Financial Accounting > QUESTIONS & ANSWERS > ZDSFFSDF 21212Capital Budgeting (2) (All)

ZDSFFSDF 21212Capital Budgeting (2)

Document Content and Description Below

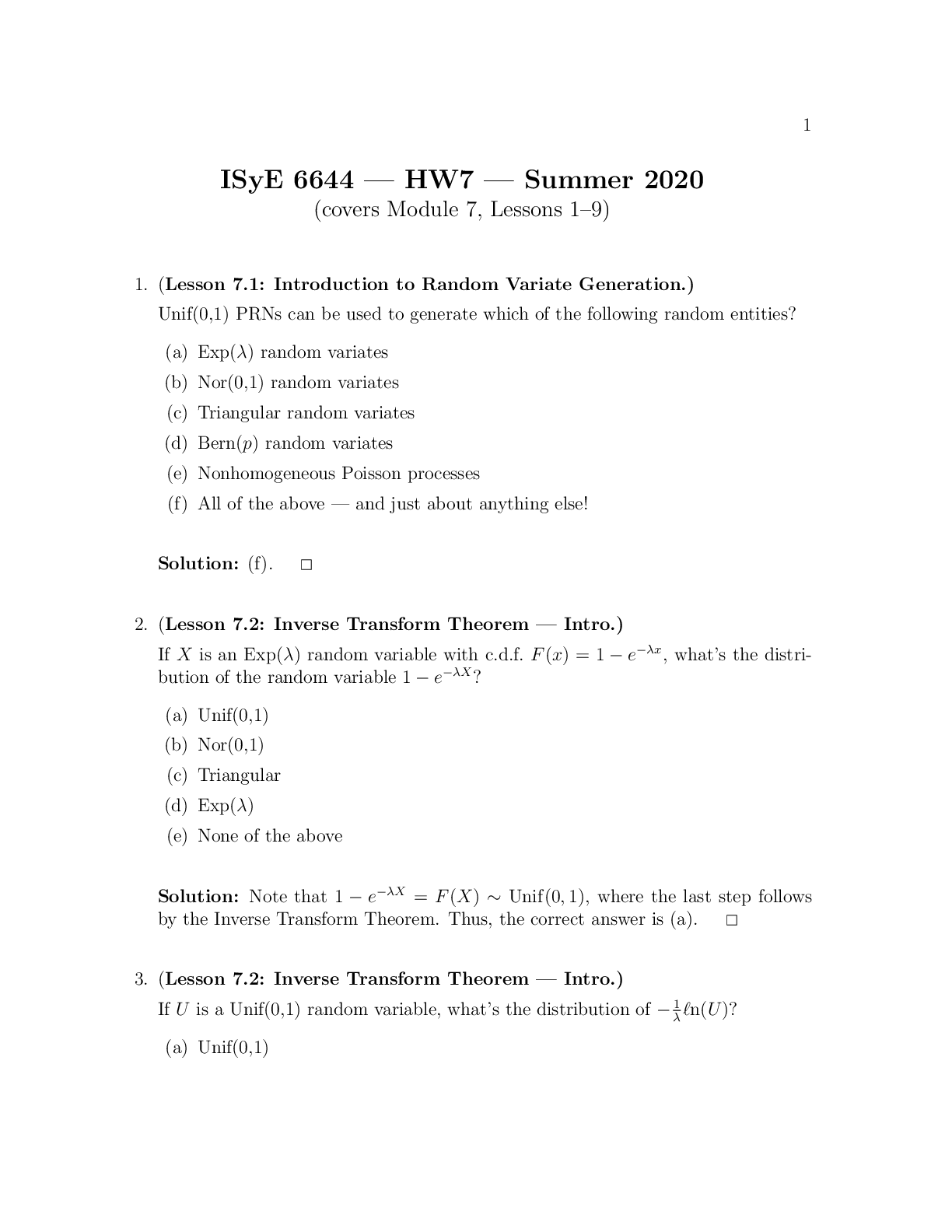

CAPITAL BUDGETING 1. Which of the following about capital budgeting and capital budget is incorrect? a. Capital budgeting is the process of planning expenditures for assets, the return on which are ... expected to be realized within one year. b. Once capital decisions are made, they tend to be relatively inflexible because the commitments extend well into the future. c. In capital budgeting, accurate forecasting is needed to anticipate changes in the demand for the product so that the firm may realize full economic benefits when the capital asset is available for use. d. In capital budgeting, planning is important because of possible changes in inflation, the money supply and interest rates. ANSWER: A Capital Budgeting is the process of planning expenditures for assets, the return on which are expected to continue beyond one year. 2. The capital budget is a (an) a. plan that coordinates and communicates a company’s plan for the coming year to all the segments of the organization. b. plan that assesses the firm’s expenditures for long-lived assets. c. plan to insure that there is enough working capital for the company’s needs. d. a plan that establishes the firm’s long-term goals in the context of relevant factors in the firm’s environment. ANSWER: B A Capital Budget is a plan that assesses the firm’s expenditures for long-lived assets. The plan that coordinates and communicates a company’s plan for the coming year to all the segments of the organization is called operating budget. A capital budget involves long-term investment needs, not working capital for operating needs. Strategic planning establishes the firm’s long-term goals in the context of relevant factors in the firm’s environment. 3. Capital budgeting techniques are least likely to be used in evaluating a. a disinvestment decision, such as sale of unprofitable business segment. b. the acquisition of a new ship by a shipping line. c. the adoption of the ABC system in allocating costs to product lines. d. the implementation of a major advertising program that will have long-term effects on the company. ANSWER: C Capital budgeting involves planning expenditures for long-term investments, as well as the financing ramifications of such investments. The ABC system, which is a method of allocating costs to product lines, has no effect on the firms’ cash flows, does not relate to acquisition of long-term assets, and is not concerned with financing. Hence, the capital budgeting techniques have nothing to do with such allocation method. A disinvestments decision, such as a sale of unprofitable business segment should be evaluated using capital budgeting techniques. 4. The following items are included in the computation of the net cost of investment, except: a. The initial cash outlay covering all expenditures on the investment project up to the time when it is ready for use or operation. b. Working capital requirement to operate the capital investment project. c. Avoidable cost of immediate repairs on old asset to be replaced, net of tax. d. The book value of the old asset to be replaced. ANSWER: D The book value of an old asset to be replaced is irrelevant, and therefore not included in the computation of the net cost of investment. 