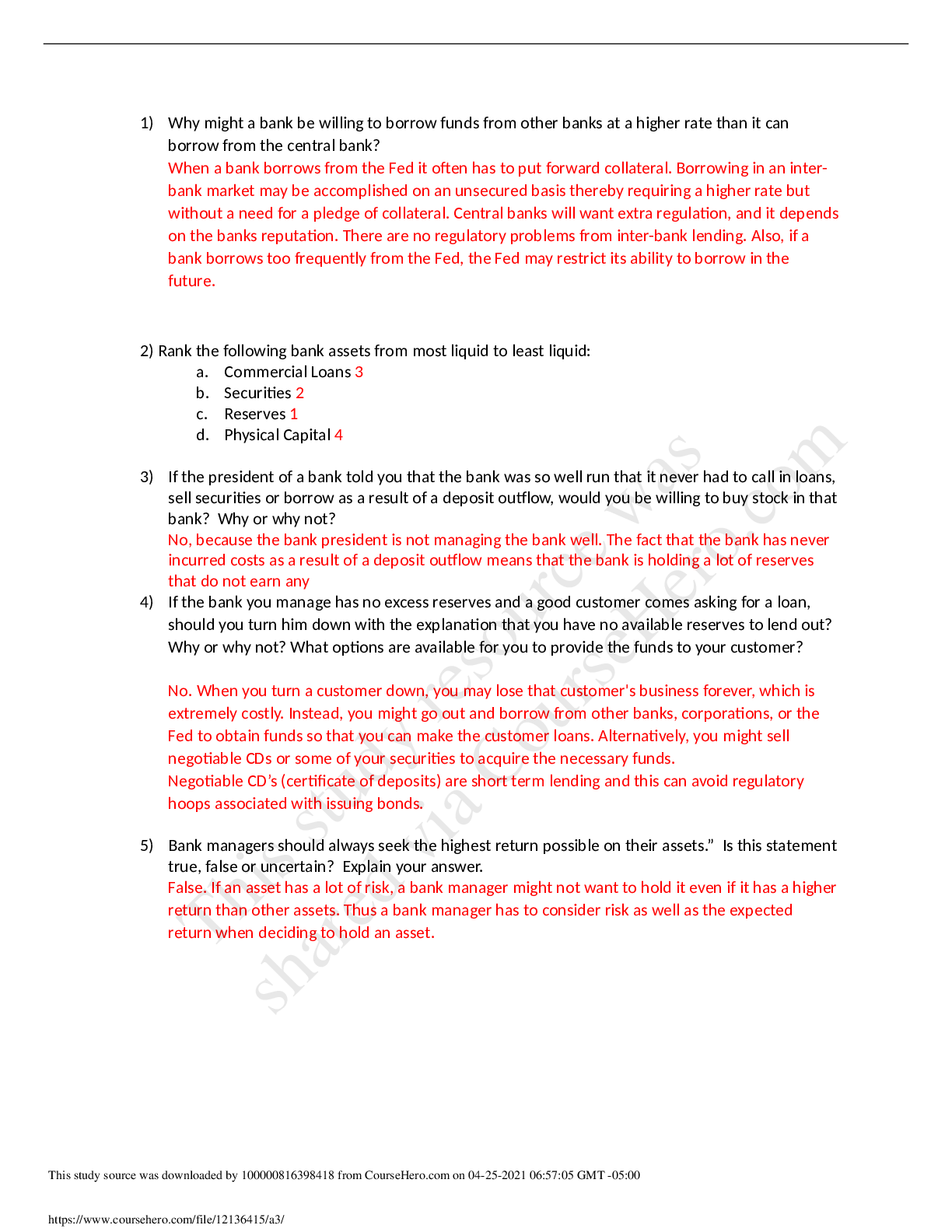

) Why might a bank be willing to borrow funds from other banks at a higher rate than it can

borrow from the central bank?

When a bank borrows from the Fed it often has to put forward collateral. Borrowing in an interba

...

) Why might a bank be willing to borrow funds from other banks at a higher rate than it can

borrow from the central bank?

When a bank borrows from the Fed it often has to put forward collateral. Borrowing in an interbank market may be accomplished on an unsecured basis thereby requiring a higher rate but

without a need for a pledge of collateral. Central banks will want extra regulation, and it depends

on the banks reputation. There are no regulatory problems from inter-bank lending. Also, if a

bank borrows too frequently from the Fed, the Fed may restrict its ability to borrow in the

future.

2) Rank the following bank assets from most liquid to least liquid:

a. Commercial Loans 3

b. Securities 2

c. Reserves 1

d. Physical Capital 4

3) If the president of a bank told you that the bank was so well run that it never had to call in loans,

sell securities or borrow as a result of a deposit outflow, would you be willing to buy stock in that

bank? Why or why not?

No, because the bank president is not managing the bank well. The fact that the bank has never

incurred costs as a result of a deposit outflow means that the bank is holding a lot of reserves

that do not earn any

4) If the bank you manage has no excess reserves and a good customer comes asking for a loan,

should you turn him down with the explanation that you have no available reserves to lend out?

Why or why not? What options are available for you to provide the funds to your customer?

No. When you turn a customer down, you may lose that customer's business forever, which is

extremely costly. Instead, you might go out and borrow from other banks, corporations, or the

Fed to obtain funds so that you can make the customer loans. Alternatively, you might sell

negotiable CDs or some of your securities to acquire the necessary funds.

Negotiable CD’s (certificate of deposits) are short term lending and this can avoid regulatory

hoops associated with issuing bonds.

5) Bank managers should always seek the highest return possible on their assets.” Is this statement

true, false or uncertain? Explain your answer.

False. If an asset has a lot of risk, a bank manager might not want to hold it even if it has a higher

return than other assets. Thus a bank manager has to consider risk as well as the expected

return when deciding to hold an asset

[Show More]