Financial Accounting > QUESTIONS & ANSWERS > CHAPTER 9 Cost of Goods Sold and Inventory: Estimation and Noncost Valuation ( WITH ANSWER KEY ) (All)

CHAPTER 9 Cost of Goods Sold and Inventory: Estimation and Noncost Valuation ( WITH ANSWER KEY )

Document Content and Description Below

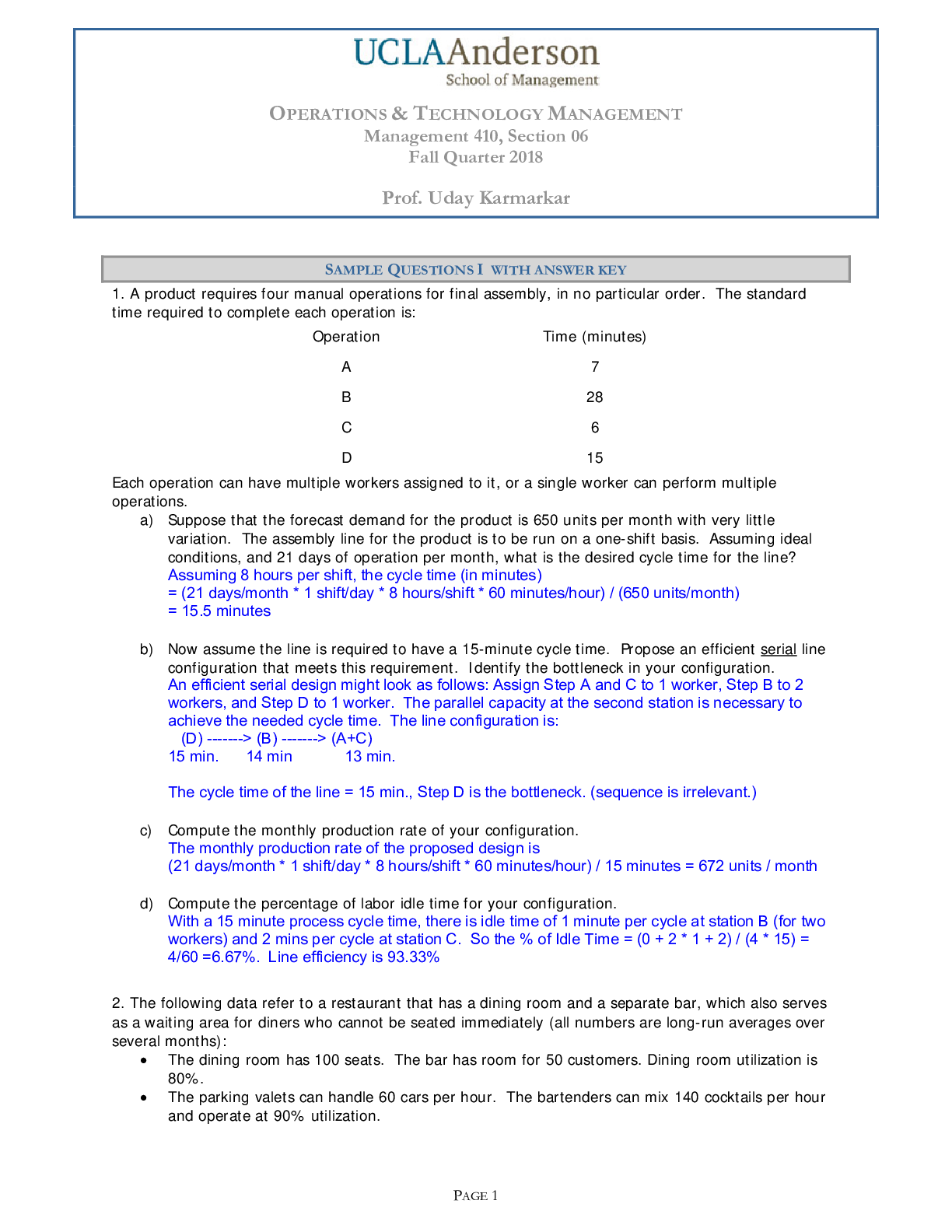

CHAPTER 9 Cost of Goods Sold and Inventory: Estimation and Noncost Valuation MULTIPLE CHOICE QUESTIONS Theory/Definitional Questions 1 Reporting a purchase commitment 2 Assumptions of gross ... profit method 3 Usefulness of gross profit method 4 Constraint of the gross profit method 5 Relationship between ending inventory and net income 6 Relationship between ending inventory and net income 7 Relationship between ending inventory and net income 8 Retail inventory method--inclusion of freight-in 9 Uses of the gross profit method 10 Items included in goods available for sales under retail inventory 11 Understating ending inventory in COGS calculation 12 Relationship between ending inventory and net income 13 Advantages of the retail method 14 Characteristics of retail inventory method 15 Assumptions of the retail method 16 Calculating the cost ratio to be used with retail inventory method 17 Net realizable value 18 Net realizable value 19 Relationship of markups on cost and on selling price 20 Reporting decline in value of noncancellable purchase contract 21 Dollar-value LIFO retail and an incremental layer 22 Treatment of net markups and markdowns under retail method 23 Current rate defined by exchange rate 24 Replacement cost of inventory under the lower of cost or market method 25 When net realizable value is appropriate for inventory valuation 26 Lower of cost or market method 27 Lower of cost or market method 28 Current replacement cost as general meaning for "market" 29 Method for inventory costing needs to be disclosed 30 Relationship between cost ratio retail inventory method and the estimated 6364 Chapter 9 Cost of Goods Sold and Inventory: Estimation and Noncost Valuation cost of ending inventory Computational Questions 31 Computation of ending inventory 32 Computation of ending inventory using the gross margin method 33 Computation of estimated inventory balance given gross margin 34 Computation of cost of goods sold and operating profit 35 Estimate cost of goods sold under gross profit method 36 Computation of estimated costs of missing inventory 37 Computation of loss due to theft 38 Computation of estimated inventory loss due to fire 39 Computation of LCM value for inventory 40 Computation of cost of goods available for sale 41 Recording of raw materials 42 Computation of LCM value for inventory 43 Computation of ending inventory at cost using retail method 44 Computation of estimated inventory at lower of cost or market using retail method 45 Computation of unit price using lower of cost or market 46 Computation of unit price using lower of cost or market 47 Computation of ending inventory using LIFO retail 48 Computation of inventory under dollar-value LIFO retail method 49 Computation of cost component of LCM 50 Computation of market component of LCM 51 Computation of inventory value under LCM 52 Computation of exchange gain/loss 53 Computation of exchange gain/loss 54 Computation of estimated inventory balance given gross margin 55 The effect of undiscovered errors on