Finance > QUESTIONS & ANSWERS > University of MelbourneFNCE 9006 ALL ANSWERS CORRECT EDITED BY EXPERTS. DOWNLOAD TO SCORE A!!! (All)

University of MelbourneFNCE 9006 ALL ANSWERS CORRECT EDITED BY EXPERTS. DOWNLOAD TO SCORE A!!!

Document Content and Description Below

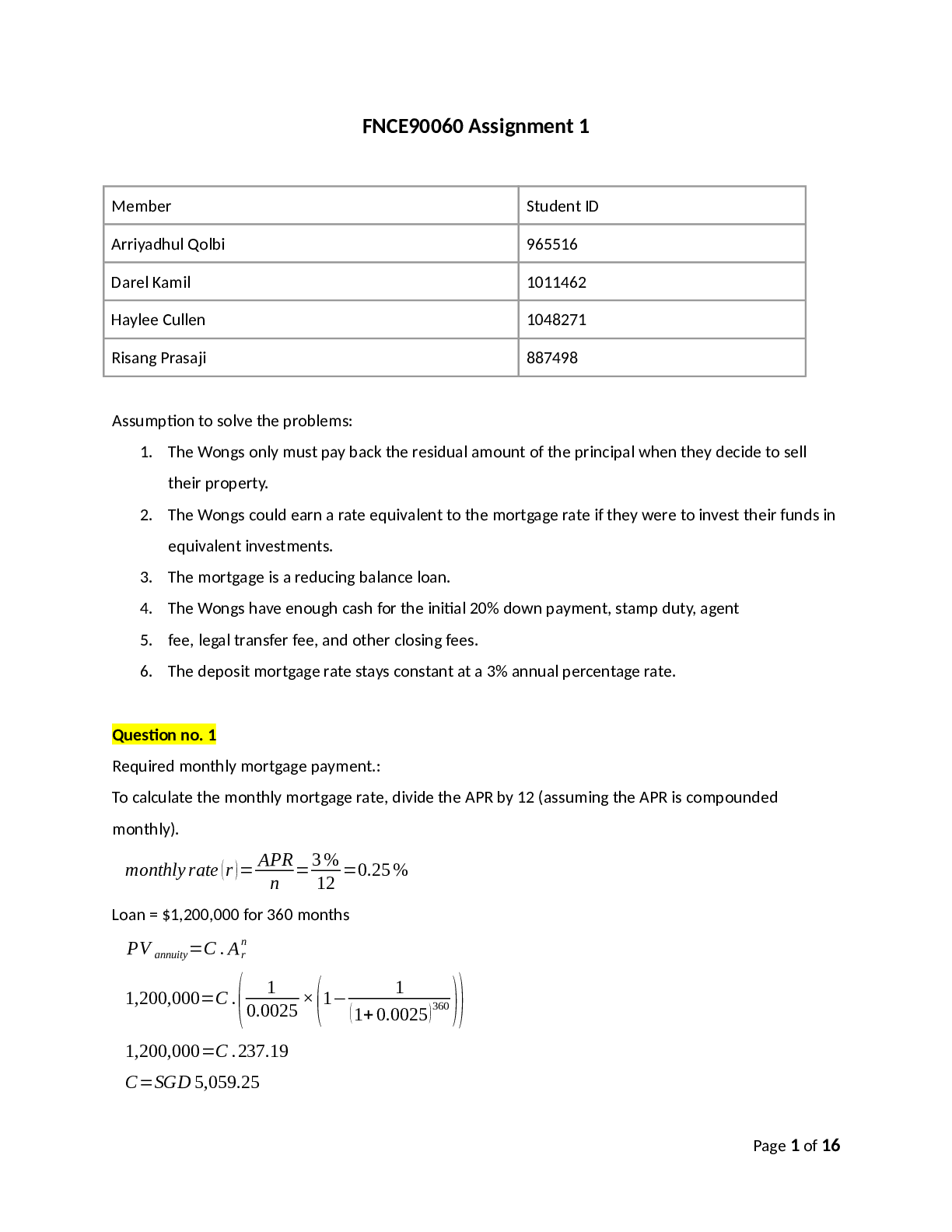

Assumption to solve the problems: 1. The Wongs only must pay back the residual amount of the principal when they decide to sell their property. 2. The Wongs could earn a rate equivalent to the mort... gage rate if they were to invest their funds in equivalent investments. 3. The mortgage is a reducing balance loan. 4. The Wongs have enough cash for the initial 20% down payment, stamp duty, agent 5. fee, legal transfer fee, and other closing fees. 6. The deposit mortgage rate stays constant at a 3% annual percentage rate. Question no. 1 Required monthly mortgage payment.: To calculate the monthly mortgage rate, divide the APR by 12 (assuming the APR is compounded monthly). monthly rate (r)= APR n = 3% 12 =0.25 % Loan = $1,200,000 for 360 months PV annuity=C . Ar n 1,200,000=C .(0.0025 1 ×(1− (1+0.0025 1 )360)) 1,200,000=C .237.19 C=SGD 5,059.25 Page 1 of 16Thus, the monthly mortgage payment Mr. Wong must pay is SGD 5,059.25. Note that the additional fee that Mr. Wong must pay in order to choose to buy the house is not included in the calculation as the question is only interested in the monthly mortgage payment. Question no. 2 The initial cash outflows of the buy decision: Initial cash outflows = Down Payment + Stamp Duty + Agent fee + Legal fee + Closing fee Initial cash outflows = 300,000 + 3 100 (1,500,000) + 100 1 (1,500,000) + 4,000 + 4,000 Initial cash outflows = SGD 368,000 Mr. Wong must withdraw SGD 225,000 from his pension plan and another additional SGD 75,000 from his savings. Thus, Mr. Wong only has SGD 300,000 in hand and still needs to source SGD 68,000. This is beyond the consideration of this assignment as the assumption here is Mr. Wong has enough initial funds to finance his buying house decision [Show More]

Last updated: 2 years ago

Preview 1 out of 16 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$8.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Apr 30, 2021

Number of pages

16

Written in

Additional information

This document has been written for:

Uploaded

Apr 30, 2021

Downloads

0

Views

85

.png)

.png)

Questions and Answers (latest Update), 100% Correct, Download to Score A.png)

, 100% Correct, Download to Score A.png)

, 100% Correct, Download to Score A.png)

, 100% Correct, Download to Score A.png)

Questions and Answers (latest Update), 100% Correct, Download to Score A.png)

, 100% Correct, Download to Score A.png)

Questions and Answers (latest Update), 100% Correct, Download to Score A.png)