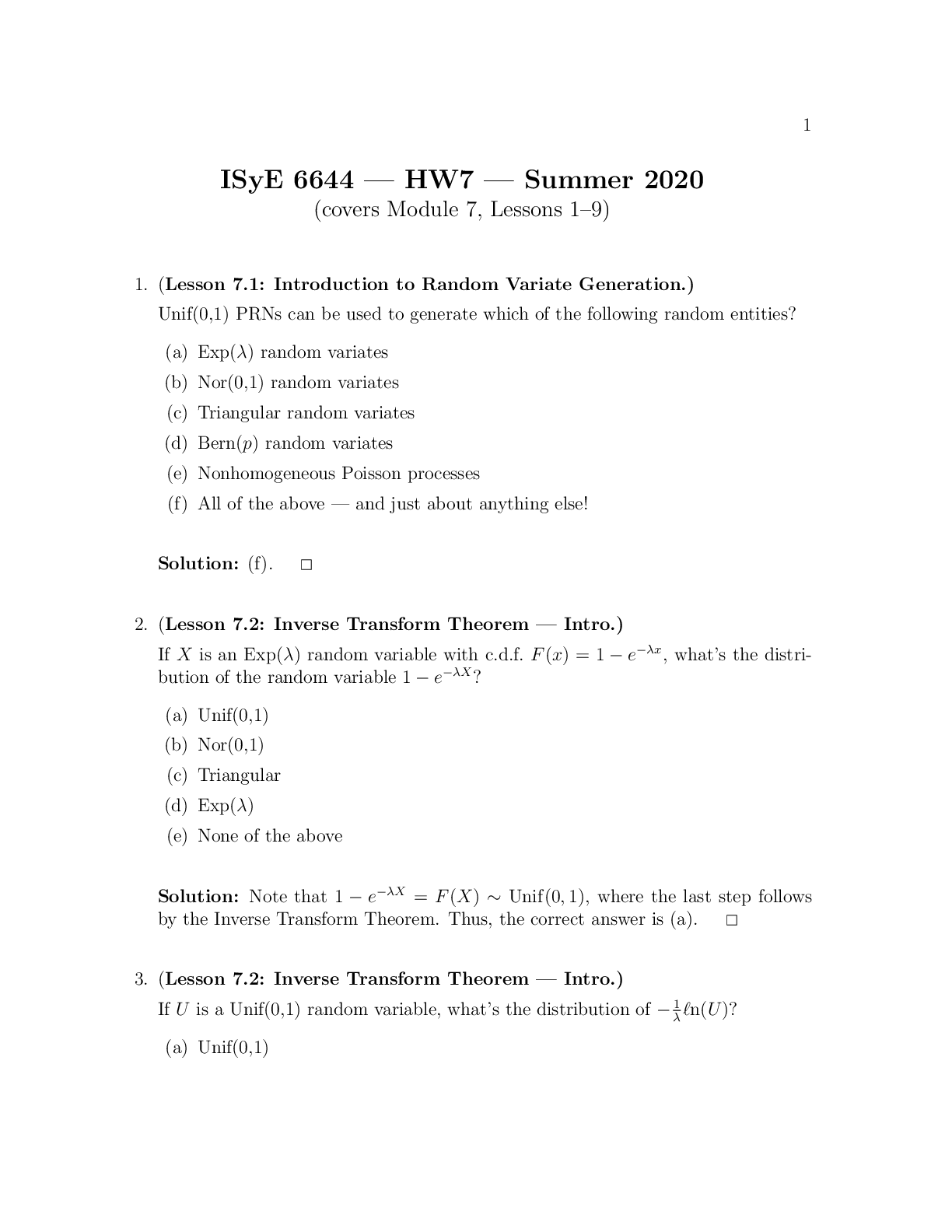

18-18 (Objective 18-3)

The following questions concern internal controls in the acquisition and payment cycle. Choose

the best response.

a. A client erroneously recorded a large purchase twice. Which of the following

...

18-18 (Objective 18-3)

The following questions concern internal controls in the acquisition and payment cycle. Choose

the best response.

a. A client erroneously recorded a large purchase twice. Which of the following internal

controls would be most likely to detect this error in a timely and efficient manner?

(1) Footing the purchases journal.

(2) Reconciling vendors’ monthly statements with subsidiary payable ledger accounts.

(3) Tracing totals from the purchases journal to the ledger accounts.

(4) Sending written quarterly confirmations to all vendors.

b. Budd, the purchasing agent of Lake Hardware Wholesalers, has a relative who owns a

retail hardware store. Budd arranged for hardware to be delivered by manufacturers to the

relative’s retail store on a COD basis, thereby enabling his relative to buy at Lake’s

wholesale prices. Budd was probably able to accomplish this because of Lake’s poor

internal control over

(1) Purchase requisitions.

(2) purchase orders.

(3) Cash receipts.

(4) Perpetual inventory records.

c. Which of the following is an internal control that will prevent paid cash disbursement

documents from being presented for payment a second time?

(1) The date on cash disbursement documents must be within a few days of the date that the

document is presented for payment.

