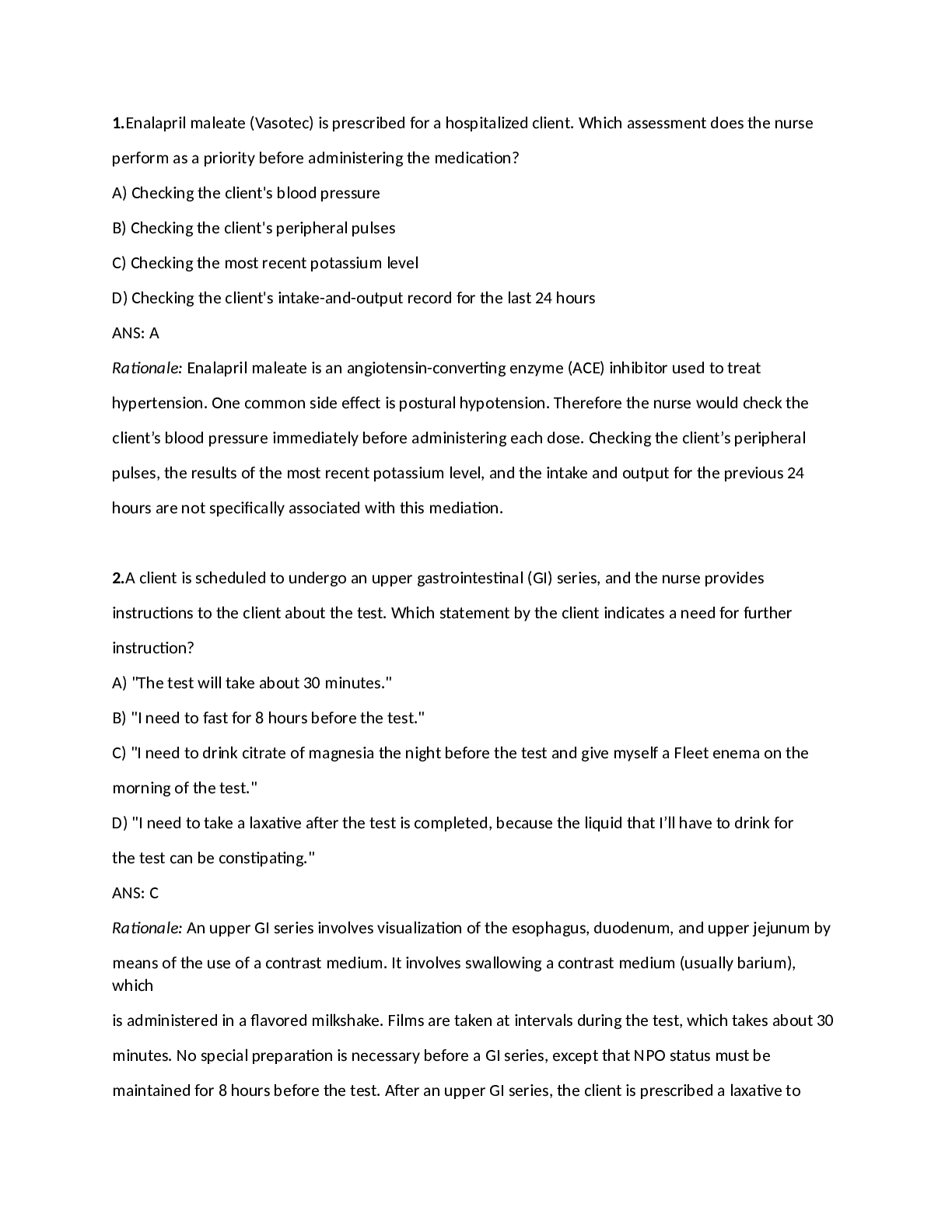

5o Assignment 1. What is the value of a European call option with an exercise price of $40 and a maturity date six months from now if the stock price is $28, the instantaneous variance of the stock ... price is 0.5 and the risk-free rate is 6%? Use both a) a two-steps binomial tree, b) the Black-Scholes pricing formula We have: So=$28, K=$40, r=0.06, σ2=0.5, Τ=0.5, and Τ/2=0.25 (for each step of the binomial tree) a) The risk-neutral probability is u d e d p r t =0.433, while ue t =1.424 and de t =0.702 The binomial tree, for a call option is the following D B E A C F We know that: fu = e-rT (p fuu + (1-p) fud) fd = e-rT (p fud + (1-p) fdd) f = e-rT (p fu + (1-p) fd) Substituting, we have for the price of the call option, c=3.06. From put-call parity, the price of the put option is p=13.87 b) We know that cS0N(d1) Xe rT N(d2) and [Show More]

Last updated: 3 years ago

Preview 1 out of 6 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$7.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Apr 22, 2021

Number of pages

6

Written in

All

Additional information

This document has been written for:

Uploaded

Apr 22, 2021

Downloads

0

Views

202