subsequent year-end inventories 56 The effect of undiscovered errors on subsequent year-end inventories 57 The effect of undiscovered errors on subsequent year-end inventories 58 Computation of estimated cost of inventory 59 Computation of estimated inventory using conventional retail/weighted average 60 Record decline in value of noncancellable inventory contract 61 Record decline in value of noncancellable inventory contract PROBLEMS 1 Estimation of cost of inventory given markups 2 Computation of inventory loss due to fire 3 Computation of net income after discovering inventory errors 4 Estimation of loss due to theft5 Computation of net income after discovering inventory errors 6 Computation of ending inventory at LCM using retail method 7 Computation of ending inventory at LCM using retail method 8 Computation of ending inventory using dollar-value LIFO retail method 9 Computation of ending inventory using dollar-value LIFO retail method 10 Exchange gain/loss--record sale, adjustment, and receipt of payment 11 Determination of proper carrying value of inventory items at LCM 12 Lower-of-cost-or-market method and entries 13 Gross profit method 14 Dollar-value retail LIFO method 15 Effect of failure to apply LCM 16 Validity of retail method approximating weighted average cost 17 Uses of the retail method MULTIPLE CHOICE QUESTIONS c 1. An airline that enters into a commitment to purchase next month's fuel at a set LO6 price should a. record an appropriation of retained earnings. b. record an asset for the inventory and a liability for the payment obligation at the date on which the commitment is made. c. disclose the existence of the commitment in the financial statements. d. disclose the existence of the commitment in the financial statements only if prices have declined since entering the commitment. d 2. The use of the gross profit method assumes LO2 a. the amount of gross profit is the same as in prior years. b. sales and cost of goods sold have not changed from previous years. c. inventory values have not increased from previous years. d. the relationship between selling price and cost of goods sold is similar to prior years. c 3. The gross profit method of estimating inventory would not be useful when LO2 a. a periodic system is in use and inventories are required for interim statements. b. inventories have been destroyed or lost by fire, theft, or other casualty, and the specific data required for inventory valuation are not available. c. there is a significant change in the mix of products being sold. d. the relationship between gross profit and sales remains stable over time. [Show More]

Last updated: 2 years ago

Preview 1 out of 38 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$12.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

May 17, 2021

Number of pages

38

Written in

Additional information

This document has been written for:

Uploaded

May 17, 2021

Downloads

0

Views

100

.png)

Chapter 5 Ethernet (802.png)

Chapter 6 Wireless LANS I QUIZ 6 WITH ANSWER KEY.png)

Chapter 7 Wireless LANS II QUIZ 7 With Answer Key.png)

Chapter 8 TCP IP Internetworking QUIZ 8 With Answer Key.png)

Chapter 9 TCP IP Internetworking II QUIZ 9 With Answer Key.png)

Chapter 10 Carrier Wide Area Networks (WANs) QUIZ 10 With Answer Key.png)

Chapter 3 Network Management QUIZ 3 With Answer Key.png)