5. In evaluating capital investment proposals, the project’s expected rate of return is compared with a hurdle rate, or a desired rate of return. This standard rate may be the weighted-average rate of return of the company must pay to its long-term creditors and shareholders for the use of their funds. It is the cost of using funds and is more commonly called as: 1a. discount rate b. capital c. capital expense d. cost of capital ANSWER: D Cost of capital is the cost of using funds. It is also called hurdle rate, minimum desired rate of return, and standard rate. It may be used as a discount rate to convert future cash flows to present value. The project’s expected rate of return is compared with this hurdle rate or standard rate. It is the weighted-average rate of return the company must pay to its long-term creditors and shareholders for the use of heir funds. 6. Which of the following statements about cash flow determination for capital budgeting purposes is incorrect? a. Relevant opportunity costs are included in the cash flow forecast. b. Tax savings due to depreciation expense must be considered. c. Depreciation is relevant because it affects net income. d. Changes in net working capital should be included in the cash flow forecast. ANSWER: C Depreciation, although an expense, is a non-cash item, so it does not affect the projected cash flow of an investment project. What is relevant is the tax savings due to depreciation expense. 7. The discounted cash flow model is ordinarily considered the best model for long-range decision-making. It may be characterized as follows, except: a. The discounted cash flow model considers the time value of money. b. The discounted cash flow model involves interest factors and risk. c. The accounting rate of return and net present value methods are among the methods used in the discounted cash flow model. d. The model involves the use of present value factors to discount the future cash flows to present values. ANSWER: C The discounted cash flow model considers the time value of money. The internal rate of return and net present value methods are among the methods used in this model. The accounting rate of return which does not consider the time value of money is not a method under the discounted cash flow model. 8. Sandy Corporation is planning to buy a new equipment costing P150,000 to replace an old one purchased 6 years ago for P90,000. The old equipment is being depreciated on a straight-line basis over 10 years to a zero salvage value. The same method and useful life will be used to depreciate the new equipment. Sandy Corporation pays tax at a rate of 32% of income before tax. If the old equipment is sold for P30,000 and the new one is purchased, the net cash investment at the time of purchase of the new one is a. P118,080 b. P150,000 c. P121,920 d. P120,000 ANSWER: A SOLUTION: Purchase price of the new