Business > QUESTIONS & ANSWERS > Monash UniversityBFW 2751MG - BFW2751 ASSIGNMENT 1-ALL ANSWERS CORRECT-2020 (All)

Monash UniversityBFW 2751MG - BFW2751 ASSIGNMENT 1-ALL ANSWERS CORRECT-2020

Document Content and Description Below

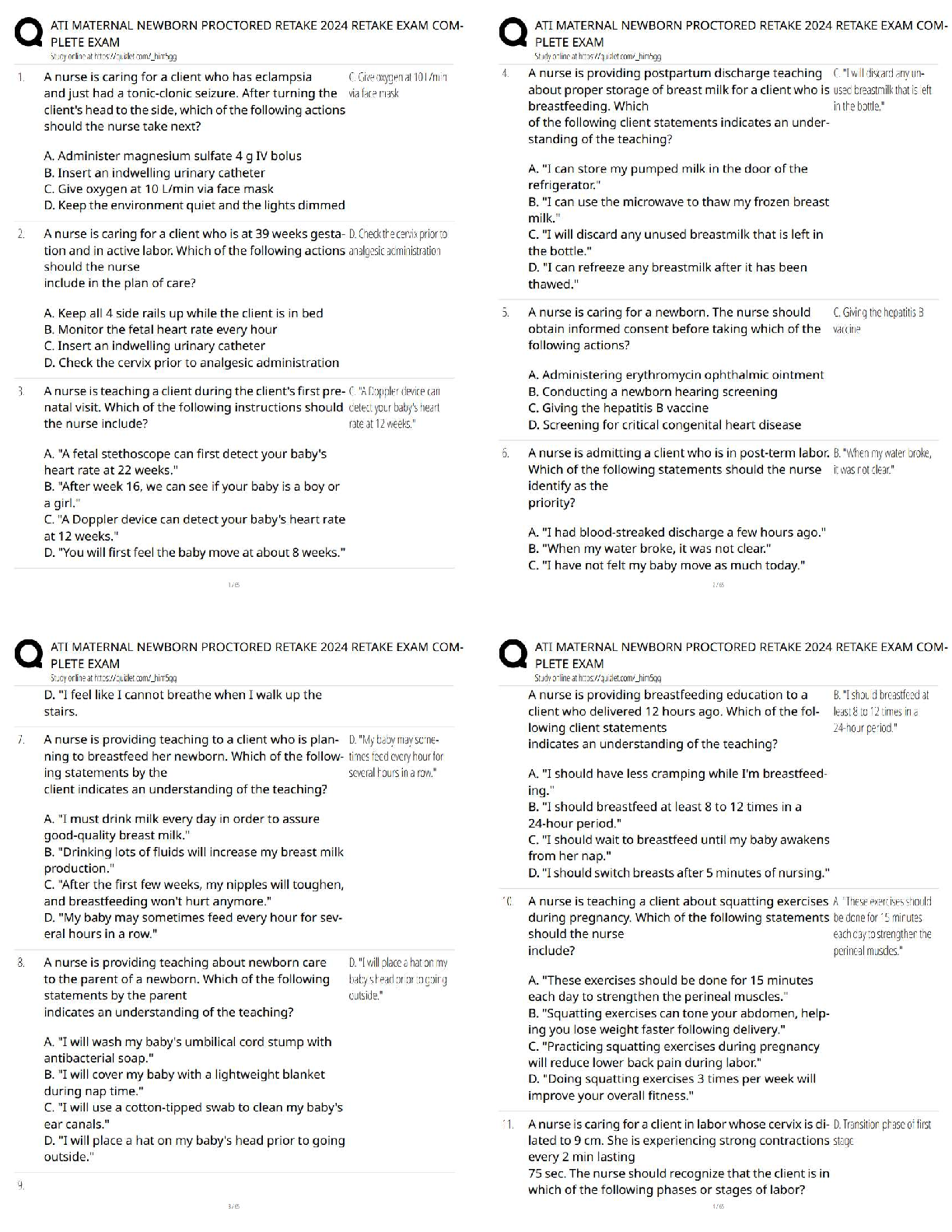

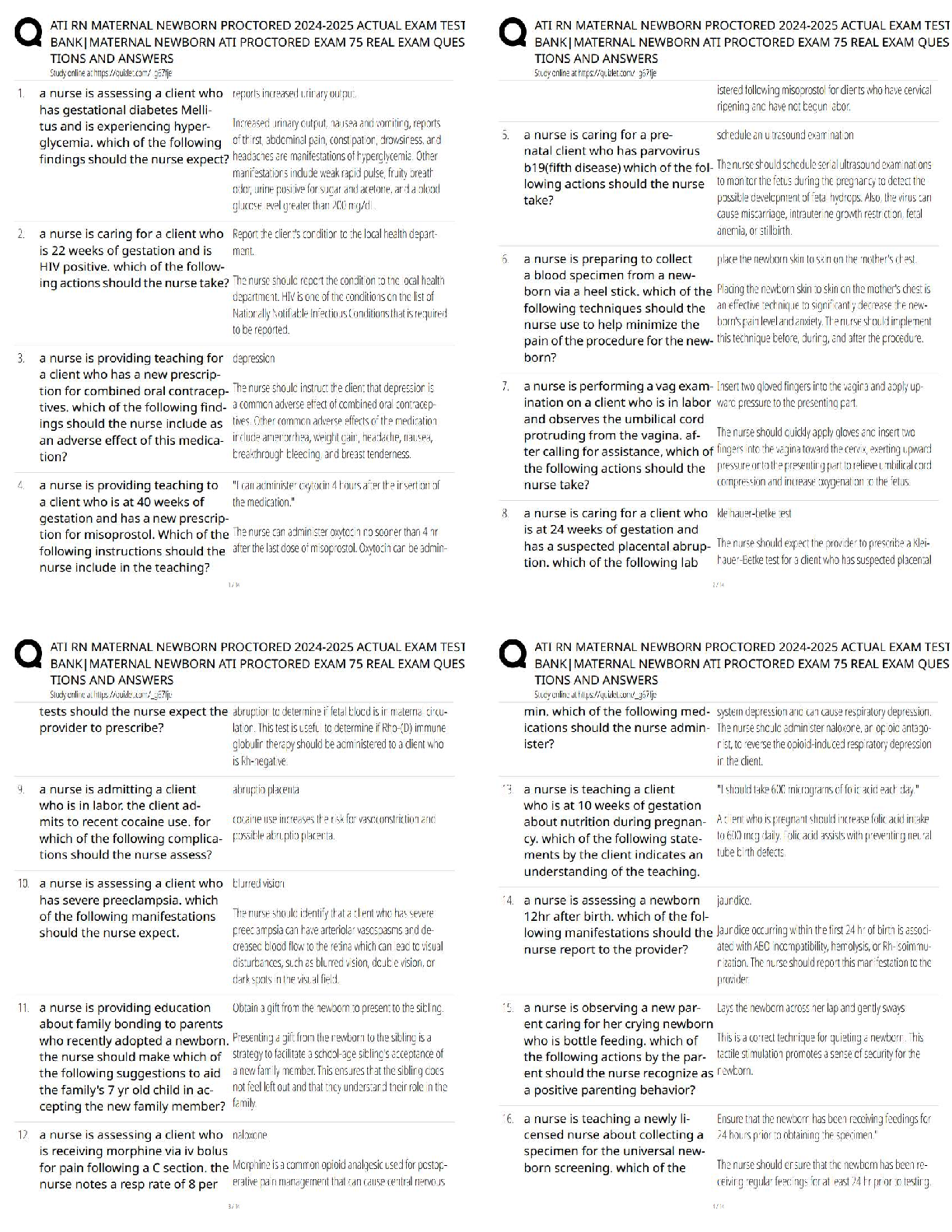

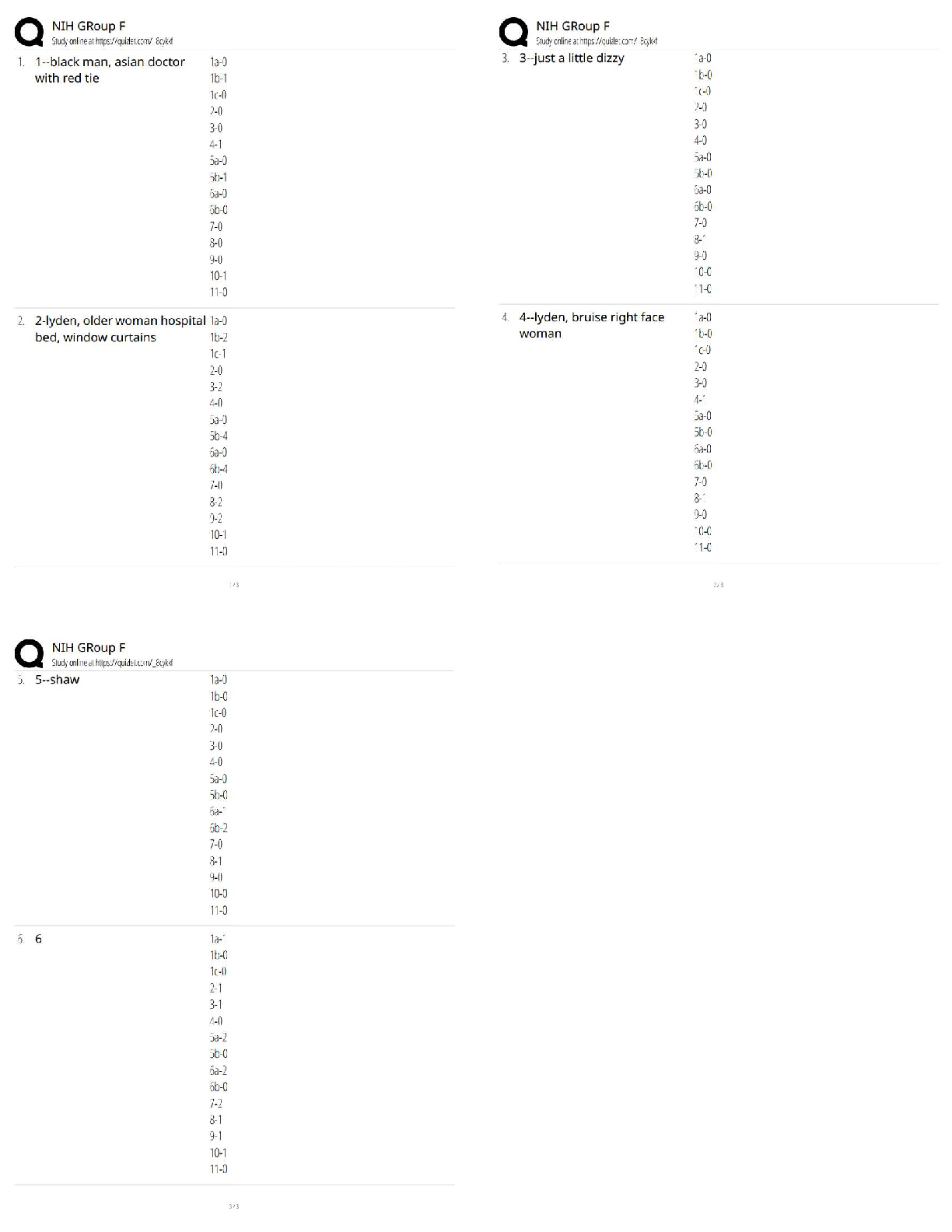

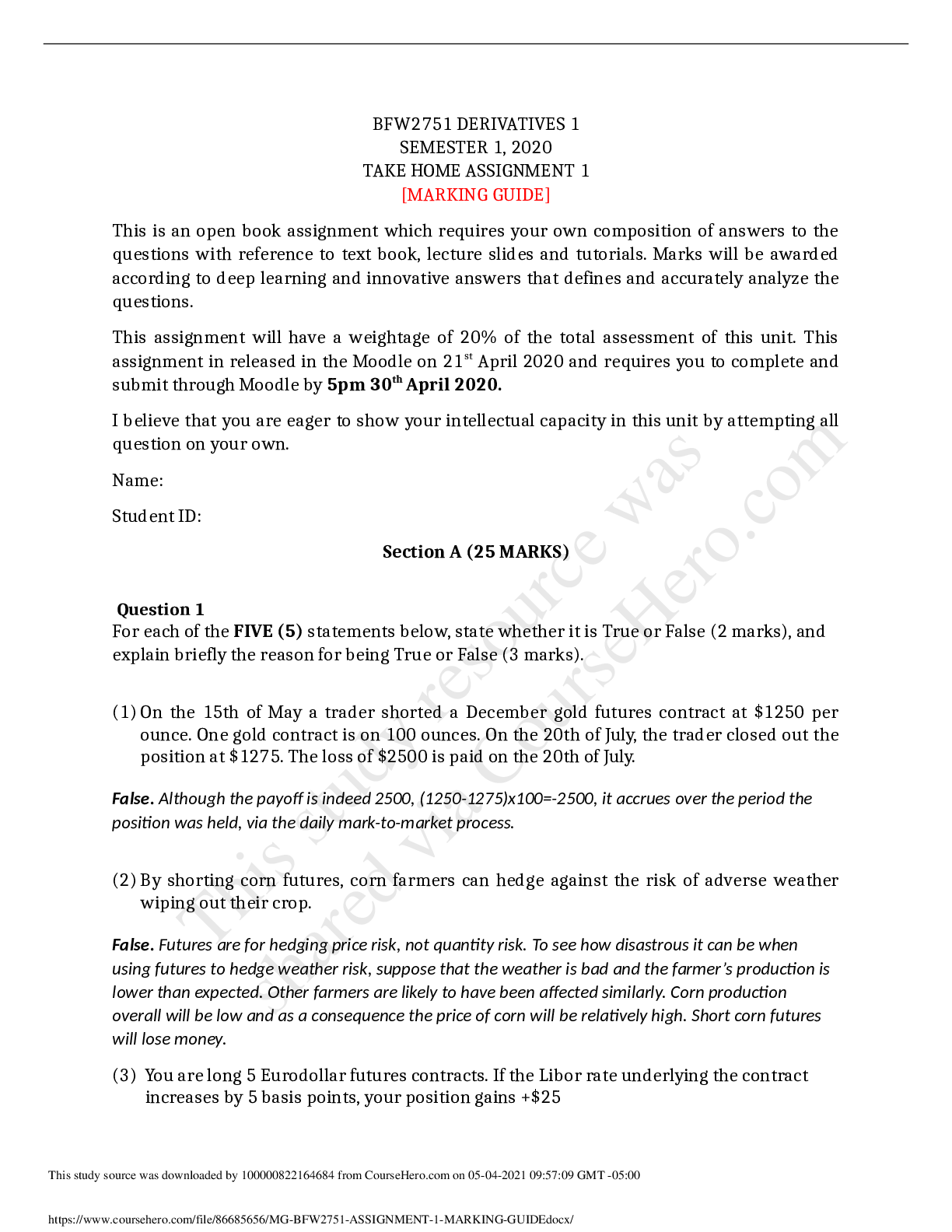

Section A (25 MARKS) Question 1 For each of the FIVE (5) statements below, state whether it is True or False (2 marks), and explain briefly the reason for being True or False (3 marks). (1) On the ... 15th of May a trader shorted a December gold futures contract at $1250 per ounce. One gold contract is on 100 ounces. On the 20th of July, the trader closed out the position at $1275. The loss of $2500 is paid on the 20th of July. False. Although the payoff is indeed 2500, (1250-1275)x100=-2500, it accrues over the period the position was held, via the daily mark-to-market process. (2) By shorting corn futures, corn farmers can hedge against the risk of adverse weather wiping out their crop. False. Futures are for hedging price risk, not quantity risk. To see how disastrous it can be when using futures to hedge weather risk, suppose that the weather is bad and the farmer’s production is lower than expected. Other farmers are likely to have been affected similarly. Corn production overall will be low and as a consequence the price of corn will be relatively high. Short corn futures will lose money. [Show More]

Last updated: 3 years ago

Preview 1 out of 6 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$6.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

May 04, 2021

Number of pages

6

Written in

All

Additional information

This document has been written for:

Uploaded

May 04, 2021

Downloads

0

Views

53

.png)

.png)