(2) The official signing the check compares the check with the documents and should deface the

documents.

(3) Unsigned checks are prepared by individuals who are responsible for signing checks.

(4) Cash disbursement documents are approved by at least two responsible management officials.

d. Which of the following questions would be best to include in an internal control

questionnaire concerning the completeness assertion for purchases?

(1) Is an authorized purchase order required before the receiving department can accept a

shipment or the vouchers payable department can record a voucher?

(2) Are purchase requisitions prenumbered and independently matched with vendor invoices?

(3) Is the unpaid voucher file periodically reconciled with inventory records by an employee who

does not have access to purchase requisitions?(4) Are purchase orders, receiving reports, and vouchers prenumbered and periodically

accounted for?

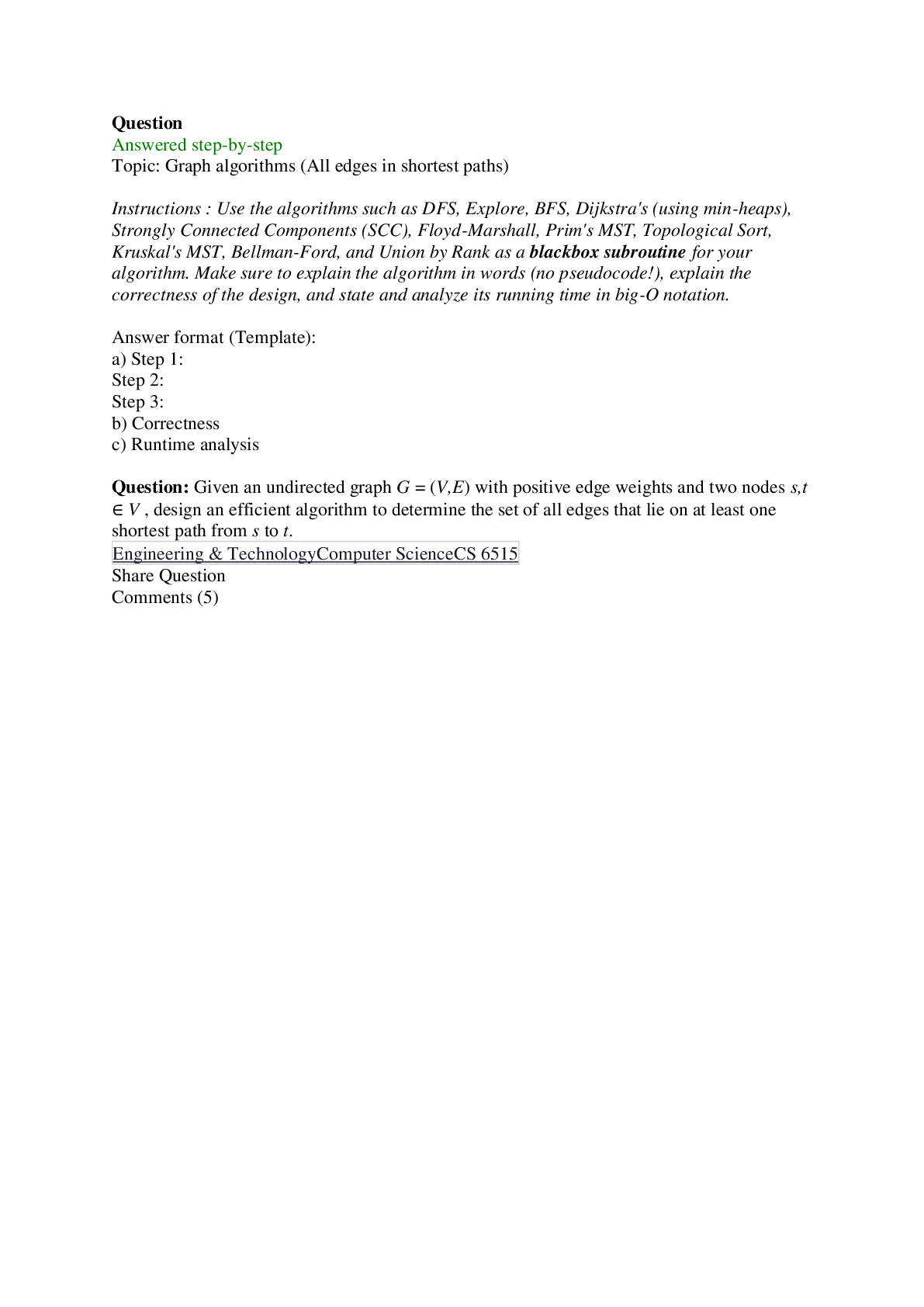

18-21 (Objective 18-3)

Questions 1 through 8 are typically found in questionnaires used by auditors to obtain an

understanding of internal control in the acquisition and payment cycle. In using the

questionnaire for a client, a “yes” response to a question indicates a possible internal

control, whereas a “no” indicates a potential deficiency.

1. Is the purchasing function performed by personnel who are independent of the receiving and

shipping functions and the payables and disbursing functions?