equipment P150,000 Less: Proceeds from sale of old equipment P30,000 Tax savings due to loss on sale of old equipment: Sales value P30,000 Less book value: Acquisition cost P90,000 Accum. Dep’n ([P90,000/10] x 6years) 54,000 Book value P36,000 Loss on sale P 6,000 x Tax rate 32%1,920 31,920 Net cash investment on the new equipment P118,080 9. Ojie, Inc. provides hot, ready-to-eat meals to construction workers. The company is considering the purchase of a new truck to replace an old truck now in use in delivering meals to construction sites. The new truck would cost P2M. 2If the new truck is purchased, the old truck will be sold as is to another company for P400,000. This old truck was acquired for P1.2M and has a current book value of P500,000. If the new truck is not purchased, the company will have to continue using the old one, although extensive repairs would be needed that will cost P250,000. This repairs cost will be expensed, for tax purposes, in the year incurred. The income tax rate for corporations is 32%. If the new truck is purchased, the net cost of investment for decision-making purposes is: a. P1,398,000 b. P2,000,000 c. P1,350,000 d. P1,462,000 ANSWER: A SOLUTION: Purchase cost of new truck P2,000,000 Less: Proceeds from sale of old truck, including Tax savings due to loss on sale Sales proceeds P400,000 Tax savings due to loss on sale: Sales proceeds P400,000 Book value 500,000 Loss P100,000 x Tax rate 32% 32,000 Avoidable cost of repairs, net of tax (P250,000 x 68%) 170,000 602,000 Net cost of investment for decision-making purposes P1,398,000 ITEMS 10 AND 11 ARE BASED ON THE FOLLOWING INFORMATION: ACR Company, which operates a school canteen, is planning to buy a dough-nut making machine for P300,000. The machine is expected to produce 36,000 units of doughnuts per year which can be sold for P10 each. Variable cost to produce and sell the doughnut is P4 per unit. Incremental fixed costs, exclusive of depreciation, is estimated at P56,000 per year. The doughnut-making machine will be depreciated on a straight-line basis for 5 years to a zero salvage value. The company pays income tax at a rate of 32%. 10. What is the expected annual return (accounting net income) to be earned from the doughnut-making machine? a. P108,800 b. P128,000 c. P100,000 d. P 68,000 ANSWER: D SOLUTION: Sales (P36,000 x P10) P360,000 Less variable costs (36,000 x P4) 144,000 Contribution margin P216,000 Less fixed costs: Cash fixed costs P56,000 Depreciation (P300,000/5years) 60,000 116,000 Income before tax P100,000 Less tax (32%) 32% Accounting net income P 68,000 11. What is the annual net cash inflows from the doughnut-making machine? a. P108,800 b. P128,000 c. P100,000 d. P 68,000 ANSWER: B SOLUTION: Net Income (from Item #10) P 68,000 Add depreciation 60,000 Net cash inflows P128,000 [Show More]

Last updated: 3 years ago

Preview 1 out of 34 pages

.png)

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$10.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

May 15, 2021

Number of pages

34

Written in

All

Additional information

This document has been written for:

Uploaded

May 15, 2021

Downloads

0

Views

58