2. Are all vendors’ invoices routed directly to accounting from the mailroom?

3. Are all receiving reports prenumbered and the numerical sequence checked by a person

independent of check preparation?

4. Are all extensions, footings, discounts, and freight terms on vendors’ invoices checked for

accuracy?

5. Does a responsible employee review and approve the invoice account distribution before the

transaction is entered in the computer?

6. Are checks automatically posted in the cash disbursements journal as they are prepared?

7. Are all supporting documents properly cancelled at the time the checks are signed?

8. Is the custody of checks after signature and before mailing handled by an employee

independent of all payable, disbursing, cash, and general ledger functions? Required

a. For each of the preceding questions, state the transaction-related audit objective(s) being

fulfilled if the control is in effect.

b. For each internal control, list a test of control to test its effectiveness.

c. For each of the preceding questions, identify the nature of the potential financial

misstatement(s) if the control is not in effect.

d. For each of the potential misstatements in part c, list a substantive audit procedure that can be

used to determine whether a material misstatement exists.

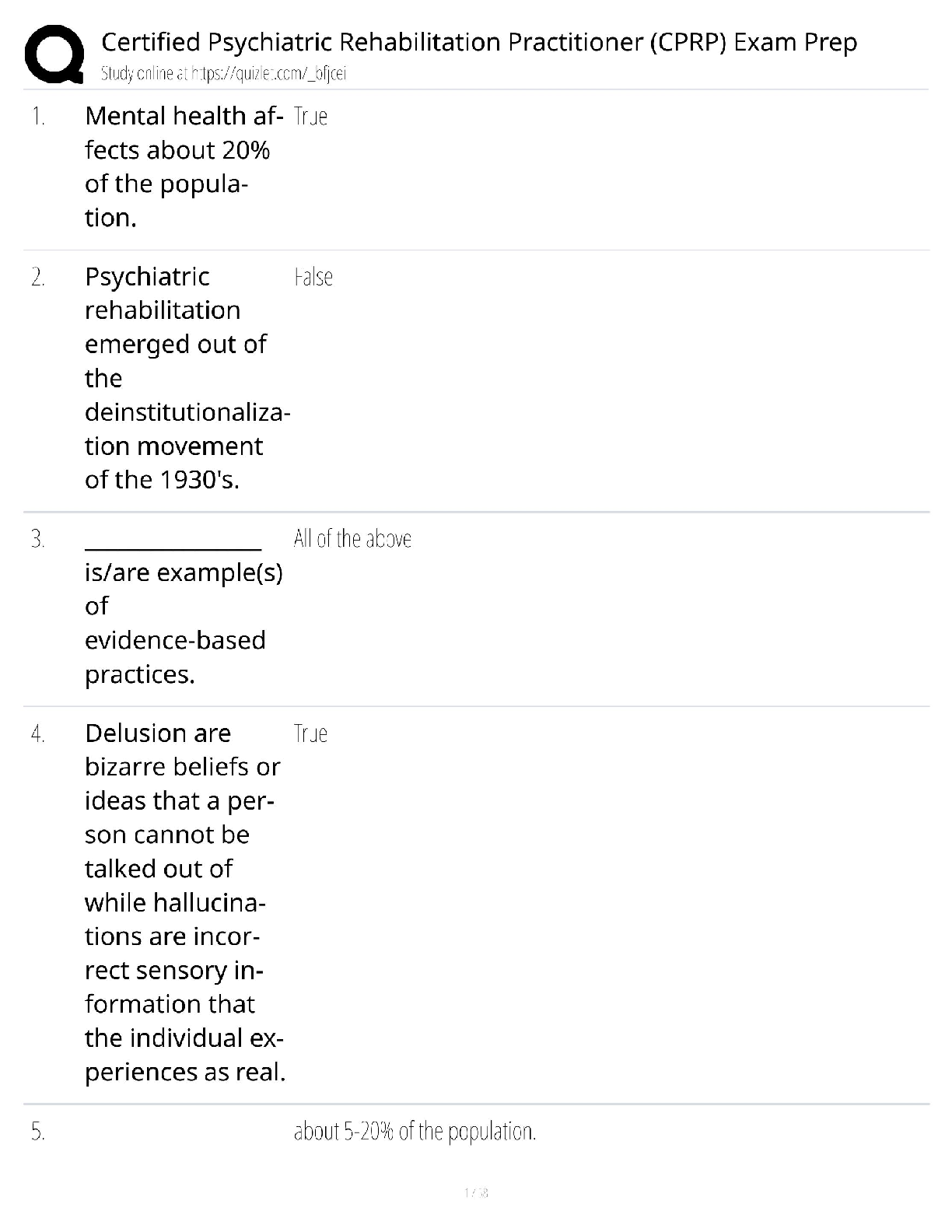

QUESTION A.

TRANSACTIO

N RELATED

B. TEST OF

CONTROL

C. POTENTIAL

MISTATEMENTS

D.SUBSTANTIVE

PROCEDUREAUDIT

OBJECTIVES

1 Recorded

acquisitions and

payments are for

goods and

services

received,

consistent with

the best interest

of the client

(occurrence)

Observe

[Show More]